Swissquote Bank Platform: Observing Euro And Futures Market Shifts

Table of Contents

Accessing Real-time Data on the Swissquote Platform

The Swissquote Bank platform's strength lies in its ability to deliver real-time data crucial for navigating the volatile Euro and Futures markets. This timely information empowers traders to make informed decisions based on the most current market conditions.

Live Currency Quotes & Charts

Swissquote provides real-time streaming quotes for the EUR/USD and other major currency pairs, crucial for monitoring short-term fluctuations in the Euro market. Detailed charts with customizable indicators (MACD, RSI, Bollinger Bands, etc.) allow for comprehensive technical analysis. This empowers traders to identify trends, support and resistance levels, and potential reversal points.

- Access to multiple chart types: Candlestick, line, bar, and area charts offer diverse perspectives on price action.

- Customizable timeframes: Analyze price movements from 1-minute intervals to monthly charts, adapting your analysis to your chosen trading strategy.

- Integration with third-party technical analysis tools: While not explicitly stated in the outline, this would be a valuable addition to mention if Swissquote offers this feature, enhancing the platform's analytical capabilities.

- Price alerts: Set customizable alerts for price targets and breakouts, ensuring you don't miss crucial trading opportunities in the Euro market.

Futures Market Data & Contract Specifications

The platform delivers comprehensive data on various futures contracts, including Eurodollar futures and other relevant indices. Understanding contract specifications – such as expiry dates, tick sizes, and margin requirements – is vital for managing risk and maximizing profitability within the Futures market.

- Access to contract details: Clearly defined contract specifications minimize ambiguity and allow for precise trade planning.

- Real-time futures price quotes and charts: Stay up-to-date on the latest price movements and identify potential trading opportunities.

- Open interest and volume data: Analyze open interest and trading volume to gauge market sentiment and potential price momentum within the Futures market.

- Historical futures data: Access to historical data allows for backtesting trading strategies and evaluating their performance over time.

Utilizing Swissquote's Analytical Tools for Market Insight

Swissquote's analytical tools go beyond simple charting, providing advanced features designed to enhance market understanding and improve trading decisions for both Euro and Futures markets.

Advanced Charting & Technical Indicators

Beyond basic charting, Swissquote offers a suite of advanced charting tools and a wide array of technical indicators to aid in identifying trends and potential trading opportunities. These tools enable traders to refine their analysis and improve their prediction accuracy.

- Drawing tools: Identify support and resistance levels, trendlines, and other significant price points with precision.

- Fibonacci retracements and extensions: Use Fibonacci tools to identify potential price reversal points and target levels.

- Automated trading strategies (if available): If available, automated trading features can streamline your trading process and execute strategies based on predefined parameters.

- Economic calendar integration: Stay informed about upcoming economic announcements that can significantly impact both the Euro and Futures markets.

Fundamental Analysis Resources

While primarily focused on technical analysis, access to news feeds and economic reports provides crucial context for fundamental analysis, contributing to a more holistic trading approach. Understanding fundamental factors driving market movements is essential for long-term success.

- Access to economic data releases: Stay informed on key economic indicators like inflation, GDP growth, and interest rate changes that influence the Euro and Futures markets.

- News and analysis from reputable sources: Access to high-quality news sources allows traders to stay informed about events impacting market sentiment. (Mention specific sources if available on the Swissquote platform).

- Integration with fundamental data providers (if applicable): This would further enhance the platform’s analytical capabilities (mention if applicable).

Trading Strategies on the Swissquote Platform for Euro and Futures

The Swissquote platform caters to a diverse range of trading styles, offering the tools necessary for executing various strategies effectively in both the Euro and Futures markets.

Scalping and Day Trading

The platform's speed and real-time data are ideal for short-term trading strategies like scalping and day trading. The low latency execution is crucial for swiftly capitalizing on small price fluctuations.

- Low latency execution: Ensure your orders are executed quickly and efficiently, minimizing slippage.

