Swissquote Bank: Euro And European Futures Rise, US Futures Fall

Table of Contents

Euro Strength: Reasons Behind the Rise

The Euro's appreciation is a key feature of today's market landscape. The EUR/USD exchange rate has seen a significant jump, driven by several converging factors impacting the European economy and its currency.

- Stronger-than-expected European economic data: Recent releases of key economic indicators, such as GDP growth and inflation figures, have exceeded analyst expectations, suggesting a more resilient European economy than previously anticipated. This positive outlook boosts investor confidence in the Euro.

- Potential for increased European Central Bank interest rates: Speculation regarding future ECB interest rate hikes is contributing to the Euro's strength. The anticipation of tighter monetary policy helps to attract investment, increasing demand for the Euro.

- Weakening US dollar due to inflation concerns: The US dollar is weakening relative to the Euro, partly due to persistent inflationary pressures in the US. Concerns about the Fed's ability to control inflation without triggering a recession are putting downward pressure on the US dollar.

- Geopolitical factors impacting the Eurozone and the US: Ongoing geopolitical instability, particularly the war in Ukraine and its impact on energy prices, is impacting both the Eurozone and the US differently. The Eurozone's relatively more unified response to these challenges is perceived favorably by some investors.

European Futures Rally: Sectors Leading the Charge

The rise of the Euro is mirrored in a strong rally within European futures markets. Several sectors are showing particularly robust performance.

- Energy sector performance: The energy sector has seen significant gains, driven primarily by sustained high demand and supply constraints in the wake of the ongoing geopolitical situation. This reflects continued uncertainty within global energy markets and boosts futures contracts tied to this sector.

- Technology sector trends: The technology sector is also performing strongly, indicating sustained investor confidence in the long-term growth prospects of European tech companies.

- Financial sector movements: The financial sector shows mixed results. While some financial institutions are thriving, others face challenges related to rising interest rates and economic uncertainty. This creates a more complex picture within this sector's futures market.

- Impact of investor sentiment on specific sectors: Positive investor sentiment, fueled by the Euro's rise and positive economic data, is contributing to the overall strength of European futures markets.

US Futures Decline: Factors Contributing to the Drop

In contrast to the European market’s strength, US futures contracts are showing a decline, signaling investor apprehension about the US economic outlook.

- Concerns about inflation and potential Federal Reserve interest rate hikes: Persistent inflation and the anticipation of further interest rate hikes by the Federal Reserve are weighing on investor sentiment. The prospect of higher interest rates to combat inflation can stifle economic growth and impact corporate profits.

- Weakening consumer confidence indicators: Declining consumer confidence indicators suggest weakening consumer spending, potentially signaling a slowdown in economic activity. This creates uncertainty in the market and impacts future projections.

- Geopolitical instability and its impact on the US economy: The global geopolitical landscape is adding to the uncertainty surrounding the US economy, impacting investor confidence and influencing market movements.

- Specific company performance influencing market sentiment: The performance of specific companies, particularly large technology firms and key players in the energy sector, significantly influences the overall market sentiment and can create significant fluctuations within futures contracts.

Swissquote Bank's Perspective and Trading Opportunities

Swissquote Bank observes a clear divergence between European and US markets, reflecting differing economic fundamentals and investor sentiment. This presents both challenges and opportunities for traders.

- Long-term versus short-term investment strategies: Swissquote Bank advises investors to carefully consider their risk tolerance and investment horizon before making trading decisions. Long-term investors may see the current market volatility as a buying opportunity, while short-term traders may benefit from exploiting short-term price fluctuations.

- Risk management considerations for traders: Implementing a robust risk management strategy is crucial in the current volatile market conditions. This involves diversifying investments, setting stop-loss orders, and managing position sizes effectively.

- Suggestions for diversification in investment portfolios: Diversifying investments across different asset classes and geographical regions is a key strategy to mitigate risk and enhance portfolio resilience.

