The Financial Impact Of A Consumer Boycott: The Target Example

Table of Contents

The Target Boycott: A Catalyst for Financial Scrutiny

The Target boycott, which gained significant momentum in recent years, stemmed from a confluence of factors related to the company's policies and perceived political affiliations. While Target has always positioned itself as a family-friendly retailer, certain actions triggered a strong backlash from a segment of its customer base.

- Specific examples: Target's LGBTQ+ inclusive policies, particularly its support for transgender rights and the provision of inclusive spaces in its stores, became a central point of contention for some consumers. This was further fueled by perceived political donations and endorsements.

- Key figures: While no single individual spearheaded the boycott, various conservative groups and online influencers played a significant role in organizing and promoting the boycott across social media platforms.

- Social media impact: The boycott's amplification through social media platforms like Facebook, Twitter, and TikTok was crucial. Online activism, utilizing hashtags and coordinated campaigns, quickly spread awareness and encouraged widespread participation in the boycott. The rapid spread of information and emotional appeals online significantly escalated the boycott's reach and intensity.

Measuring the Financial Fallout: Stock Performance and Sales Figures

While pinpointing the exact financial impact of the boycott on Target is challenging due to multiple contributing factors, analyzing its stock performance and sales data during the period provides valuable insights.

- Stock performance: Although precise figures related solely to the boycott are difficult to isolate, analysts observed fluctuations in Target's stock price during the period of heightened boycott activity. These fluctuations, though not solely attributable to the boycott, indicated market sensitivity to the negative publicity and potential impact on sales.

- Sales data: While Target didn't release specific sales data directly linking declines to the boycott, industry analysts reported overall sales growth slowing during the period. The negative publicity surrounding the boycott likely contributed to this slowdown, affecting consumer confidence and purchasing decisions.

- Company statements: Target’s official statements generally avoided direct acknowledgement of the boycott's financial impact, focusing instead on reaffirming its commitment to inclusivity. This cautious approach reflects the sensitivity of the situation and the potential risks of further fueling the controversy.

- Marketing changes: In response to the negative publicity, Target likely adjusted its marketing and public relations strategies, potentially shifting focus away from the aspects of its policies that sparked the boycott. Such adjustments, while not explicitly stated, represent a tacit acknowledgement of the boycott's impact.

Beyond the Numbers: Long-Term Brand Damage and Reputational Risk

The financial ramifications of the Target boycott extend beyond immediate sales figures and stock prices. The long-term impact on brand image and reputation cannot be overlooked.

- Customer perception: The boycott significantly impacted customer perception, leading to a decrease in customer loyalty among segments of the population. This loss of loyalty can have lasting implications for Target's market share and future sales.

- Future business decisions: The boycott forced Target to reconsider its approach to corporate social responsibility and its engagement with various stakeholder groups. Future business decisions, particularly those related to social and political stances, will likely be carefully considered to avoid repeating similar incidents.

- Regaining consumer trust: Rebuilding lost consumer trust after a boycott is a challenging and long-term process. Target will likely need to implement significant public relations and engagement strategies to win back customers who were alienated during the boycott.

The Cost of Damage Control

The expenses incurred by Target in managing the negative publicity and fallout from the boycott are difficult to quantify precisely. However, these costs likely included increased spending on public relations, community outreach, and potentially adjustments to marketing strategies. These indirect costs contribute significantly to the overall financial impact of a consumer boycott.

Lessons Learned: Avoiding the Impact of a Consumer Boycott

The Target example offers valuable lessons for businesses striving to avoid or mitigate the impact of potential boycotts. Proactive strategies are key to mitigating risk.

- Proactive stakeholder engagement: Regular and transparent dialogue with various stakeholders, including customers, employees, and community groups, is crucial. Active listening and understanding diverse perspectives are essential for identifying and addressing potential concerns before they escalate into boycotts.

- Strong CSR policies: Developing and implementing strong Corporate Social Responsibility (CSR) policies that align with the values of a broad customer base is vital. These policies should be transparent and consistently applied.

- Open communication: Transparent and open communication channels are essential for fostering trust and understanding. Responding promptly and honestly to consumer concerns can significantly reduce the likelihood of a boycott gaining momentum.

- Active listening: Actively listening to and responding to consumer concerns demonstrates respect and a commitment to understanding customer needs. This proactive approach can prevent minor issues from escalating into major conflicts.

Conclusion:

The Target boycott serves as a powerful illustration of the financial impact a well-organized consumer boycott can have. From significant stock fluctuations to lasting reputational damage, the costs can be substantial. Businesses must prioritize strong corporate social responsibility, transparent communication, and active engagement with their customer base to mitigate the risk of facing a similar financial crisis sparked by a consumer boycott. Ignoring consumer sentiment comes at a price; understanding the power of the consumer and acting responsibly is crucial for long-term financial success. Learn from the Target example and develop proactive strategies to protect your brand from the devastating force of a consumer boycott.

