Swissquote Bank: Sovereign Bond Market Analysis

Table of Contents

Current State of the Sovereign Bond Market

Global Economic Outlook and its Impact on Bond Yields

The global economic outlook significantly impacts sovereign bond yields. Factors like inflation, interest rate hikes by central banks, and economic growth forecasts directly influence bond prices. High inflation, for instance, typically leads to rising interest rates, pushing bond yields up and prices down. Conversely, slower economic growth often results in lower yields as investors seek the safety of government bonds.

- Key Economic Indicators: Inflation rates (CPI, PPI), GDP growth rates, unemployment rates, and central bank policy statements are all crucial indicators.

- Country-Specific Examples: The performance of US Treasury bonds often acts as a benchmark, while Eurozone government bonds reflect the complexities of the Euro area's economic integration. Emerging market sovereign bonds offer higher yields but come with increased risk. Analyzing these different markets requires a nuanced understanding of each country's economic fundamentals.

- Swissquote Bank Data: (This section would ideally include specific charts and data from Swissquote Bank’s research reports, illustrating the correlation between economic indicators and bond yields.)

Major Central Bank Policies and their Influence

Central bank policies play a pivotal role in shaping sovereign bond markets. Quantitative easing (QE), where central banks inject liquidity into the market by purchasing government bonds, typically lowers yields. Conversely, interest rate hikes aimed at curbing inflation generally drive yields higher.

- Quantitative Easing (QE): QE programs increase demand for sovereign bonds, pushing prices up and yields down. The impact varies depending on the scale and duration of the program.

- Interest Rate Hikes: Rising interest rates make newly issued bonds more attractive, reducing demand for existing bonds and thus lowering their prices (and increasing their yields).

- Differing Central Bank Approaches: The Federal Reserve (Fed) in the US, the European Central Bank (ECB), and the Bank of England (BoE) employ different monetary policies, leading to varied impacts on their respective sovereign bond markets. (This section would benefit from specific examples comparing central bank actions and their resulting effects on bond markets.)

- Swissquote Bank Analysis: (This section should incorporate insights and analysis from Swissquote Bank's research on central bank policies and their impact.)

Analysis of Key Sovereign Bond Markets

US Treasury Bonds

US Treasury bonds are considered a safe-haven asset, and their performance is closely tied to the US dollar's strength and global economic conditions. The yield curve, which illustrates the relationship between yields and maturities, provides valuable insights into future interest rate expectations. An inverted yield curve, for example, is often seen as a recessionary indicator.

- US Dollar Strength: A strong US dollar tends to attract foreign investment in US Treasuries, pushing demand and prices higher.

- Yield Curve Analysis: Monitoring the yield curve helps anticipate future interest rate movements and assess the overall economic outlook.

- Swissquote Bank Insights: (Include relevant insights from Swissquote Bank's research on US Treasury bonds.)

Eurozone Government Bonds

The Eurozone government bond market presents a more complex landscape due to the diverse economic conditions within the Eurozone. The ECB's monetary policies significantly impact all Eurozone members, but country-specific factors such as fiscal health and political stability also play important roles.

- ECB Monetary Policy: The ECB's actions influence yields across the Eurozone, although the impact varies based on individual country risk profiles.

- Country-Specific Risks: Peripheral Eurozone countries often face higher borrowing costs compared to core countries like Germany due to perceived higher credit risk.

- Swissquote Bank Data and Charts: (Include data and charts illustrating the performance of Eurozone government bonds, highlighting the differences between various countries.)

