Tariff Shock: How Bond Markets Are Feeling The Impact

Table of Contents

The global economy has recently witnessed significant upheaval due to escalating tariffs. This "tariff shock," as it's become known, isn't just impacting trade; it's creating significant volatility in the bond market. The imposition of tariffs on billions of dollars worth of goods has sent shockwaves through global supply chains, triggering uncertainty that is directly influencing bond yields, investor behavior, and overall market stability. This article will delve into the various ways tariff shocks are reshaping the landscape of the bond market.

Rising Inflation and Bond Yields

Tariffs exert a direct influence on inflation. The increased cost of imported goods, a direct consequence of tariffs, leads to higher prices for consumers. This reduction in purchasing power can, in turn, spur demands for wage increases, creating a feedback loop that further fuels inflation. This inflationary pressure is a key driver of rising bond yields. Central banks, tasked with maintaining price stability, often respond by implementing measures such as interest rate hikes or quantitative tightening to curb inflation. These actions, while intended to control inflation, can have a significant negative impact on bond prices, often resulting in a decline in bond values as investors seek higher returns in a higher interest rate environment.

- Increased import costs: Tariffs directly increase the price of imported goods, impacting everything from consumer staples to manufacturing inputs.

- Reduced consumer purchasing power: Higher prices erode consumer spending, slowing economic growth.

- Potential for wage increases: Businesses may be forced to increase wages to retain employees in the face of higher living costs, further driving inflation.

- Central bank response: Interest rate hikes make borrowing more expensive, dampening demand and ideally slowing inflation. Quantitative tightening reduces the money supply, similarly aiming to control inflation.

Increased Uncertainty and Investor Sentiment

The inherent unpredictability of tariff policies is a major source of uncertainty in the market, significantly impacting investor sentiment. This uncertainty breeds risk aversion, causing investors to seek safer havens for their investments. Government bonds, traditionally seen as low-risk, become highly sought after, leading to increased demand and potentially higher prices. Conversely, riskier assets such as corporate bonds may experience price declines as investors shift their allocations towards less volatile investments. This flight to safety can also result in decreased liquidity within certain segments of the bond market, making it more challenging to buy or sell bonds efficiently.

- Reduced predictability: The volatile nature of tariff policies makes it difficult for businesses and investors to plan for the future.

- Investment hesitancy: Uncertainty discourages investment, hindering capital expenditure and economic expansion.

- Flight to safety: Investors flock to perceived "safe" assets like government bonds, driving up their demand and prices.

- Decreased bond market liquidity: Reduced trading volume in certain segments of the market can lead to wider bid-ask spreads and higher transaction costs.

Sector-Specific Impacts: Which Bonds Are Most Affected?

The impact of tariff shocks isn't uniform across all bond sectors. Government bonds, generally perceived as low-risk, often benefit from increased demand during times of economic uncertainty. However, corporate bonds, particularly those issued by companies heavily reliant on international trade, are more vulnerable to the negative consequences of tariffs. High-yield bonds ("junk bonds"), already carrying a higher risk profile, are particularly susceptible to the economic fallout from trade disputes. Similarly, emerging market bonds, often dependent on global trade, are highly sensitive to tariff-related disruptions in international commerce.

- Government bonds: These typically see increased demand during periods of uncertainty, acting as a safe haven asset.

- Corporate bonds: Companies directly impacted by tariffs face potential credit rating downgrades, impacting their bond prices.

- High-yield bonds: These high-risk bonds are extremely vulnerable to economic downturns, making them particularly susceptible to tariff shocks.

- Emerging market bonds: Economies reliant on exports or imports are disproportionately affected by disruptions to international trade.

Geopolitical Implications and Global Bond Markets

The ramifications of tariff shocks extend far beyond national borders, carrying significant geopolitical implications. The imposition of tariffs often triggers retaliatory measures from other countries, escalating into trade wars that disrupt global supply chains and hinder international trade. These trade disputes can trigger a global economic slowdown, reverberating through bond markets worldwide. As a consequence, investors may withdraw capital from regions perceived as politically or economically unstable, causing currency fluctuations and impacting bond yields globally.

- Retaliatory tariffs: Trade wars result from countries imposing tariffs on each other's goods, further disrupting global supply chains.

- Global economic slowdown: Reduced trade and investment lead to slower economic growth worldwide.

- Capital flight: Investors may pull investments from countries embroiled in trade disputes, seeking safer investment opportunities.

- Currency fluctuations: Changes in exchange rates can impact the value of foreign bond holdings.

Conclusion: Navigating the Tariff Shock in the Bond Market

Tariff shocks significantly impact the bond market, affecting inflation, investor sentiment, and the performance of various bond sectors. Understanding these intricate dynamics is crucial for investors seeking to navigate this complex and volatile environment. Keeping abreast of developments in trade policy and their likely economic repercussions is vital for effective investment decision-making and risk mitigation. By carefully assessing the sector-specific impacts of tariff shocks and adopting strategic portfolio management techniques, investors can better position themselves to weather this ongoing challenge. Staying informed about future tariff developments and their potential impact on the bond market is critical for managing your investments effectively.

