Tariff Wars Freeze IPO Market: Analyzing The Current Crisis

Table of Contents

Increased Uncertainty and Investor Hesitation

The unpredictable nature of tariff policies creates significant uncertainty for businesses considering an IPO. This unpredictability makes it incredibly difficult to plan for the future and assess long-term viability. Investors, naturally risk-averse, are hesitant to commit capital in such a volatile environment. The fear of unforeseen costs and market fluctuations outweighs the potential rewards.

- Fear of future tariff impacts on company profitability: Tariffs can dramatically increase input costs, squeezing profit margins and impacting the bottom line, making it difficult to project future earnings.

- Difficulty in accurately forecasting future earnings: The ever-changing tariff landscape makes reliable financial forecasting nearly impossible, a key factor for investors evaluating potential investments. This lack of clarity makes it hard to justify a specific valuation.

- Reduced investor confidence and risk appetite: Uncertainty breeds hesitation. Investors are less willing to take on the perceived increased risk associated with companies operating in a volatile tariff environment.

- Lower valuations due to perceived increased risk: The inherent uncertainty surrounding tariffs directly translates to lower valuations for companies preparing for IPOs. Investors demand a discount to compensate for the added risk.

Impact on Valuation and Pricing

Tariffs directly impact a company's bottom line, making it challenging to determine a fair IPO valuation. This directly impacts the IPO process itself, often leading to delays or outright cancellations. Accurate valuation is a cornerstone of successful IPOs, and tariffs undermine this process.

- Increased input costs due to tariffs on imported goods: Tariffs on raw materials and components raise production costs, eroding margins and making it harder to compete.

- Reduced export opportunities and revenue streams: Retaliatory tariffs from other countries can severely limit export markets and revenue streams, impacting overall company performance.

- Difficulty in securing accurate financial projections for investors: The instability introduced by tariffs makes creating reliable financial projections, a vital part of the IPO prospectus, an extremely challenging task.

- Pressure to lower IPO pricing to attract investors: Faced with uncertainty and reduced investor confidence, companies are often forced to lower their IPO pricing to attract investors, resulting in lower proceeds for the company.

Sector-Specific Impacts: Which Industries are Hit Hardest?

Certain sectors are more vulnerable to tariff impacts than others, resulting in a disproportionate impact on their IPO prospects. Companies with complex, global supply chains are especially vulnerable.

- Technology companies reliant on global supply chains: Many tech companies rely on international supply chains for components and manufacturing. Tariffs disrupt these chains, increasing costs and delaying product launches.

- Manufacturing companies heavily reliant on imported materials: Manufacturers who use imported raw materials are particularly susceptible to tariff increases, affecting their production costs and competitiveness.

- Retail companies impacted by tariffs on consumer goods: Retailers face increased costs on imported goods, forcing them to either absorb the higher costs or pass them on to consumers, impacting sales and profitability.

- Analysis of specific examples of delayed or cancelled IPOs across various sectors: Several high-profile IPOs have been delayed or cancelled due to tariff uncertainty, highlighting the far-reaching impact of this issue. Analysis of these cases demonstrates the significant negative consequences.

The Geopolitical Landscape and its Role

The broader geopolitical climate of trade disputes significantly contributes to the uncertainty, further discouraging IPO activity. The ongoing trade tensions create a climate of fear and uncertainty, impacting investor confidence.

- Escalation of trade tensions between major economies: The ongoing trade war between major economies creates a general atmosphere of uncertainty, affecting investor sentiment across the board.

- Uncertainty regarding future trade agreements and policies: The lack of clarity on future trade policies creates a considerable impediment to long-term planning and investment.

- Impact of retaliatory tariffs and trade sanctions: Retaliatory tariffs create a vicious cycle of trade restrictions, making it difficult for companies to operate in a predictable and stable manner.

- Influence of political instability on investor sentiment: Political instability and unpredictability further amplify the negative impact of trade wars on investor confidence and willingness to invest in new ventures.

Potential Solutions and Future Outlook

Navigating the current climate requires proactive strategies and careful consideration of future scenarios. Companies must adapt to mitigate the negative impacts of tariff wars.

- Strategies for mitigating tariff impacts on company operations: Companies can explore strategies like diversifying supply chains, improving operational efficiency, and hedging against currency fluctuations.

- Seeking alternative supply chains and sourcing strategies: Re-evaluating supply chains and exploring alternatives can help mitigate the impact of tariffs and ensure business continuity.

- Improved transparency and communication with investors: Open and honest communication with investors about the company's approach to managing tariff risks can help maintain investor confidence.

- Predicting future trends and potential recovery in the IPO market: Close monitoring of geopolitical developments and tariff policy changes will be critical for companies considering an IPO in the future. Analyzing historical data and making informed projections is crucial.

Conclusion

The current freeze in the IPO market, largely driven by the uncertainties surrounding tariff wars, presents a significant challenge for businesses seeking capital and investors seeking opportunities. Understanding the interconnectedness of global trade policies and their impact on financial markets is crucial. Navigating this crisis requires careful analysis of individual company situations, proactive risk management, and a close watch on evolving geopolitical factors. To stay informed on the impact of Tariff Wars on the IPO Market, and to navigate this challenging environment successfully, continue following our analysis and updates. We will provide regular insights and commentary on how these tariff wars are affecting the IPO market freeze, and offer strategies to help businesses and investors make informed decisions.

Featured Posts

-

Investors Submit Revised Bid For Quebecs Lion Electric

May 14, 2025

Investors Submit Revised Bid For Quebecs Lion Electric

May 14, 2025 -

Erfolgreiche Naturschutzmassnahme 190 000 Baeume Im Nationalpark Saechsische Schweiz Gepflanzt

May 14, 2025

Erfolgreiche Naturschutzmassnahme 190 000 Baeume Im Nationalpark Saechsische Schweiz Gepflanzt

May 14, 2025 -

Swiateks Ranking Plunge After Rome Loss To Collins

May 14, 2025

Swiateks Ranking Plunge After Rome Loss To Collins

May 14, 2025 -

Metas Antitrust Troubles Examining The Whats App And Instagram Acquisitions

May 14, 2025

Metas Antitrust Troubles Examining The Whats App And Instagram Acquisitions

May 14, 2025 -

Man Utds Exciting New Recruit The England Stars Brother

May 14, 2025

Man Utds Exciting New Recruit The England Stars Brother

May 14, 2025

Latest Posts

-

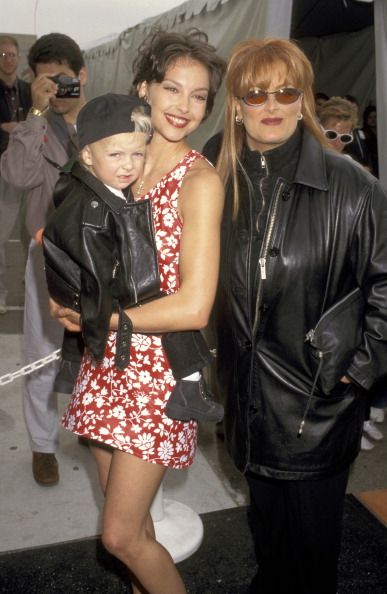

Wynonna And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025

Wynonna And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025 -

Wynonna And Ashley Judd Open Up Their Family Story In A New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up Their Family Story In A New Docuseries

May 14, 2025 -

The Judd Family Wynonna And Ashley Share Their Stories In New Docuseries

May 14, 2025

The Judd Family Wynonna And Ashley Share Their Stories In New Docuseries

May 14, 2025 -

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025 -

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025