The Dollar's Descent: Implications For Asian Currency Traders

Table of Contents

Understanding the Dollar's Weakening

Factors Contributing to the Dollar's Descent

Several interconnected factors contribute to the ongoing weakening of the US dollar, creating a dynamic and unpredictable environment for currency exchange rates. These include:

-

Rising Inflation and Interest Rate Hikes: Persistent inflation in the US has forced the Federal Reserve to implement aggressive interest rate hikes. While intended to curb inflation, these hikes can also weaken the dollar as investors seek higher returns elsewhere. This impacts investor sentiment significantly, driving capital away from US-denominated assets.

-

Geopolitical Instability: Global geopolitical instability often leads investors to seek the safety of the US dollar, traditionally a safe-haven currency. However, prolonged uncertainty and escalating conflicts can erode this perception, weakening the dollar's appeal and impacting currency exchange rates negatively.

-

Strengthening of Other Major Currencies: The Euro, Japanese Yen, and other major currencies have been strengthening relative to the dollar, further contributing to its decline. This shift in global currency dynamics significantly alters the USD exchange rates against Asian currencies.

-

Increased Demand for Alternative Currencies and Assets: Growing investor interest in alternative currencies and assets, such as those in emerging markets, diverts capital away from the dollar, impacting its value in the currency exchange market.

Analyzing Currency Exchange Rate Volatility

The weakening dollar introduces significant volatility into currency exchange rates, presenting both opportunities and challenges for Asian currency traders.

-

Impact on Trading Strategies: Unpredictable exchange rates require traders to adapt their strategies frequently. Short-term trading becomes more challenging, while long-term strategies need to incorporate more sophisticated risk management techniques.

-

Technical and Fundamental Analysis: Traders rely on both technical and fundamental analysis to navigate this volatility. Technical analysis examines price charts and trends to predict future movements, while fundamental analysis considers economic indicators and geopolitical events to assess long-term value.

-

Hedging Strategies: To mitigate risks, traders employ hedging strategies, such as using forward contracts or options, to lock in exchange rates and protect against adverse movements in USD/Asian currency pairs.

Opportunities for Asian Currency Traders

The dollar's descent presents several lucrative opportunities for shrewd Asian currency traders.

Profiting from Currency Devaluation

A weakening dollar makes Asian currencies relatively more expensive, creating opportunities for traders.

-

Favorable Exchange Rates: The decline in the dollar's value creates favorable exchange rates for traders to buy Asian currencies at lower USD costs. This presents the chance for substantial profit when the currencies appreciate.

