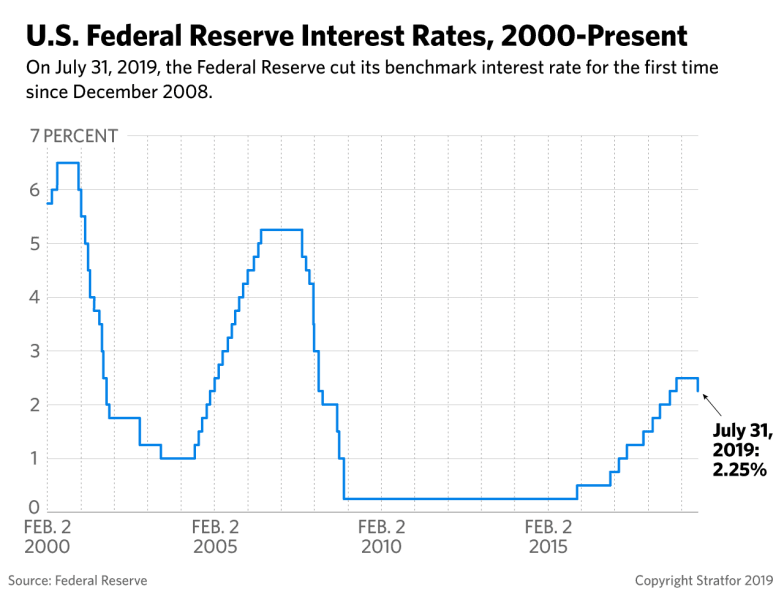

The Fed And Rate Cuts: A Divergence From Global Trends

Table of Contents

The Fed's Rationale Behind Resisting Rate Cuts

The Fed's reluctance to cut rates, despite a slowing global economy, stems from several key factors. Its primary concern remains the persistent threat of inflation.

Persistent Inflationary Pressures

The US continues to grapple with stubbornly high inflation. The Fed's mandate prioritizes price stability, making rate cuts a less attractive option while inflation remains elevated.

- Core Personal Consumption Expenditures (PCE) index: Remains above the Fed's 2% target, indicating persistent inflationary pressures beyond volatile food and energy prices.

- Consumer Price Index (CPI): While showing signs of cooling, CPI remains significantly above the Fed's target, signaling ongoing inflation risks.

- Fed's inflation targets: The Fed's unwavering commitment to its 2% inflation target dictates its monetary policy decisions. Rate cuts, considered stimulative, are deemed inappropriate until inflation consistently falls within this target range. The Fed is determined to avoid repeating the mistakes of the 1970s, when persistent inflation eroded economic stability.

The Fed's hesitation to implement Fed rate cuts highlights its dedication to achieving and maintaining price stability, even at the potential cost of slower economic growth.

Strong Labor Market Conditions

Another key factor influencing the Fed's hawkish stance is the robust US labor market. While this is generally positive, it also contributes to inflationary pressures.

- Low unemployment rates: Historically low unemployment rates suggest a tight labor market, where employers are competing for a limited pool of workers, leading to upward pressure on wages.

- Wage growth: Strong wage growth, while beneficial for workers, fuels inflationary pressures if it outpaces productivity growth. This is a classic wage-price spiral scenario.

- Impact on inflationary pressures: The combination of low unemployment and robust wage growth creates a self-reinforcing cycle, where increased wages lead to higher prices, prompting further wage demands.

The Fed aims to cool the labor market slightly to curb inflation, recognizing the potential for a wage-price spiral that could derail its inflation-fighting efforts. This necessitates a cautious approach to rate cuts.

Concerns about Economic Overheating

The Fed is also concerned about the potential for economic overheating. Excessive monetary easing through aggressive Fed rate cuts could exacerbate existing inflationary pressures and create other risks.

- Potential risks to financial stability: Extremely low interest rates can encourage excessive risk-taking in financial markets, potentially leading to asset bubbles and subsequent market instability.

- Impact on inflation expectations: Premature rate cuts could signal to the public that the Fed is unconcerned about inflation, leading to higher inflation expectations and further entrenching inflationary pressures.

- Long-term interest rates: Rate cuts can influence long-term interest rates, impacting borrowing costs for businesses and consumers, and potentially fueling further economic activity and inflation.

The Fed's cautious approach aims to avoid creating conditions that might ultimately lead to greater instability and exacerbate inflationary problems in the longer term.

