Tech IPO Freeze: The Impact Of Rising Tariffs

Table of Contents

The Direct Impact of Tariffs on Tech Companies

Rising tariffs directly impact tech companies in several crucial ways, hindering their ability to thrive and discouraging IPOs.

Increased Costs of Production

Rising tariffs on imported components, essential to the production of most tech products, directly increase production costs. These components include semiconductors, rare earth minerals, and various raw materials. The increased cost of these inputs directly reduces profit margins, making tech companies less attractive to investors considering an IPO. For example, increased tariffs on imported smartphone displays dramatically increase the cost of manufacturing, impacting profitability and potentially delaying or preventing an IPO.

- Reduced profitability: Higher production costs eat into profit margins, reducing the attractiveness of an IPO.

- Lower revenue projections: Increased prices to compensate for tariff costs can deter consumers, leading to lower revenue forecasts.

- Decreased investor confidence: Reduced profitability and uncertain revenue streams make investors hesitant to back an IPO.

Supply Chain Disruptions

Tariffs don't just increase costs; they also severely disrupt global supply chains. The complexity of modern tech manufacturing relies on a seamless flow of components from various countries. Tariffs introduce delays, uncertainty, and increased logistical hurdles. This makes it extremely difficult for tech companies to accurately predict their costs and future revenue streams – a critical factor for securing investor confidence before an IPO.

- Production bottlenecks: Delays in receiving imported components can halt or slow down production lines.

- Increased shipping costs: Tariffs often lead to higher shipping and handling costs, further squeezing profit margins.

- Difficulty in meeting demand: Supply chain disruptions can make it challenging to meet market demand, impacting revenue and investor sentiment.

The Indirect Impact on Investor Sentiment

Beyond the direct costs, rising tariffs create an indirect, but equally significant, impact on investor sentiment, chilling the tech IPO market.

Global Economic Uncertainty

Rising tariffs contribute significantly to global economic uncertainty. This uncertainty makes investors inherently risk-averse, leading them to shy away from potentially volatile investments like tech IPOs. In times of economic uncertainty, investors tend to move towards safer, more established investments, leaving tech startups struggling to secure the funding needed for an IPO.

- Reduced investor appetite for risk: Uncertainty makes investors prioritize lower-risk investments.

- Flight to safety in established markets: Investors often move funds into established, less volatile sectors.

- Lower IPO valuations: Reduced investor interest translates into lower valuations for tech IPOs.

Impact on Venture Capital Funding

The uncertainty surrounding tariffs also significantly impacts venture capital (VC) funding for tech startups. VC firms become more cautious, less willing to invest in companies facing increased costs and significant market volatility due to tariff-related disruptions. This reduction in funding means fewer companies reach the stage of being IPO-ready, further contributing to the tech IPO freeze.

- Reduced venture capital investment: VC firms become more selective, prioritizing less risky ventures.

- Fewer startups reaching IPO maturity: A lack of funding hinders growth and delays IPO readiness.

- Increased difficulty in securing funding rounds: Startups face increased hurdles in securing necessary investment.

The Future of Tech IPOs in a Tariff-Heavy Environment

While the current situation presents challenges, the future of tech IPOs in a tariff-heavy environment depends on adaptation, mitigation strategies, and supportive government policies.

Adaptation and Mitigation Strategies

Tech companies are actively exploring strategies to mitigate the impact of tariffs. These include diversifying their supply chains, exploring domestic or regional sourcing (nearshoring), and negotiating favorable trade deals to reduce their reliance on heavily-tariffed imports. Innovation also plays a crucial role – developing new technologies that reduce the need for imported components.

- Reshoring and nearshoring initiatives: Moving production closer to home reduces tariff impacts.

- Development of alternative technologies: Innovation can reduce reliance on imported components.

- Strategic partnerships to secure supply chains: Collaborations ensure access to crucial components.

Government Policy and Regulatory Changes

Government policies and regulations play a pivotal role in shaping the future of tech IPOs. Trade agreements that reduce or eliminate tariffs can significantly stimulate IPO activity. Clear, stable policies create an environment of confidence that encourages investment.

- Trade agreement negotiations: Favorable trade deals reduce tariff barriers and boost investor confidence.

- Tariff reduction policies: Lowering tariffs directly reduces production costs and boosts profitability.

- Regulatory reforms to support tech innovation: Supportive regulations encourage growth and investment.

Conclusion

The tech IPO freeze is a complex issue intrinsically linked to the escalating impact of rising tariffs. Increased production costs, supply chain disruptions, and overall economic uncertainty all contribute significantly. While challenges remain, tech companies are adapting, and government policies will play a crucial role in shaping the future of tech IPOs. Understanding the impact of tariffs on the tech sector is crucial for both investors and companies. Stay informed about developments in trade policy and closely monitor the effects of rising tariffs on the tech IPO market to make well-informed decisions. Navigating the complexities of the tech IPO market in a tariff-affected environment requires careful analysis and strategic planning.

