The Fallout From US Tariffs: Shein's London IPO On Hold

Table of Contents

The Impact of US Tariffs on Shein's Global Strategy

Increased US tariffs on Chinese imports, where Shein primarily manufactures its clothing, significantly impact the company's profitability and are a key factor in the Shein IPO delay. These tariffs directly translate into:

- Increased production costs: Higher import duties mean Shein's manufacturing expenses rise, eating into profit margins.

- Reduced profit margins: The increased costs are difficult to absorb completely, leading to squeezed profit margins and impacting the company's overall financial health. This directly affects the attractiveness of the Shein IPO to potential investors.

- Potential price increases for consumers: To offset increased costs, Shein might be forced to raise prices, potentially impacting its competitive advantage of offering incredibly low prices.

- Pressure on Shein's competitive advantage (low prices): Shein's business model relies heavily on its ability to offer ultra-low prices. Tariffs threaten this core strategy, impacting the Shein IPO prospects significantly.

Shein has likely explored tariff avoidance strategies, such as shifting production to other countries or altering its supply chain. However, these options are often costly and complex, taking time to implement and not fully mitigating the impact of the tariffs. Data from the Office of the United States Trade Representative shows that tariffs on clothing imports from China have been substantial, averaging [insert data if available – e.g., "X%" ] over the past few years, significantly impacting businesses like Shein.

Shein's Financial Performance and Investor Concerns

Shein's recent financial performance, in the face of these tariff challenges, is crucial in understanding the Shein IPO delay. While the company hasn't publicly released detailed financial statements, reports suggest [insert any available data on revenue growth or decline, losses, or decreased profitability]. These figures, whether showing strong revenue growth or a decline, directly influence investor confidence. Negative financial news, especially in relation to the ongoing tariff issues, would understandably create investor hesitancy.

The uncertainty surrounding Shein's long-term profitability in the face of persistent trade barriers is a major concern for potential investors. Any reported losses or significantly reduced profitability would severely impact the valuation of the company, making a successful Shein IPO less likely in the current climate. Rumors of investor withdrawal or hesitancy further support the connection between financial concerns and the Shein IPO delay.

Alternative IPO Locations and Strategic Options for Shein

Given the complications surrounding the London IPO, Shein might explore alternative locations for its public offering. Potential options include Hong Kong, Singapore, and even the US. Each location presents unique advantages and disadvantages:

- Hong Kong: A strong financial hub with experience in handling large IPOs, but political considerations might be a factor.

- Singapore: A stable and business-friendly environment, but possibly a smaller investor pool compared to Hong Kong or the US.

- US: The world's largest stock market, but stricter regulatory requirements and a potential negative perception due to the ongoing tariff disputes.

The regulatory frameworks of each location significantly impact Shein's business model and the ease of conducting an IPO. Furthermore, the investor landscape in each location varies greatly, affecting the potential valuation and success of the Shein IPO.

Beyond an immediate IPO, Shein might consider other strategic options: further expanding into new markets less affected by US tariffs, investing heavily in supply chain diversification to reduce reliance on China, or focusing on internal cost optimization strategies to mitigate the effects of tariffs.

The Future of Fast Fashion and Global Trade

The Shein IPO delay has wider implications for the fast-fashion industry. Global trade tensions and protectionist policies are impacting many fast-fashion brands, not just Shein. The long-term effects on consumers could include higher prices and reduced choice. For the fashion industry, it highlights the increasing vulnerability of businesses relying on globalized supply chains. The Shein IPO delay serves as a case study in the complexities of navigating international trade in a rapidly changing global economic landscape.

Conclusion

The Shein IPO delay is primarily attributed to the significant impact of US tariffs on Shein's financial health and the resulting uncertainty among potential investors. The increased production costs, reduced profit margins, and pressure on its low-price competitive advantage all contribute to the current situation. Shein's future plans remain uncertain, with alternative IPO locations and strategic options being explored. To stay informed about further developments concerning the Shein IPO delay and the broader implications of US tariffs on global trade, regularly check reputable financial news sources. Understanding the intricacies of the Shein IPO delay and its impact on the fast-fashion industry and global trade is crucial for investors and anyone following the future of fast fashion.