Other Key Sovereign Bond Markets

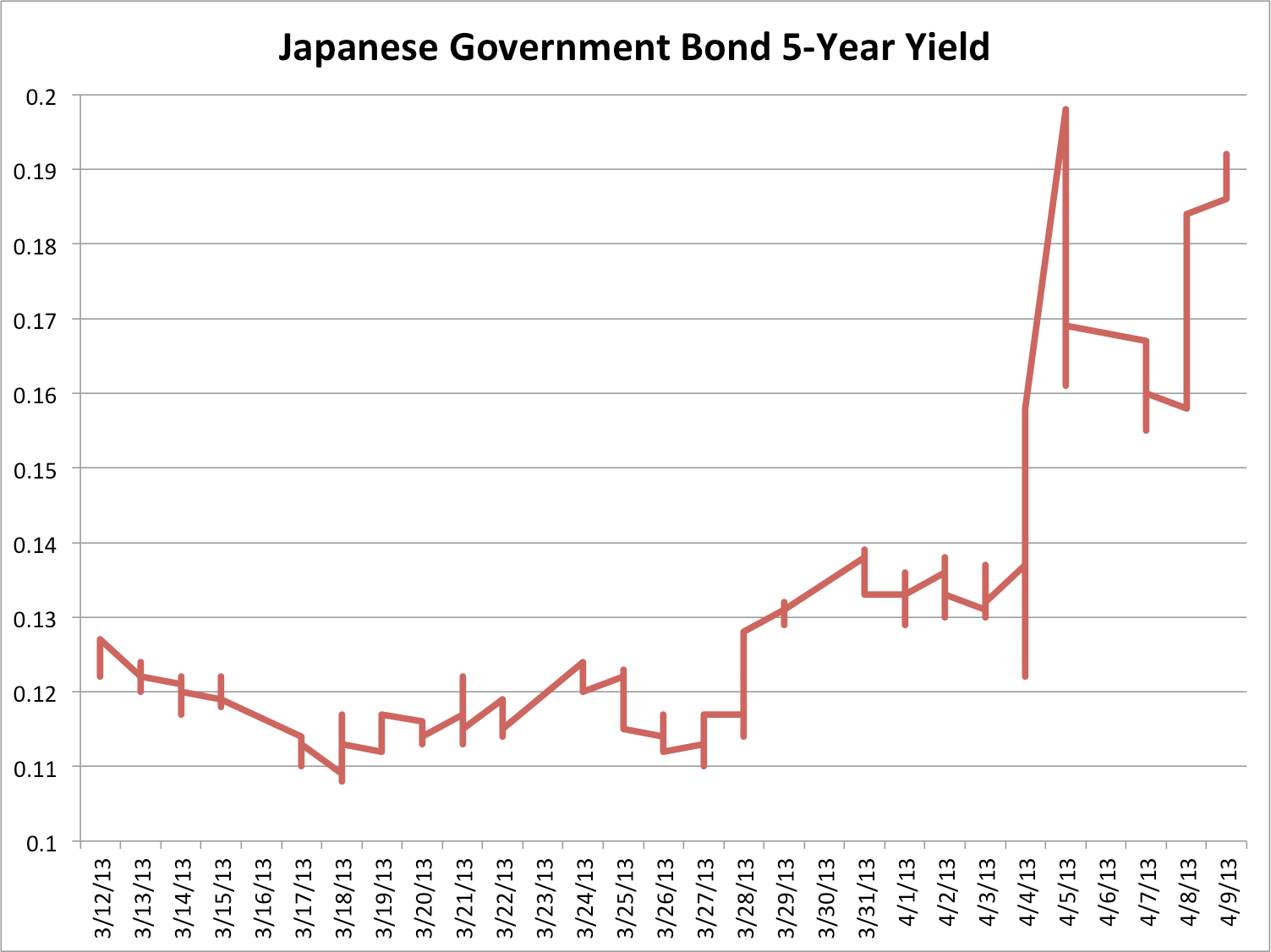

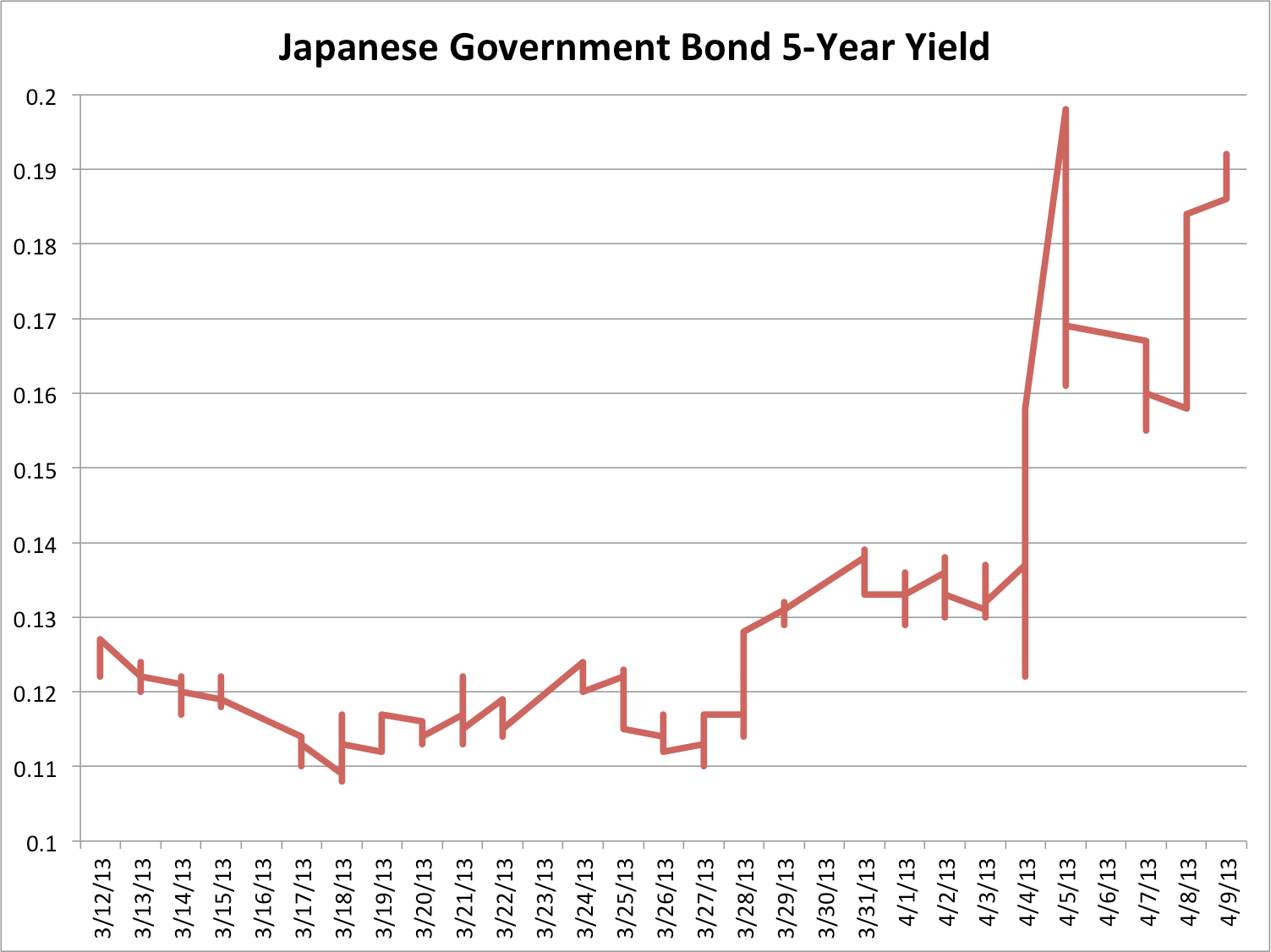

Other significant sovereign bond markets, such as UK Gilts and Japanese Government Bonds (JGBs), also exhibit unique characteristics. UK Gilts are influenced by Brexit-related uncertainties and global economic conditions, while JGBs are impacted by Japan's low interest rate environment and deflationary pressures. (This section should include brief analyses of other key markets, incorporating data from Swissquote Bank's research where available.)

Investment Strategies in the Sovereign Bond Market

Risk Management in Sovereign Bond Investing

Sovereign bonds, while generally considered less risky than corporate bonds, still carry inherent risks. Diversification across different countries and maturities is key to mitigating risk. Understanding credit ratings is crucial, as they reflect the creditworthiness of the issuing government.

