The Airbus Tariff And Its Effect On US Airlines

Table of Contents

The Origins and Scope of the Airbus Tariff

The Airbus tariff is a result of a long-running trade dispute between the United States and the European Union (EU). At the heart of the conflict are allegations of illegal subsidies provided to Airbus by various European governments, giving it an unfair competitive advantage over its main rival, Boeing. The World Trade Organization (WTO) ruled in favor of the US, authorizing the imposition of tariffs on Airbus aircraft imported into the US.

These tariffs, implemented in stages, apply specific percentages to different Airbus models. This means that the cost of acquiring Airbus planes for US airlines has increased substantially.

- Timeline of key events:

- 2004: The US files a complaint with the WTO against EU subsidies to Airbus.

- 2011: The WTO rules in favor of the US.

- 2019: The US begins imposing tariffs on Airbus aircraft.

- Ongoing: The trade dispute continues, with ongoing negotiations and retaliatory tariffs from the EU.

- Specific tariff percentages: The percentages vary depending on the aircraft model, but they represent a significant increase in the purchase price.

- Countries impacted: While the tariffs directly impact the US, the retaliatory tariffs imposed by the EU affect various US industries and exports.

Financial Impacts on US Airlines

The Airbus tariffs have directly increased the costs for US airlines purchasing Airbus aircraft. This has had a significant impact on their bottom lines and has raised concerns about potential increases in ticket prices for consumers.

- Airlines significantly affected: JetBlue, a significant Airbus operator, has been directly impacted, alongside other airlines that have a considerable portion of their fleet from Airbus.

- Increased operational costs: Higher aircraft prices translate to increased operational costs, potentially affecting profitability and investment capacity.

- Strategies to mitigate impact: Airlines are exploring various strategies, including increased reliance on Boeing aircraft, leasing, and route adjustments, to absorb some of these costs.

Strategic Responses from US Airlines

Faced with the increased costs associated with the Airbus tariff, US airlines have had to adapt their aircraft purchasing strategies. This has led to a noticeable shift towards Boeing aircraft and increased reliance on aircraft leasing.

- Increased reliance on Boeing aircraft: Many airlines are now opting for Boeing aircraft, taking advantage of the absence of tariffs and seeking better pricing negotiations.

- Growth in aircraft leasing agreements: Leasing allows airlines to avoid the upfront costs of purchasing aircraft, offering a degree of flexibility in managing the increased costs imposed by the tariffs.

- Long-term implications: The shift towards Boeing could have long-term implications for the market share of both manufacturers and could affect future aircraft procurement strategies.

The Role of Aircraft Leasing Companies

Aircraft leasing companies play a critical role in the aviation industry, and the Airbus tariff has significantly impacted their operations.

- Absorbing or passing on tariff costs: Leasing companies have had to navigate the challenge of either absorbing a portion of the increased costs or passing them onto their airline clients.

- Changes in leasing contracts: Tariff uncertainties have necessitated adjustments in leasing contracts, including clauses addressing potential future tariff changes.

- Future implications: The long-term impact on the leasing market remains to be seen, with potential shifts in leasing terms and conditions as the trade dispute evolves.

Consumer Impact and Future Outlook

The Airbus tariff and the subsequent adjustments by airlines have potential ramifications for consumers.

- Potential increase in airfare prices: Airlines may attempt to pass some of the increased costs onto consumers through higher airfares.

- Possible reduction in flight routes or frequencies: Some less profitable routes may become unviable, leading to reduced flight options for travelers.

- Long-term effects on air travel accessibility: The overall impact on air travel accessibility and affordability remains a key area of concern.

Conclusion

The Airbus tariff has significantly impacted the US airline industry, leading to increased costs, strategic adjustments in aircraft purchasing, and potential consequences for consumers. The complexity of this trade dispute and its far-reaching consequences highlight the interconnectedness of the global aviation market. Understanding the ramifications of the Airbus tariff is crucial for navigating this complex environment. Stay informed about the evolving situation surrounding the Airbus tariffs and its continuing impact on the US airline industry and the broader aviation sector. The repercussions of this trade dispute will continue to shape the future of air travel.

