The Future Of BBVA Investment Banking: A Long-Term Strategy

Table of Contents

Digital Transformation and Technological Advancements in BBVA Investment Banking

The future of investment banking is inextricably linked to technological innovation. BBVA Investment Banking is actively embracing this transformation, leveraging cutting-edge technologies to enhance its operations and client offerings.

AI and Machine Learning in Investment Strategy

BBVA is significantly investing in artificial intelligence (AI) and machine learning (ML) to revolutionize its investment strategies. These technologies are being used to:

- Algorithmic trading: AI-powered algorithms analyze vast datasets to identify profitable trading opportunities, executing trades with speed and precision. This improves execution speed and potentially reduces transaction costs.

- Fraud detection: ML models analyze transaction patterns to identify and prevent fraudulent activities, safeguarding both BBVA and its clients. This strengthens risk management and protects against financial losses.

- Predictive analytics for market forecasting: Advanced algorithms analyze market data to predict future trends, enabling more informed investment decisions and risk management strategies. This allows for proactive portfolio adjustments based on data-driven insights.

The impact of AI and ML on BBVA's profitability and efficiency is expected to be substantial. By automating processes and improving decision-making, the bank aims to gain a competitive edge and deliver superior returns for its clients. For example, BBVA's implementation of AI in algorithmic trading has already demonstrated significant improvements in trade execution speed and accuracy.

Blockchain Technology and its Role in Securities Trading

Blockchain technology is poised to disrupt the securities trading industry, offering increased transparency, reduced settlement times, and improved security. BBVA is actively exploring the potential of blockchain to streamline its operations and enhance its services.

- Increased transparency: Blockchain provides a secure and auditable record of all transactions, improving transparency and trust among market participants.

- Reduced settlement times: Smart contracts on blockchain can automate the settlement process, significantly reducing delays and costs.

- Improved security: The decentralized nature of blockchain enhances security and reduces the risk of fraud and manipulation.

BBVA's participation in various blockchain initiatives demonstrates its commitment to this transformative technology. Future applications might include tokenized securities and improved cross-border payments, further enhancing efficiency and client services within BBVA Investment Banking.

Enhanced Client Onboarding and Digital Platforms

BBVA is investing heavily in digital platforms to improve client experience and efficiency. This includes:

- Online portals: Secure online portals provide clients with access to their accounts, statements, and other relevant information 24/7.

- Mobile applications: User-friendly mobile apps offer clients convenient access to their portfolios and trading capabilities on the go.

- Automated KYC/AML processes: Automated Know Your Customer (KYC) and Anti-Money Laundering (AML) processes streamline client onboarding, reducing processing times and improving compliance.

These digital initiatives not only enhance client satisfaction but also significantly reduce operational costs for BBVA Investment Banking by automating previously manual processes. The improved digital experience fosters stronger client relationships and attracts new business.

Sustainable Finance and ESG Investing at BBVA Investment Banking

BBVA Investment Banking recognizes the growing importance of Environmental, Social, and Governance (ESG) factors in investment decisions. The bank is actively integrating ESG considerations into its investment strategies and advising its clients on sustainable finance solutions.

Focus on ESG Criteria in Investment Decisions

BBVA is committed to incorporating ESG criteria into its investment decisions. This includes:

- Green bonds: Investing in green bonds that finance environmentally friendly projects.

- Sustainable investments: Focusing on companies with strong ESG performance.

- Impact investing: Investing in businesses that generate positive social and environmental impact.

BBVA's commitment to ESG is reflected in its sustainability reports and initiatives. These demonstrate the bank's dedication to responsible investing and its efforts to align its investments with global sustainability goals. This approach attracts investors who prioritize ethical and sustainable investing practices.

Advising Clients on Sustainable Finance Strategies

BBVA Investment Banking is actively advising its clients on incorporating sustainable practices into their businesses. This involves:

- Carbon footprint reduction: Helping clients measure and reduce their carbon emissions.

- Renewable energy investments: Advising on investments in renewable energy projects.

- Sustainable supply chain management: Supporting clients in building sustainable supply chains.

BBVA's expertise in sustainable finance enables it to offer valuable guidance to its clients, helping them navigate the transition to a more sustainable economy. Examples of BBVA's client work in this area showcase its leadership in sustainable finance advisory services.