Global Central Banks' Actions and Their Motivations

In contrast to the Fed's approach, many global central banks are actively cutting interest rates. This divergence stems from significantly different economic realities across the globe.

Differing Economic Conditions

Economic conditions vary dramatically across countries. Several nations face significant economic headwinds that necessitate rate cuts to stimulate growth.

- Economic slowdowns or recessions: Many European nations and other global economies are experiencing or anticipating recessions, necessitating aggressive monetary easing. Examples include the Eurozone, facing energy crises and slowing growth. Japan is also experiencing similar challenges.

- Comparison with the US: Unlike the US, many of these countries face weaker labor markets, lower inflation, and slower economic growth, creating an entirely different monetary policy context. The strength of the US economy compared to others contributes to this difference.

These differing economic circumstances justify the divergent monetary policy responses.

Responses to Global Economic Slowdowns

Numerous central banks are utilizing rate cuts as a primary tool to combat economic slowdowns or recessionary fears.

- Stimulative rate cuts: Rate cuts aim to lower borrowing costs for businesses and consumers, encouraging increased investment and spending, thereby stimulating economic activity.

- Examples of rate cuts: The European Central Bank (ECB), the Bank of Japan (BOJ), and others have implemented rate cuts or are signaling their intent to do so, reflecting the urgency of the situation in their respective economies.

- Effectiveness of rate cuts: While rate cuts are a widely used tool, their effectiveness varies depending on specific economic circumstances, the severity of the downturn, and the overall global economic environment.

The effectiveness of rate cuts differs based on local conditions, highlighting the complexity of global monetary policy coordination.

Currency Exchange Rate Impacts

The divergence in monetary policies significantly impacts currency exchange rates.

- US dollar strength: The Fed's relatively hawkish stance compared to other central banks has led to a strengthening of the US dollar against other currencies.

- Impact on US exports: A stronger dollar makes US exports more expensive, potentially hindering US export growth and impacting global trade balances. This is a significant consideration for the US economy.

- Global trade implications: The differing interest rate policies lead to volatility in currency markets, which can impact global trade flows and investment decisions.

Potential Consequences of this Divergence

The diverging monetary policies have significant potential consequences for both the US and the global economy.

Impact on the US Economy

The Fed's policy choices present potential trade-offs for the US economy.

- Risks of a recession: The Fed's focus on inflation control could inadvertently lead to a recession if interest rates remain too high for too long, stifling economic activity.

- Slower economic growth: Even without a full-blown recession, the Fed's policies could result in slower economic growth and potentially increased unemployment.

- Trade-off between inflation and growth: The Fed faces a difficult trade-off between controlling inflation and maintaining economic growth. This balancing act is crucial for navigating the current economic climate.

Global Economic Implications

The Fed's actions have significant spillover effects on the global economy.

- Spillover effects: The Fed's policies affect global capital flows, exchange rates, and overall global economic stability. The strength of the US dollar, for example, can significantly impact emerging markets.

- Increased financial market volatility: The divergence in monetary policies can lead to increased volatility in financial markets as investors adjust to the differing policy environments.

- Capital flows: Capital may flow out of countries with lower interest rates and into the US, potentially creating further economic challenges for those countries.

Conclusion: Navigating the Future of Fed Rate Cuts and Global Monetary Policy

The Fed's resistance to implementing Fed rate cuts, despite global trends, stems from its unwavering focus on controlling inflation, contrasting sharply with other central banks’ responses to slowing economies. Key differences in economic conditions and policy priorities explain this divergence. The potential consequences, ranging from slower US growth to increased global financial market volatility, underscore the complexity of navigating the current economic landscape. To stay informed, monitor global interest rate movements and understand the implications of monetary policy divergence. Stay updated on Fed rate cuts and their impact through reputable economic news sources, analyzing their implications for your investments or business strategies. Understanding these dynamics is crucial for making informed decisions in this evolving economic environment.

