Tech Billionaires And The Trump Inauguration: A $194 Billion Loss And Counting

Table of Contents

The Initial Market Reaction and the Subsequent Downturn

The days leading up to the Trump inauguration saw a surge in market optimism, fueled by promises of deregulation and economic growth. However, this positive sentiment proved short-lived. The post-inauguration period witnessed a rapid reversal, leading to a significant downturn in the stock market, particularly impacting the tech sector.

-

Unexpected Policy Changes: Trump's unexpected policy changes, including threats of trade wars and stricter immigration policies, rattled investor confidence. The uncertainty surrounding these shifts created volatility and negatively affected investor sentiment. This uncertainty directly impacted the valuation of tech companies heavily reliant on global trade and skilled immigration.

-

Social Media and News Coverage: The 24/7 news cycle and the pervasive influence of social media amplified market anxieties. Negative headlines and speculative reporting contributed to a climate of fear and uncertainty, prompting many investors to sell off their tech stocks. This created a self-fulfilling prophecy, driving down stock prices even further.

-

Significant Stock Drops: Major tech companies experienced substantial drops in their stock prices. Apple, Google (Alphabet), and Amazon, among others, saw significant declines in their market capitalization, directly impacting the net worth of their CEOs and major shareholders. This decline wasn't simply a short-term fluctuation; it represented a shift in investor confidence regarding the future prospects of the tech sector under the new administration.

-

Regulatory Uncertainty: The uncertainty surrounding future regulations on tech companies, particularly concerning antitrust issues and data privacy, added to the downward pressure on tech stocks. The potential for increased regulatory scrutiny created a risk-averse environment, pushing investors towards more stable investments.

Specific Losses Suffered by Prominent Tech Billionaires

The market downturn following the Trump inauguration resulted in substantial personal losses for many prominent tech billionaires.

-

Jeff Bezos: The founder of Amazon, witnessed a significant drop in his net worth due to the decline in Amazon's stock price. The decrease reflected investor concerns about potential regulatory changes impacting the company's e-commerce dominance and cloud computing business.

-

Mark Zuckerberg: Facebook (now Meta) also experienced a decline in its stock valuation, impacting Zuckerberg's personal wealth. Concerns about data privacy, fake news, and the company's overall business model contributed to the decline.

-

Bill Gates: While Gates' investment portfolio is highly diversified, the overall market downturn still impacted his net worth. Although less directly affected than Bezos or Zuckerberg due to his diversified holdings, he still experienced a substantial, albeit proportionally smaller, loss.

(Note: To enhance this section, include charts and graphs illustrating the fluctuations in their net worth around the inauguration. This would require obtaining and incorporating relevant financial data.) The different factors affecting each billionaire's portfolio highlight the complex interplay between individual company performance and broader macroeconomic factors.

The Long-Term Effects on the Tech Industry

The post-inauguration market downturn had far-reaching consequences for the tech sector.

-

Impact on Tech Innovation and Investment: The decreased market valuation and investor uncertainty led to a slowdown in venture capital funding and a more cautious approach to investment in new technologies. This affected both established tech companies and startups.

-

Changes in Hiring Practices and Business Strategies: Many tech companies adjusted their hiring practices and business strategies in response to the economic uncertainty. Some slowed down hiring, while others focused on cost-cutting measures.

-

Broader Economic Effects: The downturn in the tech sector had ripple effects throughout the broader economy, impacting related industries and employment levels. The tech industry's significant role in the overall economy meant that its struggles influenced other sectors.

Political Factors and their Influence on Market Volatility

The market volatility following the Trump inauguration was largely driven by political factors.

-

Policy Proposals and Enacted Policies: Specific policy proposals and enacted policies, such as those concerning trade and immigration, directly affected the tech industry's performance and investor sentiment. The uncertainty surrounding these policies created a volatile market environment.

-

Impact of Changing Trade Relations: The Trump administration's protectionist trade policies, including tariffs and trade disputes, negatively impacted tech companies heavily involved in global trade. Supply chains were disrupted, and costs increased.

-

Political Rhetoric and News Cycles: Political rhetoric and the constant news cycle surrounding the new administration contributed to heightened market volatility. Negative news and uncertainty created a climate of fear and uncertainty among investors, driving them to sell off assets.

