The Correlation Between Elon Musk's Anger And Tesla's Stock Price

Table of Contents

Tesla's stock price has seen dramatic swings, sometimes exceeding 10% in a single day. One factor frequently cited is the unpredictable behavior of its CEO, Elon Musk. This article explores the correlation between Elon Musk's anger and Tesla's stock price, analyzing the impact of his public outbursts on investor sentiment and market performance. We'll examine whether this correlation is positive, negative, or simply a complex interplay of factors. Our aim is to dissect the "Elon Musk effect" and its influence on one of the world's most volatile yet valuable companies.

2. Main Points:

H2: Analyzing Elon Musk's Public Outbursts and Their Immediate Impact on Tesla Stock

H3: The Power of the Tweet: Elon Musk's Twitter account is notorious for its unpredictable pronouncements. His tweets, often impulsive and controversial, have a demonstrable impact on Tesla's stock price. The sheer speed at which information spreads online means even a seemingly insignificant tweet can trigger significant market reactions.

- Examples: Musk's tweets about taking Tesla private in 2018, his comments about Dogecoin, and his frequent criticisms of short-sellers have all led to substantial stock price volatility.

- Mechanisms: These tweets often lead to increased trading volume, fueling volatility. They can also influence short-selling activity, as investors bet against the stock based on perceived negative news. The resulting media frenzy amplifies the impact, attracting attention from both seasoned investors and casual observers.

- Keywords: "Elon Musk tweets," "Tesla stock volatility," "market reaction," "investor sentiment," "Twitter impact," "social media influence."

H3: Public Appearances and Press Conferences: Musk's public appearances, from press conferences to interviews, are equally impactful. His demeanor, tone, and even body language can significantly influence investor perception. A confident and optimistic Musk can boost investor confidence, while a frustrated or defensive Musk can trigger negative reactions.

- Examples: Presentations showcasing groundbreaking Tesla technology have often been met with positive market responses, while controversial statements or aggressive responses to critical questions have led to dips in the stock price.

- Analysis: The subtle cues of body language – a dismissive gesture, a raised voice – can be amplified by media interpretations, further shaping public opinion and affecting investor decisions.

- Keywords: "Elon Musk press conference," "Tesla investor relations," "public image," "brand perception," "body language," "communication style."

H3: Controversies and Scandals: Numerous controversies have surrounded Musk and Tesla, ranging from SEC investigations to product recalls. These events invariably impact investor confidence and the stock price. The company's response to these crises also plays a critical role.

- Impact: Negative news cycles erode investor trust, prompting selling pressure. A poorly handled crisis can exacerbate the damage.

- Examples: The SEC investigation into Musk's "taking Tesla private" tweet and various production delays and safety concerns have all negatively impacted Tesla's stock.

- Keywords: "Tesla controversies," "SEC investigation," "Elon Musk scandals," "reputation management," "crisis communication," "product recall."

H2: Long-Term Effects: Anger, Brand Identity, and Investor Confidence in Tesla

H3: Building a Brand Around Controversy: Some argue that Musk's controversial style is an integral part of Tesla's brand identity. His unpredictable nature generates buzz and attracts attention, potentially appealing to a segment of investors who value disruption and innovation above all else.

- Analysis: While this approach might attract some investors, it also carries significant risks. The unpredictable nature of Musk's behavior can lead to periods of uncertainty and instability, potentially driving away more risk-averse investors.

- Keywords: "Tesla brand identity," "Elon Musk persona," "brand loyalty," "risk management," "disruptive innovation," "controversial branding."

H3: Investor Behavior and Long-Term Stock Performance: While short-term fluctuations are easily attributable to Musk's actions, determining the long-term correlation is more complex. It requires considering the interplay between Musk's public persona and Tesla's underlying financial performance.

- Analysis: While Musk's actions undoubtedly contribute to volatility, the long-term trajectory of Tesla's stock is ultimately shaped by factors like technological innovation, market adoption, and overall financial health.

- Keywords: "Tesla stock price," "long-term investment," "market analysis," "stock prediction," "fundamental analysis," "company performance."

