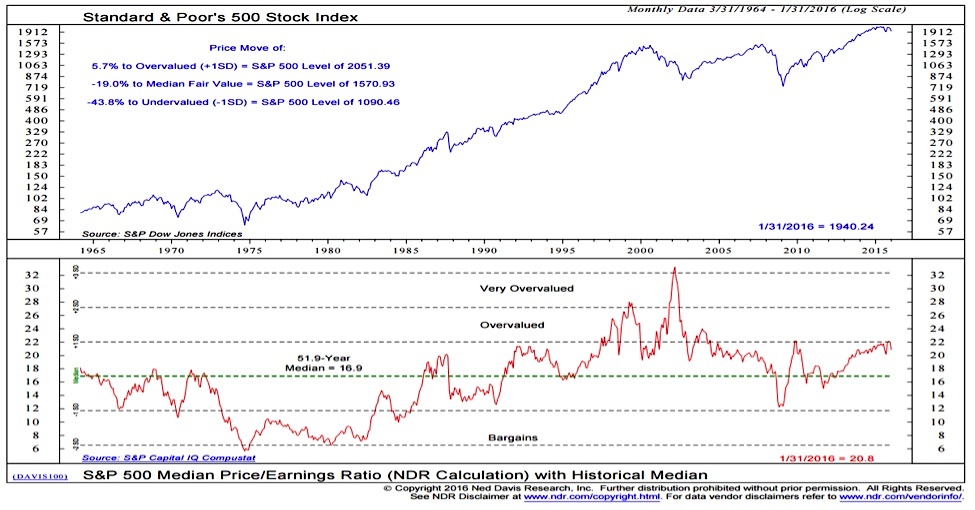

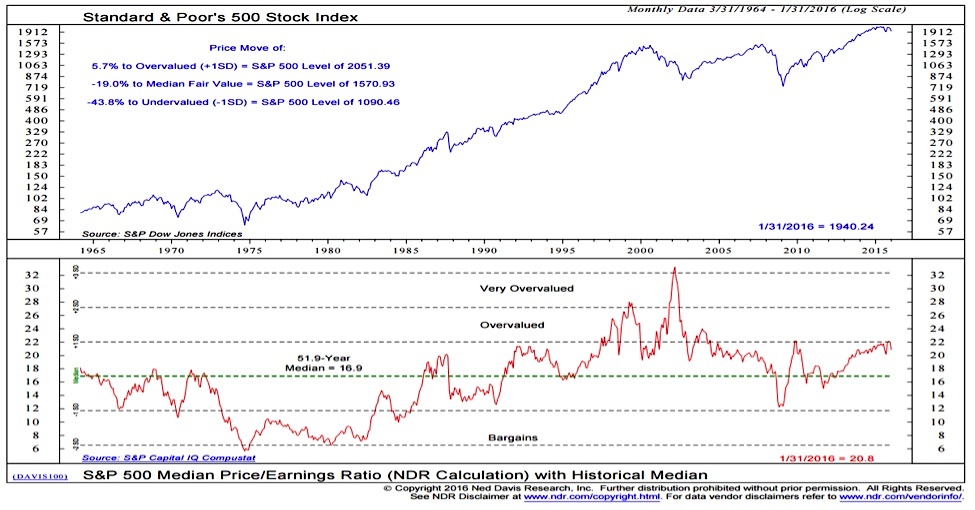

The BofA Perspective: Why Current Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

BofA's Macroeconomic Outlook: A Foundation for Market Valuation Analysis

BofA's comprehensive macroeconomic analysis forms the bedrock of its assessment of stock market valuations. Several key economic indicators, along with considerations of interest rates and inflation, contribute to their relatively optimistic outlook.

Positive Economic Indicators Supporting Current Valuations:

BofA points to several strong economic growth indicators as justification for current stock market valuations. Their research highlights:

- Robust GDP Growth: BofA's forecasts predict continued, albeit moderated, GDP growth for the coming quarters, driven by [mention specific drivers cited by BofA, e.g., consumer spending, business investment]. [Insert specific data points from BofA reports, e.g., "BofA projects a 2.5% GDP growth rate for Q4 2024"].

- Strong Employment Numbers: The continued strength of the labor market, with low unemployment rates and rising wages, signals a healthy consumer spending environment, a key driver of economic growth and supportive of higher stock market valuations. [Insert relevant data from BofA reports].

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively robust, indicating confidence in the economy and further supporting BofA's view on current stock market valuations. [Insert relevant data from BofA reports].

Interest Rate Environment and its Impact on Stock Prices:

BofA's analysis incorporates the current interest rate environment into its valuation models. While interest rate hikes impact valuations, BofA's projections suggest that interest rates will [mention BofA's prediction, e.g., "remain relatively stable or even decrease slightly in the near term"]. This relatively low-interest-rate environment can support higher stock valuations as the cost of borrowing remains manageable for companies and investors. [Insert specific data on interest rate predictions from BofA research].

Inflationary Pressures and their Influence on Stock Market Valuations:

Inflation is a critical factor influencing stock market valuations. BofA acknowledges inflationary pressures but highlights several mitigating factors: [Explain BofA's perspective on inflation, including any mitigating factors they identify, e.g., supply chain improvements, easing commodity prices]. BofA's sophisticated valuation models incorporate these inflationary pressures, providing a more nuanced and accurate picture than simply looking at headline inflation figures.