Featured Posts

-

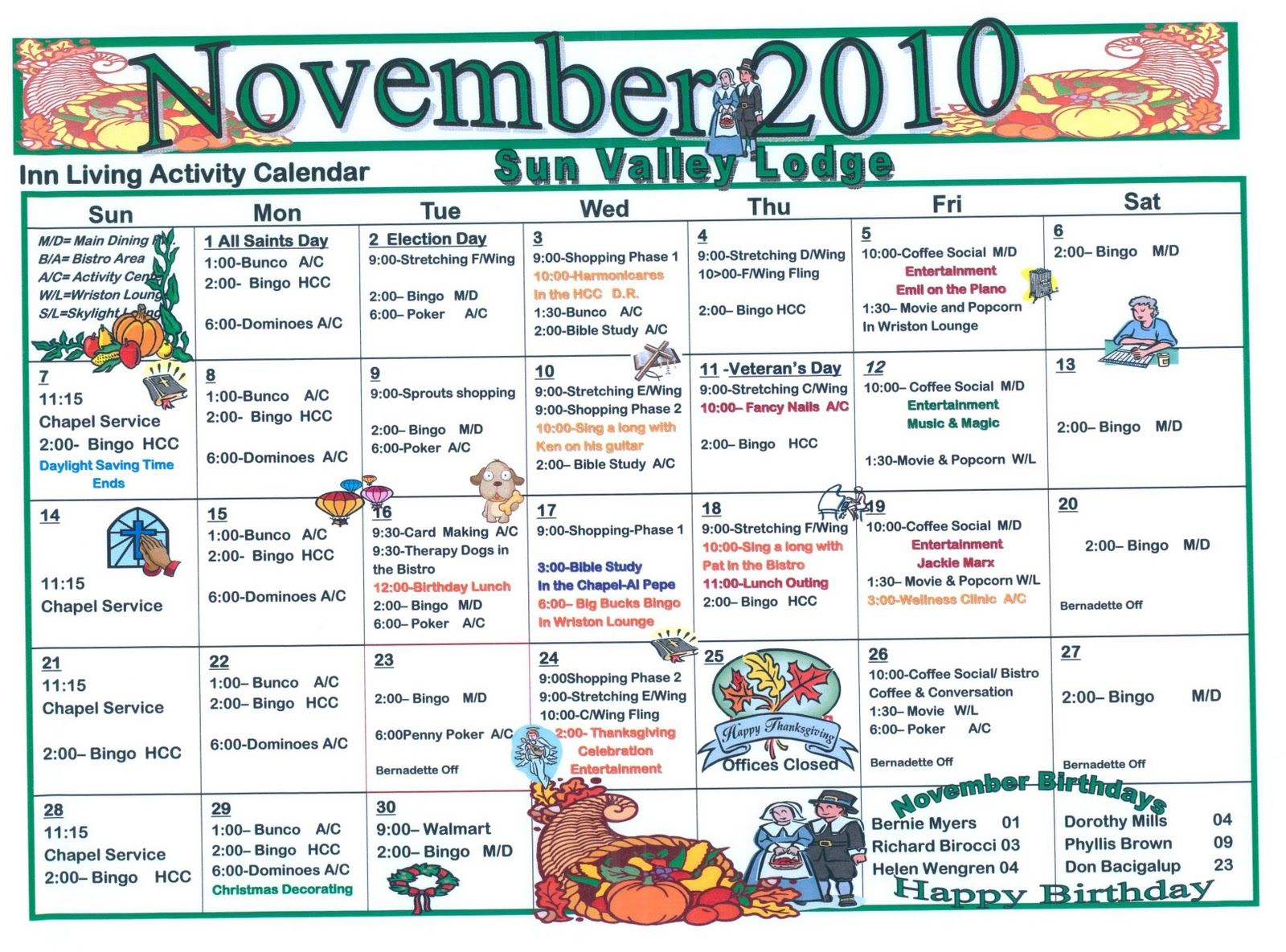

Senior Community Calendar Trips Events And Social Activities

May 12, 2025

Senior Community Calendar Trips Events And Social Activities

May 12, 2025 -

Cobra De Sylvester Stallone Un Regret Pour L Acteur

May 12, 2025

Cobra De Sylvester Stallone Un Regret Pour L Acteur

May 12, 2025 -

The Limited Appearances Of The True John Wick In The Keanu Reeves Series

May 12, 2025

The Limited Appearances Of The True John Wick In The Keanu Reeves Series

May 12, 2025 -

Kya 62 Salh Tam Krwz 36 Salh Adakarh Ke Eshq Myn Mbtla Hyn

May 12, 2025

Kya 62 Salh Tam Krwz 36 Salh Adakarh Ke Eshq Myn Mbtla Hyn

May 12, 2025 -

Asylunterkuenfte Potenzial Zur Kostenreduktion Um 1 Milliarde Euro

May 12, 2025