Featured Posts

-

Lotto Plus 1 And Lotto Plus 2 Results Official Winning Numbers

May 02, 2025

Lotto Plus 1 And Lotto Plus 2 Results Official Winning Numbers

May 02, 2025 -

Ps Plus Premium Subscribers Get Surprise Leaked 2008 Disney Game

May 02, 2025

Ps Plus Premium Subscribers Get Surprise Leaked 2008 Disney Game

May 02, 2025 -

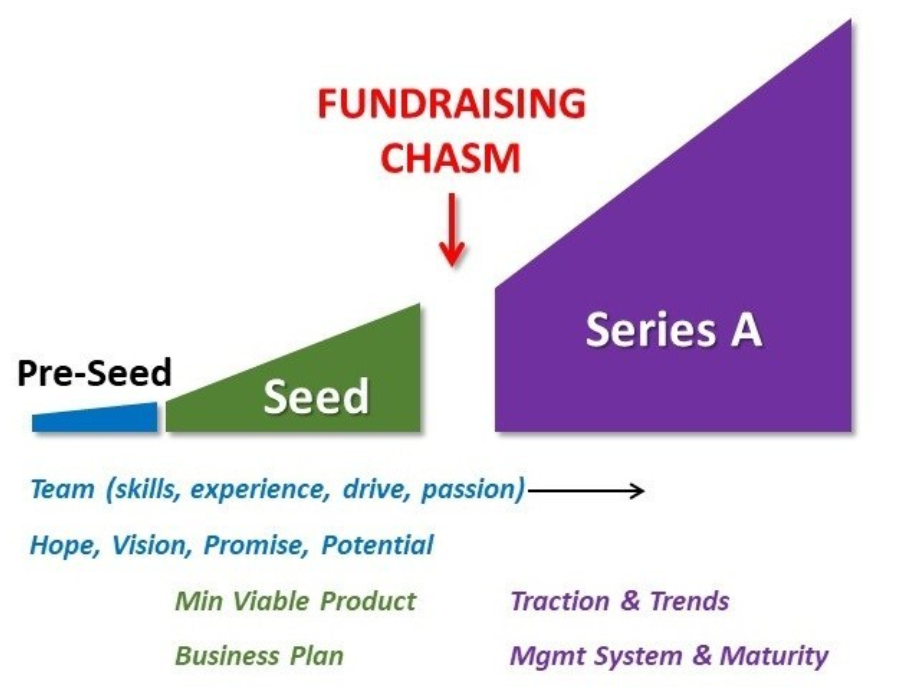

Ahead Computing Raises 21 5 Million In Seed Funding Round

May 02, 2025

Ahead Computing Raises 21 5 Million In Seed Funding Round

May 02, 2025 -

Loyle Carner Announces New Album Release Date Tracklist And More

May 02, 2025

Loyle Carner Announces New Album Release Date Tracklist And More

May 02, 2025 -

Judicial Review Of Trumps Tariffs The Case Explained

May 02, 2025

