The Economic Implications Of The Student Loan Debt Crisis In America

Table of Contents

Impact on Personal Finances and Consumer Spending

The crippling weight of student loan debt significantly restricts borrowers' financial freedom, leading to a cascade of negative economic consequences.

Reduced Disposable Income

High monthly student loan payments dramatically reduce disposable income, leaving borrowers with less money for essential expenses and discretionary spending. This directly impacts overall consumer demand, a crucial driver of economic growth.

- Reduced spending on housing: Difficulty affording rent or purchasing a home.

- Limited transportation options: Reliance on older, less reliable vehicles or restricted travel.

- Curtailed entertainment and leisure activities: Fewer opportunities for dining out, travel, or hobbies.

- Delayed or forgone savings: Inability to build an emergency fund or save for retirement.

According to the Federal Reserve, a significant portion of borrowers allocate a substantial percentage of their income towards student loan repayments, leaving little room for other financial priorities. This reduced consumer spending ripples through the economy, affecting businesses and employment.

Delayed Major Life Purchases

Student loan debt frequently delays major life decisions, postponing milestones that contribute significantly to economic activity.

- Delayed homeownership: The high cost of student loans coupled with down payment requirements significantly postpones or prevents homeownership for many young adults.

- Postponement of marriage and starting a family: Financial pressures associated with student debt influence the timing of marriage and family planning, impacting demographic trends.

- Reduced investment opportunities: Limited funds available for investments, hindering wealth accumulation and future economic contributions.

Studies show a strong correlation between student loan debt and delayed homeownership, with many borrowers unable to afford a down payment or meet mortgage requirements. This delay in a major life purchase like homeownership further restricts consumer spending and overall economic activity.

Effects on the Labor Market

The student loan debt crisis significantly impacts the labor market in several ways, hindering economic growth and productivity.

Career Choices

The pressure to repay student loans can significantly influence career choices, potentially steering individuals away from lower-paying but fulfilling professions.

- Avoidance of public service careers: Lower salaries in fields like teaching or social work discourage graduates burdened with significant debt.

- Emphasis on higher-paying but less fulfilling jobs: Individuals prioritize higher salaries over personal satisfaction, potentially leading to skill mismatches and reduced job satisfaction.

- Limited career mobility: Difficulty leaving a high-paying job to pursue further education or a career change.

This phenomenon creates skill shortages in crucial sectors while potentially increasing dissatisfaction within the workforce.

Entrepreneurship and Small Business Growth

The high burden of student loan debt significantly hinders entrepreneurial activity and the growth of small businesses.

- Difficulty securing business loans: Existing student loan debt reduces creditworthiness, making it challenging to obtain additional funding for business ventures.

- Limited access to capital: Borrowers may lack the financial resources to invest in their own businesses.

- Increased financial risk aversion: The fear of defaulting on student loans may discourage borrowers from taking the risks associated with starting a business.

A substantial number of aspiring entrepreneurs forgo starting businesses due to the financial constraints imposed by existing student loan debt, ultimately hindering innovation and job creation within the economy.

Macroeconomic Consequences

The student loan debt crisis has far-reaching macroeconomic implications, affecting overall economic growth and stability.

GDP Growth

Decreased consumer spending, reduced entrepreneurial activity, and hampered labor market dynamism all negatively impact overall GDP growth.

- Reduced aggregate demand: Lower consumer spending translates into reduced demand for goods and services, impacting businesses and employment.

- Slowed economic expansion: The overall economy grows at a slower pace as consumer and business investment is stifled.

- Potential for economic instability: The cumulative effect of these factors can contribute to economic instability and recessionary risks.

Economic models demonstrate a clear correlation between high levels of student loan debt and slower GDP growth.

Government Debt and Budgetary Strain

The government's role in managing the student loan program places a considerable financial burden on the national budget.

- Cost of loan forgiveness programs: Proposals for widespread loan forgiveness programs carry substantial fiscal implications.

- Subsidized interest rates: The government's role in subsidizing interest rates on student loans adds to the national debt.

- Default rates and government bailouts: High default rates necessitate government intervention, contributing further to budgetary strain.

The ongoing costs associated with the student loan program contribute significantly to the overall national debt and pose challenges for long-term budgetary planning.

Potential Solutions and Policy Recommendations

Addressing the student loan debt crisis requires a multifaceted approach incorporating various policy interventions.

Income-Driven Repayment Plans

Income-driven repayment plans aim to make student loan payments more manageable by linking monthly payments to borrowers' income. However, they have limitations.

- Pros: Lower monthly payments, potentially avoiding default.

- Cons: Longer repayment periods, potentially higher total interest paid.

Reforms to these plans, including more streamlined processes and clearer communication, could improve their effectiveness.

Loan Forgiveness Programs

Loan forgiveness programs, while potentially providing immediate relief, also present significant economic challenges.

- Arguments for: Stimulates consumer spending, reduces financial hardship.

- Arguments against: High cost to taxpayers, potential moral hazard.

Targeted forgiveness programs, for example, focused on specific professions or borrowers facing extreme hardship, may offer a more sustainable approach.