Featured Posts

-

Metas 168 Million Payment In Whats App Spyware Case Analysis And Outlook

May 10, 2025

Metas 168 Million Payment In Whats App Spyware Case Analysis And Outlook

May 10, 2025 -

Podcast Creation Using Ai To Process Repetitive Scatological Data

May 10, 2025

Podcast Creation Using Ai To Process Repetitive Scatological Data

May 10, 2025 -

Interest Rates Unchanged Fed Weighs Inflation And Unemployment Risks

May 10, 2025

Interest Rates Unchanged Fed Weighs Inflation And Unemployment Risks

May 10, 2025 -

Debate Sobre Derechos Transgenero Tras Arresto En Bano Femenino

May 10, 2025

Debate Sobre Derechos Transgenero Tras Arresto En Bano Femenino

May 10, 2025 -

Community Activists Proposal Enabling Transgender Women To Carry And Give Birth

May 10, 2025

Community Activists Proposal Enabling Transgender Women To Carry And Give Birth

May 10, 2025

Latest Posts

-

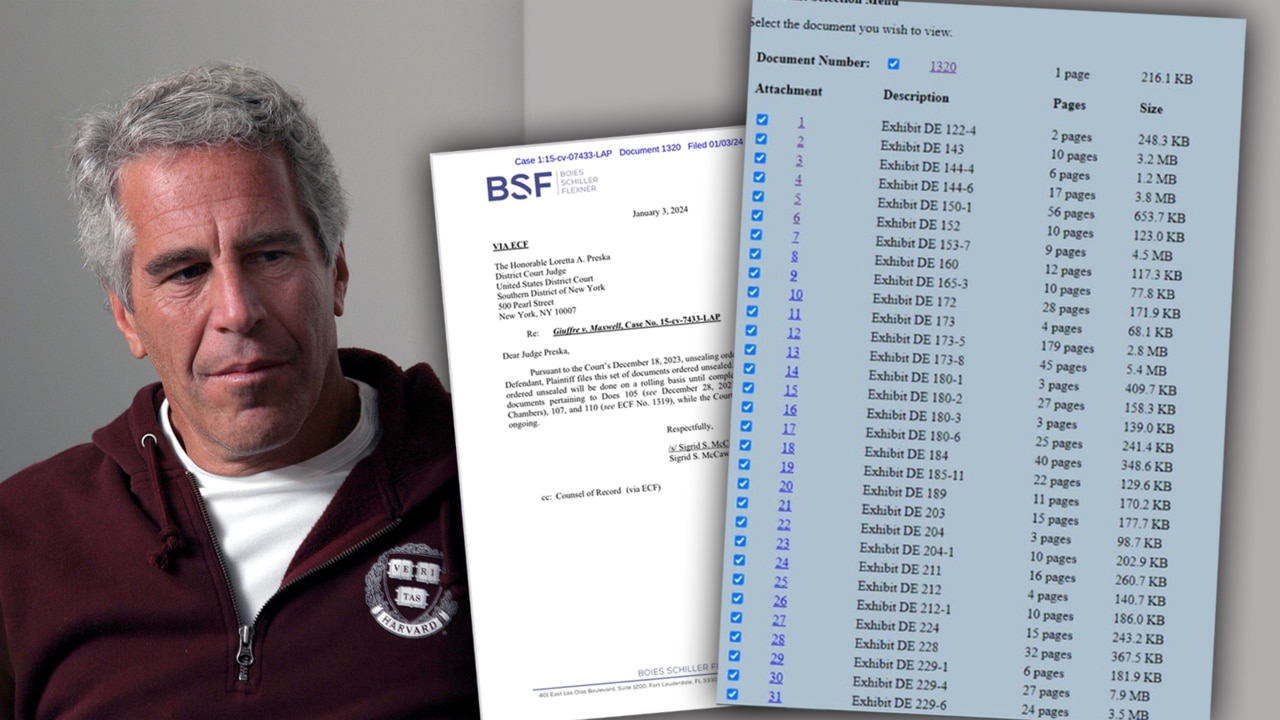

The Epstein Scandal Pam Bondis Involvement And The Client List Controversy

May 10, 2025

The Epstein Scandal Pam Bondis Involvement And The Client List Controversy

May 10, 2025 -

Did Pam Bondi Possess The Epstein Client List An Analysis Of The Claim

May 10, 2025

Did Pam Bondi Possess The Epstein Client List An Analysis Of The Claim

May 10, 2025 -

Attorney General Pam Bondi And The Alleged Epstein Client List A Deeper Look

May 10, 2025

Attorney General Pam Bondi And The Alleged Epstein Client List A Deeper Look

May 10, 2025 -

Pam Bondis Announcement Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025

Pam Bondis Announcement Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025 -

Pam Bondi On Epstein Diddy Jfk And Mlk Upcoming Document Release

May 10, 2025

Pam Bondi On Epstein Diddy Jfk And Mlk Upcoming Document Release

May 10, 2025