The Fragile State Of Private Credit: A Weekly Review Of Market Cracks

Table of Contents

Rising Interest Rates and their Impact on Private Credit

The aggressive interest rate hikes implemented by central banks globally are significantly impacting the private credit market. Higher borrowing costs make it more expensive for companies to service their debt, increasing the risk of defaults and impacting the broader credit market. This ripple effect is felt across various segments, from leveraged loans to direct lending.

-

Increased refinancing risk for existing private credit borrowers: Companies with existing loans face challenges refinancing at higher interest rates, potentially leading to financial distress. This is particularly true for borrowers with high leverage ratios and limited cash flow.

-

Higher yields demanded by investors seeking compensation for increased risk: Investors are demanding higher returns to compensate for the increased risk associated with private credit investments in this environment. This translates to higher borrowing costs for companies.

-

Potential for a surge in distressed debt opportunities: As more companies struggle to meet their debt obligations, the volume of distressed debt is expected to rise, creating opportunities for specialized investors.

-

Impact on different segments of the private credit market: The impact of rising rates varies across different segments. Leveraged loans, for instance, are particularly vulnerable due to their high debt levels. Direct lending, while potentially offering more flexibility, also faces pressure from higher borrowing costs.

Increased Scrutiny of Due Diligence and Underwriting Standards

Concerns are growing over the quality of due diligence and underwriting practices in the private credit market. Rising instances of defaults highlight potential weaknesses in existing underwriting models, leading to increased regulatory oversight and a greater focus on risk management practices.

-

Rising instances of defaults highlight potential weaknesses in existing underwriting models: The current market is exposing flaws in previous risk assessments, pushing for a reassessment of methodologies.

-

Increased focus on environmental, social, and governance (ESG) factors: Investors and regulators are paying closer attention to ESG factors, demanding more comprehensive due diligence assessments of borrowers' sustainability practices.

-

Demand for more rigorous and transparent due diligence processes: Investors are increasingly demanding more rigorous and transparent processes to better understand the risks associated with private credit investments.

-

The role of technology in improving risk assessment and credit scoring: Technology is playing an increasingly important role in enhancing risk assessment and credit scoring, offering the potential for more accurate and efficient due diligence.

Liquidity Concerns and Market Volatility in Private Credit

Concerns about liquidity are escalating, especially in the secondary market for private credit. Market volatility and reduced investor confidence are making it more challenging to sell private credit investments quickly and at favorable prices.

-

Difficulty in selling private credit investments quickly and at favorable prices: The illiquidity of private credit is becoming more apparent, making it difficult for investors to exit their positions easily.

-

Potential for increased capital calls from private credit funds: Funds may need to call on investors for additional capital to meet their obligations, potentially straining investor liquidity.

-

Impact on fund performance and investor returns: Liquidity issues and market volatility are negatively impacting fund performance and investor returns.

-

The role of market timing and diversification strategies in mitigating liquidity risk: Sophisticated investors are using market timing and diversification strategies to mitigate liquidity risks and enhance returns.

Identifying Opportunities in Distressed Private Credit

While risks abound, the current market conditions also present opportunities for sophisticated investors. The increase in distressed debt presents unique value investing opportunities for those with the expertise to navigate this complex landscape.

-

Identifying undervalued companies with strong potential for turnaround: Distressed debt strategies often involve identifying undervalued companies with strong potential for turnaround.

-

Evaluating the viability of restructuring strategies: Successful investments require a thorough evaluation of the viability of various restructuring strategies.

-

The importance of detailed due diligence and expert negotiation skills: Detailed due diligence and expert negotiation skills are crucial for achieving successful outcomes in distressed debt investments.

-

Potential for significant returns through active management and value creation: Active management and value creation can lead to significant returns for investors willing to take on the risks associated with distressed debt.

Conclusion

The private credit market is undoubtedly facing a period of significant challenge. Rising interest rates, stricter scrutiny, and liquidity concerns are creating cracks in the system. However, for those with the expertise and risk appetite, opportunities exist, particularly within distressed debt. By closely monitoring the weekly shifts in the market and engaging in thorough due diligence, investors can navigate the fragile state of private credit and potentially capitalize on emerging opportunities. Stay informed with our ongoing weekly review of the private credit market and develop a robust investment strategy to manage the risks and benefits of this dynamic sector. Regularly check back for our analysis on the fragile state of private credit and how to navigate the complexities of alternative lending and private debt investments.

