Thames Water Executive Compensation: A Case Study In Corporate Excess

Table of Contents

Scrutinizing Thames Water's Financial Performance

Profitability and Investment in Infrastructure

Thames Water's financial performance reveals a troubling disconnect between profitability and investment in essential infrastructure. While the company reports profits, a closer examination suggests a significant portion of these earnings are not being reinvested in upgrading the aging water network. This underinvestment directly impacts service quality and contributes to ongoing issues like leaks and water shortages.

- Profit Margins: Compare Thames Water's profit margins to industry averages – the disparity might be striking, indicating potential over-profiting at the expense of necessary infrastructure upgrades.

- Discrepancies in Reporting: A detailed analysis of financial statements might unearth discrepancies between reported profits and actual investment in essential services. For instance, planned investments may not materialize, leading to deferred maintenance.

- Specific Examples of Underinvestment: Citing specific instances of underinvestment, like delayed pipe replacements or inadequate leak detection programs, strengthens the argument and highlights the real-world consequences of prioritizing executive pay over infrastructure maintenance.

Comparison with Competitor Executive Pay

Benchmarking Thames Water's executive compensation against similar water companies in the UK and internationally reveals significant discrepancies. This comparative analysis provides context and highlights the potentially excessive nature of Thames Water's executive pay packages.

- Industry Averages: Data on average executive pay in the water sector, both nationally and internationally, establishes a benchmark against which Thames Water's compensation can be judged.

- Significant Discrepancies: Highlighting specific instances where Thames Water executive pay dramatically exceeds industry averages provides compelling evidence of corporate excess.

- Reasons for Differences: Investigating potential reasons for such differences is crucial. Are these discrepancies justified by superior performance, or do they reflect a systemic issue of corporate governance?

Customer Bill Analysis

The correlation between rising customer bills and escalating executive compensation warrants scrutiny. Are customers effectively subsidizing exorbitant executive pay packages?

- Bill Increases Over Time: Presenting data on customer bill increases over the years, juxtaposed with the growth in executive salaries, reveals any direct relationship.

- Connecting Pay Rises and Bill Increases: Demonstrating a clear link between executive salary increases and corresponding bill increases for customers strengthens the argument of unfair burden-sharing.

- Public Reaction and Complaints: Including public reaction, including customer complaints and social media discussions, provides valuable context and highlights the public's frustration with rising bills and perceived corporate greed.

Transparency and Accountability in Executive Compensation

Disclosure of Executive Remuneration

The level of transparency surrounding Thames Water's executive remuneration is crucial for accountability. A lack of transparency allows for potential abuses and hinders public scrutiny.

- Lack of Transparency: Highlight instances where the company falls short of full disclosure, such as omitting details of bonuses, stock options, or other benefits.

- Legal and Regulatory Requirements: Mentioning any relevant legal or regulatory requirements regarding the disclosure of executive compensation strengthens the argument for greater transparency.

- Examples of Inadequate Disclosure: Specific examples of inadequate disclosure, such as vague descriptions of compensation packages, demonstrate the need for improved reporting practices.

Board Composition and Independence

The composition and independence of Thames Water's board of directors are critical in overseeing executive compensation. A lack of independence can lead to conflicts of interest and unchecked executive pay.

- Board Independence: Analyzing the board's independence from management, identifying any potential conflicts of interest among board members.

- Effectiveness of Board Oversight: Assessing the board's effectiveness in overseeing executive compensation, scrutinizing their decision-making processes.

- Potential Conflicts of Interest: Highlighing instances where board members might have personal financial ties to executives, influencing their decision-making.

Performance-Based Pay Metrics

The metrics used to justify executive bonuses and incentives must accurately reflect the company's performance and align with the public interest. Flaws in these metrics can result in rewarding executives even when the company underperforms.

- Critical Evaluation of Metrics: A detailed analysis of the metrics used, questioning their relevance and validity in assessing overall performance.

- Potential Flaws and Biases: Pointing out any biases or flaws in the chosen metrics, illustrating how they might incentivize actions detrimental to customers or infrastructure investment.

- Alternative Performance Indicators: Suggesting alternative performance indicators that more accurately reflect the company’s responsibilities to the public and the environment.

Public Scrutiny and Regulatory Response to Thames Water Executive Compensation

Public Outrage and Media Coverage

The public's reaction to Thames Water executive compensation, as reflected in media coverage and public discourse, underscores the widespread concern about corporate excess.

- News Articles and Public Statements: Citing specific examples from news articles, editorials, and public statements highlighting public anger and outrage.

- Social Media Discussions: Incorporating social media discussions and online campaigns, illustrating public engagement and the reach of the controversy.

- Political Responses: Mentioning any political responses, including parliamentary questions or government inquiries.

Regulatory Investigations and Actions

Any regulatory investigations or actions taken in response to concerns about executive compensation at Thames Water highlight the severity of the issue and the need for stronger oversight.

- Fines and Penalties: Mentioning any fines or penalties imposed on the company for its compensation practices.

- Regulatory Changes: Discussing any regulatory changes that have resulted from the controversy, aimed at preventing similar situations in the future.

- Outcomes of Investigations: Detailing the outcomes of any investigations, showing the impact on executive pay policies.

Calls for Reform

The controversy surrounding Thames Water executive compensation has fueled calls for reform in corporate governance and executive compensation practices within the water industry.

- Stricter Regulations: Suggesting specific, stricter regulations that could limit executive pay and improve transparency.

- Increased Transparency: Advocating for greater transparency in the reporting and disclosure of executive compensation.

