Tariffs And The Fed: Jerome Powell's Concerns About Economic Stability

Table of Contents

The Direct Impact of Tariffs on Inflation and Consumer Prices

Tariffs, essentially taxes on imported goods, directly increase the cost of those goods. This increased cost is then passed on to consumers in the form of higher prices, fueling inflationary pressure. The simplest example is a tariff on imported steel; this immediately raises the price of steel, impacting the cost of everything from cars and appliances to construction projects. This inflationary effect reduces consumer purchasing power, potentially leading to a decline in overall consumer spending.

- Increased prices for imported materials: Tariffs raise the cost of raw materials and intermediate goods, leading to higher production costs across various industries.

- Reduced consumer purchasing power: Higher prices for goods and services mean consumers have less disposable income, impacting demand and overall economic activity.

- Potential for wage stagnation or decline: Businesses facing increased costs might struggle to maintain wages, leading to potential wage stagnation or even declines, further dampening consumer spending.

- Ripple effects across various sectors of the economy: The inflationary pressure caused by tariffs isn't isolated; it ripples through the economy, affecting various sectors and potentially triggering a domino effect.

Tariffs and Their Effect on Supply Chains and Business Investment

The imposition of tariffs disrupts global supply chains, creating uncertainty and hindering efficient production. Businesses rely on intricate global networks for sourcing materials and distributing finished products. Tariffs introduce unforeseen costs and delays, making it difficult to predict costs and plan for the future. This uncertainty discourages business investment, as companies become hesitant to commit to long-term projects in the face of unpredictable trade policies.

- Increased costs of production: Tariffs increase the cost of imported inputs, significantly impacting production costs and profitability.

- Delayed delivery times: Navigating tariff complexities and potential trade disputes can lead to significant delays in the delivery of goods.

- Uncertainty in business planning: The unpredictable nature of tariff policies makes it extremely challenging for businesses to create long-term strategic plans.

- Reduced foreign direct investment: The uncertainty and increased costs associated with tariffs discourage foreign investment, impacting economic growth.

The Fed's Response to Tariff-Induced Economic Challenges

The Federal Reserve employs various tools to manage inflation and stimulate economic growth. These include adjusting interest rates and implementing quantitative easing. However, the economic uncertainty generated by tariffs complicates the Fed's task. The Fed faces the difficult trade-off of combating inflation (which tariffs exacerbate) while simultaneously supporting economic growth. Raising interest rates to curb inflation might stifle economic activity, particularly if businesses are already struggling due to tariff-related challenges.

- Interest rate hikes to combat inflation: The Fed might raise interest rates to cool down inflation, but this can slow economic growth.

- Potential for slower economic growth due to tighter monetary policy: Higher interest rates can make borrowing more expensive, discouraging investment and potentially slowing economic growth.

- The challenges of balancing inflation control with supporting employment: The Fed must navigate a delicate balance between keeping inflation under control and maintaining employment levels.

- The limitations of monetary policy in addressing tariff-related structural issues: Monetary policy can address inflation and economic growth, but it's limited in its ability to fix the structural problems caused by tariffs.