Featured Posts

-

Trumps Conduct At Pope Benedicts Funeral A Controversial Display

Apr 27, 2025

Trumps Conduct At Pope Benedicts Funeral A Controversial Display

Apr 27, 2025 -

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Brazil To Host Chargers And Justin Herbert In 2025 Season Opener

Apr 27, 2025

Brazil To Host Chargers And Justin Herbert In 2025 Season Opener

Apr 27, 2025 -

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025 -

The Zuckerberg Trump Dynamic Impact On Technology And Society

Apr 27, 2025

The Zuckerberg Trump Dynamic Impact On Technology And Society

Apr 27, 2025

Latest Posts

-

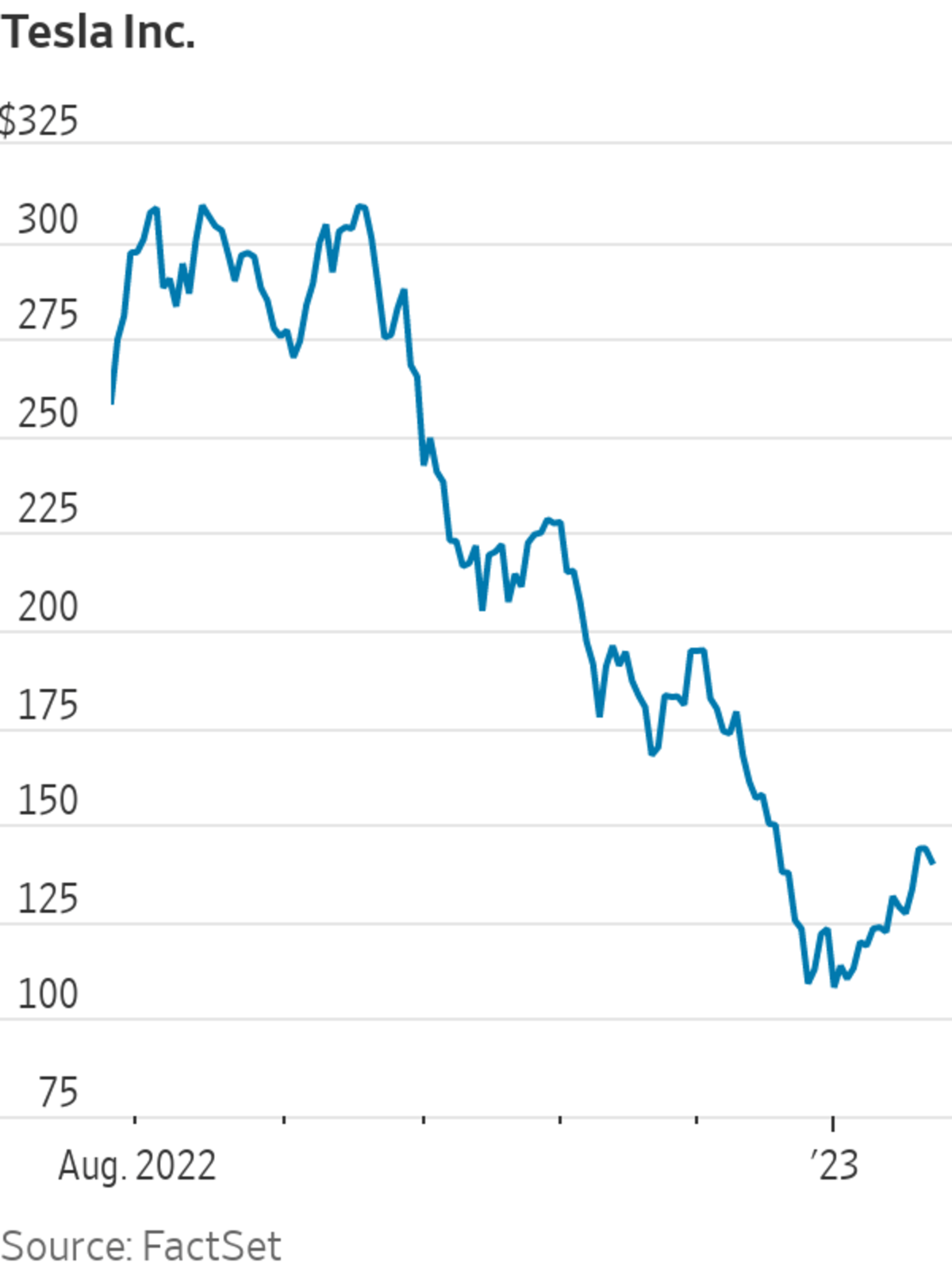

Teslas Rise Leads Tech Driven Us Stock Market Gains

Apr 28, 2025

Teslas Rise Leads Tech Driven Us Stock Market Gains

Apr 28, 2025 -

Tech Powerhouses Propel Us Stock Market Higher Teslas Impact

Apr 28, 2025

Tech Powerhouses Propel Us Stock Market Higher Teslas Impact

Apr 28, 2025 -

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025 -

Broadcoms V Mware Deal An Extreme Price Hike Of 1 050 According To At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Hike Of 1 050 According To At And T

Apr 28, 2025