The Copper Market's Response To Evolving US-China Trade Relations

Table of Contents

Historical Impact of US-China Trade Tensions on Copper Prices

Examining past trade disputes reveals a clear correlation between US-China trade tensions and copper market volatility. The 2018 trade war, for example, serves as a prime illustration. Increased uncertainty surrounding global trade flows directly impacted copper demand and prices.

- Increased tariffs on copper imports and exports: The imposition of tariffs significantly increased the cost of copper, impacting both producers and consumers. This led to a reduction in overall trade volume and price fluctuations.

- Disruptions to global supply chains impacting copper availability: Tariffs and trade restrictions disrupted established supply chains, leading to shortages and further price volatility in the copper market. Businesses struggled to source copper reliably, leading to increased costs and delays in projects.

- Investor uncertainty leading to price volatility: The unpredictable nature of the trade disputes created significant uncertainty amongst investors, leading to significant price swings in the copper futures market. This volatility presented both opportunities and risks for shrewd copper traders.

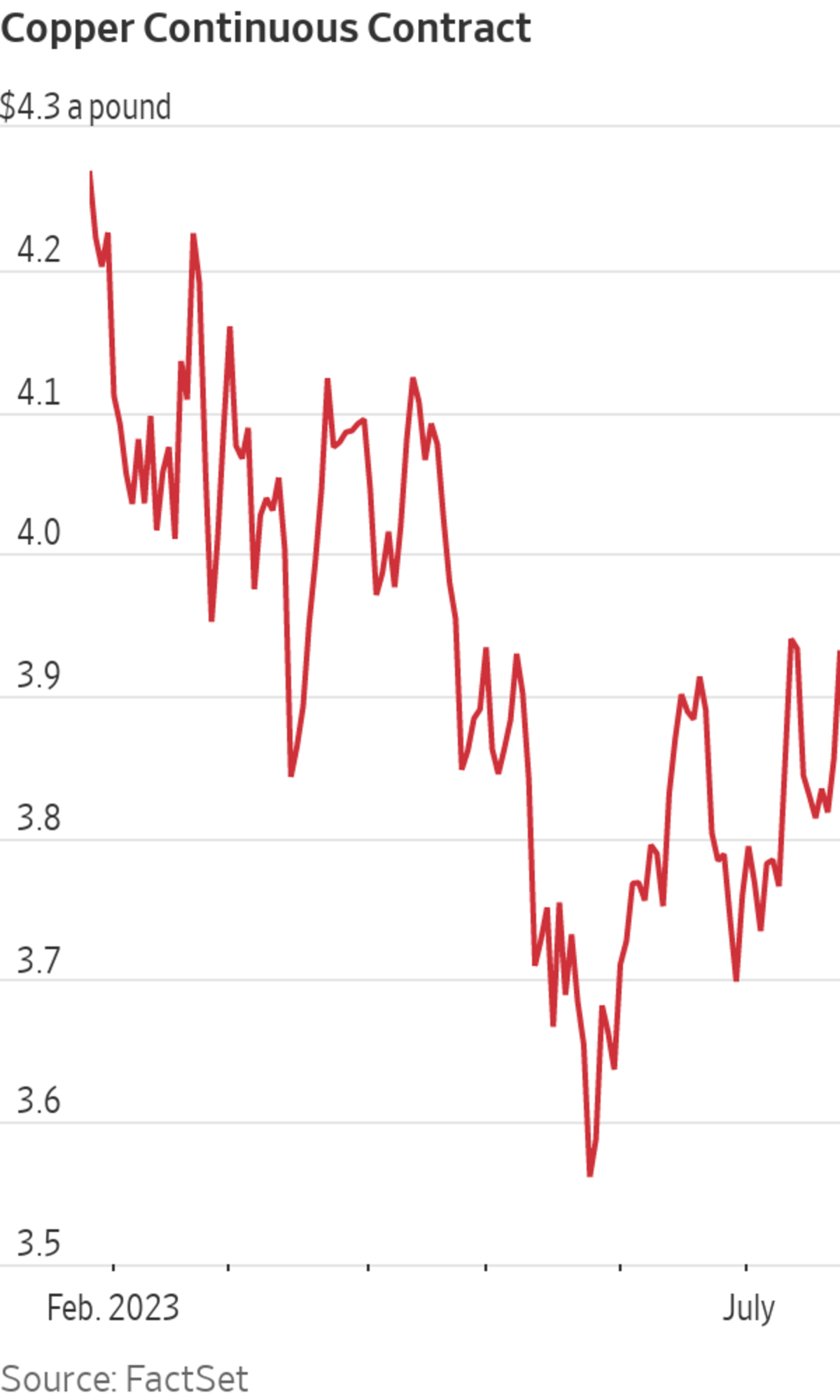

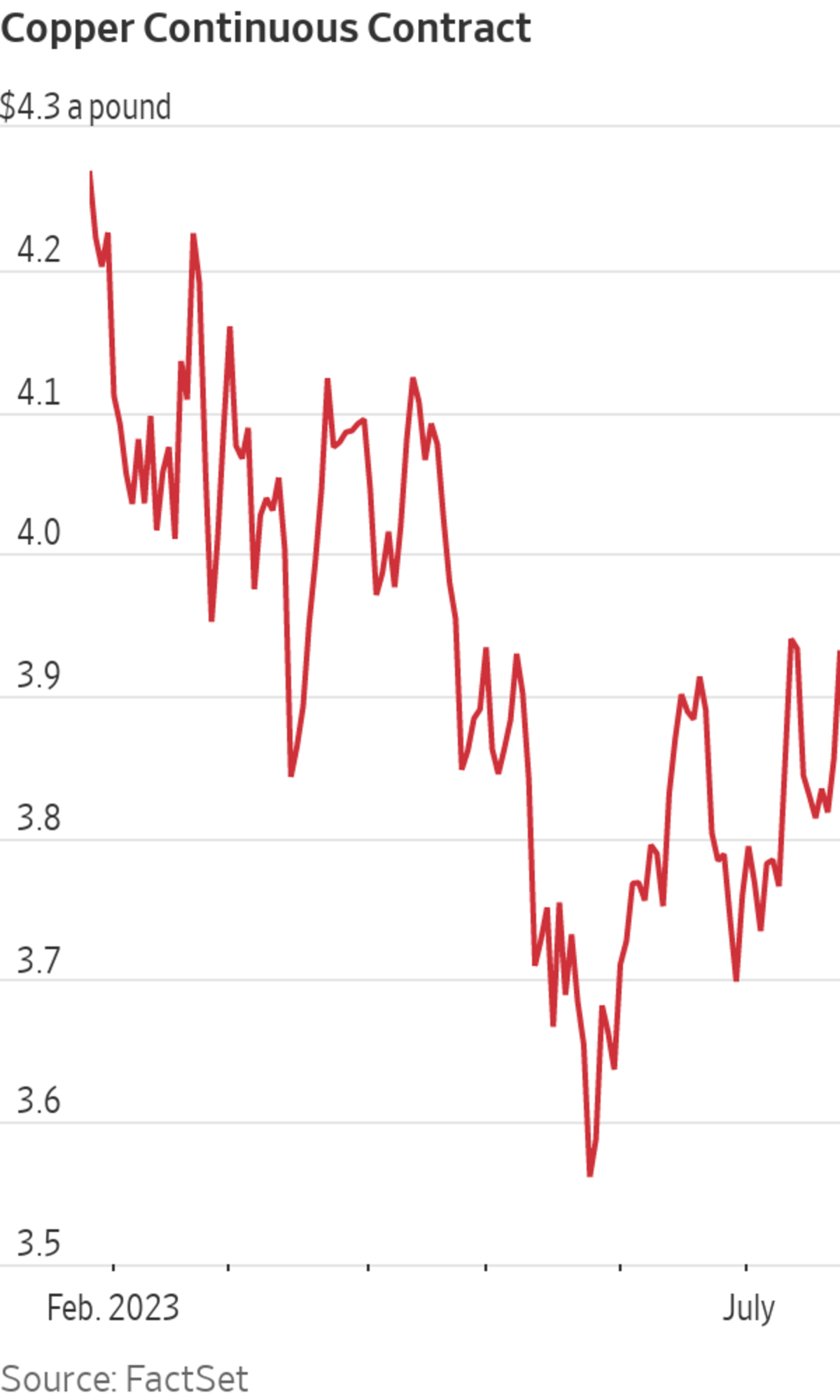

- Analysis of price fluctuations during previous periods of trade tension: Historical data clearly shows a direct correlation between escalating trade tensions and increased volatility in copper prices. Charts illustrating this relationship show a clear pattern of price spikes during periods of heightened trade uncertainty. For example, [Insert link to relevant price chart here].