Asylunterkuenfte Potenzial Zur Kostenreduktion Um 1 Milliarde Euro

May 12, 2025

Latest Posts

-

Navi Mumbai News Nmmcs Aala Unhala Niyam Pala Summer Heatwave Advisory

May 13, 2025

Navi Mumbai News Nmmcs Aala Unhala Niyam Pala Summer Heatwave Advisory

May 13, 2025 -

Prvata Kniga So Traditsionalni Romski Ba Ki E Vekje Tuka

May 13, 2025

Prvata Kniga So Traditsionalni Romski Ba Ki E Vekje Tuka

May 13, 2025 -

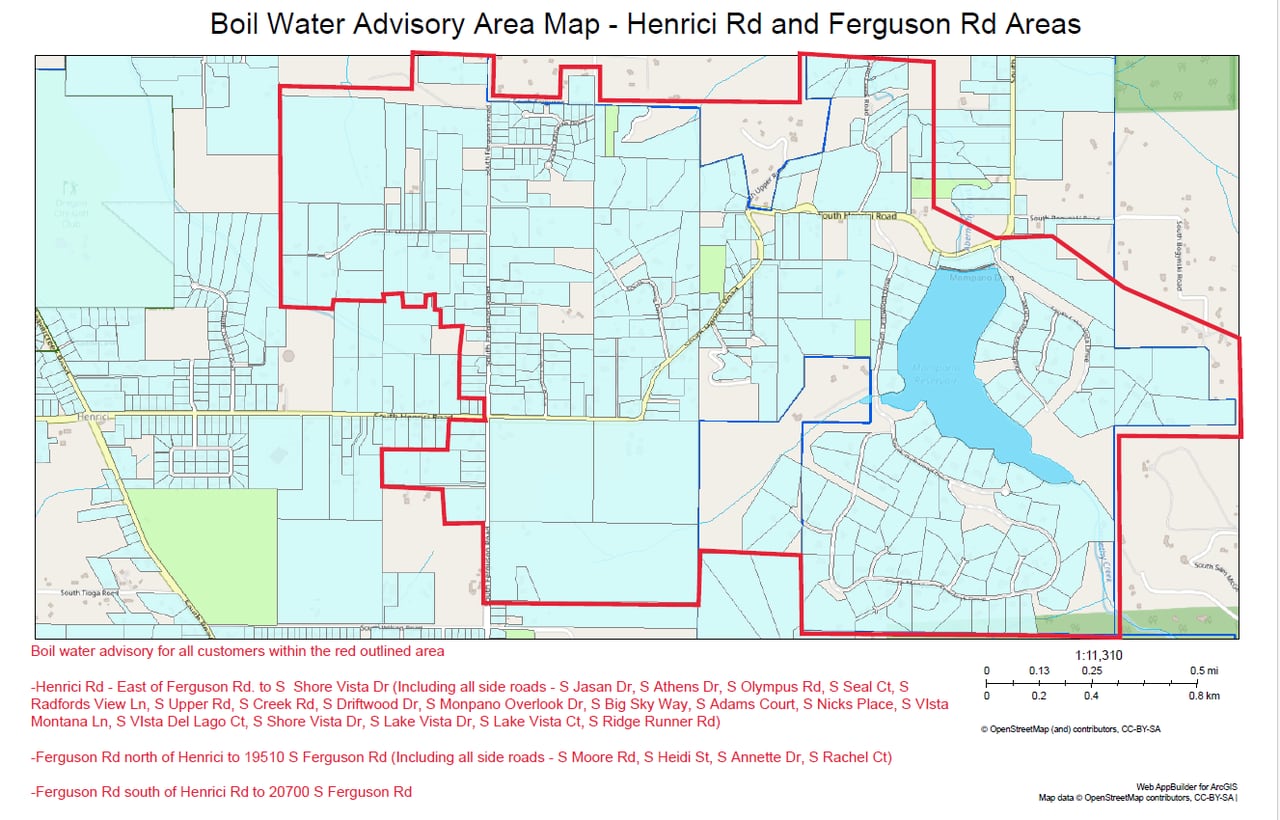

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025 -

Romanski Ba Ki Prvata Kniga E Promovirana

May 13, 2025

Romanski Ba Ki Prvata Kniga E Promovirana

May 13, 2025 -

Heatwave Warning Ghaziabad Advises Outdoor Workers

May 13, 2025

Heatwave Warning Ghaziabad Advises Outdoor Workers

May 13, 2025