The Future Is Driverless: ETFs To Bet On Uber's Autonomous Technology

Table of Contents

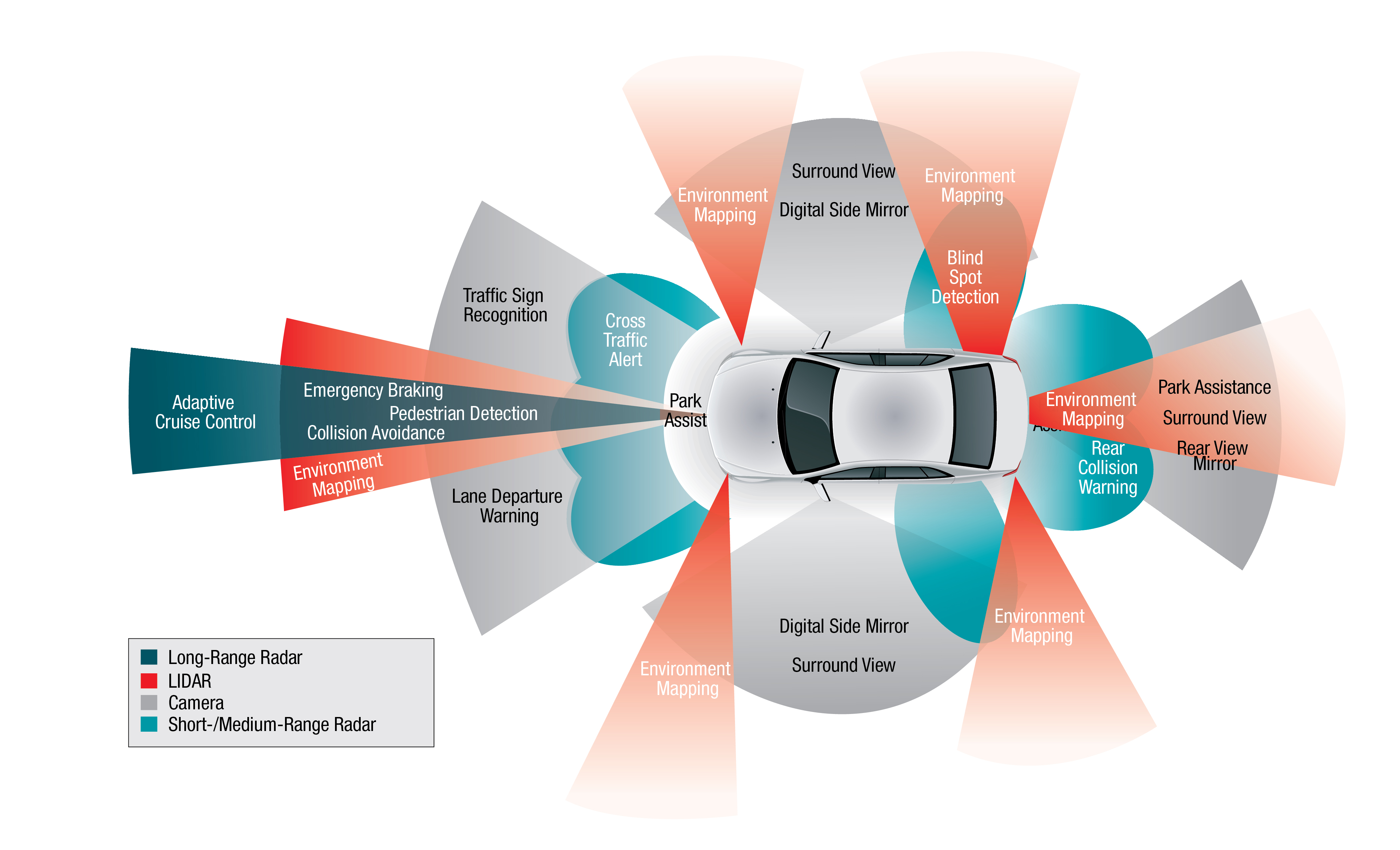

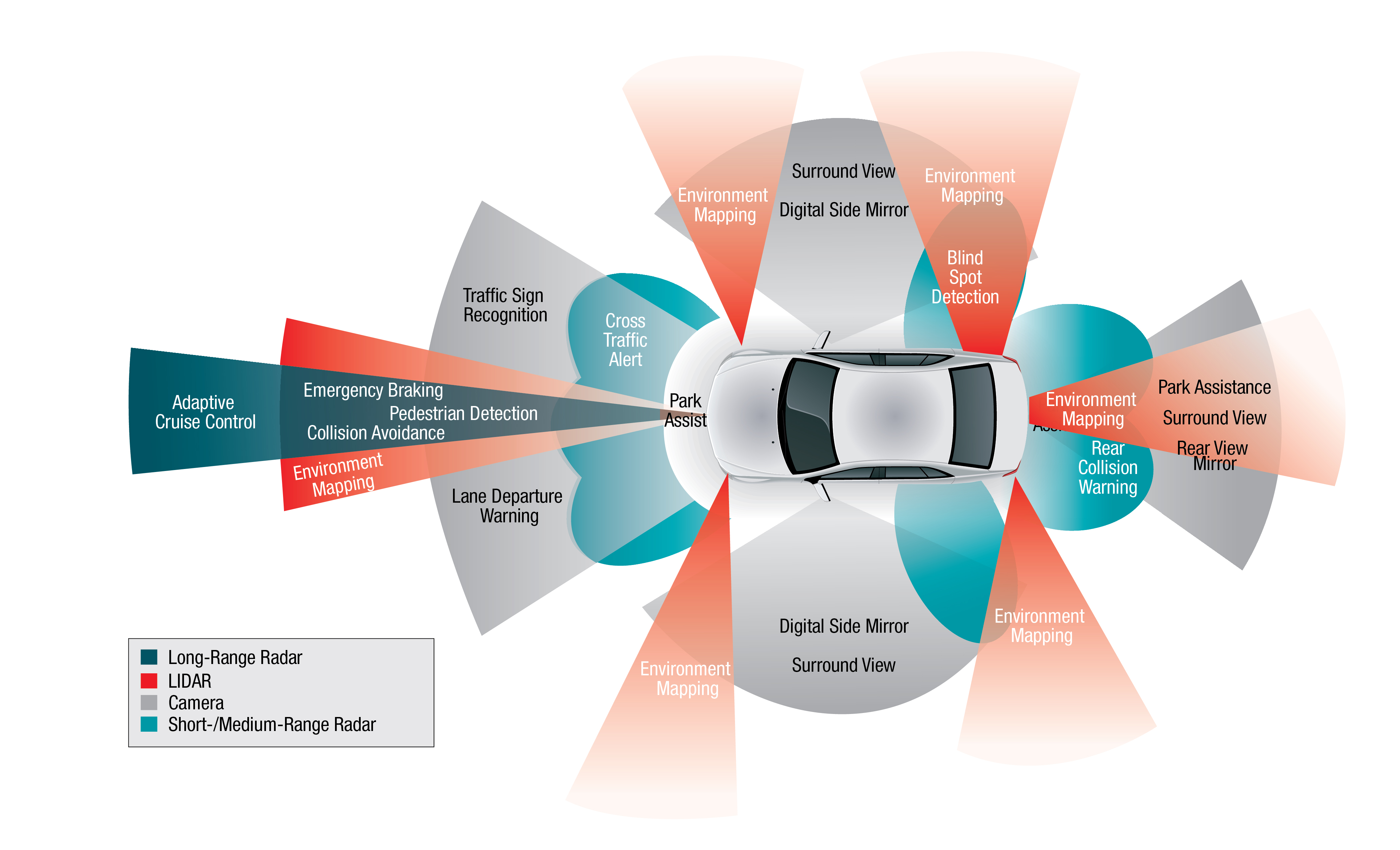

Understanding the Potential of Uber's Autonomous Vehicle Technology

Uber's Autonomous Driving Initiatives

Uber's Advanced Technologies Group (ATG) is heavily invested in developing self-driving technology. Their ambitious goal is to integrate fully autonomous vehicles into their ride-sharing platform, potentially revolutionizing transportation and significantly impacting their profitability. Uber's partnerships with various automakers and technology companies are crucial to achieving this goal. They are constantly innovating and pushing the boundaries of autonomous driving capabilities.

- Key Milestones: Uber ATG has achieved significant milestones, including millions of autonomous miles driven in test environments. However, they have also faced challenges, including accidents and regulatory hurdles.

- Future Plans: Uber continues to invest heavily in research and development, aiming to deploy fully autonomous ride-hailing services in select cities within the coming years.

- Market Projections: The autonomous vehicle market is projected to experience explosive growth in the coming decade. Reports predict a multi-trillion dollar market size by 2030, representing a massive opportunity for investors.

The Risks and Rewards of Investing in Autonomous Vehicle Technology

Investing in autonomous vehicle technology presents both substantial risks and potential rewards. The technology is still relatively new, and unforeseen challenges could emerge.