- Advanced order types: Employ stop-loss and limit orders to manage risk and protect profits.

- Access to margin trading: Leverage margin trading to amplify potential returns (discuss the inherent risks associated with margin trading).

Swing Trading and Position Trading

For longer-term approaches like swing trading and position trading, the platform's historical data and charting tools are valuable for identifying long-term trends and making informed decisions.

- Backtesting capabilities: Evaluate the performance of your trading strategies using historical data before implementing them in live trading.

- Access to historical data: Analyze extensive historical data to identify recurring patterns and predict future price movements.

- Portfolio management tools: Track your trading performance, manage your positions effectively, and optimize your portfolio allocation.

Conclusion

The Swissquote Bank platform provides a robust and comprehensive environment for observing and reacting to shifts in the Euro and Futures markets. Its real-time data, advanced charting tools, and versatile trading features empower traders of all levels to effectively analyze market dynamics and execute their strategies. By leveraging the tools and resources available on the Swissquote Bank platform, you can gain a deeper understanding of these complex markets and potentially improve your trading outcomes. Start exploring the power of the Swissquote Bank platform today and enhance your analysis of Euro and Futures market movements.

Featured Posts

-

Zoi Me Ton Xristo I Prosklisi Toy Eysevioy Apo Ti Samo

May 19, 2025

Zoi Me Ton Xristo I Prosklisi Toy Eysevioy Apo Ti Samo

May 19, 2025 -

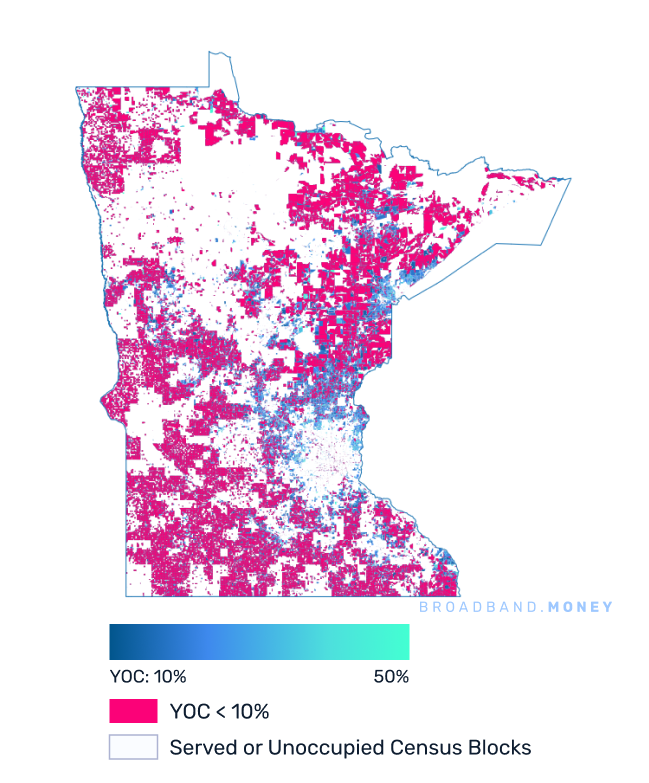

De Soto County Achieves 100 Broadband Coverage A State First

May 19, 2025

De Soto County Achieves 100 Broadband Coverage A State First

May 19, 2025 -

Eurovision 2025 Finish Time And Show Duration

May 19, 2025

Eurovision 2025 Finish Time And Show Duration

May 19, 2025 -

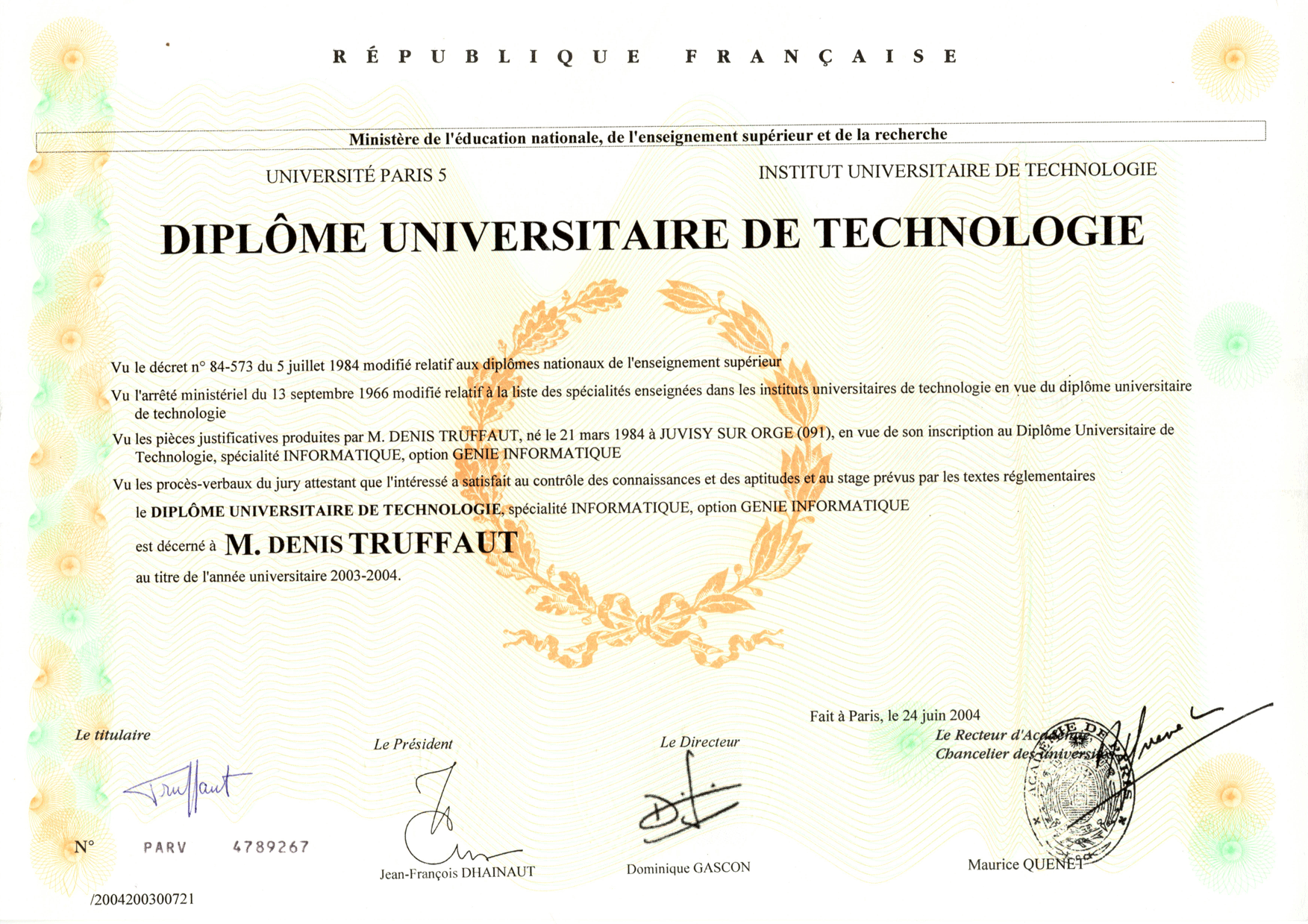

Formation Archiviste Poitiers Diplome Universitaire Et Bases Du Metier

May 19, 2025

Formation Archiviste Poitiers Diplome Universitaire Et Bases Du Metier

May 19, 2025 -

North Carolina Tar Heels Athletics March 3 9 Highlights

May 19, 2025

North Carolina Tar Heels Athletics March 3 9 Highlights

May 19, 2025