Tariff Shockwaves: Analyzing The Tremors In The Bond Market

Table of Contents

The Mechanism: How Tariffs Affect Bond Yields

Tariffs, by their very nature, introduce significant economic disruptions that directly influence bond yields. The impact is multifaceted, stemming primarily from inflationary pressures and the resulting uncertainty in the market.

Increased Inflationary Pressure

Tariffs raise prices for imported goods, directly leading to inflation. This is a fundamental principle of economics: reduced supply (due to tariffs) increases prices. Higher inflation erodes the purchasing power of fixed-income investments like bonds, making them less attractive to investors.

- Increased production costs passed onto consumers: Businesses absorb increased import costs or pass them onto consumers through higher prices.

- Reduced consumer spending due to higher prices: Inflation reduces consumer purchasing power, leading to decreased demand and potentially slowing economic growth.

- Central bank response – potential interest rate hikes to combat inflation: To control inflation, central banks may raise interest rates, impacting the attractiveness of existing bonds and increasing yields on newly issued bonds.

- Impact on inflation-indexed bonds (TIPS): While TIPS (Treasury Inflation-Protected Securities) are designed to protect against inflation, their returns are still influenced by the overall market response to inflationary pressures caused by tariffs.

Uncertainty and Investor Sentiment

The unpredictability surrounding tariff implementation is a major factor influencing bond yields. This uncertainty creates a climate of fear and risk aversion among investors.

- Increased risk aversion among investors: Uncertainty surrounding trade policy leads investors to seek safer havens, often government bonds, reducing demand for riskier assets.

- Shift towards lower-risk assets (e.g., government bonds): This "flight to safety" increases demand for government bonds, potentially pushing their yields down.

- Potential decrease in demand for corporate bonds: Corporate bonds, particularly those issued by companies heavily reliant on international trade, become less attractive due to increased risk.

- Volatility in bond yields reflecting shifting investor sentiment: Bond yields fluctuate significantly as investor sentiment changes in response to tariff announcements and policy shifts. This creates a volatile and unpredictable environment for bond market participants.

Sectoral Impacts: Which Bonds are Most Vulnerable?

The impact of tariff shockwaves isn't uniform across all bond sectors. Some bond types are significantly more vulnerable than others.

Corporate Bonds

Companies heavily reliant on imported goods or exporting to tariff-affected markets are particularly exposed to the negative consequences of tariffs. This increased risk translates into higher yields on their bonds to compensate investors for the added risk.

- Analysis of specific sectors (e.g., manufacturing, agriculture): Sectors heavily dependent on imports or exports will likely face the most significant challenges and see a rise in their bond yields.

- Credit rating downgrades and their effect on bond prices: Companies experiencing financial strain due to tariffs may see their credit ratings downgraded, leading to lower bond prices and higher yields.

- Impact on high-yield (junk) bonds: High-yield corporate bonds are especially vulnerable, as they already carry significant risk. Tariffs can exacerbate this risk, leading to even higher yields or potential defaults.

Government Bonds

Even government bonds, typically considered the safest investments, are not completely immune to tariff shockwaves. Increased government borrowing to address economic slowdowns or fund trade disputes can put upward pressure on government bond yields.

- Impact of increased government spending on bond markets: Government spending to mitigate the negative economic effects of tariffs can lead to increased borrowing and higher yields on government bonds.

- Analysis of sovereign debt and its sensitivity to tariff policies: Countries with high levels of sovereign debt are particularly vulnerable to increased borrowing costs caused by tariff-related economic uncertainty.

- Comparison of government bond yields across different countries: The impact of tariffs can vary significantly depending on a country's trade relationships and economic structure.

Strategic Responses: Navigating the Tariff-Induced Volatility

Investors need effective strategies to navigate the volatility created by tariff shockwaves in the bond market.

Diversification

Diversification is key to mitigating risk in a turbulent bond market. Spreading investments across different bond types and maturities reduces the impact of any single negative event.

- Importance of asset allocation strategies: A well-defined asset allocation strategy that considers the current economic climate is vital for managing risk.

- Benefits of diversifying across different geographies: Diversification across different countries can help mitigate the impact of tariffs imposed on specific economies.

- Role of professional investment advice: Seeking advice from a qualified financial advisor can provide valuable insights and help create a robust, diversified bond portfolio.

Hedging Strategies

Hedging instruments can protect against unexpected interest rate movements caused by tariff-related economic uncertainty.

- Explanation of various hedging techniques: Investors can use interest rate swaps, options, and other instruments to mitigate risk.

- Risks and limitations of hedging strategies: While hedging can reduce risk, it is not a foolproof strategy and can involve its own costs and complexities.

- Importance of understanding market dynamics before hedging: Effective hedging requires a thorough understanding of the market and the potential impacts of tariff policies.

Conclusion

Tariff Shockwaves are significantly impacting the bond market, creating both opportunities and challenges for investors. Understanding how tariffs influence inflation, investor sentiment, and different bond sectors is crucial for effective portfolio management. By diversifying investments and utilizing appropriate hedging strategies, investors can better navigate the complexities of this volatile market. Stay informed about the latest developments in trade policy to mitigate the risks associated with Tariff Shockwaves and make informed decisions in the bond market. Learn more about protecting your bond portfolio from future tariff impacts by consulting with a financial advisor.

