The Future Of Bond Forwards: Indian Insurers Seek Regulatory Change

Table of Contents

Current Regulatory Landscape and its Limitations for Bond Forwards in India

The current regulatory framework governing bond forwards and derivatives in India, primarily overseen by the Securities and Exchange Board of India (SEBI) and the Insurance Regulatory and Development Authority of India (IRDAI), presents several limitations for insurers. While the framework allows for some participation in derivatives markets, specific regulations hinder the widespread adoption of bond forwards as a key risk management tool.

- Restrictive limits on derivative exposures: Current regulations often impose strict limits on the amount of exposure insurers can take on through bond forward contracts, limiting their ability to effectively hedge interest rate risk.

- Capital adequacy concerns: The capital adequacy requirements for bond forward positions might be disproportionately high compared to other investment assets, reducing the attractiveness of using bond forwards for risk mitigation.

- Complex tax implications: The tax implications surrounding bond forward transactions can be unclear and cumbersome, adding another layer of complexity for insurers already navigating a complex regulatory environment.

- Lack of standardized reporting: The absence of a standardized reporting framework for bond forward transactions increases compliance costs and creates operational inefficiencies for insurers.

These limitations significantly impact the risk management strategies of Indian insurance companies. Their ability to effectively hedge interest rate risk and manage their investment portfolios is constrained, potentially leading to increased volatility in their financial performance and reduced profitability. The inability to fully utilize bond forwards also limits their ability to compete effectively with international insurers who have greater access to these instruments.

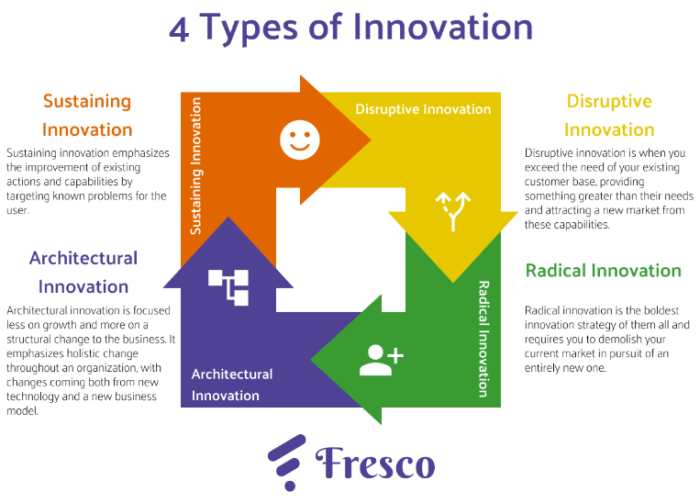

The Need for Regulatory Change: Benefits for Indian Insurers

Regulatory changes facilitating wider adoption of bond forwards by insurance companies could bring several significant benefits:

- Improved Risk Management: Bond forwards allow insurers to effectively hedge against interest rate risk, protecting their investment portfolios from adverse movements in interest rates. This leads to enhanced stability and predictability of financial performance.

- Enhanced Portfolio Diversification: Incorporating bond forwards into investment strategies enables greater diversification, reducing overall portfolio risk and potentially increasing returns.

- Increased Operational Efficiency: Improved management of liabilities through effective interest rate hedging using bond forwards leads to greater operational efficiency and reduced costs.

- Global Competitiveness: Increased access to bond forward markets positions Indian insurers on a more equal footing with their international counterparts, enhancing their competitiveness in the global insurance landscape.

- Development of a Robust Bond Market: Wider use of bond forwards contributes to the development of a more liquid and efficient Indian bond market, beneficial to the entire financial ecosystem.

Many developed economies have successfully regulated bond forwards, resulting in robust and stable markets. Learning from international best practices and adapting them to the Indian context is crucial for success. For instance, the UK's robust regulatory framework and the US's established derivatives markets provide valuable case studies.

Specific Regulatory Changes Proposed or Desired

Indian insurers are advocating for specific regulatory changes, including:

- Increased Permissible Limits: Raising the permissible limits for bond forward positions will allow insurers to take on more appropriate hedging positions.

- Clarified Capital Adequacy Requirements: Clearer and potentially more proportionate capital adequacy requirements for bond forward positions would make these instruments more attractive to insurers.

- Streamlined Reporting and Compliance: Simplifying reporting and compliance procedures would reduce the administrative burden on insurers, freeing resources for core business activities.

- Tax Incentives: Tax benefits or incentives to encourage the use of bond forwards could further stimulate their adoption.

Potential Challenges and Mitigation Strategies

Increased use of bond forwards in India may also present challenges, including potential systemic risk and market manipulation. However, these risks can be mitigated through appropriate strategies:

- Robust Risk Management Frameworks: Implementing strong risk management frameworks and oversight mechanisms is crucial to control systemic risks associated with bond forward transactions. This includes comprehensive stress testing and scenario analysis.

- Investor Education and Transparency: Promoting investor education and ensuring market transparency will help minimize the risk of manipulation and promote fair market practices.

- Regulatory Monitoring: Active monitoring and supervision by regulatory bodies are essential to detect and address potential issues quickly and effectively. This requires ongoing collaboration between regulatory bodies and market participants.

Conclusion

The future of the Indian insurance sector hinges on adapting to market demands and embracing innovative risk management solutions. The potential benefits of bond forwards in India are significant, offering improved risk management, enhanced portfolio diversification, and increased operational efficiency. However, unlocking this potential requires a progressive regulatory framework that addresses current limitations and facilitates wider adoption. A clear path forward involves engaging in the ongoing dialogue regarding regulatory changes surrounding bond forwards, working collaboratively with regulatory bodies, and fostering a robust and transparent market. Let's work together to shape a more robust and dynamic Indian insurance industry by embracing the opportunities presented by bond forwards.

Featured Posts

-

Identifying Emerging Business Hubs A Comprehensive Map Of Country Name S Growth Areas

May 10, 2025

Identifying Emerging Business Hubs A Comprehensive Map Of Country Name S Growth Areas

May 10, 2025 -

Bert Kreischers Netflix Stand Up The Impact On His Marriage

May 10, 2025

Bert Kreischers Netflix Stand Up The Impact On His Marriage

May 10, 2025 -

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025 -

Secret Service Ends Probe Into Cocaine Found At White House

May 10, 2025

Secret Service Ends Probe Into Cocaine Found At White House

May 10, 2025 -

Trumps Billionaire Buddies And The Economic Fallout Of Tariffs

May 10, 2025

Trumps Billionaire Buddies And The Economic Fallout Of Tariffs

May 10, 2025