Tesla Stock Slump Impacts Elon Musk's Net Worth, Falling Below $300 Billion

Table of Contents

The Magnitude of Tesla's Stock Decline and its Impact on Musk's Net Worth

Analyzing the Percentage Drop

Tesla's stock price has experienced a substantial percentage decrease over the past [insert timeframe, e.g., quarter, six months]. [Insert specific percentage drop here, e.g., a 25% decline] represents a significant loss in market value for the company. This dramatic fall directly impacts Elon Musk's net worth, which is heavily tied to his Tesla stock ownership.

- Dollar Amount Lost: The Tesla stock slump has resulted in a loss of approximately [insert dollar amount] for Elon Musk.

- Net Worth Comparison: Musk's current net worth, while still substantial, is significantly lower than its peak value of [insert peak net worth and date].

- Previous Fluctuations: While Musk's net worth has seen fluctuations in the past, this recent drop is noteworthy due to its scale and the speed at which it occurred. [Mention any relevant previous significant changes and their context].

The factors contributing to this decline are multifaceted, encompassing both macroeconomic conditions and company-specific challenges. Concerns surrounding production targets, increased competition in the EV market, and broader economic uncertainty have all played a role. Further analysis of these factors is crucial for understanding the full scope of the Tesla stock slump.

Factors Contributing to the Tesla Stock Slump

Macroeconomic Factors

The current macroeconomic environment has significantly impacted investor sentiment towards Tesla and other growth stocks. Rising inflation, increasing interest rates, and growing fears of a recession have led to a more risk-averse market, impacting Tesla's high valuation.

- Inflation's Impact: High inflation erodes purchasing power, potentially affecting consumer demand for expensive vehicles like Teslas.

- Interest Rate Hikes: Increased interest rates make borrowing more expensive, impacting both consumer financing and Tesla's own capital expenditures.

- Recessionary Fears: Concerns about a potential recession lead investors to shift towards safer investments, reducing demand for growth stocks like Tesla.

Company-Specific Challenges

Tesla has faced its own set of internal challenges that have contributed to the stock slump. These include:

- Production Issues: [Mention any reported delays or production bottlenecks impacting Tesla's output].

- Supply Chain Disruptions: Global supply chain issues have affected the availability of crucial components for Tesla's vehicles.

- Quality Control Concerns: Reports of quality control issues in Tesla vehicles have raised some concerns among consumers and investors.

Competitive Landscape

The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants launching their own electric vehicles. This intensifying competition impacts Tesla's market share and profitability.

- Increased Competition: Companies like [mention key competitors] are aggressively expanding their EV offerings, posing a direct threat to Tesla's dominance.

- Price Wars: Price wars within the EV market are squeezing profit margins for all players, including Tesla.

Implications for Tesla and the Wider EV Market

Investor Sentiment and Future Predictions

The Tesla stock slump has undoubtedly impacted investor sentiment, not only towards Tesla but also the wider EV market. The significant drop raises questions about the sustainability of high valuations within the sector.

- Investor Confidence: The decline has shaken investor confidence, leading some to reconsider their investments in the EV sector.

- Future Predictions: Analysts are divided on Tesla's future prospects. Some predict a recovery, while others express concerns about the long-term sustainability of its high valuation. [Cite relevant analyst reports and predictions].

Impact on Tesla's Future Plans

The stock decline might necessitate adjustments to Tesla's ambitious future plans. The company may need to re-evaluate its expansion strategies, research and development initiatives, and overall spending.

- Revised Expansion Plans: Tesla might need to scale back its expansion plans or prioritize certain projects over others.

- R&D Budget Adjustments: The company may need to adjust its R&D budget to focus on higher-return projects.

Elon Musk's Response and Future Strategies

Public Statements and Actions

Elon Musk has [mention any public statements made regarding the stock slump and his response]. His actions and communications will be closely watched by investors and the market.

Potential Strategic Moves

To recover from the downturn, Tesla might consider several strategic moves:

- New Product Launches: Launching new and innovative vehicles could help reignite consumer demand and boost investor confidence.

- Cost-Cutting Measures: Implementing cost-cutting measures might improve profitability and attract investors.

- Marketing Campaigns: Aggressive marketing campaigns could improve brand perception and drive sales.

Conclusion

The Tesla stock slump has had a significant impact on Elon Musk's net worth, pushing it below $300 billion. This decline is attributable to a complex interplay of macroeconomic factors, company-specific challenges, and intensified competition within the EV market. The implications for Tesla's future plans and the broader EV sector are substantial, requiring careful observation and analysis. To stay abreast of the ongoing developments in the "Tesla stock slump" and its impact on Elon Musk's net worth, subscribe to our newsletter, follow reputable financial news sources, and continue researching this dynamic market. Understanding the volatility of the Tesla stock price is crucial for informed investment decisions in the rapidly evolving electric vehicle landscape.