Conclusion: Navigating Market Volatility with Swissquote Bank

The contrasting performance of European and US markets highlights the importance of understanding market dynamics before making investment decisions. The rise of the Euro and European futures, juxtaposed with the fall of US futures, underscores the need for careful analysis and a well-defined trading strategy. Stay informed about the latest market movements and leverage Swissquote Bank's expertise for successful trading. Explore our resources and tools today to optimize your investment strategy with Swissquote Bank and understand the implications of Euro and European Futures movements in relation to US Futures.

Featured Posts

-

Baby Lasagna Se Vraca Na Eurosong

May 19, 2025

Baby Lasagna Se Vraca Na Eurosong

May 19, 2025 -

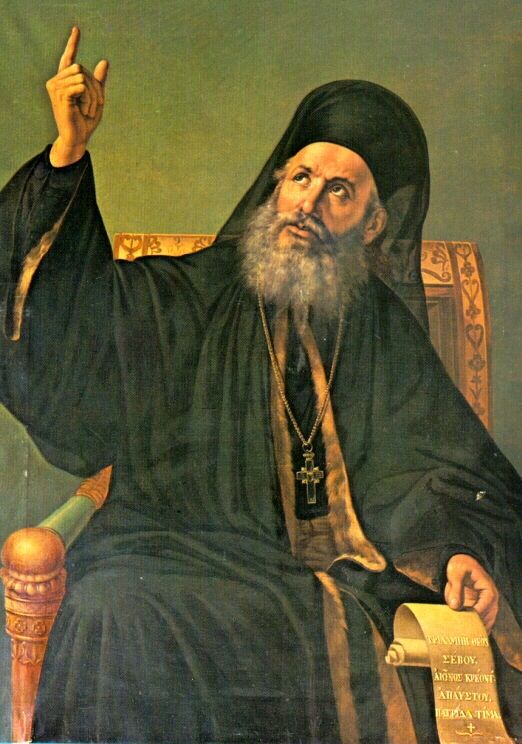

Iero Patriarxiko Sylleitoyrgo Ston Golgotha

May 19, 2025

Iero Patriarxiko Sylleitoyrgo Ston Golgotha

May 19, 2025 -

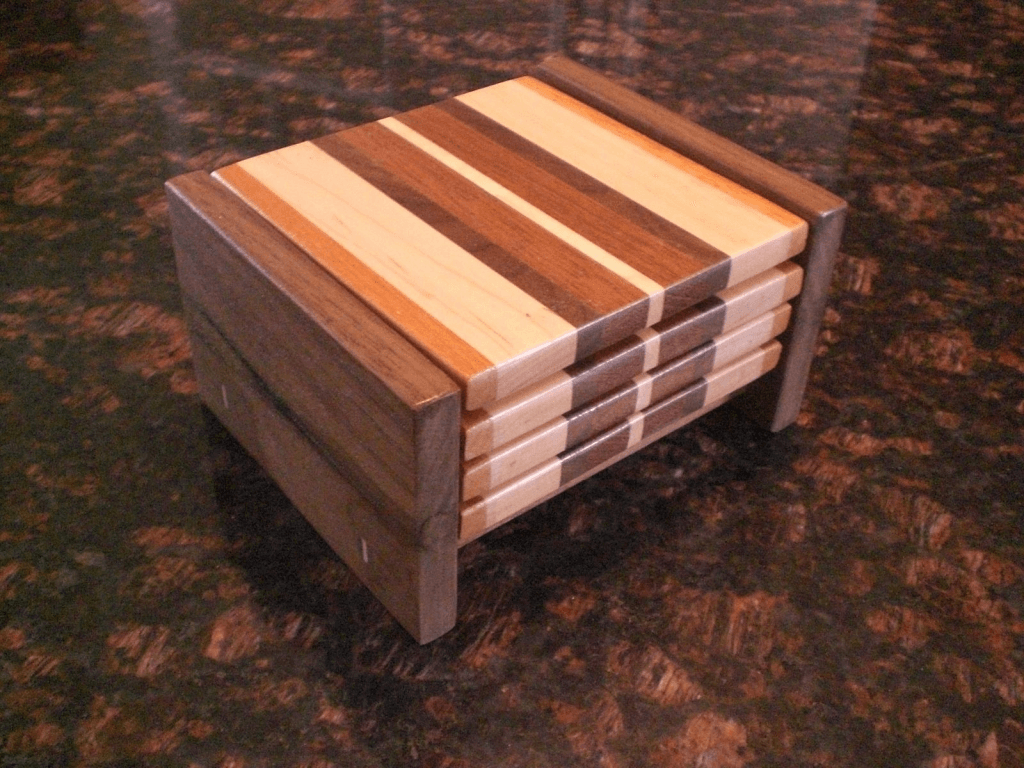

Achieving Chateau Style Simple Diy Projects For Your Home

May 19, 2025

Achieving Chateau Style Simple Diy Projects For Your Home

May 19, 2025 -

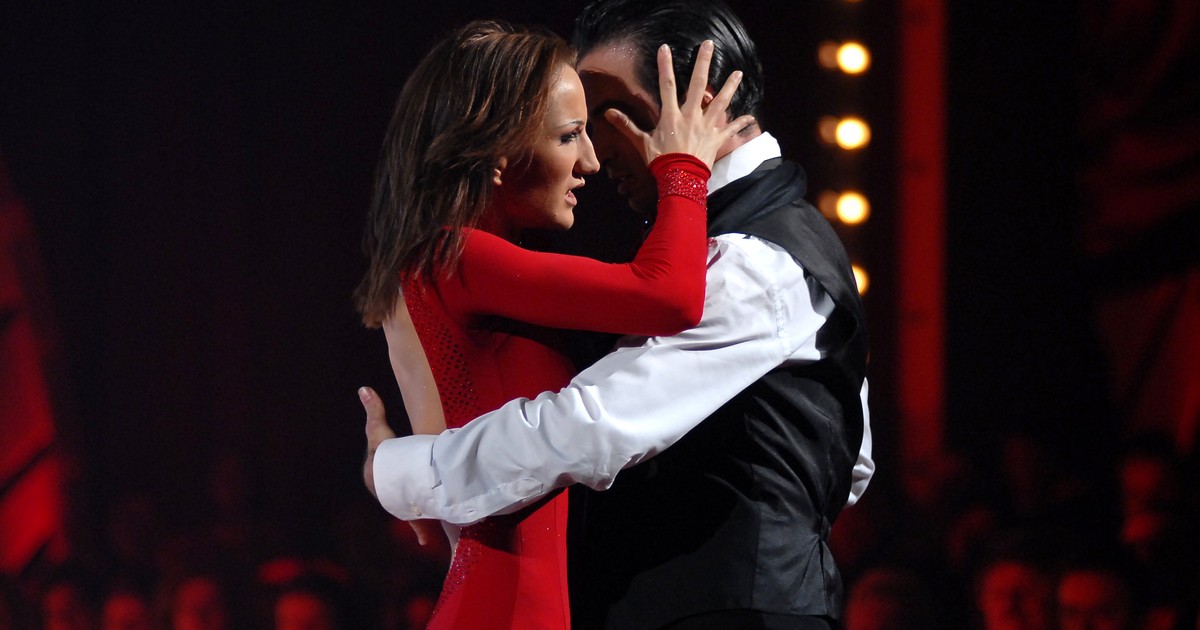

Justyna Steczkowska Niespodziewany Taniec W Reczniku Do Hitu Eurowizji

May 19, 2025

Justyna Steczkowska Niespodziewany Taniec W Reczniku Do Hitu Eurowizji

May 19, 2025 -

Rafa Nadal Y El Fallecimiento De Una Leyenda Del Tenis Un Referente Del Deporte Llora Su Perdida

May 19, 2025

Rafa Nadal Y El Fallecimiento De Una Leyenda Del Tenis Un Referente Del Deporte Llora Su Perdida

May 19, 2025