The Bitcoin Rebound: What Investors Need To Know

Table of Contents

Analyzing the Drivers of the Bitcoin Rebound

Several factors contribute to the current Bitcoin rebound, creating a complex interplay of macroeconomic conditions, technological advancements, and shifting investor sentiment.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price. High inflation and fears of recession often drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation and fiat currency devaluation. The increasing interest from institutional investors, such as hedge funds and corporations, further fuels the Bitcoin price. These large players see Bitcoin as a potential diversification tool within their portfolios, adding significant buying pressure.

- Easing of inflation concerns: A decrease in inflation rates can lead to increased investor confidence and a renewed interest in riskier assets, including Bitcoin.

- Positive regulatory developments: Clearer and more favorable regulatory frameworks in key jurisdictions can boost investor confidence and increase institutional participation.

- Global economic uncertainty: Geopolitical instability and uncertainty in traditional financial markets can drive capital flows into Bitcoin as a safe haven asset.

Technological Advancements

Bitcoin's underlying technology continues to evolve, improving its scalability, efficiency, and usability. Advancements such as the Lightning Network, a layer-2 scaling solution, significantly increase transaction speeds and reduce fees, making Bitcoin more suitable for everyday transactions. This increased efficiency and usability drive wider adoption and fuel the Bitcoin rebound.

- Layer-2 scaling solutions: These solutions improve transaction throughput, reducing congestion and lowering fees.

- Development of new Bitcoin-based applications: The emergence of decentralized finance (DeFi) applications and other innovations built on the Bitcoin blockchain expands its utility and attracts new users.

- Improved security protocols: Ongoing developments in security enhance the robustness and resilience of the Bitcoin network, increasing investor confidence.

Market Sentiment and Investor Confidence

A shift in market sentiment from bearish to bullish is a major driver of the Bitcoin rebound. Positive news coverage, growing institutional adoption, and increased trading volume all contribute to this shift. Social media plays a crucial role in shaping investor perception and driving price movements. Positive sentiment on platforms like Twitter and Reddit can trigger buying frenzies, amplifying the rebound.

- Increased trading volume: Higher trading volume indicates increased market participation and growing interest in Bitcoin.

- Positive social media sentiment: A positive shift in online discussions and sentiment about Bitcoin can fuel price increases.

- Growing institutional adoption: The continued entry of institutional investors lends credibility and stability to the Bitcoin market, boosting investor confidence.

Assessing the Risks Associated with the Bitcoin Rebound

While the Bitcoin rebound offers opportunities, it's crucial to acknowledge the inherent risks involved.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile, subject to sharp and sudden swings. This volatility presents significant risks to investors, as price drops can lead to substantial losses. Effective risk management strategies are crucial to mitigate these potential losses.

- Sudden market corrections: Unexpected drops in price can occur rapidly, potentially wiping out significant portions of an investment.

- Regulatory uncertainty: Changes in regulations can negatively impact Bitcoin's price and accessibility.

- Security vulnerabilities: Security breaches or exploits within exchanges or wallets can result in the loss of funds.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is constantly evolving, presenting considerable uncertainty. Governments worldwide are grappling with how to regulate this emerging asset class, and varying approaches can impact Bitcoin's price and accessibility.

- New regulations in specific countries: Varying regulatory frameworks across jurisdictions create uncertainty and potential challenges for investors.

- Ongoing debates on cryptocurrency classification: The lack of a universally accepted definition and classification of cryptocurrencies adds to the regulatory uncertainty.

- Tax implications: The complexities and variations in tax regulations related to cryptocurrency transactions can create uncertainty and compliance challenges.