Featured Posts

-

Shrimp Ramen Stir Fry Flavorful And Fun

May 01, 2025

Shrimp Ramen Stir Fry Flavorful And Fun

May 01, 2025 -

Death Of Ted Kotcheff Director Of The Iconic Film Rambo First Blood

May 01, 2025

Death Of Ted Kotcheff Director Of The Iconic Film Rambo First Blood

May 01, 2025 -

Dalys Match Winning Performance England Triumphs Over France In Six Nations

May 01, 2025

Dalys Match Winning Performance England Triumphs Over France In Six Nations

May 01, 2025 -

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025 -

86 80 Victory Arizona Defeats Short Handed Texas Tech

May 01, 2025

86 80 Victory Arizona Defeats Short Handed Texas Tech

May 01, 2025

Latest Posts

-

Nrc Seeks Urgent Action Against Anti Muslim Activities In Bangladesh

May 01, 2025

Nrc Seeks Urgent Action Against Anti Muslim Activities In Bangladesh

May 01, 2025 -

Nrc Vandaag Krijgt Nieuwe Presentator Bram Endedijk

May 01, 2025

Nrc Vandaag Krijgt Nieuwe Presentator Bram Endedijk

May 01, 2025 -

Anti Muslim Plots In Bangladesh Nrc Urges Immediate Action

May 01, 2025

Anti Muslim Plots In Bangladesh Nrc Urges Immediate Action

May 01, 2025 -

Bram Endedijk Nieuwe Presentator Nrc Vandaag

May 01, 2025

Bram Endedijk Nieuwe Presentator Nrc Vandaag

May 01, 2025 -

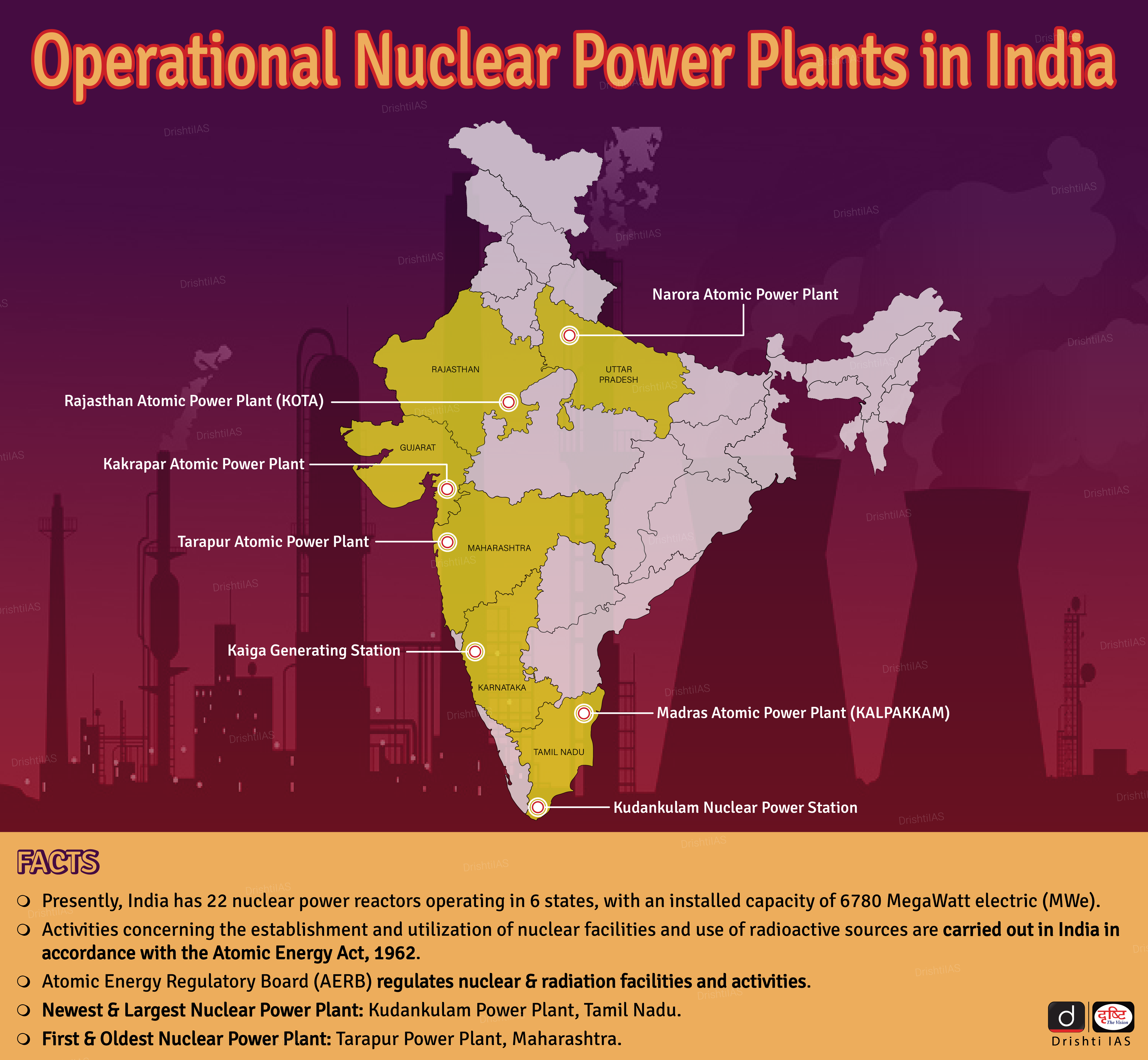

Understanding Nuclear Litigation Current Trends And Challenges

May 01, 2025

Understanding Nuclear Litigation Current Trends And Challenges

May 01, 2025