The 31% Reduction In BP's CEO Pay: What It Means

Table of Contents

The Details of the BP CEO Pay Cut

The 31% reduction in BP's CEO pay represents a substantial shift in executive compensation within the energy sector. While the exact figures may vary depending on the final reporting, the reduction signifies a notable departure from previous trends of escalating CEO salaries.

- Exact figures: While precise figures require official confirmation from BP's financial reports, the 31% reduction applied to a significant base salary and bonus structure. This translates to millions of dollars less in total compensation.

- Breakdown of compensation: The reduction likely affected various components of the CEO's compensation package, including base salary, performance-based bonuses, and long-term incentive plans like stock options. The specific proportions affected will need further clarification.

- Comparison to competitors: This pay cut places BP's CEO compensation in a different context compared to its major competitors such as Shell and ExxonMobil. Analysis of their CEO pay packages is crucial for understanding the relative magnitude of BP's decision.

- Timeline: The timing of the decision and the manner in which it was communicated to shareholders and the public will provide insight into BP's strategic motivations. Official announcements and press releases should be consulted for accurate details.

Reasons Behind the BP CEO Pay Cut

Several factors likely contributed to BP's decision to significantly reduce its CEO's pay. The interplay of these factors highlights the evolving landscape of corporate responsibility and shareholder expectations.

- Shareholder pressure: Activist investors have increasingly focused on executive compensation, advocating for more equitable pay structures and better alignment with company performance. Pressure from such groups may have played a significant role.

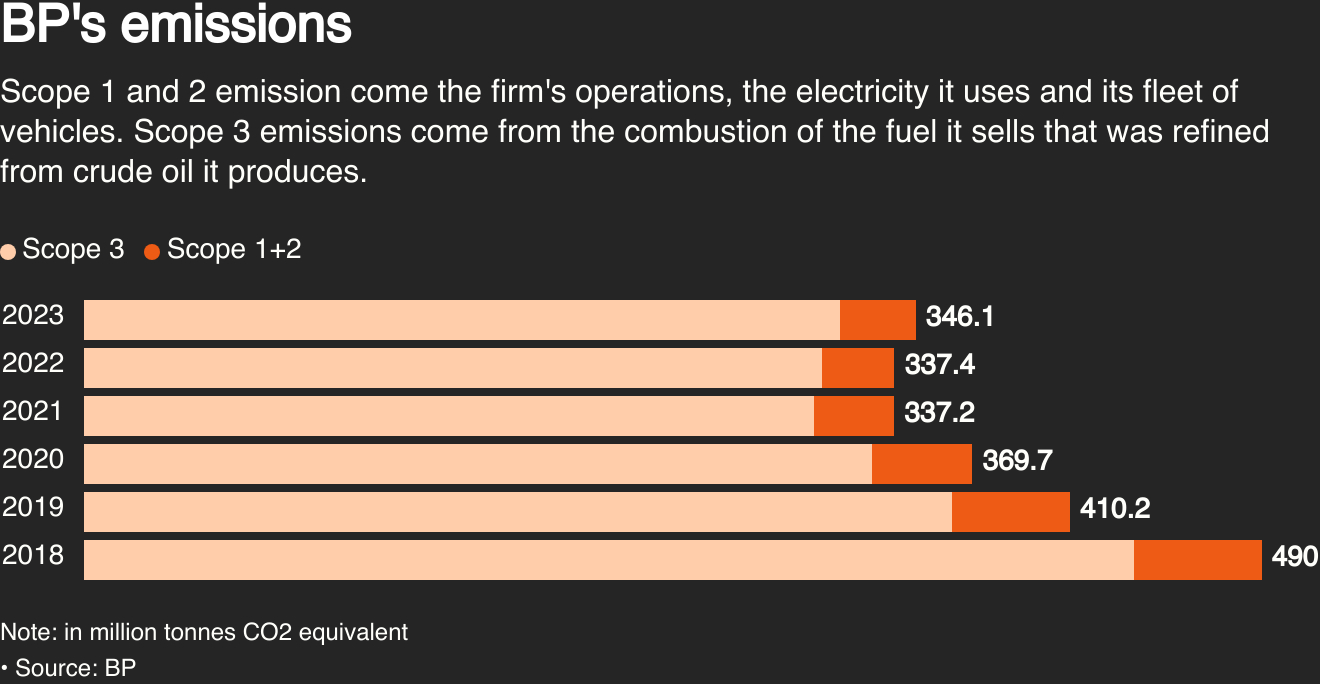

- Energy transition impact: The ongoing transition to renewable energy sources and the decline in fossil fuel profits have likely influenced BP's decision. Lower profitability might necessitate a reassessment of executive compensation.