Geopolitical Implications and Global Economic Uncertainty

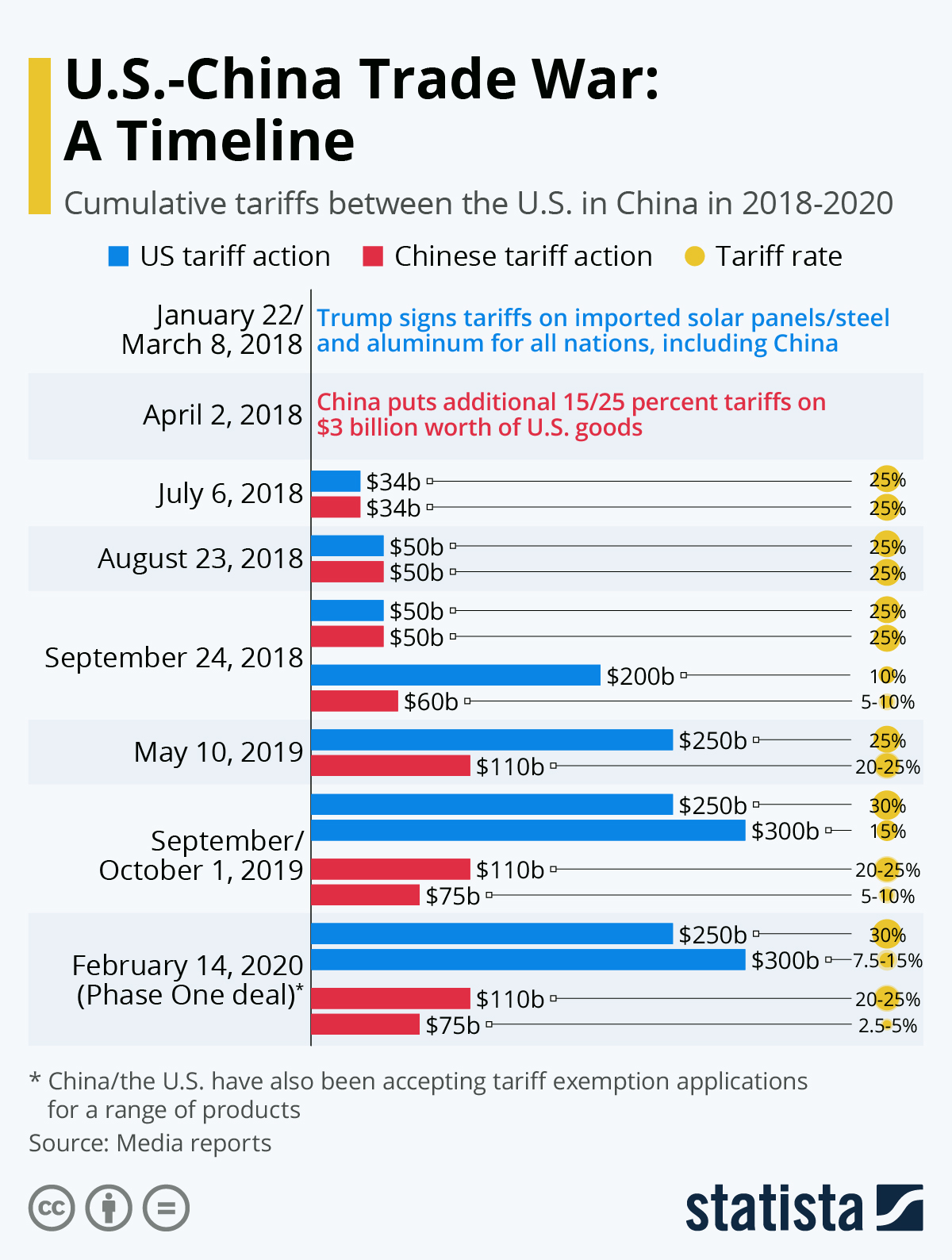

Tariffs often escalate into trade wars, creating significant geopolitical tensions and uncertainty in the global economic outlook. These trade disputes can disrupt international trade, reduce foreign direct investment, and increase volatility in financial markets. The potential for a global recession or significant economic slowdown is a serious concern in a climate of escalating trade conflicts.

- Escalation of trade disputes between countries: Tariffs can trigger retaliatory measures, leading to escalating trade wars and further economic disruption.

- Negative impact on global trade and investment: Uncertainty surrounding trade policies deters investment and reduces overall global trade.

- Increased volatility in financial markets: Trade wars and economic uncertainty can lead to increased volatility in stock markets and currency exchange rates.

- Uncertainty regarding future trade policies: The unpredictable nature of trade policies adds to the uncertainty faced by businesses and investors worldwide.

Conclusion: Understanding the Interplay Between Tariffs and the Fed

In conclusion, the interplay between Tariffs and the Fed is complex and fraught with challenges. Tariffs directly contribute to inflation, disrupt supply chains, and complicate the Fed's efforts to manage the economy. Jerome Powell faces a significant challenge in balancing inflation control with economic growth in this uncertain environment. Understanding this complex relationship is crucial for both policymakers and businesses. Stay informed about the latest updates on tariffs and the Fed's response to ensure your financial preparedness in this dynamic economic environment. Understanding the impact of Tariffs and the Fed is crucial for informed decision-making.