Featured Posts

-

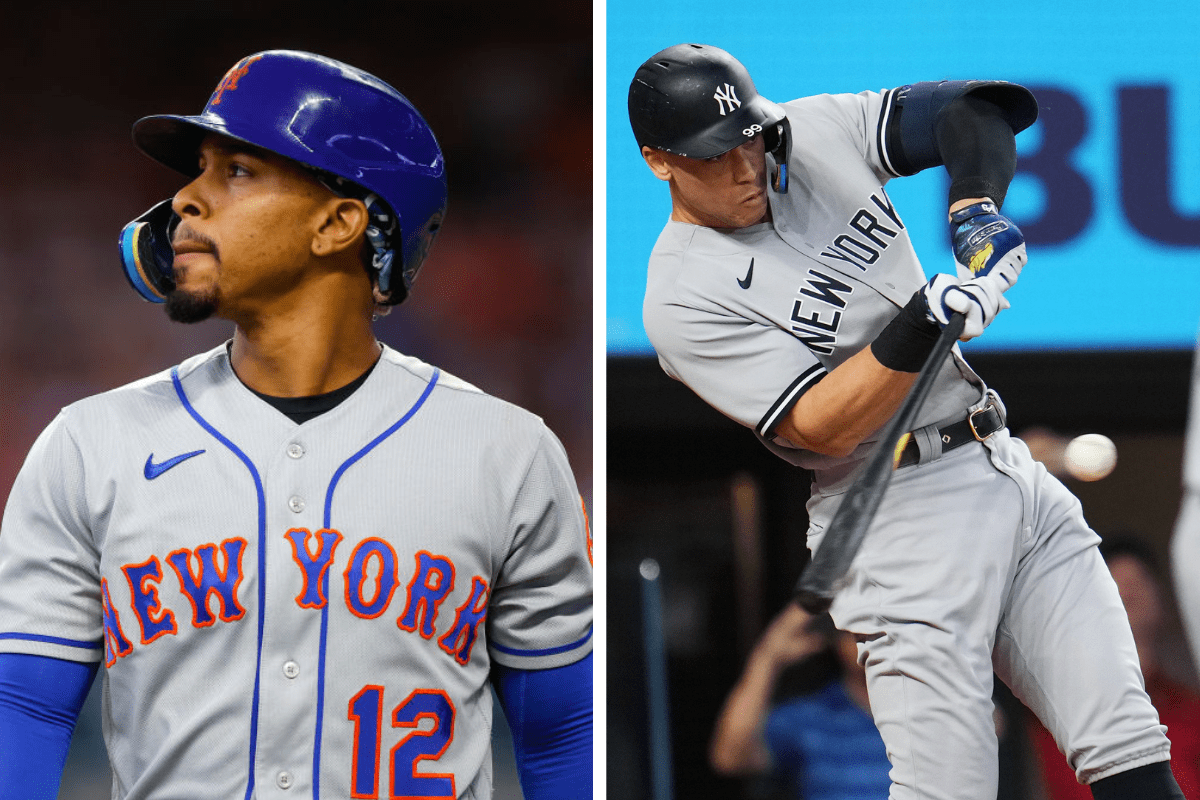

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025 -

Saechsische Schweiz Ein Wanderweg Im Zeichen Von Caspar David Friedrich

May 14, 2025

Saechsische Schweiz Ein Wanderweg Im Zeichen Von Caspar David Friedrich

May 14, 2025 -

Trade War And Recession Concerns Grip Canadian Businesses New Poll Data

May 14, 2025

Trade War And Recession Concerns Grip Canadian Businesses New Poll Data

May 14, 2025 -

Important Recall Announcement Affected Dressings And Birth Control Pills In Ontario And Canada

May 14, 2025

Important Recall Announcement Affected Dressings And Birth Control Pills In Ontario And Canada

May 14, 2025 -

Gauff And Stearns Power Into Rome Quarterfinals

May 14, 2025

Gauff And Stearns Power Into Rome Quarterfinals

May 14, 2025

Latest Posts

-

Mirka I Rodzer Federer Dva Para Blizanaca Fotografije I Detalji

May 14, 2025

Mirka I Rodzer Federer Dva Para Blizanaca Fotografije I Detalji

May 14, 2025 -

Bad Gottleuba Berggiesshuebel Ermittlungen Nach Toedlichem Wohnungsbrand

May 14, 2025

Bad Gottleuba Berggiesshuebel Ermittlungen Nach Toedlichem Wohnungsbrand

May 14, 2025 -

Wohnungsbrand Mit Todesopfern In Bad Gottleuba Berggiesshuebel

May 14, 2025

Wohnungsbrand Mit Todesopfern In Bad Gottleuba Berggiesshuebel

May 14, 2025 -

Leichenfund Nach Wohnungsbrand In Bad Gottleuba Berggiesshuebel

May 14, 2025

Leichenfund Nach Wohnungsbrand In Bad Gottleuba Berggiesshuebel

May 14, 2025 -

Tragoedie In Bad Gottleuba Berggiesshuebel Brandopfer Gefunden

May 14, 2025

Tragoedie In Bad Gottleuba Berggiesshuebel Brandopfer Gefunden

May 14, 2025