The Forerunner's Long Game: Navigating The Challenges Of Pre-IPO Startups

Table of Contents

Securing Funding & Managing Capital

Successfully navigating the pre-IPO landscape requires a meticulous approach to funding and capital management. This involves securing sufficient capital to fuel growth while maintaining fiscal responsibility.

Early-Stage Funding Strategies

Securing early-stage funding is paramount for pre-IPO startups. This typically involves several rounds of funding:

- Seed Funding: This initial funding round provides the capital necessary to develop a Minimum Viable Product (MVP) and test the market. Sources include angel investors and seed accelerators.

- Series A, B, and C Rounds: These subsequent rounds attract larger investments from venture capitalists (VCs) and other institutional investors, fueling expansion and scaling operations. Each round requires a more robust business plan and demonstrable traction.

- Crowdfunding: Platforms like Kickstarter and Indiegogo offer an alternative avenue for securing early-stage funding, directly engaging with potential customers and validating the product-market fit.

A compelling pitch deck, showcasing a strong team, a clear market opportunity, and realistic financial projections, is crucial for attracting investors at each stage. This must be accompanied by a robust financial model that demonstrates the company's potential for profitability and return on investment (ROI).

Efficient Capital Allocation

Efficient capital allocation is critical for pre-IPO success. This involves:

- Strategic Resource Allocation: Prioritizing investments in research & development (R&D), marketing and sales, and team expansion based on strategic priorities.

- Minimizing Burn Rate: Managing expenses carefully to extend the runway and maximize the impact of each funding round. This often involves lean operations and efficient resource utilization.

- Financial Forecasting & Budgeting: Developing accurate financial forecasts and budgets is crucial for securing future funding rounds and demonstrating financial prudence to potential investors. This ensures transparency and provides a roadmap for growth.

Building a Scalable and Sustainable Business Model

A robust and scalable business model is the cornerstone of pre-IPO success. This requires careful consideration of several key elements.

Defining a Clear Value Proposition

A compelling unique selling proposition (USP) is vital for differentiating your pre-IPO startup in a competitive market. This involves:

- Market Research & Competitive Analysis: Thorough market research to identify unmet needs and understand the competitive landscape.

- Scalable Business Model: Designing a business model capable of handling significant growth without compromising profitability or quality. This might include exploring different revenue streams and pricing strategies.

- Strong Value Proposition: Clearly articulating the unique value your product or service offers to customers, highlighting its competitive advantages.

Operational Efficiency and Team Building

Operational efficiency and a strong team are essential for scaling a pre-IPO startup. This means:

- Lean Operations & Automation: Implementing lean methodologies and automating processes to improve efficiency and reduce operational costs.

- Talent Acquisition & Retention: Attracting and retaining top talent through competitive compensation and benefits, fostering a positive work environment, and investing in employee development.

- Robust Technology Infrastructure: Investing in secure and reliable technology infrastructure to support operations and data security, which is increasingly crucial for pre-IPO companies.

Navigating Regulatory and Legal Compliance

Pre-IPO startups must navigate a complex regulatory landscape to ensure compliance and avoid potential legal issues.

Understanding Industry-Specific Regulations

Compliance with relevant regulations is critical for pre-IPO startups. This includes understanding and adhering to:

- Industry-Specific Regulations: HIPAA for healthcare startups, GDPR for companies handling European user data, and other relevant regulations depending on the industry.

- Legal Counsel: Engaging experienced legal counsel specializing in startups and IPOs is essential to ensure compliance and mitigate legal risks.

- Transparency & Ethical Practices: Maintaining transparency and ethical business practices builds trust with investors, customers, and regulatory bodies.

Preparing for the IPO Process

The IPO process itself is complex and requires significant preparation. This includes:

- SEC Regulations & Filings: Understanding and complying with SEC regulations and preparing the necessary filings, such as the S-1 form.

- Investment Banks & Underwriters: Working with experienced investment banks and underwriters to manage the IPO process and secure favorable terms.

- Due Diligence & Financial Audits: Undergoing rigorous due diligence and financial audits to ensure transparency and build investor confidence.

Managing Growth and Maintaining Momentum

Sustained growth and maintaining momentum are key to a successful IPO.

Scaling Operations for Rapid Growth

Scaling operations effectively while maintaining quality is a significant challenge for pre-IPO startups. This involves:

- Strategic Scaling: Implementing strategies for expanding operations without compromising quality or efficiency.

- Supply Chain Management: Establishing efficient supply chain management and logistics to ensure timely delivery and maintain customer satisfaction.

- Customer Service & Support: Scaling customer service and support to handle increased customer volume while maintaining high levels of satisfaction.

Building a Strong Brand and Reputation

A strong brand and positive reputation are crucial for attracting investors and customers. This involves:

- Brand Building & Reputation Management: Developing a strong brand identity and proactively managing the company's reputation.

- Public Relations & Marketing: Utilizing public relations and marketing strategies to build brand awareness and attract both investors and customers.

- Customer Satisfaction & Loyalty: Prioritizing customer satisfaction and building customer loyalty to create a strong foundation for long-term growth.

Conclusion

The journey of a pre-IPO startup is a demanding but potentially rewarding endeavor. By strategically addressing the challenges of securing funding, building a sustainable business model, navigating legal complexities, and managing growth effectively, pre-IPO companies can significantly increase their chances of a successful IPO. Understanding and proactively addressing these key areas is paramount for navigating the long game and ultimately achieving a successful IPO. Start planning your journey today by thoroughly researching and understanding the unique challenges faced by pre-IPO startups. Don't just survive; thrive in the competitive world of pre-IPO startups.