Featured Posts

-

Is John Wick 5 Really Happening A Look At The Evidence

May 12, 2025

Is John Wick 5 Really Happening A Look At The Evidence

May 12, 2025 -

1 Milliarde Euro Einsparpotenzial Durch Optimierte Asylunterkuenfte

May 12, 2025

1 Milliarde Euro Einsparpotenzial Durch Optimierte Asylunterkuenfte

May 12, 2025 -

The Next Pope Analyzing The Leading Contenders For The Papal Election

May 12, 2025

The Next Pope Analyzing The Leading Contenders For The Papal Election

May 12, 2025 -

Impact Of New York Court Ruling On Trump Tariffs

May 12, 2025

Impact Of New York Court Ruling On Trump Tariffs

May 12, 2025 -

Tragedy Strikes Milwaukee Apartment Fire Claims Four Lives Displaces Hundreds

May 12, 2025

Tragedy Strikes Milwaukee Apartment Fire Claims Four Lives Displaces Hundreds

May 12, 2025

Latest Posts

-

Promovirana E Prvata Kniga So Romski Ba Ki

May 13, 2025

Promovirana E Prvata Kniga So Romski Ba Ki

May 13, 2025 -

Kilkist Romiv V Ukrayini Statistichni Dani Ta Analiz Rozselennya

May 13, 2025

Kilkist Romiv V Ukrayini Statistichni Dani Ta Analiz Rozselennya

May 13, 2025 -

Romska Gromada Ukrayini Geografichne Zoseredzhennya Ta Yogo Prichini

May 13, 2025

Romska Gromada Ukrayini Geografichne Zoseredzhennya Ta Yogo Prichini

May 13, 2025 -

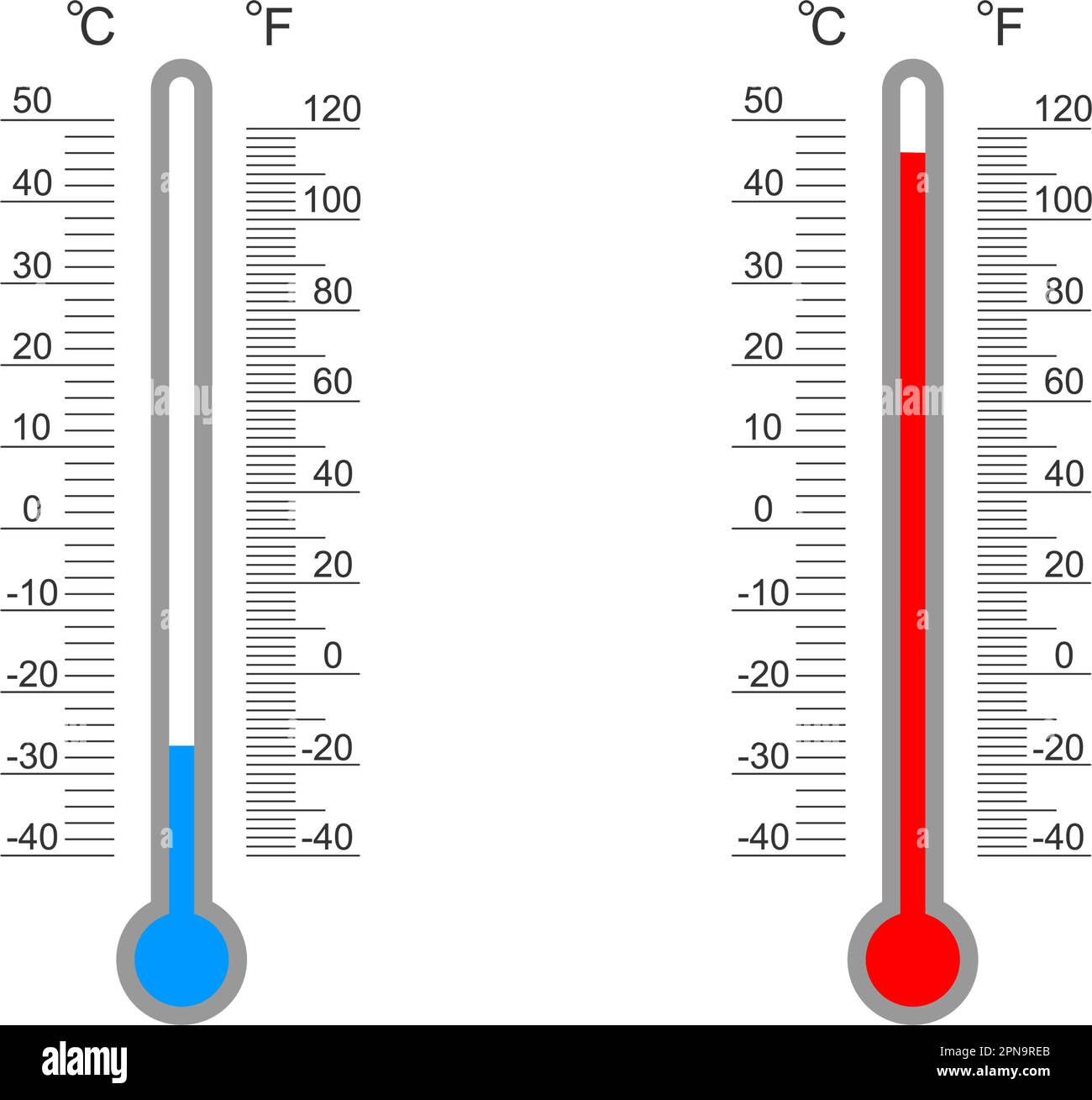

Heatwave Warning For Indore 40 C Temperature And Cmho Advisory

May 13, 2025

Heatwave Warning For Indore 40 C Temperature And Cmho Advisory

May 13, 2025 -

Indore Braces For Extreme Heat 40 Celsius Temperature And Loo Warning

May 13, 2025

Indore Braces For Extreme Heat 40 Celsius Temperature And Loo Warning

May 13, 2025