Featured Posts

-

Virginia Derby Official Announcement Expected From Stone At Colonial Downs

May 05, 2025

Virginia Derby Official Announcement Expected From Stone At Colonial Downs

May 05, 2025 -

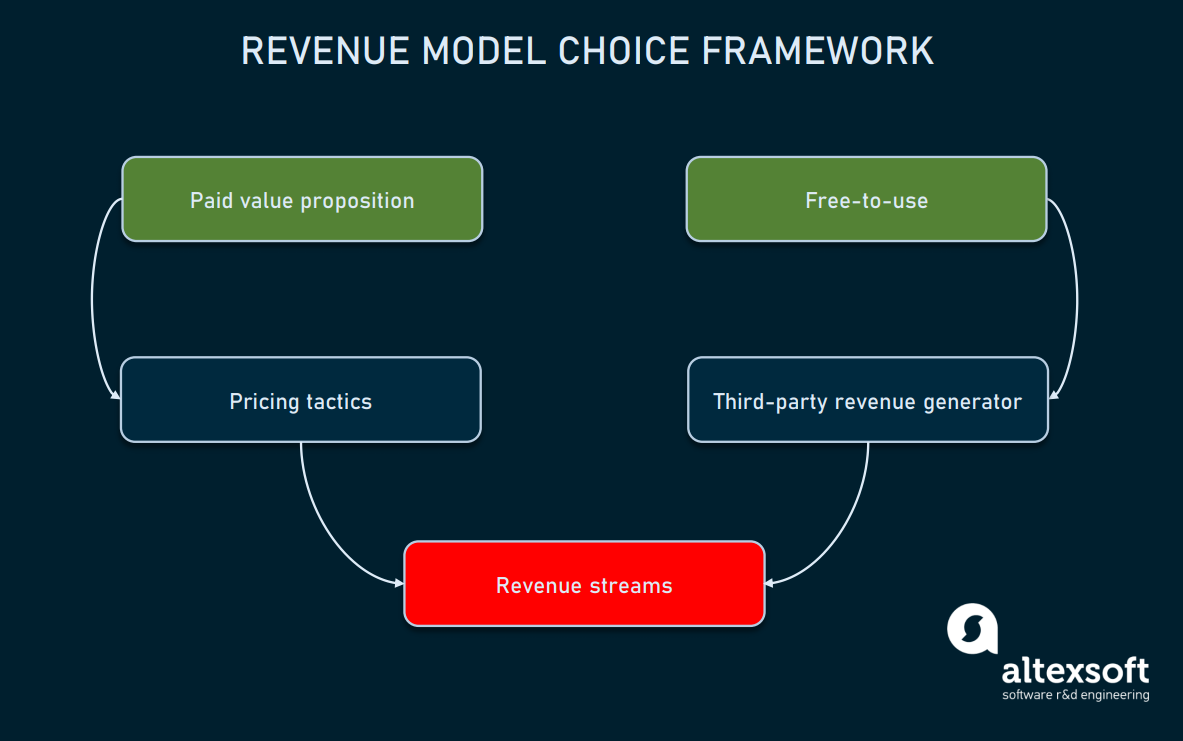

Shopify Developers Lifetime Revenue Share Model Explained

May 05, 2025

Shopify Developers Lifetime Revenue Share Model Explained

May 05, 2025 -

Tampa Bay Derby 2025 A Comprehensive Look At The Odds Field And Kentucky Derby Prospects

May 05, 2025

Tampa Bay Derby 2025 A Comprehensive Look At The Odds Field And Kentucky Derby Prospects

May 05, 2025 -

Rare Novel Worth 45 000 Unearthed In Bookstore

May 05, 2025

Rare Novel Worth 45 000 Unearthed In Bookstore

May 05, 2025 -

Greg Olsen Earns Third Emmy Nomination Surpassing Tom Brady On Fox

May 05, 2025

Greg Olsen Earns Third Emmy Nomination Surpassing Tom Brady On Fox

May 05, 2025

Latest Posts

-

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025 -

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025 -

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025 -

Cord Cutting Revolution Continues Fox And Espns Streaming Plans For 2025

May 05, 2025

Cord Cutting Revolution Continues Fox And Espns Streaming Plans For 2025

May 05, 2025 -

Fox 2 To Simulcast Select Red Wings And Tigers Games

May 05, 2025

Fox 2 To Simulcast Select Red Wings And Tigers Games

May 05, 2025