-

Potential Downsides:

- Regulatory Uncertainty: Government regulations surrounding autonomous vehicles are still evolving, and changes could significantly impact the industry.

- Technological Setbacks: Unexpected technical difficulties or delays in development could negatively affect company valuations.

- Intense Competition: The autonomous vehicle market is highly competitive, with numerous established and emerging players vying for market share.

-

Potential Upsides:

- High Growth Potential: The market's projected growth offers the potential for significant long-term returns.

- Disruptive Innovation: Autonomous vehicles have the potential to disrupt existing transportation systems, creating new business models and opportunities.

- Societal Impact: The successful adoption of autonomous vehicles could lead to increased safety, efficiency, and accessibility in transportation.

Selecting the Right ETFs for Exposure to Uber's Autonomous Vehicle Technology

Identifying Relevant ETFs

Several ETFs offer exposure to companies involved in the development and deployment of autonomous vehicle technology. While direct exposure to Uber's ATG might be limited through ETFs, investing in broader sector ETFs can still provide significant indirect exposure. It's vital to regularly check ETF holdings as compositions can change.

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This ETF invests in companies involved in robotics, artificial intelligence, and automation, including some companies that may be indirectly involved in autonomous vehicle technology.

- Invesco QQQ Trust (QQQ): This ETF tracks the Nasdaq-100 Index, which includes companies like Uber (if it continues to be a significant component). However, it's important to note that this ETF's exposure to autonomous driving is not its primary focus.

- Other ETFs: Research other ETFs that focus on technology, transportation, or automotive sectors. Look for those with significant holdings in companies developing autonomous driving technology, sensor technology, or related software.

Analyzing ETF Performance and Risk Profiles

Before investing in any ETF, it's crucial to analyze its performance, risk profile, and expense ratio. Consider your risk tolerance and long-term investment goals.

- Expense Ratio: Compare the expense ratios of different ETFs, as lower ratios generally result in higher returns.

- Historical Returns: Analyze past performance, but remember that past performance is not indicative of future results.

- Volatility: Assess the ETF's volatility to determine if it aligns with your risk tolerance.

- Professional Advice: Consider consulting a financial advisor before making investment decisions.

Diversification and a Long-Term Investment Strategy for Autonomous Vehicle ETFs

The Importance of Diversification

Diversification is key to mitigating risk in any investment portfolio. Don't put all your eggs in one basket. Spreading your investment across multiple ETFs focused on different aspects of the autonomous vehicle ecosystem is crucial.

- Sector Diversification: Invest in ETFs focused on various areas like sensor technology, software development, mapping, and infrastructure to build a more resilient portfolio.

- Geographic Diversification: Consider ETFs that include companies from various geographical locations to further reduce risk.

Long-Term Perspective

Investing in emerging technologies like autonomous vehicles requires a long-term perspective. Short-term market fluctuations are inevitable, and patience is essential.

- Market Volatility: Expect ups and downs in the market. Avoid panic selling during market corrections.

- Long-Term Growth: Focus on the long-term growth potential of the autonomous vehicle market.

Conclusion

The future of transportation is undeniably heading towards automation, and Uber is a significant player in this transformative shift. While directly investing in Uber carries risks, diversifying your investment through strategically selected driverless car ETFs allows you to participate in the growth potential of Uber's autonomous vehicle technology while mitigating some risk. By carefully researching and selecting appropriate autonomous vehicle technology ETFs, coupled with a long-term investment strategy, you can position yourself to benefit from this revolutionary technological advancement. Start exploring the best Uber autonomous vehicles ETFs today and begin building your portfolio for the future of transportation!

Featured Posts

-

Best Bitcoin Casinos Usa Jackbit Review And Top Alternatives

May 17, 2025

Best Bitcoin Casinos Usa Jackbit Review And Top Alternatives

May 17, 2025 -

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025 -

Vf B Stuttgart Spera La Prezenta Lui Stiller In Finala Cupei Germaniei

May 17, 2025

Vf B Stuttgart Spera La Prezenta Lui Stiller In Finala Cupei Germaniei

May 17, 2025 -

Josh Alexander Aew Don Callis And More 97 1 Double Q Interview

May 17, 2025

Josh Alexander Aew Don Callis And More 97 1 Double Q Interview

May 17, 2025 -

Office365 Data Breach Millions Lost Criminal Charged

May 17, 2025

Office365 Data Breach Millions Lost Criminal Charged

May 17, 2025