3. Conclusion: The Unpredictable Equation: Elon Musk, Anger, and Tesla's Future

The correlation between Elon Musk's anger and Tesla's stock price is undeniably complex. While his public outbursts can trigger significant short-term volatility, the long-term performance depends on a multitude of factors beyond his personality. The impact of his actions is multifaceted, presenting both risks and opportunities for the company. Further research is needed to fully understand this intricate relationship and to predict the long-term effects of this unpredictable equation. We encourage readers to share their insights and perspectives on the correlation between Elon Musk's anger and Tesla's stock price, and to further explore the broader impact of CEO personality on market capitalization.

Featured Posts

-

Sinners New Horror Movie Filmed In Louisiana Release Date Revealed

May 26, 2025

Sinners New Horror Movie Filmed In Louisiana Release Date Revealed

May 26, 2025 -

Tour Of Flanders Preview Pogacar And Van Der Poels Clash For Victory

May 26, 2025

Tour Of Flanders Preview Pogacar And Van Der Poels Clash For Victory

May 26, 2025 -

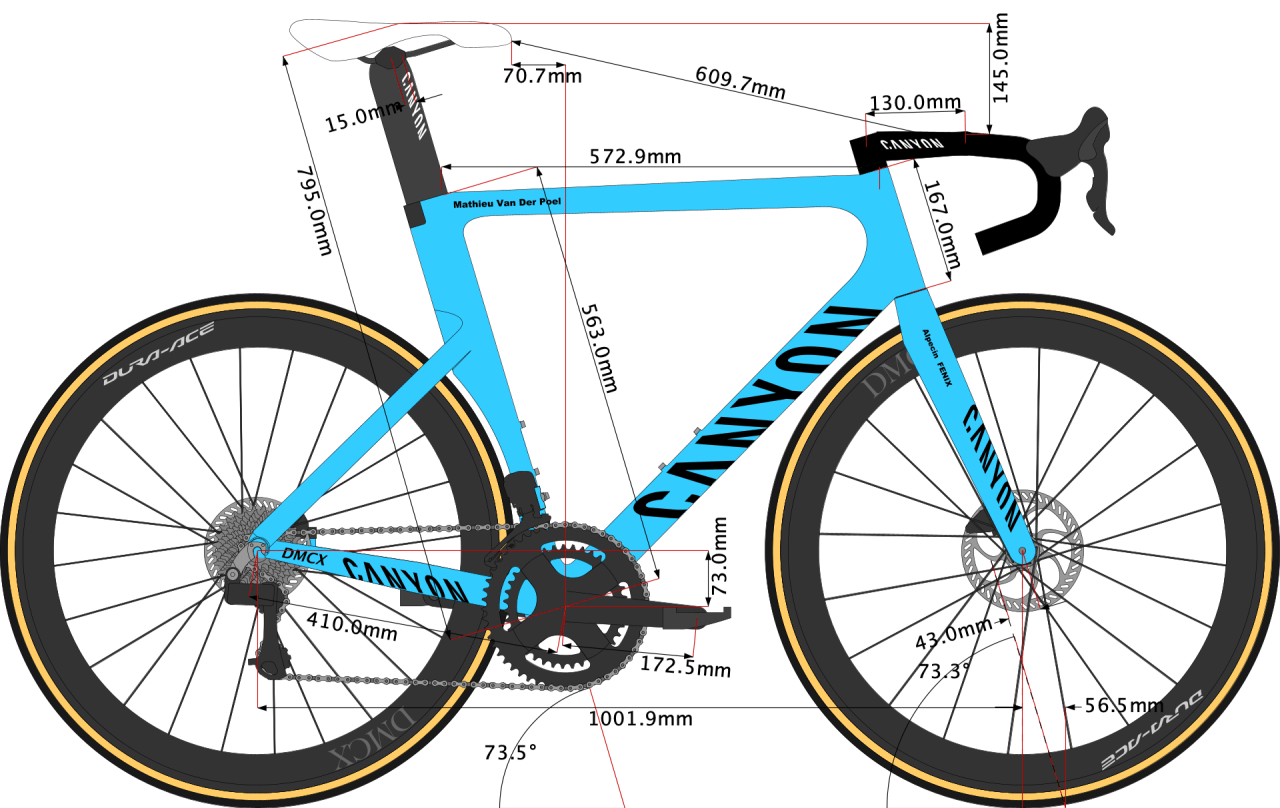

Van Der Poels New Canyon Aeroad A Closer Look At His Tirreno Adriatico Bike

May 26, 2025

Van Der Poels New Canyon Aeroad A Closer Look At His Tirreno Adriatico Bike

May 26, 2025 -

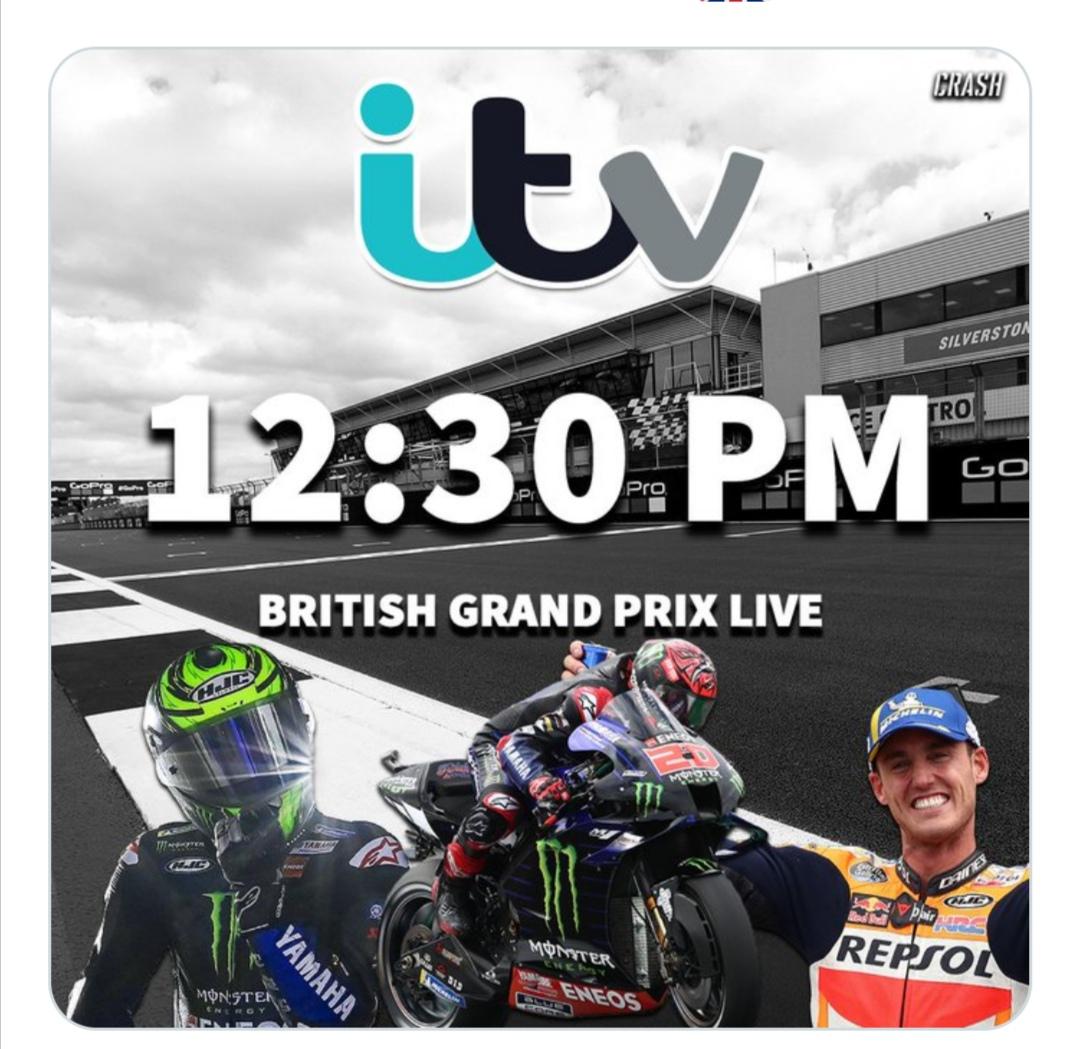

Catat Tanggalnya Jadwal Terbaru Moto Gp Inggris Di Silverstone

May 26, 2025

Catat Tanggalnya Jadwal Terbaru Moto Gp Inggris Di Silverstone

May 26, 2025 -

Jenson And The Fw 22 Extended Collection New Styles And Details

May 26, 2025

Jenson And The Fw 22 Extended Collection New Styles And Details

May 26, 2025