The GOP Tax Plan's Impact On The Federal Deficit: An In-Depth Examination

Table of Contents

Immediate Effects of the GOP Tax Plan on the Federal Deficit

Revenue Loss Projections

The initial Congressional Budget Office (CBO) projections, released shortly after the TCJA's passage, estimated significant revenue losses. These projections, however, have undergone revisions over time, reflecting the complexities of economic forecasting.

- 2018: Projected revenue loss of $130 billion (CBO initial estimate). This figure later saw revisions based on actual economic performance.

- 2019: Projected revenue loss of $180 billion (CBO initial estimate). Subsequent analyses have shown a narrower gap than initially predicted in some sectors.

- Corporate Tax Rate Reduction: The reduction of the corporate tax rate from 35% to 21% significantly contributed to the projected revenue loss. This was a central component of the GOP tax plan impacting the federal deficit.

- Individual Tax Bracket Changes: Changes to individual tax brackets, standard deductions, and other provisions also resulted in substantial decreases in federal revenue. The overall impact of these changes on individual tax burdens varied widely depending on income level.

- Discrepancies: Initial CBO projections often overestimate or underestimate the actual revenue figures. This discrepancy highlights the challenges in accurately predicting the effects of complex tax legislation on the federal budget. It is crucial to consider this when analyzing the GOP tax plan and federal deficit relationship.

Increased Spending Due to Economic Growth (Claimed Effects)

Proponents of the TCJA argued that the tax cuts would stimulate economic growth, leading to increased tax revenue that would offset the initial revenue losses. This argument relies heavily on the Laffer Curve theory.

- Laffer Curve: This economic theory suggests that there is an optimal tax rate that maximizes government revenue. Reducing taxes from a rate above this optimum could, theoretically, increase revenue by stimulating economic activity.

- Empirical Evidence: Empirical evidence supporting this claim is mixed. While some studies have shown a positive impact on economic growth, others find little to no significant effect, highlighting the difficulties in isolating the effects of the tax cuts from other economic factors.

- Impact on Tax Revenue: The relationship between economic growth and tax revenue is not linear. Increased economic activity may lead to higher tax revenue but the magnitude of this effect is difficult to predict accurately. Analysis of the GOP tax plan's impact must consider this uncertainty.

