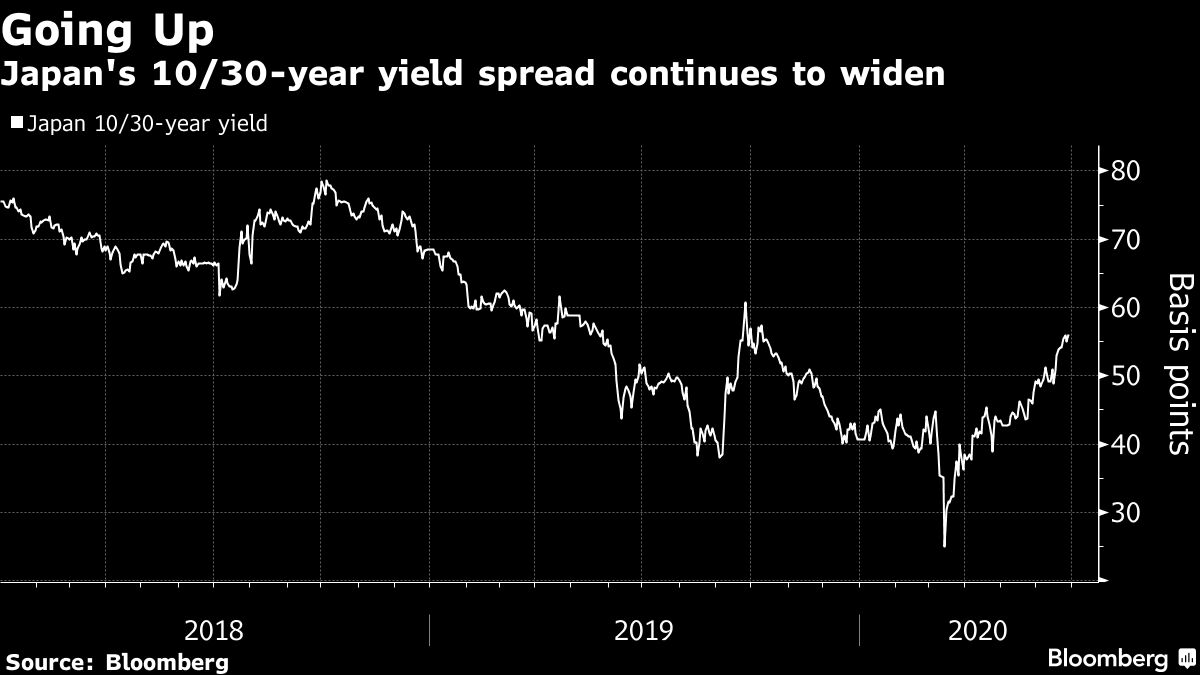

The Economic Consequences Of Japan's Steep Bond Yield Curve

Table of Contents

Impact on Monetary Policy and the Bank of Japan (BOJ)

The Bank of Japan (BOJ) faces significant challenges in managing the yield curve, particularly given its yield curve control (YCC) policy. A steep yield curve complicates the effectiveness of quantitative easing (QE) and the attainment of the BOJ's inflation targets.

-

Yield Curve Control (YCC) and its Limitations: YCC aims to control long-term interest rates, but a steep curve indicates that market forces are pushing long-term rates higher despite the BOJ's interventions. This limits the BOJ's ability to stimulate the economy through lower borrowing costs.

-

Impact of a Steep Curve on QE Effectiveness: A steep yield curve can undermine the effectiveness of QE. When long-term yields rise despite QE, the intended stimulative effect on borrowing and investment is diminished. The BOJ's purchases of JGBs may not be sufficient to offset market pressures.

-

Potential Policy Adjustments: The BOJ might need to adjust its YCC policy, potentially widening the target range for long-term yields or abandoning YCC altogether. These adjustments carry significant risks, potentially impacting market stability and investor confidence.

-

Consequences of Abandoning YCC: Abandoning YCC could lead to a sharp increase in long-term interest rates, potentially triggering a surge in borrowing costs for businesses and consumers, and potentially dampening economic growth. This could also lead to increased volatility in the JGB market.

Effects on the Japanese Banking Sector

A steep yield curve significantly affects the profitability of Japanese banks through its impact on net interest margins (NIMs). This has major implications for lending and credit risk.