Security Concerns

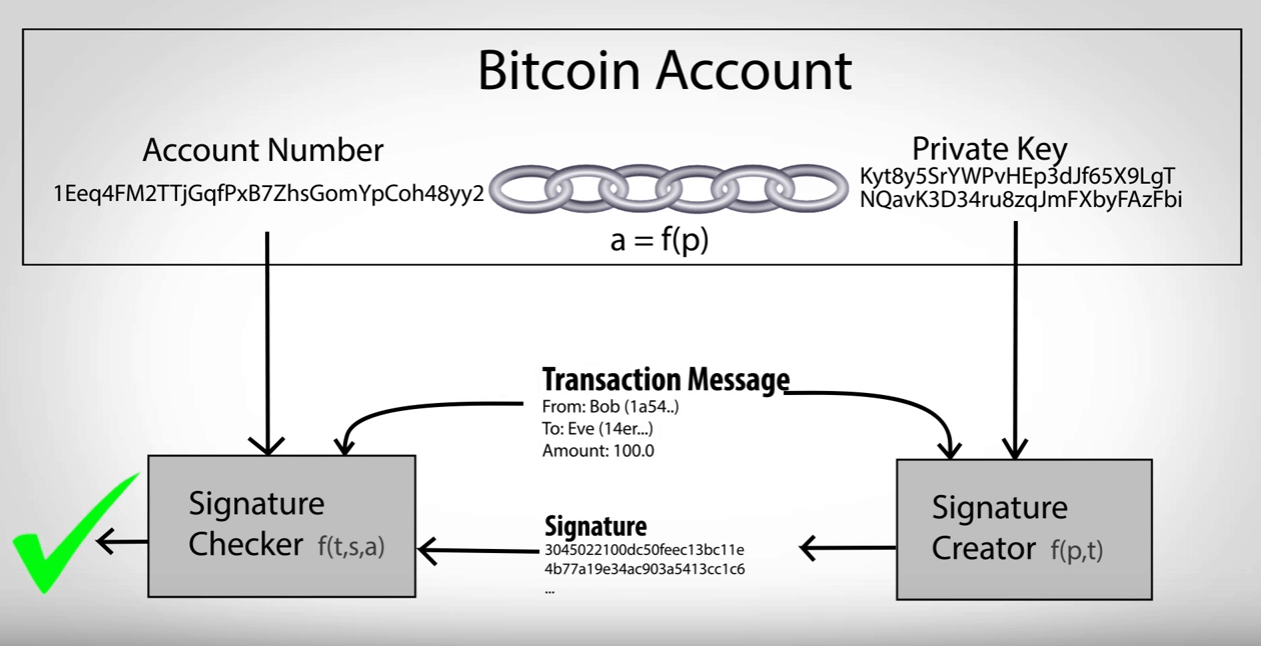

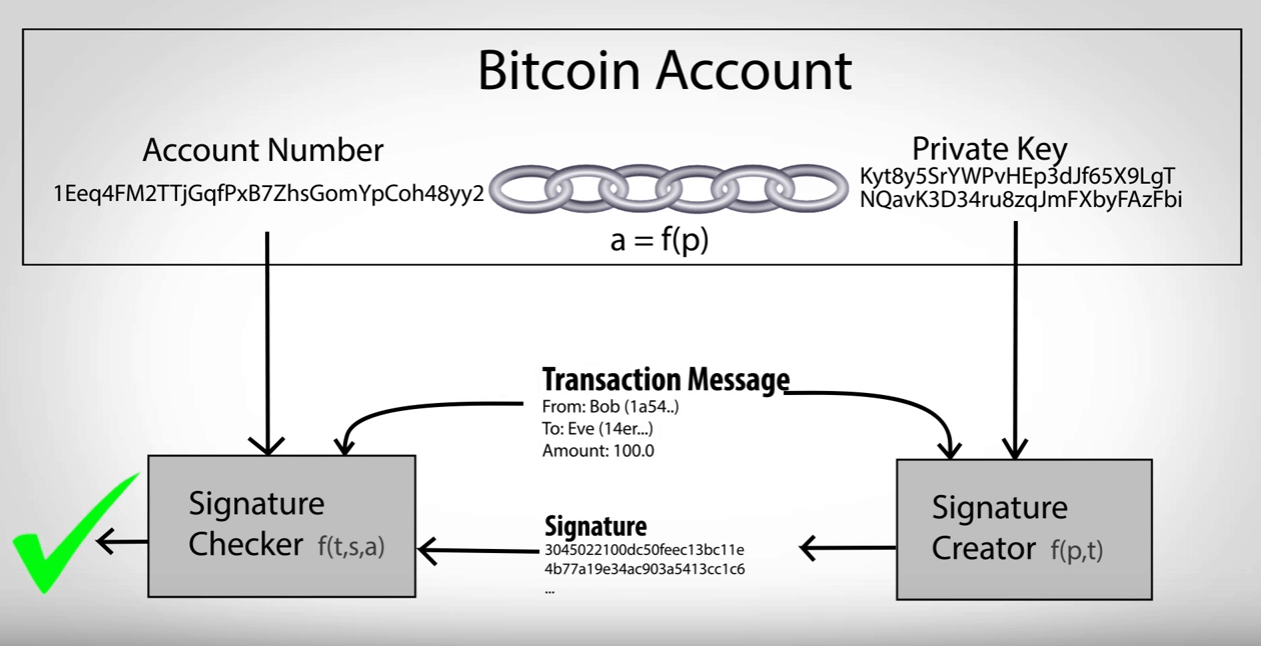

The decentralized nature of Bitcoin doesn't eliminate security risks. Hacking, theft, and scams remain significant concerns. Secure storage practices and due diligence are essential to protect investments.

- Exchange hacks: Exchanges are vulnerable to hacking attempts, which can result in the loss of user funds.

- Phishing scams: Fraudulent activities targeting unsuspecting users to steal their Bitcoin are common.

- Private key loss: Losing access to private keys renders Bitcoin inaccessible and unrecoverable.

Strategies for Investing in the Bitcoin Rebound

Navigating the Bitcoin rebound requires a well-defined investment strategy.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a large sum at a market peak.

Diversification

Diversifying your crypto portfolio across different cryptocurrencies reduces the risk associated with investing heavily in a single asset like Bitcoin.

Risk Tolerance

Only invest an amount you can afford to lose. Bitcoin's volatility means potential for substantial losses.

Research and Due Diligence

Thorough research and understanding of the risks associated with Bitcoin are paramount before investing.

Conclusion

