The Autonomous Future: ETF Opportunities With Uber's Driverless Technology

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's ambition extends far beyond ride-sharing. The company views autonomous vehicle technology as crucial to its future, aiming to significantly reduce operational costs and enhance efficiency. Their investment in driverless technology is a long-term strategic play focused on several key areas:

- Reducing reliance on human drivers: This is a major cost factor for Uber, and autonomous vehicles offer the potential for substantial savings.

- Expanding service offerings: Driverless technology can enable Uber to offer new services, such as autonomous delivery and potentially even robo-taxi fleets.

- Technological leadership: Uber's significant investment in R&D positions them as a contender in the fiercely competitive AV race.

Uber's strategy involves a multifaceted approach, including:

- Internal development: Significant resources are dedicated to developing its own autonomous driving technology.

- Strategic partnerships: Collaborations with other tech companies and automotive manufacturers provide access to expertise and resources.

- Acquisitions: Uber has acquired several companies specializing in autonomous driving technology, bolstering its capabilities.

Key Milestones Achieved:

- Successful pilot programs in select cities.

- Continued advancements in sensor technology and AI algorithms.

- Expansion of testing fleets.

Future Plans:

- Expansion to new cities and regions.

- Integration of autonomous vehicles into its existing ride-sharing platform.

- Development of new applications for autonomous technology beyond ride-sharing.

Identifying Relevant ETFs for Autonomous Vehicle Investment

ETFs offer a diversified and efficient way to invest in the autonomous vehicle sector. Unlike individual stocks, ETFs provide exposure to a basket of companies involved in various aspects of the industry, mitigating risk and providing broader market participation.

Here are some examples of ETFs with significant exposure to companies involved in autonomous vehicle technology (Note: Specific ETF tickers and their holdings are subject to change. Always conduct your own thorough research before investing):

- Example ETF 1 (Ticker): This ETF might focus on technology companies developing autonomous driving software, sensor technology, or AI.

- Example ETF 2 (Ticker): This ETF could include a mix of automotive manufacturers, technology companies, and related infrastructure companies.

- Example ETF 3 (Ticker): This ETF may target companies specializing in the supply chain for autonomous vehicles, such as battery technology or component manufacturing.

Analysis of ETF Composition and Investment Strategies:

Before investing in any ETF, it is essential to carefully examine its portfolio holdings, asset allocation, investment strategy, and expense ratio. Look for ETFs with a clear focus on the autonomous vehicle sector and a diversified portfolio to minimize risk.

Assessing the Risks and Rewards of Investing in Autonomous Vehicle ETFs

Investing in autonomous vehicle ETFs offers considerable potential for substantial returns, driven by the transformative potential of this disruptive technology. However, it's crucial to acknowledge the inherent risks:

Potential Risks:

- Regulatory hurdles: Government regulations and safety standards could significantly impact the adoption rate of autonomous vehicles.

- Technological setbacks: Unexpected technical challenges or delays in development could affect the timeline for widespread deployment.

- Intense competition: The autonomous vehicle market is highly competitive, with numerous players vying for market share.

- Market Volatility: The value of ETFs can fluctuate significantly, especially in a rapidly evolving sector like autonomous driving.

Potential Rewards:

- High-growth potential: The autonomous vehicle market is projected to experience significant growth in the coming years, offering substantial investment returns.

- Disruption of a large market: Autonomous vehicles have the potential to transform the transportation industry, creating immense economic opportunities.

Risk Management:

Diversification is crucial. Don't invest your entire portfolio in autonomous vehicle ETFs. Spreading your investment across different asset classes can help mitigate risk. Consider your risk tolerance and investment timeline before making any investment decisions.

Due Diligence and Smart Investment Strategies for Autonomous Vehicle ETFs

Investing in ETFs, particularly those focused on emerging technologies, requires thorough research and a well-defined investment strategy:

- Thorough Research: Before investing in any ETF, carefully examine its holdings, performance history, expense ratio, and investment strategy. Use reputable financial news sources and analytical tools to conduct your due diligence.

- Assess Financial Health: Review the financial statements and performance metrics of the ETF to gauge its health and stability.

- Asset Allocation: Integrate autonomous vehicle ETFs into a broader investment portfolio, diversifying your holdings across various asset classes to balance risk and reward.