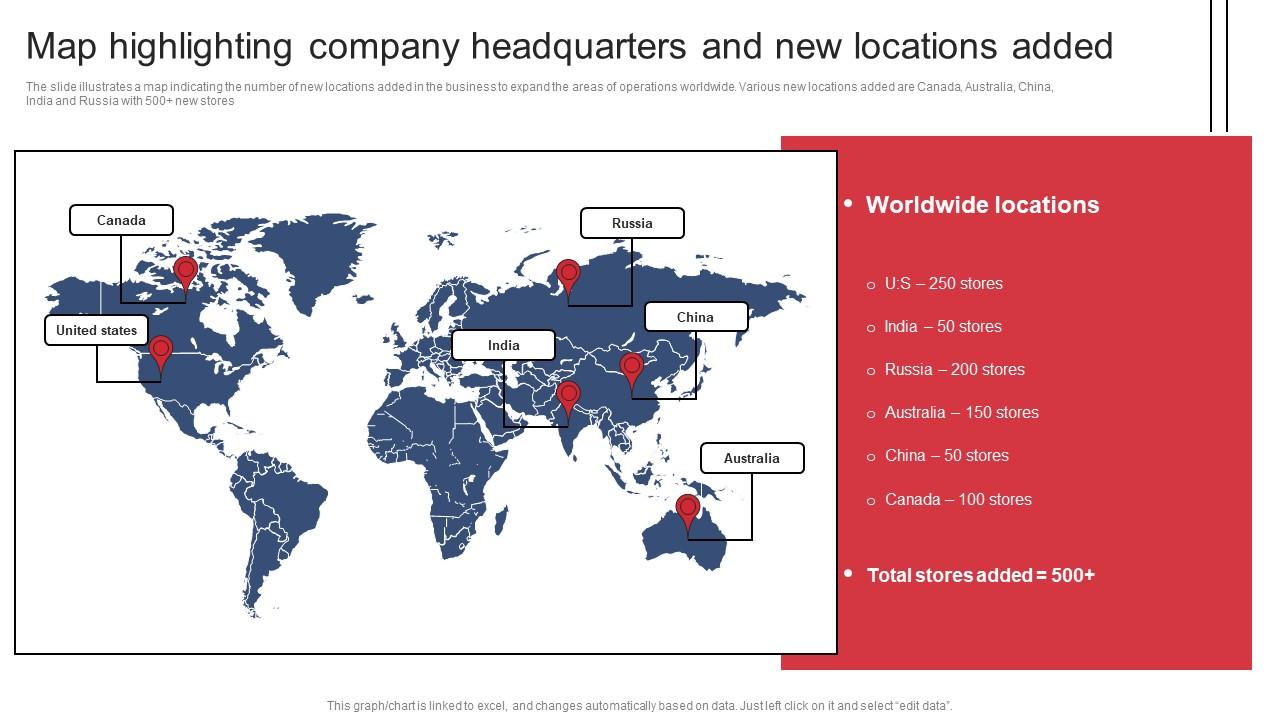

Expansion into Emerging Markets and Global Growth Strategies for BBVA Investment Banking

BBVA Investment Banking is pursuing a strategy of global expansion, targeting key emerging markets for growth opportunities.

Targeting Growth Opportunities in Key Emerging Markets

BBVA is focusing its expansion efforts on several key regions:

- Latin America: Leveraging its existing presence and expertise in the region. Specific countries like Mexico, Colombia, and Peru present strong growth potential.

- Asia: Exploring opportunities in rapidly growing economies such as China, India, and Southeast Asian nations.

- Africa: Identifying opportunities in countries with high growth potential and developing financial markets.

BBVA's analysis of market potential and competitive landscape in these regions informs its strategic investment decisions, balancing risk and reward for long-term growth.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions are key components of BBVA Investment Banking's growth strategy. These collaborations can provide access to new markets, technologies, and expertise.

- Potential partnerships could involve collaborations with Fintech companies or local financial institutions in target markets.

- Acquisitions could involve acquiring smaller investment banks or specialized firms to expand BBVA’s service offerings or geographic reach.

The potential benefits of these collaborations include enhanced market access, technological advancements, and diversification of revenue streams. However, careful due diligence is essential to mitigate potential risks associated with such ventures.

Conclusion

The future of BBVA Investment Banking hinges on its ability to adapt to rapid technological advancements, embrace sustainable finance principles, and strategically expand its global reach. By leveraging digital transformation, focusing on ESG investing, and pursuing calculated growth in key markets, BBVA Investment Banking is positioning itself for sustained success. This long-term strategy showcases BBVA's commitment to innovation and responsible growth within the competitive investment banking landscape. To learn more about the specific initiatives and detailed strategies employed by BBVA Investment Banking, visit their official website and explore their latest reports on sustainability and investment strategies. Stay informed about the future of BBVA Investment Banking and its ongoing contributions to the global financial market.

Featured Posts

-

Icy Roads Lead To Multiple Car Accidents In Oklahoma City

Apr 25, 2025

Icy Roads Lead To Multiple Car Accidents In Oklahoma City

Apr 25, 2025 -

Oklahoma City Parks Your Spring Break Destination

Apr 25, 2025

Oklahoma City Parks Your Spring Break Destination

Apr 25, 2025 -

Stock Market Valuation Concerns Bof A Offers Perspective For Investors

Apr 25, 2025

Stock Market Valuation Concerns Bof A Offers Perspective For Investors

Apr 25, 2025 -

Zmina Ritoriki Trampa Schodo Viyni V Ukrayini

Apr 25, 2025

Zmina Ritoriki Trampa Schodo Viyni V Ukrayini

Apr 25, 2025 -

Mapping The Countrys Hottest New Business Locations

Apr 25, 2025

Mapping The Countrys Hottest New Business Locations

Apr 25, 2025

Latest Posts

-

Lars Klingbeil Die Neue Fuehrung Der Spd Bundestagsfraktion

Apr 30, 2025

Lars Klingbeil Die Neue Fuehrung Der Spd Bundestagsfraktion

Apr 30, 2025 -

Coalition Agreement On The Line Germanys Spd Faces Key Party Vote

Apr 30, 2025

Coalition Agreement On The Line Germanys Spd Faces Key Party Vote

Apr 30, 2025 -

Coalition Deal Imminent German Government Formation Nears Completion

Apr 30, 2025

Coalition Deal Imminent German Government Formation Nears Completion

Apr 30, 2025 -

German Coalition Deal Midday Announcement Expected Sources Say

Apr 30, 2025

German Coalition Deal Midday Announcement Expected Sources Say

Apr 30, 2025 -

Spd Coalition Talks Germany Awaits Party Vote Outcome

Apr 30, 2025

Spd Coalition Talks Germany Awaits Party Vote Outcome

Apr 30, 2025