The 2025 D-Wave Quantum (QBTS) Stock Slump: Causes And Implications

Table of Contents

The year is 2025. D-Wave Quantum (QBTS) stock, once a beacon of hope in the burgeoning quantum computing sector, has experienced a significant downturn. This unexpected fall raises critical questions about the future of this promising technology and the wisdom of investing in quantum computing companies. This article delves into the potential causes behind the D-Wave Quantum stock slump and analyzes its broader implications for the quantum computing market and investors. We will explore factors contributing to the QBTS stock price decline and examine the future outlook for the company and the wider quantum computing field.

Macroeconomic Factors Impacting QBTS Stock Performance

The decline in D-Wave Quantum stock (QBTS) isn't solely attributable to company-specific issues. Broader macroeconomic forces significantly impacted its performance, mirroring trends across the tech sector.

The Broader Tech Stock Correction

2025 saw a significant correction in the technology sector, impacting even the most promising companies. This correction wasn't unique to quantum computing; many established tech giants experienced similar setbacks. This widespread downturn highlights the inherent volatility of the tech market, particularly for companies operating in nascent fields like quantum computing.

- Increased interest rates: Rising interest rates made borrowing more expensive, reducing the appeal of high-growth, often unprofitable, tech companies like D-Wave.

- Reduced venture capital funding: The overall tightening of credit markets led to a decrease in venture capital funding for tech startups, impacting D-Wave’s access to capital for expansion and research.

- General market volatility: Increased uncertainty in the global economy translated into higher market volatility, disproportionately affecting riskier investments like QBTS stock.

Inflationary Pressures and Investor Risk Aversion

High inflation and rising interest rates fostered a climate of risk aversion among investors. Investors sought safer havens, shifting away from speculative investments like D-Wave Quantum stock (QBTS) towards more established, less volatile assets.

- Investors shifting to safer investments: The perceived risk associated with quantum computing, a relatively new and unproven technology, increased during inflationary periods, driving investors towards safer options like government bonds.

- Increased cost of capital: Higher interest rates increased D-Wave's cost of borrowing, impacting its operational efficiency and profitability, further impacting investor sentiment.

- Reduced investor appetite for long-term ventures: Inflation erodes the future value of profits, making long-term investments in high-growth companies like D-Wave less attractive in the short term.

Company-Specific Challenges Contributing to the QBTS Slump

While macroeconomic conditions played a role, internal challenges at D-Wave Quantum also contributed significantly to the QBTS stock slump.

Competition in the Quantum Computing Market

The quantum computing landscape is becoming increasingly competitive. The emergence of new players with diverse approaches and technological advancements poses a serious threat to D-Wave's market share and overall success.

- Emergence of new players: Competitors employing different quantum computing approaches (e.g., gate-based, photonic) are challenging D-Wave's dominance in the annealing-based quantum computing market.

- Aggressive marketing and strategic partnerships: Competitors are actively pursuing strategic partnerships and engaging in aggressive marketing campaigns to gain market share and attract investors.

- Potential for technological breakthroughs: The possibility of disruptive technological advancements by competitors could quickly render D-Wave’s technology obsolete.

Slower-than-Expected Technological Advancements

D-Wave faced challenges in achieving key technological milestones, impacting investor confidence and the QBTS stock price.

- Challenges in scaling up quantum processors: Scaling up the size and power of quantum processors is proving more difficult than initially anticipated, impacting the performance and capabilities of D-Wave's systems.

- Difficulties in achieving fault tolerance: Building fault-tolerant quantum computers is a significant hurdle, and slower progress in this area affects the reliability and practical applications of D-Wave's technology.

- Unexpected hurdles in software development: Developing robust and efficient software for quantum applications is a complex undertaking, and setbacks in this area hinder the adoption of D-Wave's systems.

