Tariff Wars Top Threat To Ryanair's Growth, Company Initiates Buyback Plan

Table of Contents

The Impact of Tariff Wars on Airline Operations

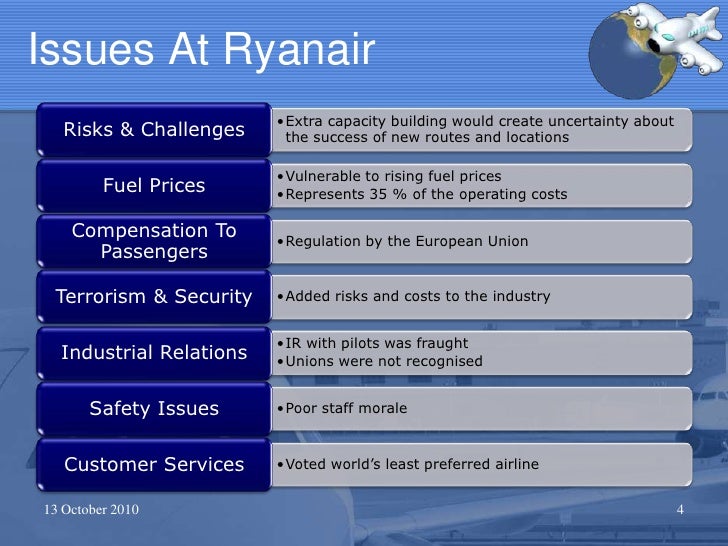

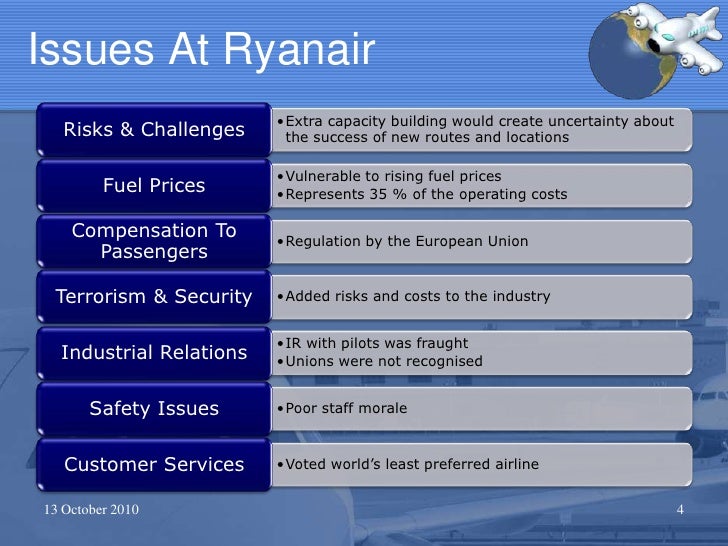

Escalating tariffs significantly impact airline operations, impacting profitability and long-term planning. For a cost-sensitive giant like Ryanair, these impacts are particularly acute. The ripple effects of tariff wars extend across numerous aspects of the business.

-

Increased Fuel Costs: Import tariffs on crude oil and refined fuels directly translate to higher operational costs. Fuel is a major expense for any airline, and even a small percentage increase can significantly affect profitability margins. Ryanair's vast network magnifies the impact of these price hikes.

-

Higher Maintenance Costs: Aircraft maintenance relies heavily on imported parts and components. Tariffs on these imports inevitably translate to increased maintenance expenses, squeezing profit margins further. This is especially concerning given the large fleet Ryanair operates.

-

Supply Chain Disruptions: Tariff wars disrupt global supply chains. Delays in receiving essential parts, whether for routine maintenance or unexpected repairs, can lead to operational inefficiencies and grounded aircraft, resulting in lost revenue and frustrated passengers.

-

Potential Impact on Aircraft Leasing Costs: The complexities of international trade agreements and tariffs can also indirectly affect aircraft leasing costs, as manufacturers and lessors absorb and pass on increased expenses.