Featured Posts

-

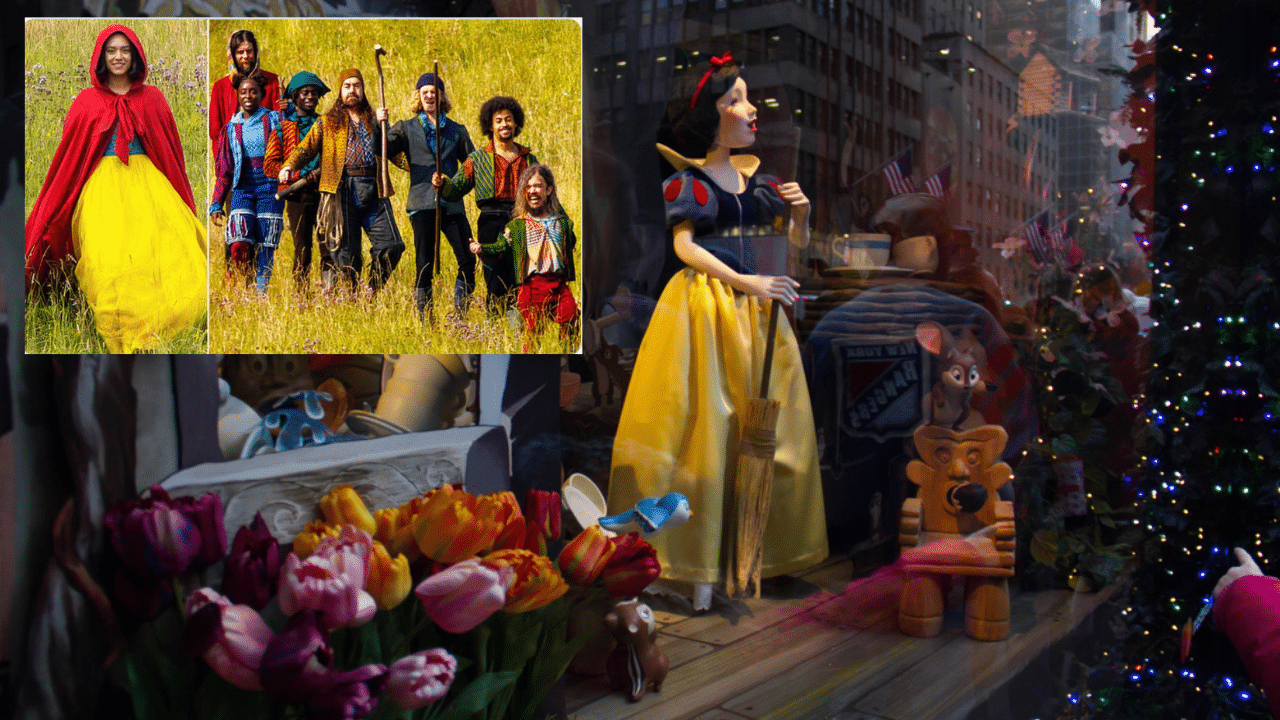

Disneys Snow White Remake Addressing The Biggest Issue

May 14, 2025

Disneys Snow White Remake Addressing The Biggest Issue

May 14, 2025 -

Innovative Sensortechnologie Im Einsatz Sachsenforst Verbessert Waldbrandpraevention In Der Saechsischen Schweiz

May 14, 2025

Innovative Sensortechnologie Im Einsatz Sachsenforst Verbessert Waldbrandpraevention In Der Saechsischen Schweiz

May 14, 2025 -

Tommy Boy Sequel In The Works David Spades Involvement Explained

May 14, 2025

Tommy Boy Sequel In The Works David Spades Involvement Explained

May 14, 2025 -

Celta Vs Sevilla Minuto A Minuto Del Partido De La Liga

May 14, 2025

Celta Vs Sevilla Minuto A Minuto Del Partido De La Liga

May 14, 2025 -

Tommy Fury And Molly Mae Hague A Comparative Analysis Of Their Public Image Management

May 14, 2025

Tommy Fury And Molly Mae Hague A Comparative Analysis Of Their Public Image Management

May 14, 2025

Latest Posts

-

Bad Gottleuba Berggiesshuebel Ermittlungen Nach Toedlichem Wohnungsbrand

May 14, 2025

Bad Gottleuba Berggiesshuebel Ermittlungen Nach Toedlichem Wohnungsbrand

May 14, 2025 -

Wohnungsbrand Mit Todesopfern In Bad Gottleuba Berggiesshuebel

May 14, 2025

Wohnungsbrand Mit Todesopfern In Bad Gottleuba Berggiesshuebel

May 14, 2025 -

Leichenfund Nach Wohnungsbrand In Bad Gottleuba Berggiesshuebel

May 14, 2025

Leichenfund Nach Wohnungsbrand In Bad Gottleuba Berggiesshuebel

May 14, 2025 -

Tragoedie In Bad Gottleuba Berggiesshuebel Brandopfer Gefunden

May 14, 2025

Tragoedie In Bad Gottleuba Berggiesshuebel Brandopfer Gefunden

May 14, 2025 -

Federerov Povratak Inspiratsi A Za Novu Generatsi U Tenisera

May 14, 2025

Federerov Povratak Inspiratsi A Za Novu Generatsi U Tenisera

May 14, 2025