- Diversification: Spread investments across different sovereign bond markets and maturities to reduce exposure to specific country or interest rate risks.

- Hedging: Utilize hedging strategies to protect against adverse movements in exchange rates or interest rates.

- Credit Ratings: Pay close attention to credit ratings assigned by agencies like Moody's, S&P, and Fitch to assess the creditworthiness of the issuer.

- Swissquote Bank's Risk Management Advice: (Include advice on risk management strategies from Swissquote Bank's expertise.)

Opportunities and Challenges in the Current Market

The current sovereign bond market presents both opportunities and challenges. Low interest rates in many developed economies offer limited returns, while rising inflation poses a threat to bond values. However, selective opportunities exist in emerging markets or in specific sectors, if properly researched and understood.

- Potential Opportunities: Emerging market bonds may offer higher yields, but these typically come with higher risks. Careful analysis of country-specific risks is necessary.

- Potential Challenges: Rising inflation can erode the real return from bonds, and sudden shifts in central bank policies can cause significant market volatility.

- Swissquote Bank’s Market Outlook: (This section should incorporate Swissquote Bank's outlook on the sovereign bond market and highlight potential investment opportunities and challenges.)

Conclusion: Leveraging Swissquote Bank's Expertise for Sovereign Bond Market Success

The sovereign bond market is a complex and dynamic environment requiring careful analysis and informed decision-making. This article has explored the current market conditions, highlighting key factors influencing sovereign bond yields and prices, leveraging insights from Swissquote Bank. Understanding the impact of global economic conditions, central bank policies, and individual country risks is critical for success in this market segment.

Remember that relying on reliable sources like Swissquote Bank for in-depth analysis and up-to-date information is essential for navigating the complexities of the sovereign bond market and building a robust investment strategy. Visit Swissquote Bank today to access in-depth sovereign bond market analysis and enhance your investment strategy. Learn more about Swissquote Bank’s comprehensive tools and resources for trading sovereign bonds and take advantage of their expertise to confidently navigate this crucial market.

Featured Posts

-

Eurovision Voting System Rules Regulations And How It Impacts The Results

May 19, 2025

Eurovision Voting System Rules Regulations And How It Impacts The Results

May 19, 2025 -

Analyse Minder Luchtreizigers Maastricht Airport Begin 2025

May 19, 2025

Analyse Minder Luchtreizigers Maastricht Airport Begin 2025

May 19, 2025 -

Creating A Chateau Aesthetic Your Guide To Diy Chateau Decor

May 19, 2025

Creating A Chateau Aesthetic Your Guide To Diy Chateau Decor

May 19, 2025 -

Nyt Mini Crossword Answers Today March 13 2025 Hints And Clues

May 19, 2025

Nyt Mini Crossword Answers Today March 13 2025 Hints And Clues

May 19, 2025 -

Mairon Santos And The Lightweight Division A Look At His Potential Move After Yusuff Fight

May 19, 2025

Mairon Santos And The Lightweight Division A Look At His Potential Move After Yusuff Fight

May 19, 2025

Latest Posts

-

Kaysima Pos Na Eksoikonomisete Xrimata Stin Kypro

May 19, 2025

Kaysima Pos Na Eksoikonomisete Xrimata Stin Kypro

May 19, 2025 -

Poy Na Breite Ta Fthinotera Kaysima Stin Kypro

May 19, 2025

Poy Na Breite Ta Fthinotera Kaysima Stin Kypro

May 19, 2025 -

Odigos Gia Tin Eyresi Fthinon Kaysimon Stin Kypro

May 19, 2025

Odigos Gia Tin Eyresi Fthinon Kaysimon Stin Kypro

May 19, 2025 -

Eyresi Ton Xamiloteron Timon Se Kaysima Stin Kypro

May 19, 2025

Eyresi Ton Xamiloteron Timon Se Kaysima Stin Kypro

May 19, 2025 -

Akrivotera Kai Fthinotera Pratiria Kaysimon Stin Kypro

May 19, 2025

Akrivotera Kai Fthinotera Pratiria Kaysimon Stin Kypro

May 19, 2025