The Future Of US-China Trade: 30% Tariffs Projected Until 2025

Table of Contents

Economic Impacts of Continued 30% Tariffs on US-China Trade

The projected continuation of 30% tariffs on US-China trade until 2025 will have profound and multifaceted economic consequences. These impacts will be felt across various sectors, from consumers facing increased prices to businesses grappling with higher production costs.

Impact on US Consumers

- Increased prices for imported goods: Consumers will inevitably bear the brunt of these tariffs through higher prices on a wide range of goods, from electronics and clothing to furniture and toys, all heavily reliant on Chinese manufacturing.

- Reduced consumer purchasing power: Increased prices will reduce consumer purchasing power, potentially leading to decreased consumer spending and slowing economic growth.

- Potential for inflation: The widespread price increases caused by the tariffs could contribute to inflationary pressures across the US economy.

- Examples of Affected Goods:

- Smartphones and other electronics

- Clothing and footwear

- Household appliances

- Furniture and home décor

Impact on US Businesses

- Increased production costs: US businesses reliant on Chinese imports for components, raw materials, or finished goods will face significantly increased production costs. This can squeeze profit margins and reduce competitiveness.

- Reduced competitiveness in global markets: Higher production costs make US businesses less competitive in the global marketplace, potentially leading to lost market share to competitors in other countries.

- Potential for job losses: Businesses facing increased costs may be forced to reduce their workforce or even shut down operations, leading to job losses in certain sectors.

- Vulnerable Industries:

- Manufacturing

- Retail

- Agriculture (certain products)

Impact on the Chinese Economy

- Decreased exports to the US market: China will experience a significant decrease in exports to the US market, impacting its economic growth trajectory.

- Potential for economic slowdown: Reduced export revenue could lead to a slowdown in the Chinese economy, potentially impacting global financial markets.

- Impact on specific Chinese industries: Industries heavily reliant on exports to the US, such as manufacturing and agriculture, will be particularly hard hit.

- Sectoral Impacts:

- Manufacturing: A major decline in exports to the US.

- Agriculture: Reduced demand for certain agricultural products.

- Technology: Potential for disruption in global supply chains.

Geopolitical Implications of Prolonged Trade Tensions

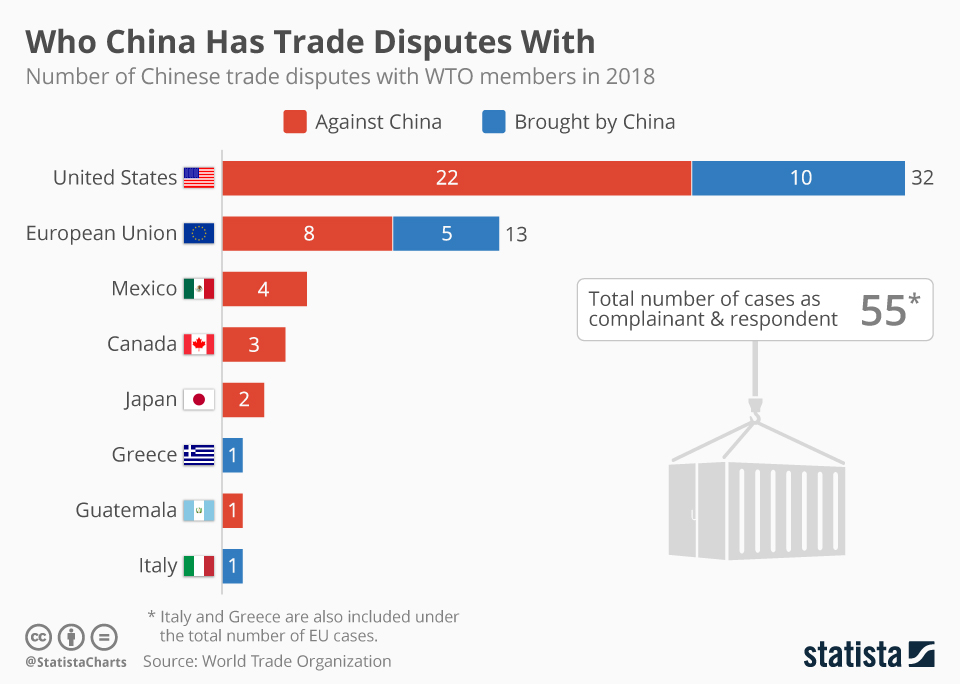

The prolonged trade tensions between the US and China extend far beyond economic considerations, carrying significant geopolitical implications.

Strained US-China Relations

The trade war has exacerbated existing tensions between the US and China, impacting diplomatic relations and cooperation on other global issues. This further complicates already complex global challenges.

Impact on Global Trade

The US-China trade dispute has created uncertainty in global trade patterns and supply chains, impacting businesses and consumers worldwide. Many countries are caught in the crossfire, facing difficulties in maintaining their own trade relationships.

Potential for Escalation

The ongoing trade dispute carries a risk of further escalation, potentially leading to additional trade restrictions or even broader conflicts. This uncertainty makes long-term economic planning extremely difficult.

Potential Mitigation Strategies and Future Outlook

While the outlook for US-China trade under the shadow of 30% tariffs until 2025 appears challenging, several mitigation strategies could potentially lessen the impact.

Negotiation and Trade Deals

Renegotiated trade agreements or new trade deals could potentially reduce or eliminate the tariffs, alleviating some of the economic and geopolitical pressures. However, this requires significant diplomatic effort and compromise from both sides.

Diversification of Supply Chains

US businesses can mitigate the impact of tariffs by diversifying their supply chains, sourcing goods and materials from other countries besides China. This, however, requires substantial investment and time.

Technological Advancements

Technological advancements, such as automation and 3D printing, could help reduce reliance on imports from China, promoting domestic production and increasing resilience to trade disruptions.

Conclusion

The projected continuation of 30% tariffs on US-China trade until 2025 presents significant economic and geopolitical challenges. The impacts will be felt across various sectors, from consumers facing higher prices to businesses grappling with increased production costs. Strained US-China relations, disrupted global trade, and the potential for further escalation are all serious concerns. While mitigation strategies exist, their effectiveness remains uncertain. It is crucial to monitor US-China trade updates closely to understand the evolving situation and its implications. Stay informed on the future of US-China trade and the implications of the projected 30% tariffs on US-China trade by regularly consulting reputable economic news sources and government reports. Understanding these developments is vital for both businesses and consumers navigating this complex and evolving landscape.

Featured Posts

-

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025 -

Fsu Shooting Victims Investigating The Background Of A Deceased Employee

May 19, 2025

Fsu Shooting Victims Investigating The Background Of A Deceased Employee

May 19, 2025 -

First Class Stamp Price Hike Cost To Rise To 1 70

May 19, 2025

First Class Stamp Price Hike Cost To Rise To 1 70

May 19, 2025 -

Bilateral Trade Disputes Indias Measures Affecting Bangladesh Imports

May 19, 2025

Bilateral Trade Disputes Indias Measures Affecting Bangladesh Imports

May 19, 2025 -

Federal Investigation Millions Lost In Office365 Executive Account Breaches

May 19, 2025

Federal Investigation Millions Lost In Office365 Executive Account Breaches

May 19, 2025