- ESG commitments: BP has made public commitments to environmental, social, and governance (ESG) goals. Reducing CEO pay could be seen as aligning with these commitments and demonstrating a commitment to responsible business practices.

- Public relations: In the face of growing public scrutiny of executive pay, particularly in the energy sector, a pay cut could be a strategic move to improve BP's public image and address reputational concerns.

Implications for BP's Shareholders and Investors

The BP CEO pay cut carries significant implications for its shareholders and investors, influencing perceptions of value and long-term strategy.

- Impact on stock price: While the market's immediate reaction might be mixed, the long-term impact on the stock price remains to be seen. The perceived commitment to responsible governance could positively influence investor confidence.

- Alignment of interests: The pay cut signals an effort to better align the CEO's interests with those of shareholders, potentially enhancing trust and promoting long-term value creation.

- Strategic signaling: The decision sends a message to the market about BP's long-term strategic priorities, emphasizing a focus on sustainability and responsible business practices.

- Talent retention: A potential concern is the impact of the pay cut on BP's ability to attract and retain top talent. However, some may view the company's commitment to ESG as an attractive feature.

Wider Implications for Corporate Governance and Executive Pay

The BP CEO pay cut sets a precedent with wider implications for corporate governance and executive compensation practices.

- Industry-wide impact: The decision may influence other companies in the energy sector and beyond to reconsider their executive compensation strategies, potentially leading to a broader shift towards more moderate pay levels.

- Fairness debate: The ongoing debate about the fairness and appropriateness of executive pay continues, fueled by such events. This decision provides further fuel to the discussion of executive compensation's relationship to company performance and broader societal concerns.

- Shareholder activism's role: The incident underscores the increasing power of shareholder activism in influencing corporate decision-making, particularly concerning executive compensation.

- ESG's influence: The move highlights the growing influence of ESG considerations on compensation strategies, as companies increasingly integrate sustainability and social responsibility into their business models.

Conclusion: Understanding the Impact of BP's CEO Pay Cut

The 31% reduction in BP's CEO pay is a significant event with far-reaching implications. Driven by a combination of shareholder pressure, the energy transition, ESG commitments, and public relations considerations, the pay cut signals a shift towards more responsible corporate governance and a reevaluation of executive compensation practices. The long-term impact on BP's stock price, investor sentiment, and its ability to attract and retain top talent remains to be seen. However, the decision's wider influence on corporate governance and the ongoing debate about executive pay is undeniable. Stay informed about the ongoing developments surrounding BP CEO pay and other crucial corporate governance issues. Understanding the implications of executive compensation is critical for navigating the complexities of the modern business world.

Featured Posts

-

Quiz Culturel Loire Atlantique Histoire Gastronomie Et Patrimoine

May 21, 2025

Quiz Culturel Loire Atlantique Histoire Gastronomie Et Patrimoine

May 21, 2025 -

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025 -

Odigos Efimerion Giatron Stin Patra 12 13 4

May 21, 2025

Odigos Efimerion Giatron Stin Patra 12 13 4

May 21, 2025 -

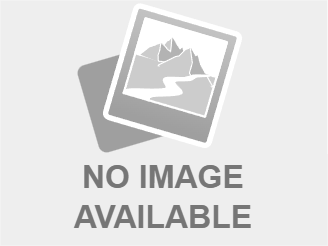

Goretzka In Germany Nations League Squad Nagelsmanns Selection

May 21, 2025

Goretzka In Germany Nations League Squad Nagelsmanns Selection

May 21, 2025 -

The Fate Of An Abc News Program A Post Layoff Analysis

May 21, 2025

The Fate Of An Abc News Program A Post Layoff Analysis

May 21, 2025