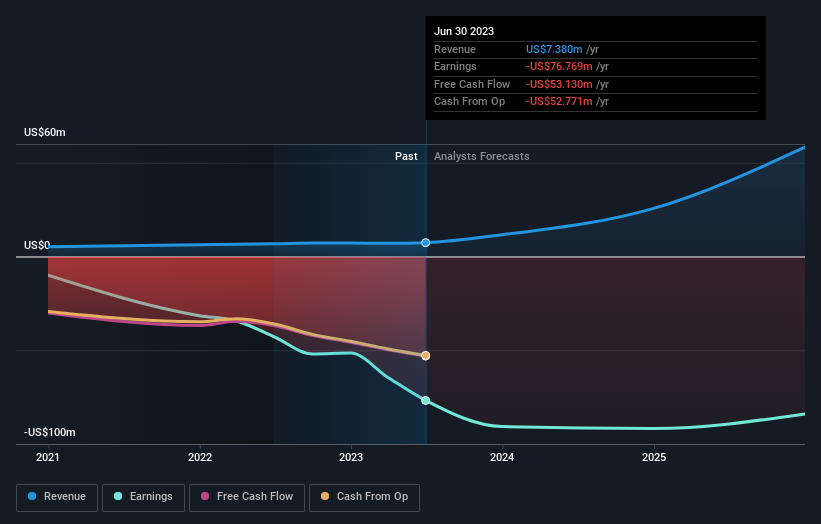

Financial Performance and Revenue Projections

D-Wave's financial performance and revenue projections fell short of expectations, contributing to the decline in QBTS stock.

- Lower-than-expected revenue figures: The company's revenue growth failed to meet investor expectations, raising concerns about its long-term financial viability.

- Increased operating expenses and decreased profitability: Rising operating expenses, combined with slower revenue growth, resulted in decreased profitability, further impacting investor sentiment.

- Negative cash flow: Negative cash flow indicates that D-Wave is spending more money than it's earning, raising concerns about its ability to sustain its operations and fund future research and development.

Implications of the QBTS Stock Slump

The QBTS stock slump has significant implications for both D-Wave and the broader quantum computing industry.

Impact on the Quantum Computing Industry

The D-Wave Quantum stock decline might negatively affect investor confidence in the quantum computing sector as a whole.

- Potential slowdown in venture capital funding: The slump could lead to reduced venture capital funding for other quantum computing startups, hindering innovation and development in the field.

- Impact on the overall valuation of quantum computing companies: The decline in QBTS stock could negatively influence the valuation of other quantum computing companies, making it harder for them to attract investment.

- Reduced public interest and awareness: Negative news surrounding D-Wave could dampen public interest and awareness of quantum computing technology, slowing down its adoption.

Advice for Investors

Investing in D-Wave Quantum stock (QBTS) or any quantum computing stock requires a careful assessment of risks and rewards.

- Diversification: Diversify your investment portfolio to mitigate the risk associated with investing in a single company or sector.

- Due Diligence: Conduct thorough due diligence before investing, analyzing the company's financial statements, technological advancements, and competitive landscape.

- Long-term Perspective: The quantum computing industry is still in its early stages. A long-term investment perspective is essential, as significant returns might not be realized immediately.

Conclusion

The 2025 slump in D-Wave Quantum (QBTS) stock serves as a reminder of the inherent risks in investing in emerging technologies. While the long-term potential of quantum computing remains significant, macroeconomic conditions, company-specific challenges, and fierce competition all influence investment outcomes. Understanding these factors is crucial for making informed investment choices. Before investing in D-Wave Quantum stock (QBTS) or other quantum computing ventures, conduct thorough research and carefully weigh the risks involved. Stay informed about the evolving landscape of the D-Wave Quantum (QBTS) stock and the broader quantum computing market to navigate this dynamic sector effectively.

Featured Posts

-

Iatroi Patras Efimeries Savvatokyriako

May 21, 2025

Iatroi Patras Efimeries Savvatokyriako

May 21, 2025 -

Tyler Bate Returns To Wwe A Look At His Potential Storylines

May 21, 2025

Tyler Bate Returns To Wwe A Look At His Potential Storylines

May 21, 2025 -

Buy Canadian Beauty Products The Impact Of Tariffs On Local Businesses

May 21, 2025

Buy Canadian Beauty Products The Impact Of Tariffs On Local Businesses

May 21, 2025 -

Why D Wave Quantum Qbts Stock Took A Hit On Monday

May 21, 2025

Why D Wave Quantum Qbts Stock Took A Hit On Monday

May 21, 2025 -

Southern Frances Alps Face Intense Storms Late Season Snowfall

May 21, 2025

Southern Frances Alps Face Intense Storms Late Season Snowfall

May 21, 2025