- Consult Financial Advisors: Seek advice from qualified financial professionals to develop a personalized investment strategy tailored to your financial goals and risk tolerance.

Tips for Choosing ETFs:

- Look for ETFs with a strong track record and experienced management teams.

- Compare expense ratios to find cost-effective options.

- Consider ETFs with a diversified portfolio of holdings.

Navigating the Autonomous Future: Your Path to ETF Investment Success

Uber's commitment to driverless technology presents a significant investment opportunity. While investing in autonomous vehicle ETFs holds the potential for substantial returns, understanding the associated risks is paramount. This requires diligent research, diversification, and potentially seeking guidance from a financial advisor. Start your journey into the autonomous future by researching and selecting appropriate ETFs related to Uber's driverless technology. Take control of your investment portfolio today!

Featured Posts

-

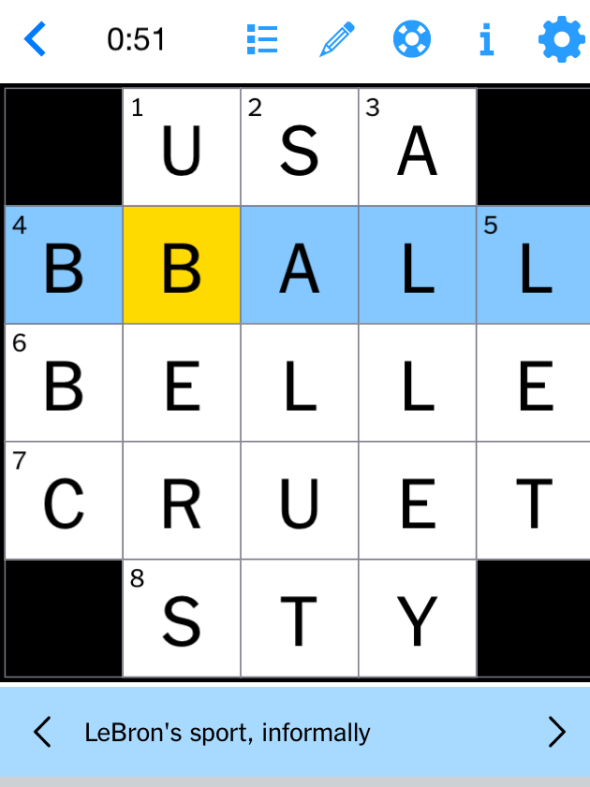

Nyt Mini Crossword Answers For Tuesday April 8 2025

May 19, 2025

Nyt Mini Crossword Answers For Tuesday April 8 2025

May 19, 2025 -

Orlando Health To Close Brevard County Hospital Impact And Future Plans

May 19, 2025

Orlando Health To Close Brevard County Hospital Impact And Future Plans

May 19, 2025 -

Mumbai Uber Taking Your Pet On A Ride A Step By Step Guide

May 19, 2025

Mumbai Uber Taking Your Pet On A Ride A Step By Step Guide

May 19, 2025 -

Find The Answers Nyt Mini Crossword April 18 2025

May 19, 2025

Find The Answers Nyt Mini Crossword April 18 2025

May 19, 2025 -

School Employee Among Fsu Shooting Victims A Familys Legacy Of Espionage

May 19, 2025

School Employee Among Fsu Shooting Victims A Familys Legacy Of Espionage

May 19, 2025

Latest Posts

-

Ufc Vegas 106 Burns Vs Morales Complete Guide To Fight Card Date And Location

May 19, 2025

Ufc Vegas 106 Burns Vs Morales Complete Guide To Fight Card Date And Location

May 19, 2025 -

Burns Vs Morales Ufc Vegas 106 Fight Card Date Time And Venue

May 19, 2025

Burns Vs Morales Ufc Vegas 106 Fight Card Date Time And Venue

May 19, 2025 -

Gilbert Burns More Than The Chimaev Della Maddalena And Muhammad Losses

May 19, 2025

Gilbert Burns More Than The Chimaev Della Maddalena And Muhammad Losses

May 19, 2025 -

Beyond The Losses Gilbert Burns Reveals His Greatest Setback

May 19, 2025

Beyond The Losses Gilbert Burns Reveals His Greatest Setback

May 19, 2025 -

What Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025

What Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025