Ryanair's Response: A Share Buyback Plan

In the face of these challenges, Ryanair has initiated a share buyback plan. This strategic move raises several questions. Is it a vote of confidence in the company's future, or a defensive maneuver to return value to shareholders amid uncertainty?

-

The size and scope of the buyback program: The specific details of the buyback program highlight the scale of Ryanair's commitment to shareholder returns despite the external pressures from tariff wars.

-

The timing of the buyback: The timing relative to escalating tariff disputes is noteworthy, signaling the company's assessment of its own financial strength and its view of the long-term effects of the trade war.

-

Potential investor reactions: Investor reactions to the buyback can indicate market confidence or concern regarding Ryanair's ability to weather the storm of tariff wars. A positive market response may suggest confidence in Ryanair's long-term strategy.

-

The buyback as a signal: This action can be interpreted either as a confident assertion of Ryanair's financial stability or as a defensive strategy to return capital to shareholders before potential further negative impacts.

Alternative Strategies to Mitigate Tariff Impacts

While the share buyback addresses shareholder concerns, Ryanair needs a broader strategy to mitigate the long-term effects of tariff wars. Several alternative approaches could be considered:

-

Fuel Hedging: Implementing comprehensive fuel hedging strategies can help to manage the volatility of fuel prices caused by import tariffs and global market fluctuations.

-

Route Optimization: Adjusting flight routes to minimize exposure to high-tariff regions can help reduce the impact of increased fuel and maintenance costs.

-

Alternative Suppliers: Exploring alternative suppliers for aircraft parts, potentially from regions less affected by tariffs, could help mitigate rising maintenance costs and supply chain disruptions.

-

Fuel-Efficient Aircraft: Investing in newer, more fuel-efficient aircraft can reduce fuel consumption and lower the overall impact of higher fuel prices.

The Broader Geopolitical Context of Tariff Wars

Ryanair's challenges are not isolated. The airline industry as a whole is grappling with the unpredictability of global trade policies. This broader geopolitical context underscores the severity of the situation.

-

Impact on Air Travel Demand: Broader trade disputes can negatively affect air travel demand, impacting the overall number of passengers and profitability for airlines.

-

Uncertainty of Future Policies: The inherent unpredictability of future tariff policies creates significant challenges for long-term airline planning and investment decisions.

-

Comparison to Other Airlines: Analyzing how other airlines are responding to similar challenges provides valuable insights and potential best practices for Ryanair's ongoing strategy.

Conclusion: Navigating the Turbulence of Tariff Wars – Ryanair's Future

Tariff wars pose a considerable threat to Ryanair's continued growth and profitability. While the share buyback plan demonstrates a commitment to shareholder value, it’s only one piece of the puzzle. A multi-pronged approach, incorporating fuel hedging, route optimization, and investment in fuel-efficient technologies, is crucial for navigating the long-term challenges posed by these trade disputes. Staying informed about the ongoing impact of tariff wars on Ryanair and the wider aviation industry is essential. Follow industry news and analysis to understand how this dynamic situation continues to evolve and how Ryanair adapts its strategies. Subscribe to our newsletter for regular updates on the impact of trade policies on the aviation sector.

Featured Posts

-

Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten Een Diepgaande Analyse

May 21, 2025

Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten Een Diepgaande Analyse

May 21, 2025 -

Predicting Rain The Most Accurate Timing Forecasts Available

May 21, 2025

Predicting Rain The Most Accurate Timing Forecasts Available

May 21, 2025 -

Ultimate Team Ea Fc 24 Fut Birthday Player Tier List

May 21, 2025

Ultimate Team Ea Fc 24 Fut Birthday Player Tier List

May 21, 2025 -

Millions Stolen Inside The Office365 Hack Targeting Executives

May 21, 2025

Millions Stolen Inside The Office365 Hack Targeting Executives

May 21, 2025 -

Bundesliga Leverkusen Upsets Bayern Delays Title Celebrations Kane Sidelined

May 21, 2025

Bundesliga Leverkusen Upsets Bayern Delays Title Celebrations Kane Sidelined

May 21, 2025