Analyzing Sector-Specific Valuations from a BofA Perspective:

BofA's analysis goes beyond a macro view, delving into sector-specific valuations to paint a more complete picture.

Strong Performing Sectors and Their Justification:

Several sectors, despite appearing to have high valuations, are deemed fundamentally strong by BofA. These include [list sectors, e.g., technology, healthcare]:

- Technology: Continued technological advancements and increasing demand for software and cloud services support high valuations in this sector. Companies like [mention examples and their valuations] are seen as having robust growth prospects.

- Healthcare: Aging populations and ongoing advancements in medical technology underpin strong performance and potentially justify higher valuations in this sector. Companies like [mention examples and their valuations] represent examples of this strength.

Understanding Sectors with Seemingly High Valuations:

Some sectors exhibit seemingly high valuations. However, BofA's analysis often reveals justifications:

- [Mention a sector with seemingly high valuations]. BofA acknowledges the high valuation but points to [explain reasons, e.g., disruptive technologies, significant growth potential] as factors supporting their outlook. [Provide examples and discuss their potential].

Risk Assessment and Mitigation Strategies According to BofA:

BofA acknowledges inherent risks in the market.

Identifying Potential Risks and Downside Scenarios:

BofA identifies potential risks impacting stock market valuations, including:

- Geopolitical Instability: [Explain BofA's assessment of geopolitical risks and their potential impact on markets].

- Supply Chain Disruptions: [Explain BofA's assessment of supply chain risks and their potential impact on valuations].

Strategies for Managing Portfolio Risk in the Current Market:

To mitigate these risks, BofA suggests several strategies:

- Diversification: Diversifying across different sectors and asset classes is crucial to manage risk effectively.

- Strategic Sector Allocation: Focusing on sectors with strong fundamentals and growth potential can enhance portfolio performance.

- Risk Tolerance Considerations: Investors should carefully consider their individual risk tolerance when making investment decisions.

Conclusion: A Measured Approach to Stock Market Valuations Based on BofA's Insights

In conclusion, BofA's comprehensive analysis suggests that while current stock market valuations may appear high on the surface, they are not necessarily a cause for alarm. Their positive macroeconomic outlook, sector-specific analysis justifying high valuations in certain areas, and strategies for effective risk mitigation provide a balanced perspective. Current stock market valuations, therefore, should be viewed within the context of BofA's broader assessment. To understand stock market valuations better and manage your investment portfolio effectively, explore BofA's insights on current market conditions by visiting [insert links to relevant BofA resources]. Making informed investment decisions requires a nuanced understanding of these factors, and BofA’s research offers valuable tools to navigate the complexities of current market dynamics.

Featured Posts

-

Us Congress Reintroduces Taiwan International Solidarity Act

Apr 25, 2025

Us Congress Reintroduces Taiwan International Solidarity Act

Apr 25, 2025 -

Anzac Day Disrespect Aussie War Veteran Speaks Out On Schools Actions And National Decline

Apr 25, 2025

Anzac Day Disrespect Aussie War Veteran Speaks Out On Schools Actions And National Decline

Apr 25, 2025 -

Looking Back To April 1999 Can You Identify These Faces

Apr 25, 2025

Looking Back To April 1999 Can You Identify These Faces

Apr 25, 2025 -

Overcoming Challenges After Mastectomy Inspiration From Linda Evangelista

Apr 25, 2025

Overcoming Challenges After Mastectomy Inspiration From Linda Evangelista

Apr 25, 2025 -

Courtney Act And Tony Armstrong To Host Sbs Eurovision 2024

Apr 25, 2025

Courtney Act And Tony Armstrong To Host Sbs Eurovision 2024

Apr 25, 2025

Latest Posts

-

Beyonce Apokalyptiki Emfanisi Me Tzin Sortsaki Se Tileoptiki Diafimisi

Apr 30, 2025

Beyonce Apokalyptiki Emfanisi Me Tzin Sortsaki Se Tileoptiki Diafimisi

Apr 30, 2025 -

Why Only Rumi And Blue Ivy Exploring Beyonces Decision On Sir Carters Public Appearances

Apr 30, 2025

Why Only Rumi And Blue Ivy Exploring Beyonces Decision On Sir Carters Public Appearances

Apr 30, 2025 -

Is A Cotswolds Move On The Cards For Beyonce And Jay Z

Apr 30, 2025

Is A Cotswolds Move On The Cards For Beyonce And Jay Z

Apr 30, 2025 -

Tzin Sortsaki Kai Beyonce I Nea Diafimisi Poy Syzitietai

Apr 30, 2025

Tzin Sortsaki Kai Beyonce I Nea Diafimisi Poy Syzitietai

Apr 30, 2025 -

Rumi And Blue Ivy On Stage Understanding Beyonces Choice Regarding Sir Carter

Apr 30, 2025

Rumi And Blue Ivy On Stage Understanding Beyonces Choice Regarding Sir Carter

Apr 30, 2025