Addressing the Root Causes

Long-term solutions must address the root causes of the crisis, focusing on affordability and financial literacy.

- Reduced tuition costs: Government interventions and policy changes to control rising tuition costs.

- Increased financial aid: Expanding access to grants and scholarships to reduce reliance on loans.

- Improved career and financial literacy: Providing resources to students and families to make informed decisions about higher education financing.

Comprehensive reforms addressing the underlying causes of the student loan debt crisis are crucial for long-term economic stability and individual financial well-being.

Conclusion

The student loan debt crisis poses significant economic challenges, impacting personal finances, the labor market, and macroeconomic growth. Its consequences range from reduced consumer spending and delayed major life purchases to hampered entrepreneurship and increased government debt. Addressing this crisis requires a multifaceted approach, including improvements to income-driven repayment plans, thoughtful consideration of loan forgiveness programs, and, most importantly, long-term solutions that focus on affordability and financial literacy. The student loan debt crisis demands immediate and comprehensive action. Understanding its far-reaching economic consequences is the first step towards finding solutions. Contact your representatives today and demand change!

Featured Posts

-

Viktor Gyoekeres Istatistikler Performans Ve Attigi Goller

May 28, 2025

Viktor Gyoekeres Istatistikler Performans Ve Attigi Goller

May 28, 2025 -

1968 And 2024 A Springtime Comparison And Summer Drought Outlook

May 28, 2025

1968 And 2024 A Springtime Comparison And Summer Drought Outlook

May 28, 2025 -

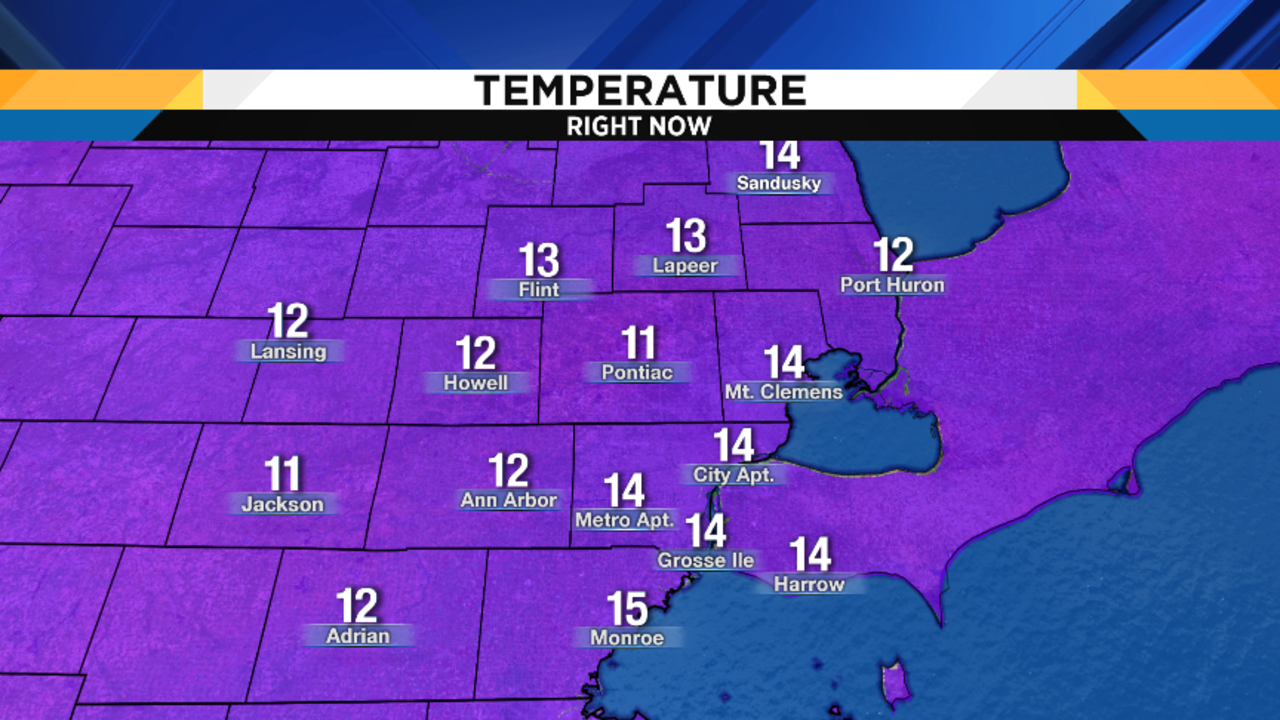

Metro Detroit Weather Forecast Cool Monday Clearing To Sunshine

May 28, 2025

Metro Detroit Weather Forecast Cool Monday Clearing To Sunshine

May 28, 2025 -

E3 Billion Hit Housing Corporations Warn Against Rent Freeze

May 28, 2025

E3 Billion Hit Housing Corporations Warn Against Rent Freeze

May 28, 2025 -

Alejandro Garnacho Transfer Speculation Potential Destinations And Transfer Fee

May 28, 2025

Alejandro Garnacho Transfer Speculation Potential Destinations And Transfer Fee

May 28, 2025