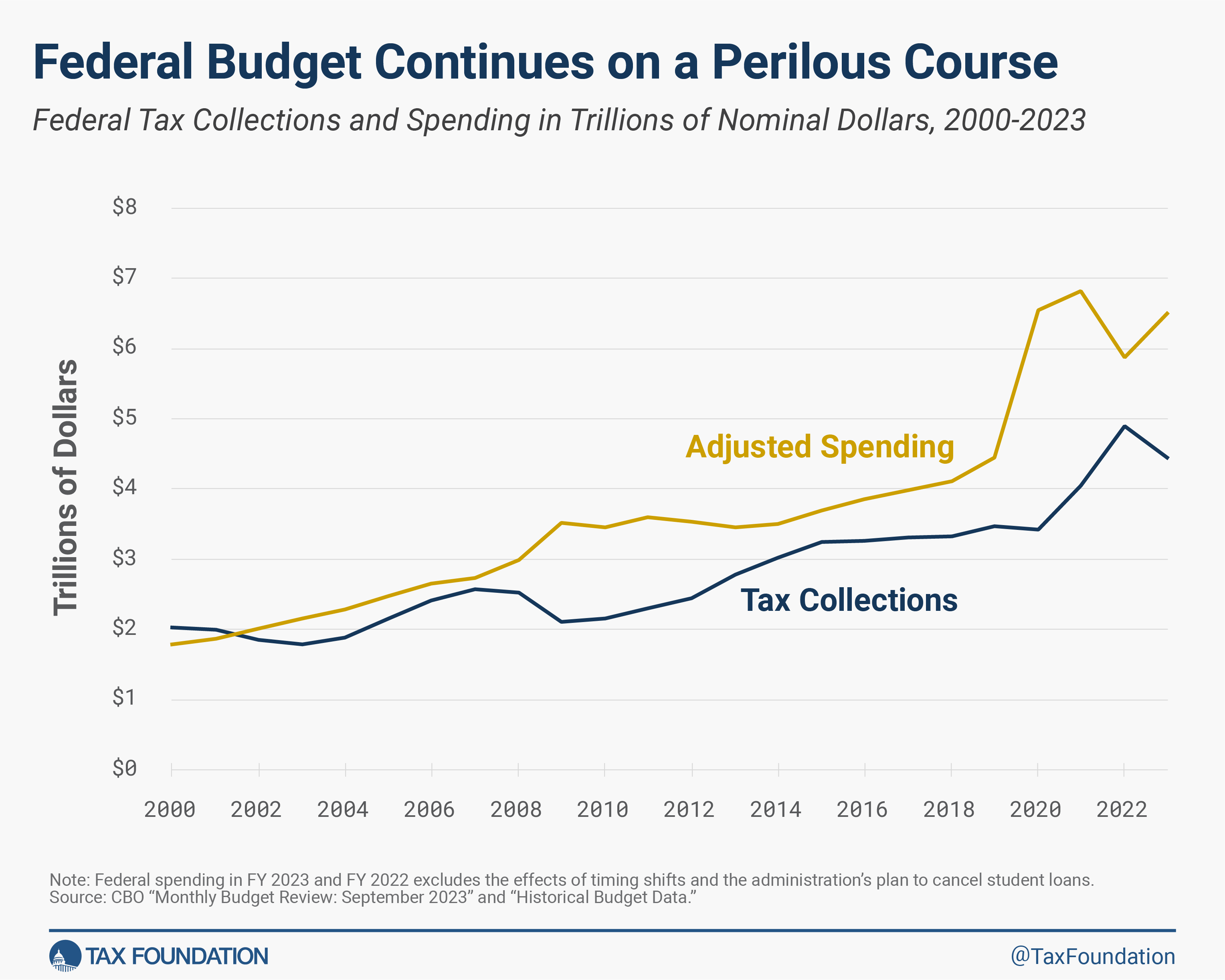

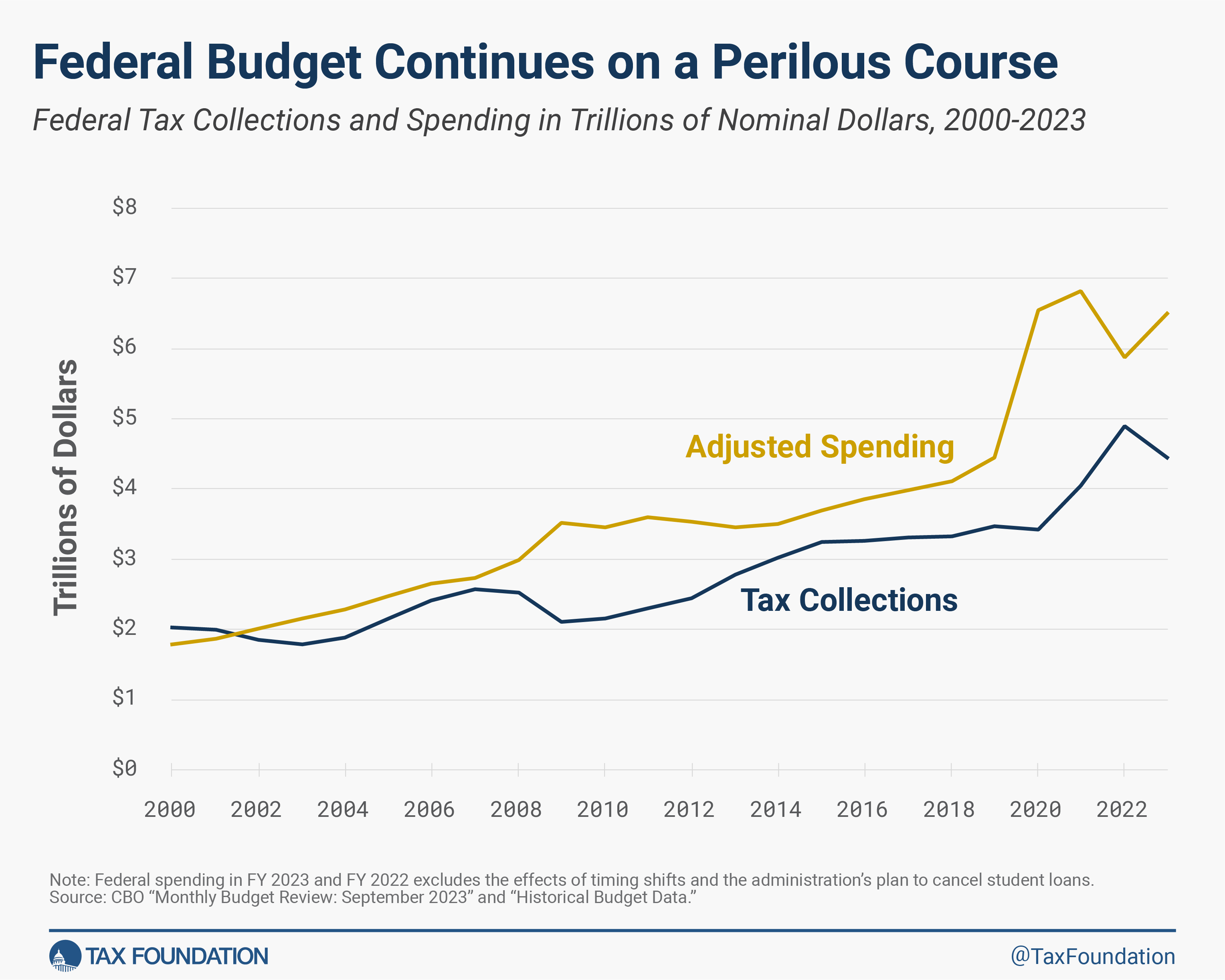

Changes in National Debt

The substantial revenue loss from the TCJA directly contributed to an increase in the national debt.