-

Net Interest Margins (NIMs) and a Steep Curve: A steep yield curve initially boosts NIMs as banks can lend at higher rates while their cost of funding (short-term rates) remains low. However, a sustained steep curve may indicate rising interest rate risks and future funding challenges.

-

Implications for Bank Lending: While initially benefiting from higher lending rates, a steep curve can also reduce overall lending if it signals an economic slowdown or increased risk aversion. Businesses may hesitate to borrow due to higher costs, and banks may tighten lending standards.

-

Increased Credit Risk: A steep yield curve can signal rising inflation and increased economic uncertainty, elevating credit risk for banks. Non-performing loans could increase, impacting bank profitability and financial stability.

-

Bank Responses to a Steep Yield Curve: Banks might respond by diversifying their assets, adjusting lending strategies, and hedging against interest rate risk to mitigate the negative impacts of a sustained steep curve.

Influence on Investment and Economic Growth

The steepness of Japan's yield curve considerably impacts investment decisions, both domestically and internationally. It influences corporate bond issuance, stock market performance, and foreign investment.

-

Corporate Borrowing Costs: A steep curve increases corporate borrowing costs, potentially hindering capital expenditure and business expansion. Companies might delay or cancel investments due to higher financing costs.

-

Investor Confidence and Risk Appetite: A steep yield curve can signal economic uncertainty and potentially reduce investor confidence. This could lead to a decrease in risk appetite, affecting both domestic and foreign investment flows.

-

Yield Curve and Economic Growth: A persistently steep yield curve can negatively correlate with economic growth. Higher borrowing costs can stifle investment and consumption, hindering overall economic expansion.

-

Foreign Direct Investment (FDI): A steep yield curve may deter foreign direct investment (FDI) as investors perceive increased risk and higher borrowing costs. This could negatively impact Japan's long-term economic growth potential.

The Role of Inflation and Deflation

The interplay between the yield curve's steepness and inflationary or deflationary pressures is complex. A steep curve can potentially exacerbate existing economic imbalances in Japan.

-

Inflation Expectations and Bond Yields: A steep yield curve might reflect rising inflation expectations, as investors demand higher yields to compensate for the erosion of purchasing power. However, this is not always the case, and other factors influence bond yields.

-

Impact on Consumer Spending and Business Investment: If a steep curve signals higher future inflation, consumers might bring forward purchases, while businesses may accelerate investment to avoid higher future costs. However, this can also lead to an overheated economy.

-

Steep Curve and Deflationary Forces: A steep curve could potentially hinder efforts to combat deflation. Higher borrowing costs can reduce investment and consumption, further depressing prices and prolonging deflationary pressures.

Conclusion

The economic consequences of a steep Japanese bond yield curve are multifaceted and interconnected. It significantly influences monetary policy, the banking sector's profitability, investment decisions, and the overall economic growth trajectory. The interplay between the steep yield curve, inflation expectations, and the BOJ's policies creates a complex environment with potential risks and opportunities. Understanding the nuances of the Japan bond yield curve is vital for navigating the complexities of the Japanese economy and making informed investment decisions. Stay informed about ongoing developments in the Japanese bond market and the BOJ's policy responses to manage the steep yield curve. Further research into the dynamic interplay between the Japan bond yield curve and key economic indicators will provide deeper insights.

Featured Posts

-

Double Digit Rally For Uber In April Reasons And Analysis

May 17, 2025

Double Digit Rally For Uber In April Reasons And Analysis

May 17, 2025 -

Top No Kyc Casinos For Instant Withdrawals In 2025 7 Bit Casino Review

May 17, 2025

Top No Kyc Casinos For Instant Withdrawals In 2025 7 Bit Casino Review

May 17, 2025 -

Brasilien Als Zukunftsmarkt Warum Die Vae In Favelas Investieren

May 17, 2025

Brasilien Als Zukunftsmarkt Warum Die Vae In Favelas Investieren

May 17, 2025 -

Novak Djokovic Yine Zirvede Kariyerinin En Iyi Doenemi Mi

May 17, 2025

Novak Djokovic Yine Zirvede Kariyerinin En Iyi Doenemi Mi

May 17, 2025 -

How Jalen Brunsons Absence Impacts The New York Knicks

May 17, 2025

How Jalen Brunsons Absence Impacts The New York Knicks

May 17, 2025