- Mention specific copper price charts and data illustrating the impact: Detailed analysis of copper price data from periods of heightened trade friction demonstrates a statistically significant correlation between trade tensions and copper price volatility. This data should be presented visually to illustrate the point clearly.

Current State of US-China Trade and its Influence on the Copper Market

The current state of US-China trade relations remains complex and dynamic, continuing to exert a significant influence on the copper market. While some trade tensions have eased, underlying geopolitical factors remain.

- Current tariff levels and their impact on copper trade: While some tariffs have been reduced or removed, others remain in place, continuing to impact the cost and flow of copper between the US and China. This affects pricing and competitiveness in both markets.

- Impact of any ongoing trade negotiations or agreements: Ongoing negotiations and agreements between the US and China directly influence the copper market. Any progress towards a more stable trade relationship can lead to increased certainty and potentially lower price volatility.

- Analysis of current copper demand from China and the US: China remains a significant consumer of copper, primarily driven by its construction and manufacturing sectors. US demand is also substantial, primarily driven by construction and infrastructure projects. Changes in demand in either country can significantly influence global copper prices.

- Discussion of alternative sourcing strategies for copper: The ongoing trade tensions have spurred companies to explore alternative sourcing strategies for copper, reducing reliance on either the US or China. This diversification can stabilize the market in the long run, but might lead to short-term price fluctuations.

- Evaluation of the role of geopolitical factors beyond trade: Geopolitical factors beyond direct trade relations, such as political stability and global economic growth, can also significantly impact the copper market and should be considered alongside US-China trade dynamics.

Future Projections and Investment Strategies in the Copper Market

Predicting the future of US-China trade relations, and their consequent impact on the copper market, is inherently challenging. However, scenario planning offers a useful framework for navigating the uncertainty.

- Scenario planning: analyzing potential trade outcomes (e.g., de-escalation, further escalation): Investors should consider various scenarios, ranging from a complete de-escalation of trade tensions to a further escalation. Each scenario will have a different impact on copper prices and investment strategies.

- Forecasting copper demand based on different trade scenarios: Demand forecasts should be adjusted based on the chosen trade scenario. For instance, a scenario involving further trade restrictions would likely lead to lower copper demand compared to a scenario with de-escalation.

- Risk management strategies for investors in the copper market: Risk management is crucial in this volatile market. Hedging strategies, diversification of investments, and careful monitoring of market developments are vital for mitigating potential losses.

- Diversification strategies to mitigate trade-related risks: Diversifying investments across different commodities and markets can help reduce the impact of potential trade-related shocks on the overall investment portfolio.

- Analysis of potential long-term trends impacting copper prices (e.g., green energy transition): Long-term trends, such as the global transition to renewable energy, will significantly influence copper demand. The increasing use of copper in electric vehicles and renewable energy infrastructure will likely drive future demand.

Conclusion

The relationship between US-China trade relations and the copper market is intricate and dynamic. Historical data shows a clear correlation between trade tensions and copper price volatility. The current trade landscape continues to influence copper prices, and future projections depend heavily on the evolving nature of US-China trade relations. Understanding these dynamics is critical for both investors and businesses involved in the copper industry. Staying informed about evolving US-China trade developments is paramount for making well-informed decisions regarding copper market investments and trading strategies. Continuously monitor copper prices and global trade news to effectively navigate this dynamic environment and optimize your copper trading strategies. Understanding the influence of US-China trade relations on the copper market is crucial for success.

Featured Posts

-

The Trump Carney Meeting A Pivotal Moment For Cusma

May 06, 2025

The Trump Carney Meeting A Pivotal Moment For Cusma

May 06, 2025 -

Pharrell A Ap Rocky And Colman Domingo Grace Vogues May Cover

May 06, 2025

Pharrell A Ap Rocky And Colman Domingo Grace Vogues May Cover

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers Nude Scene

May 06, 2025 -

Where To Watch Celtics Vs Heat On February 10th Game Time And Streaming Info

May 06, 2025

Where To Watch Celtics Vs Heat On February 10th Game Time And Streaming Info

May 06, 2025 -

How To Win And Avoid Losing In Meetings With Trump A Comprehensive Guide

May 06, 2025

How To Win And Avoid Losing In Meetings With Trump A Comprehensive Guide

May 06, 2025