Featured Posts

-

Nyt Strands Game 402 Hints And Solutions For Wednesday April 9

May 09, 2025

Nyt Strands Game 402 Hints And Solutions For Wednesday April 9

May 09, 2025 -

Inisiatif 10 Adn Pas Selangor Untuk Mangsa Tragedi Putra Heights

May 09, 2025

Inisiatif 10 Adn Pas Selangor Untuk Mangsa Tragedi Putra Heights

May 09, 2025 -

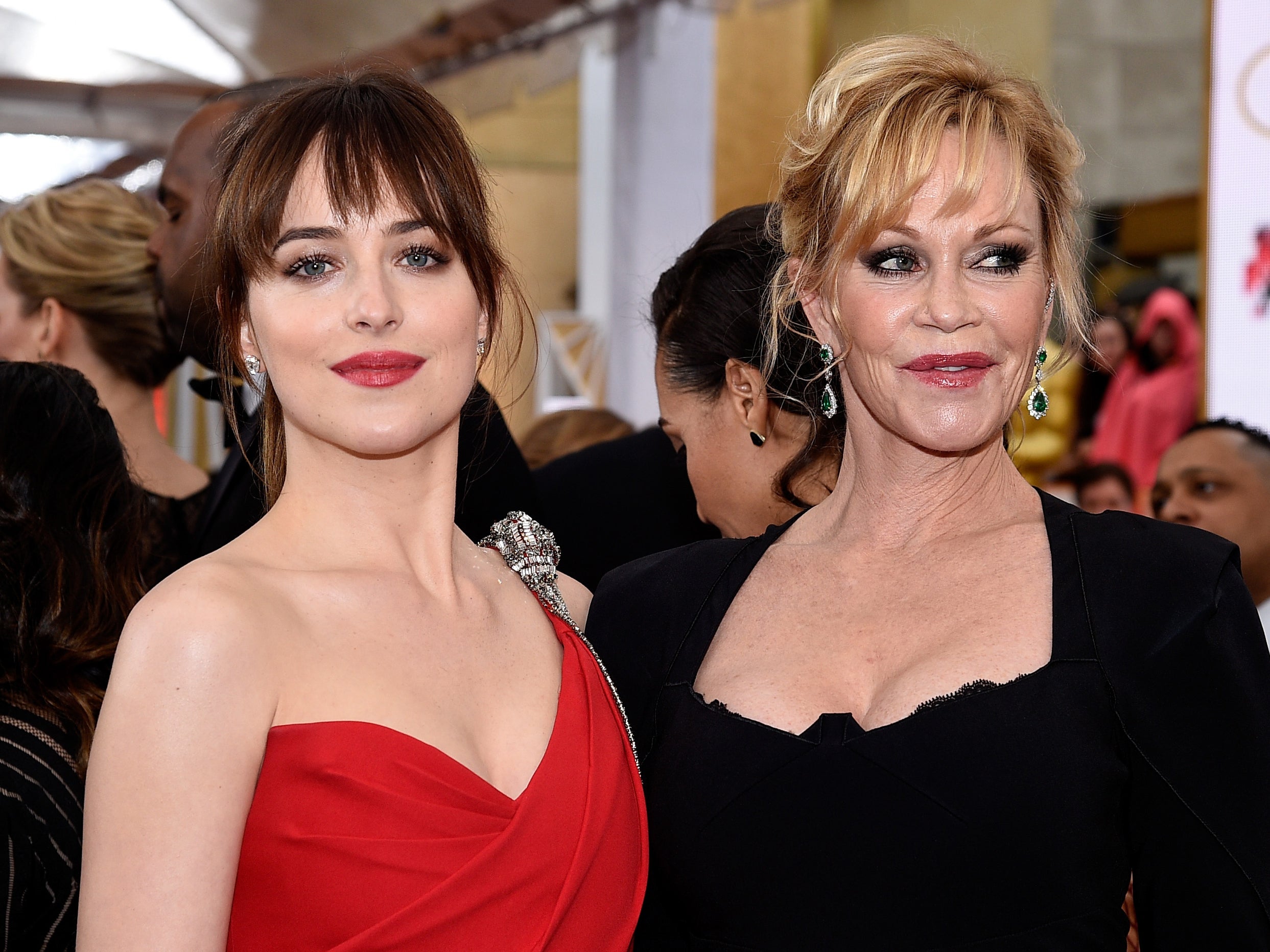

Melanie Griffith And Dakota Johnsons Spring Fashion A Family Affair

May 09, 2025

Melanie Griffith And Dakota Johnsons Spring Fashion A Family Affair

May 09, 2025 -

Analysis Trumps Nomination Of Casey Means And The Maha Movements Influence

May 09, 2025

Analysis Trumps Nomination Of Casey Means And The Maha Movements Influence

May 09, 2025 -

Trumps Tariffs A Weapon Of Choice Says Warner

May 09, 2025

Trumps Tariffs A Weapon Of Choice Says Warner

May 09, 2025