The Bitcoin rebound presents both opportunities and significant risks. Understanding the driving forces, including macroeconomic conditions, technological advancements, and investor sentiment, is crucial for informed decision-making. While the potential for substantial returns exists, the volatility, regulatory uncertainty, and security concerns must be carefully considered. By employing sound risk management strategies like dollar-cost averaging and diversification, conducting thorough research, and carefully assessing your risk tolerance, you can potentially capitalize on the Bitcoin rebound while mitigating losses. Stay informed about the latest developments in the Bitcoin market and make well-researched decisions to navigate the potential of this exciting Bitcoin rebound successfully.

Featured Posts

-

New Uk Rules Limiting Student Visas From High Asylum Claim Countries

May 09, 2025

New Uk Rules Limiting Student Visas From High Asylum Claim Countries

May 09, 2025 -

Ra Soat Chat Che Co So Giu Tre Tu Nhan Xu Ly Nghiem Bao Hanh Tre Em

May 09, 2025

Ra Soat Chat Che Co So Giu Tre Tu Nhan Xu Ly Nghiem Bao Hanh Tre Em

May 09, 2025 -

Credit Suisse Whistleblower Case 150 Million In Potential Rewards

May 09, 2025

Credit Suisse Whistleblower Case 150 Million In Potential Rewards

May 09, 2025 -

Recent Bitcoin Mining Increase Causes And Implications

May 09, 2025

Recent Bitcoin Mining Increase Causes And Implications

May 09, 2025 -

Colapinto For Doohan In Imola Analyzing The F1 Replacement Rumors

May 09, 2025

Colapinto For Doohan In Imola Analyzing The F1 Replacement Rumors

May 09, 2025