-

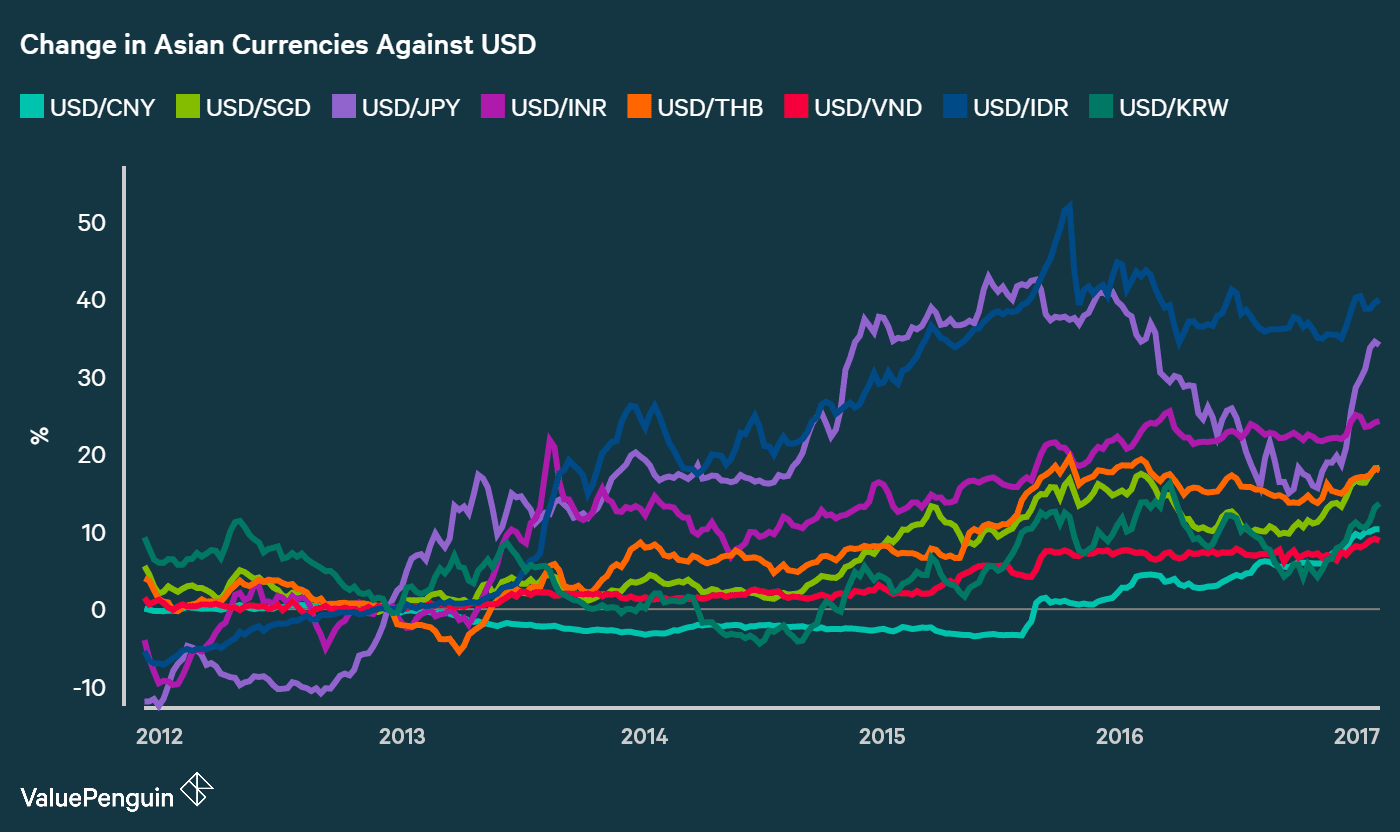

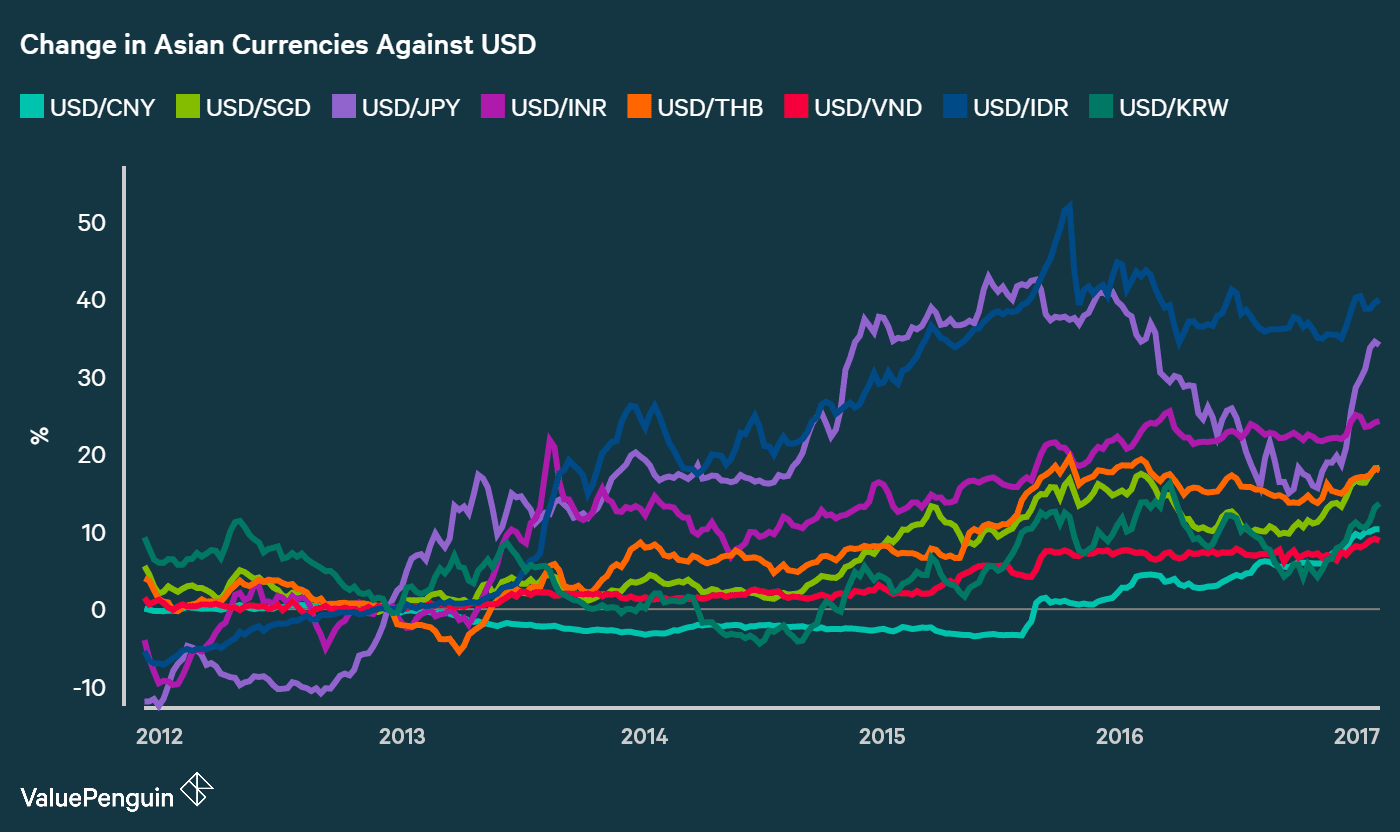

Specific Currency Pairs: Pairs like USD/JPY (US Dollar/Japanese Yen), USD/CNY (US Dollar/Chinese Yuan), and USD/INR (US Dollar/Indian Rupee) offer potential for growth depending on market conditions and individual trading strategies concerning the dollar's descent.

-

Leverage and Risk: Leverage can magnify both profits and losses. While it can enhance returns during periods of currency appreciation, it's crucial to understand and manage the associated risks.

Diversification and Portfolio Optimization

In a volatile market, diversification is paramount.

-

Diversifying Across Asian Currencies: Spreading investments across different Asian currencies (e.g., Japanese Yen, Chinese Yuan, South Korean Won, Singapore Dollar) reduces the impact of any single currency's fluctuations, mitigating risk associated with the dollar's descent.

-

Well-Defined Trading Strategy: A well-defined trading strategy, integrated within a diversified portfolio, is crucial. This includes clear entry and exit points, risk tolerance levels, and a thorough understanding of market dynamics relating to the dollar's descent.

Challenges and Risks for Asian Currency Traders

Despite the opportunities, the weakening dollar also introduces challenges and risks.

Increased Market Uncertainty

The unpredictable nature of the weakening dollar significantly increases market uncertainty.

-

Challenges in Risk Management: Increased volatility makes risk management more complex. Traders need sophisticated tools and strategies to effectively manage their exposure.

-

Thorough Market Research: Success requires thorough market research and analysis. Staying informed about economic indicators, geopolitical events, and central bank policies is critical for navigating the uncertain landscape.

Geopolitical and Economic Risks

Regional factors can independently impact Asian currencies, adding to the complexities.

-