Conclusion

The Trump inauguration in 2017 resulted in substantial financial losses for tech billionaires, with an estimated $194 billion wiped off their collective net worth. This staggering figure underscores the significant impact of political events on the financial markets. The contributing factors included unexpected policy changes, amplified anxieties through social media, significant stock drops in major tech companies, and uncertainty surrounding future regulations. The long-term effects on the tech industry included a slowdown in innovation, adjustments to hiring practices, and ripple effects throughout the broader economy. Understanding the intricate relationship between politics and the tech market is crucial for navigating future economic uncertainty.

Call to action: Learn more about the complex relationship between politics and the tech market. Understand the impact of political events on your investments. Analyze the ongoing effects of the Trump inauguration on tech billionaires and the overall economy by exploring further research on the impact of tech billionaires and the Trump inauguration.

Featured Posts

-

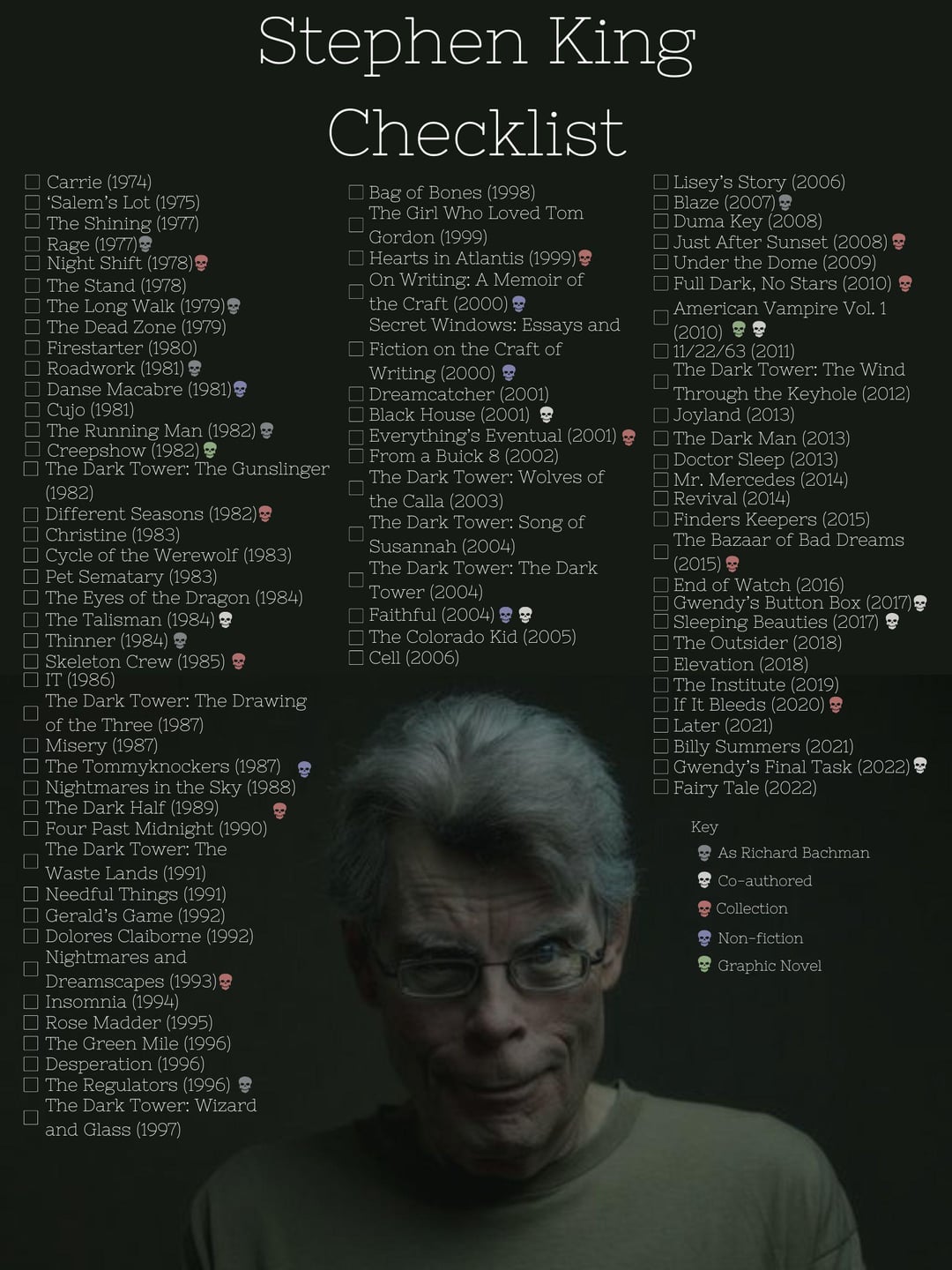

Short Sweet And Scary A Stephen King Series Perfect For A Quick Binge

May 09, 2025

Short Sweet And Scary A Stephen King Series Perfect For A Quick Binge

May 09, 2025 -

Man Learns Costly Lesson Babysitter Fee Leads To Higher Daycare Bill

May 09, 2025

Man Learns Costly Lesson Babysitter Fee Leads To Higher Daycare Bill

May 09, 2025 -

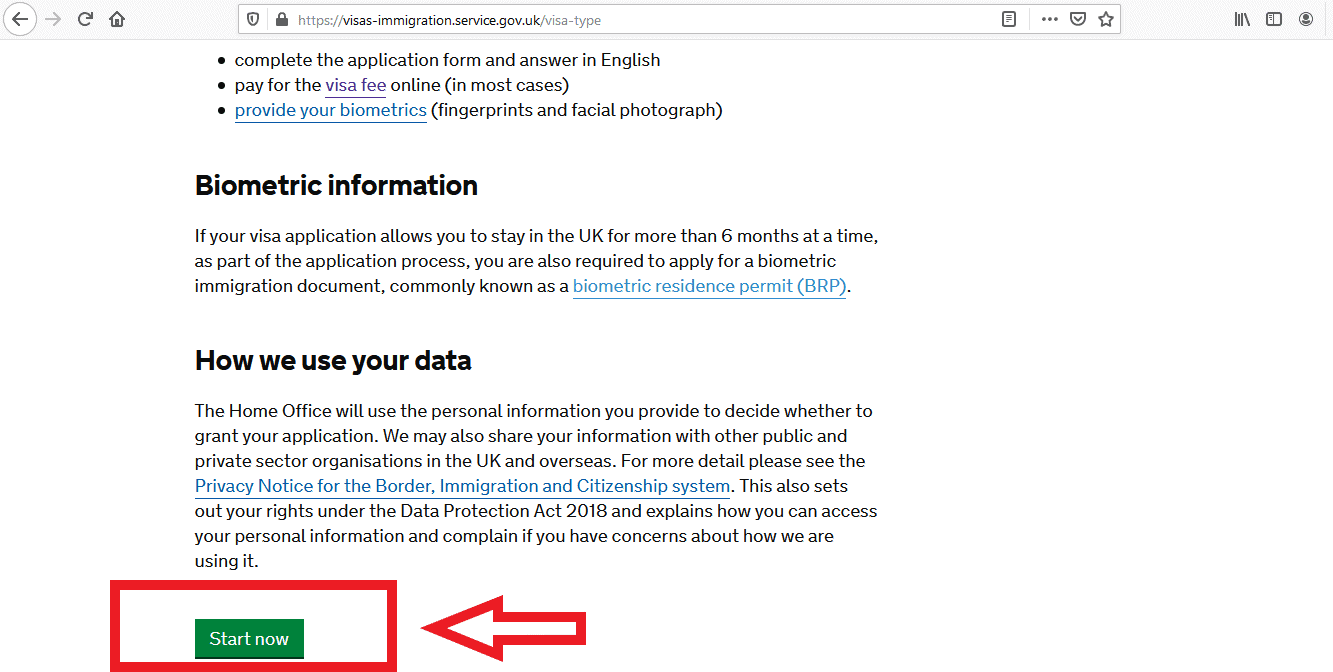

Nigeria And Pakistan New Uk Visa Regulations

May 09, 2025

Nigeria And Pakistan New Uk Visa Regulations

May 09, 2025 -

73 000

May 09, 2025

73 000

May 09, 2025 -

Should You Invest In This Spac Targeting Micro Strategys Market

May 09, 2025

Should You Invest In This Spac Targeting Micro Strategys Market

May 09, 2025