- Alternative Compensation Models: Proposing alternative compensation models that better align executive incentives with the interests of customers and the environment.

Conclusion: Addressing the Issue of Excessive Thames Water Executive Compensation

In conclusion, the analysis of Thames Water executive compensation reveals a clear case of corporate excess. The disparity between the company's performance, its investment in crucial infrastructure, and the substantial salaries paid to its executives is unacceptable. This excessive compensation places an undue burden on customers, jeopardizes essential infrastructure improvements, and undermines public trust. It's time to demand accountability for excessive Thames Water executive compensation. Learn more and get involved in the fight for fair pay and better water services. Contact your local representatives and demand greater transparency and accountability in how water companies manage their finances and compensate their executives. The future of our water supply depends on it.

Featured Posts

-

Councils Reduced Response To Mps Send Cases

May 23, 2025

Councils Reduced Response To Mps Send Cases

May 23, 2025 -

Increased Landslide Risk Prompts Concerns For Swiss Mountain Village

May 23, 2025

Increased Landslide Risk Prompts Concerns For Swiss Mountain Village

May 23, 2025 -

Mhajm Sfart Alahtlal Fy Washntn Yhtf Alhryt Lflstyn

May 23, 2025

Mhajm Sfart Alahtlal Fy Washntn Yhtf Alhryt Lflstyn

May 23, 2025 -

England Announces Cook For One Off Test Against Zimbabwe

May 23, 2025

England Announces Cook For One Off Test Against Zimbabwe

May 23, 2025 -

Dylan Dreyer And Husband Brian Ficheras Latest Family Announcement

May 23, 2025

Dylan Dreyer And Husband Brian Ficheras Latest Family Announcement

May 23, 2025

Latest Posts

-

The Jonas Brothers Couples Spat And Joes Hilarious Reaction

May 23, 2025

The Jonas Brothers Couples Spat And Joes Hilarious Reaction

May 23, 2025 -

Jonathan Groff And Just In Time A Broadway Showdown For Tony Awards Glory

May 23, 2025

Jonathan Groff And Just In Time A Broadway Showdown For Tony Awards Glory

May 23, 2025 -

Jonathan Groffs Potential Tony Award History With Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Award History With Just In Time

May 23, 2025 -

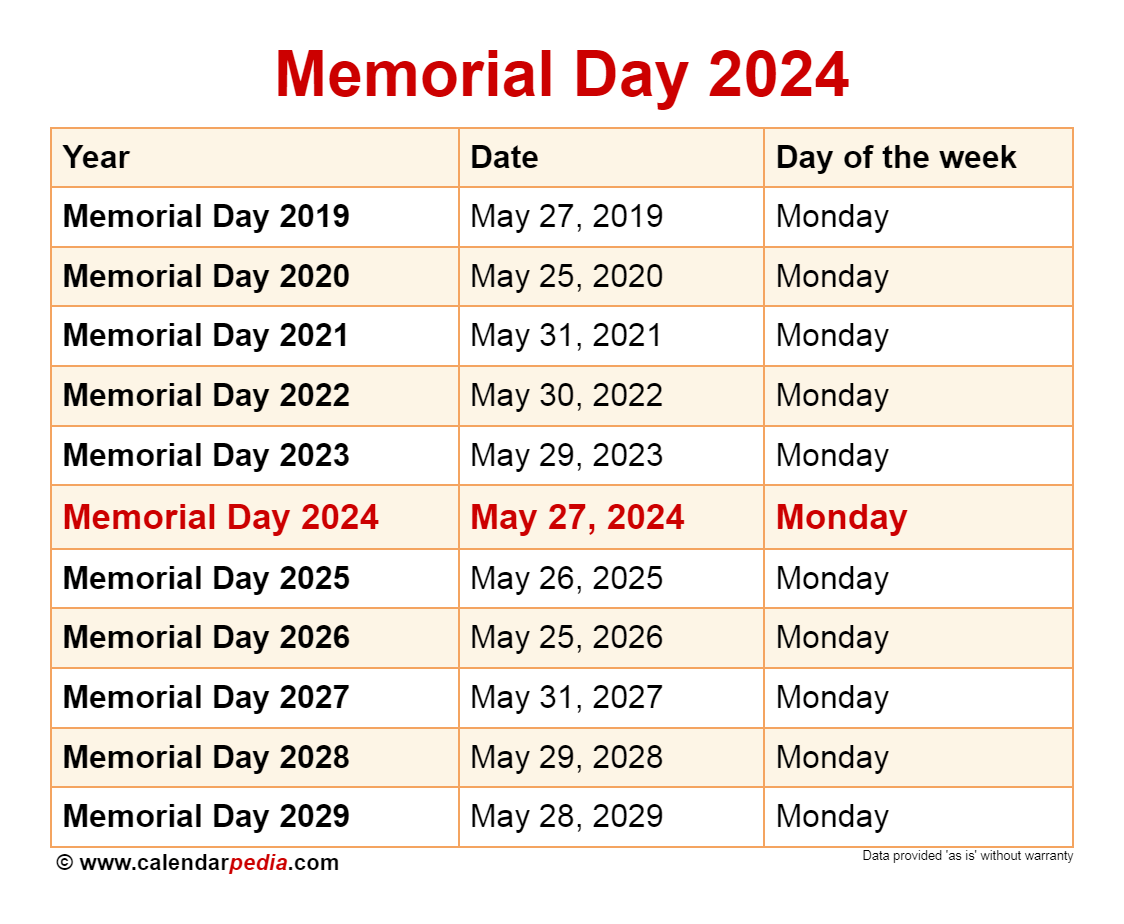

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025