Regional Instability: Political instability or economic downturns in specific Asian regions can negatively impact currency valuations, irrespective of the dollar's descent.

-

Specific Events: Events like natural disasters, political crises, or changes in government policy can significantly affect individual Asian currencies.

-

Staying Informed: Staying abreast of geopolitical and economic news is crucial for making informed trading decisions, especially in light of the dollar's descent.

Conclusion

The dollar's descent presents both exciting opportunities and significant challenges for Asian currency traders. While the weakening dollar creates potential for profit through favorable exchange rates and diversified portfolios, navigating the increased market uncertainty and geopolitical risks requires careful planning, thorough analysis, and robust risk management strategies. Staying informed on global economic trends, utilizing effective trading strategies, and constantly adapting to the dynamic shifts in the currency market are crucial for success in this evolving landscape. To stay ahead of the curve in this dynamic market, continuous learning about the dollar's descent and its impact on Asian currency trading is essential. Mastering effective strategies and risk management will be key to profiting from the opportunities that arise from this global economic shift.

Featured Posts

-

Suki Waterhouse And The Retro Trainer Revival

May 06, 2025

Suki Waterhouse And The Retro Trainer Revival

May 06, 2025 -

Nikvol Pashinyani Zijvo Mnyery Adrbyejanin Ishkhan Saghatyelyani Vyerlvo Tsvo Tyvo Ny

May 06, 2025

Nikvol Pashinyani Zijvo Mnyery Adrbyejanin Ishkhan Saghatyelyani Vyerlvo Tsvo Tyvo Ny

May 06, 2025 -

Babak Pertama Tanpa Gol Timnas U20 Indonesia Vs Yaman 0 0

May 06, 2025

Babak Pertama Tanpa Gol Timnas U20 Indonesia Vs Yaman 0 0

May 06, 2025 -

Tracee Ellis Ross Walks The Marni Runway 30 Years Later

May 06, 2025

Tracee Ellis Ross Walks The Marni Runway 30 Years Later

May 06, 2025 -

Laser Treatments Kim Kardashians Met Gala 2025 Prep

May 06, 2025

Laser Treatments Kim Kardashians Met Gala 2025 Prep

May 06, 2025