Judicial Review Of Trumps Tariffs The Case Explained

May 02, 2025

Latest Posts

-

South Carolina Election Integrity A 93 Confidence Rate

May 02, 2025

South Carolina Election Integrity A 93 Confidence Rate

May 02, 2025 -

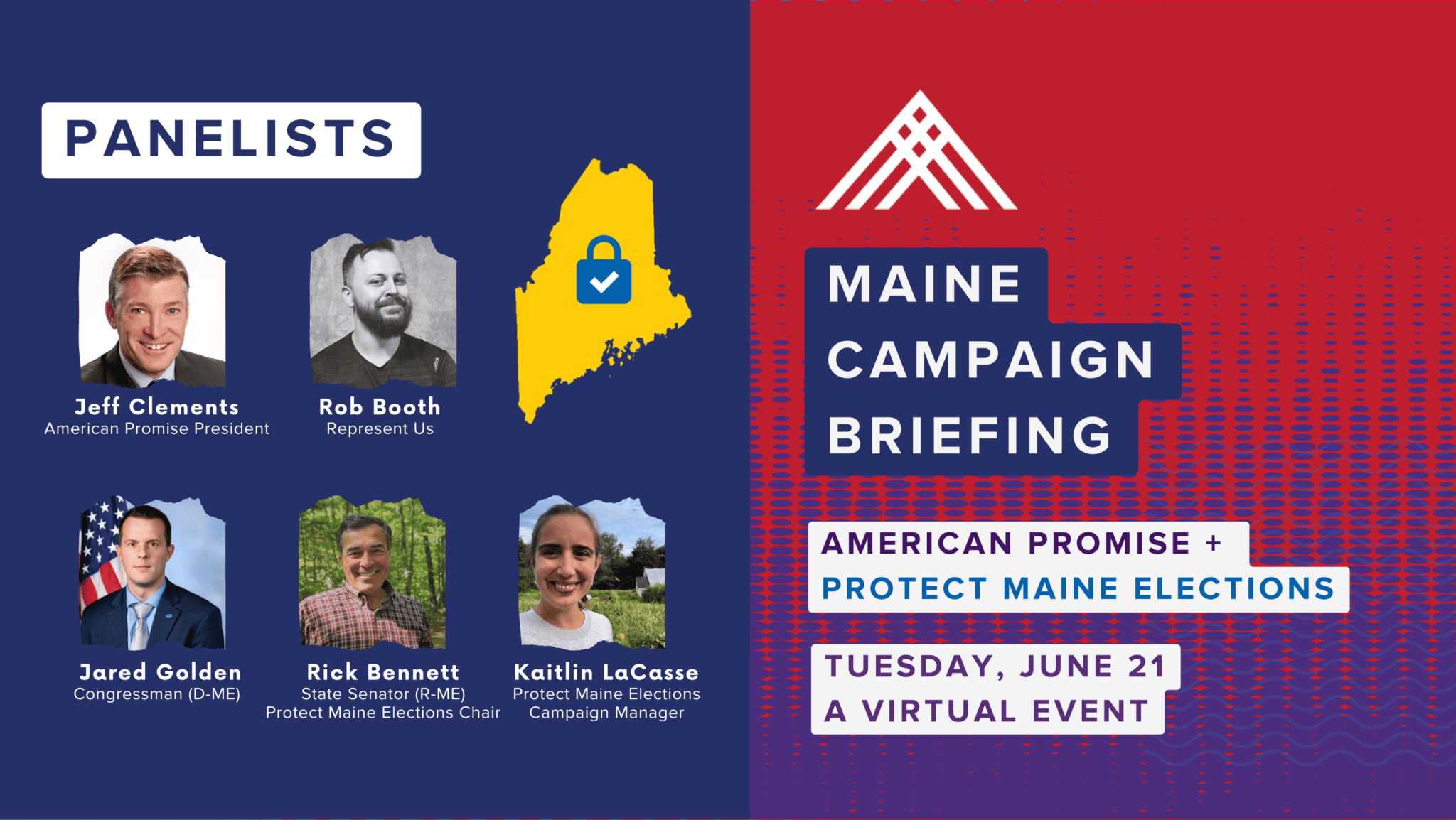

Examining Maines Inaugural Post Election Audit

May 02, 2025

Examining Maines Inaugural Post Election Audit

May 02, 2025 -

Post Election Audit Pilot Program Begins In Maine

May 02, 2025

Post Election Audit Pilot Program Begins In Maine

May 02, 2025 -

South Carolina Elections Public Trust Soars To 93

May 02, 2025

South Carolina Elections Public Trust Soars To 93

May 02, 2025 -

Deciphering Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025

Deciphering Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025