Featured Posts

-

Us Tariff Fallout Opportunities For Increased Trade Between Canada And Mexico

May 26, 2025

Us Tariff Fallout Opportunities For Increased Trade Between Canada And Mexico

May 26, 2025 -

Jadwal Moto Gp Argentina 2025 Catat Waktu Sprint Race Minggu Pagi

May 26, 2025

Jadwal Moto Gp Argentina 2025 Catat Waktu Sprint Race Minggu Pagi

May 26, 2025 -

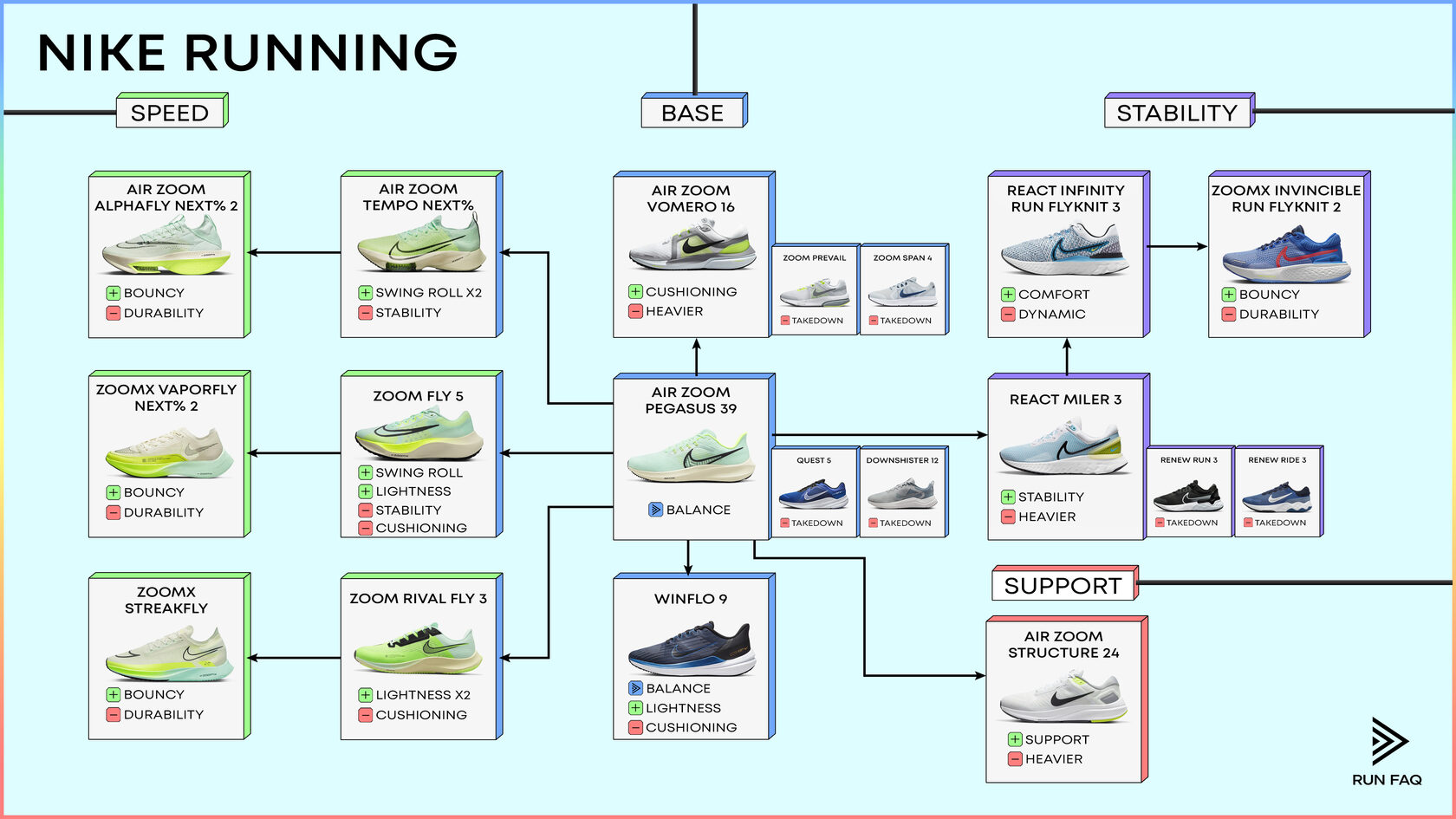

Best Nike Running Shoes In 2025 Style Performance And Comfort

May 26, 2025

Best Nike Running Shoes In 2025 Style Performance And Comfort

May 26, 2025 -

Container Ship Runs Aground On Residential Property Full Cnn Report

May 26, 2025

Container Ship Runs Aground On Residential Property Full Cnn Report

May 26, 2025 -

Land Of Sometimes Tim Rices Lyrical Contribution To The Lion King Legacy

May 26, 2025

Land Of Sometimes Tim Rices Lyrical Contribution To The Lion King Legacy

May 26, 2025