- Debt Growth: Data shows a marked increase in the rate of national debt growth following the implementation of the GOP tax plan. Graphs illustrating this trend clearly demonstrate the financial implications.

- Comparison to Previous Administrations: Comparing the rate of debt increase under the TCJA to previous administrations reveals significant differences, necessitating a thorough analysis of various macroeconomic factors during different periods.

- Implications of Increasing National Debt: A rapidly increasing national debt can lead to higher interest rates, reduced government spending in other areas, and increased vulnerability to economic shocks. This presents a serious challenge when considering the long-term consequences of the GOP tax plan and federal deficit.

Long-Term Projections and Modeling

Dynamic Scoring vs. Static Scoring

Economic forecasting involves two primary methods: dynamic and static scoring. Understanding their differences is critical for evaluating the long-term impact of the GOP tax plan on the federal deficit.

- Static Scoring: This method assumes that changes in tax policy will not affect economic behavior. It simply calculates the direct revenue impact of the changes, making it simpler but potentially less accurate.

- Dynamic Scoring: This method accounts for the potential impact of tax changes on economic variables like investment, employment, and productivity. It's more complex but offers a more comprehensive assessment of long-term effects.

- Debate and Accuracy: The choice between these methods is a source of significant debate, reflecting differing views on the responsiveness of the economy to tax changes. The accuracy of both methods is debatable and depends on the underlying assumptions and the accuracy of economic models.

Future Economic Uncertainty and its Impact

The long-term impact of the GOP tax plan is subject to considerable uncertainty due to several factors.

- Economic Recessions: A future economic recession could significantly reduce tax revenue, exacerbating the deficit.

- Interest Rate Changes: Increases in interest rates will increase the cost of servicing the national debt, further widening the deficit.

- Global Events: Unexpected global events, such as trade wars or pandemics, can have substantial and unpredictable impacts on the economy and the federal budget.

- Economic Modeling Limitations: Economic models used to forecast the future are not perfect. They rely on assumptions that may not hold true in reality, leading to inaccurate projections.

Comparison to Other Tax Plans

Comparing the projected impact of the TCJA to alternative tax policies is crucial for comprehensive evaluation.

- Alternative Proposals: Numerous alternative tax proposals exist, each with its own projected impact on the federal deficit.

- Differing Outcomes: Comparisons reveal significant differences in projected outcomes, highlighting the trade-offs between revenue generation, economic growth, and social equity.

- Policy Trade-offs: Policymakers must consider the various trade-offs inherent in choosing a specific tax policy. Each option carries unique risks and benefits in terms of deficit reduction and economic consequences.

Conclusion

The GOP tax plan's impact on the federal deficit remains a complex and highly debated topic. While initial projections indicated substantial revenue loss and an increase in the national debt, the long-term consequences are subject to considerable uncertainty due to inherent limitations in economic modeling and fluctuating economic conditions. Understanding the immediate and projected effects of the GOP tax plan, including the debates surrounding dynamic versus static scoring, is vital for evaluating fiscal policy and forming informed opinions. Further research and analysis are necessary to fully comprehend the long-term implications of the GOP tax plan on the federal deficit. Continue exploring the implications of the GOP tax plan and federal deficit by researching current economic data and engaging in informed discussions about the future of fiscal policy.

Featured Posts

-

Rashfords Goals Secure Aston Villas Fa Cup Progression Against Preston

May 21, 2025

Rashfords Goals Secure Aston Villas Fa Cup Progression Against Preston

May 21, 2025 -

Huuhkajat Kaellman Ja Hoskonen Seura Vaihtuu Puolassa

May 21, 2025

Huuhkajat Kaellman Ja Hoskonen Seura Vaihtuu Puolassa

May 21, 2025 -

The Big Reveal Peppa Pigs Mum Announces Babys Gender

May 21, 2025

The Big Reveal Peppa Pigs Mum Announces Babys Gender

May 21, 2025 -

Big Bear Ai Hit With Securities Lawsuit What Investors Need To Know

May 21, 2025

Big Bear Ai Hit With Securities Lawsuit What Investors Need To Know

May 21, 2025 -

Job Cuts At Abc News Whats Next For Their Show

May 21, 2025

Job Cuts At Abc News Whats Next For Their Show

May 21, 2025