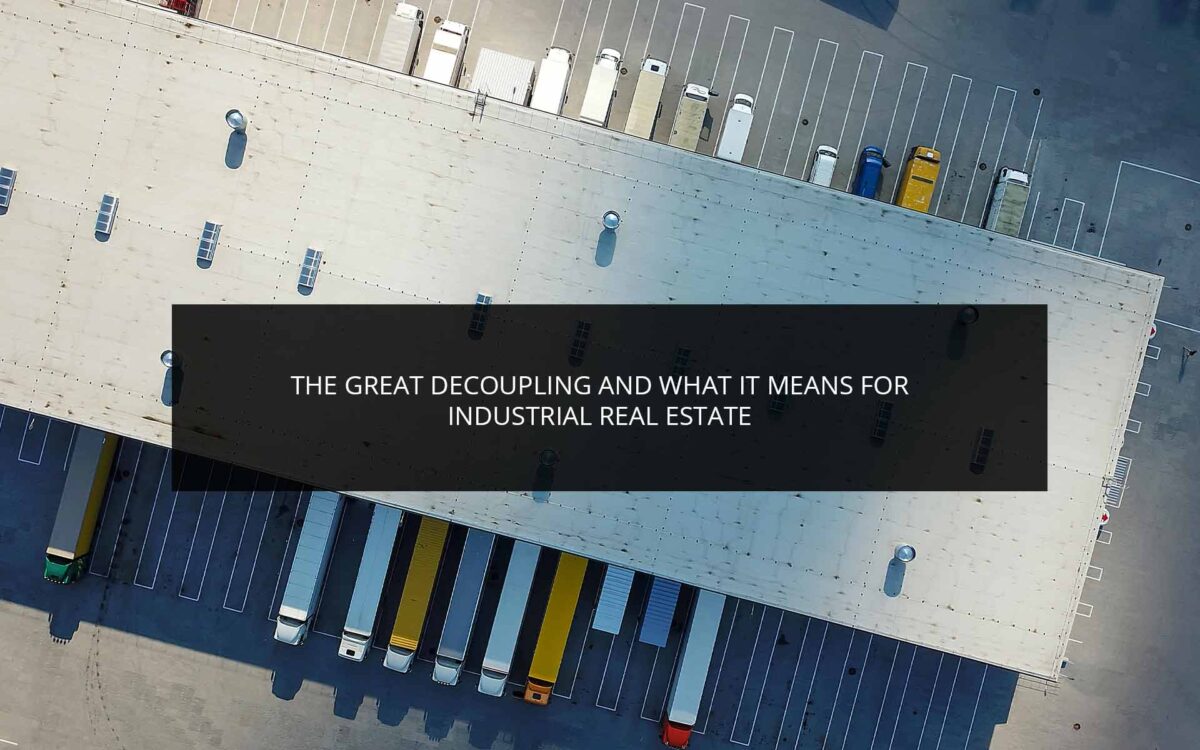

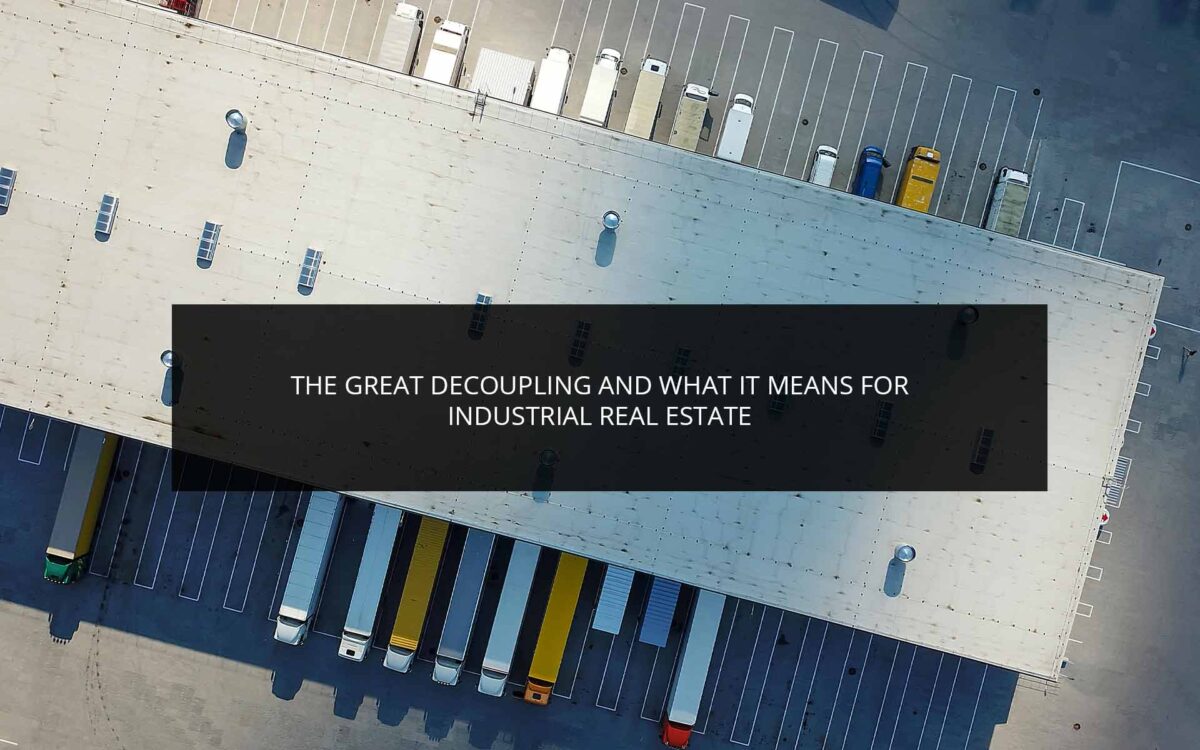

The Great Decoupling: Rethinking Global Trade And Investment

Table of Contents

Geopolitical Factors Driving the Great Decoupling

The rise of protectionism and geopolitical instability are key drivers of The Great Decoupling. The interconnectedness that characterized globalization has left many nations vulnerable to disruptions emanating from distant conflicts or policy shifts.

The Rise of Protectionism and Trade Wars

The intensification of protectionist policies, exemplified by the escalating US-China trade war, has significantly impacted global supply chains. Tariffs, sanctions, and trade disputes create uncertainty, forcing businesses to rethink their reliance on single sourcing and geographically dispersed production networks. Political ideology and national security concerns are also playing a significant role, with governments prioritizing domestic industries and reducing reliance on potentially adversarial nations.

- Increased trade barriers: Tariffs and quotas restrict the free flow of goods and services.

- Reduced foreign direct investment (FDI): Uncertainty discourages cross-border investments.

- Retaliatory measures: Trade wars often lead to tit-for-tat actions, further disrupting global trade.

The Impact of Geopolitical Instability

Geopolitical instability, including conflicts, political upheavals, and shifting alliances, creates significant risks for global trade. Companies are increasingly hesitant to invest in or source goods from regions with high political risk. For example, the war in Ukraine dramatically disrupted global energy markets and highlighted the vulnerability of supply chains reliant on a single source. International organizations are working to mitigate these risks but their influence is limited when faced with major geopolitical events.

- Supply chain disruptions: Conflicts and instability can severely disrupt the flow of goods.

- Increased risk aversion: Businesses are becoming more cautious in their global operations.

- Regionalization of trade: Companies are increasingly focusing on regional markets to reduce reliance on distant suppliers.

Economic Factors Fueling the Great Decoupling

Beyond geopolitical factors, economic considerations are also pushing companies towards regionalization and diversification.

Reshoring and Nearshoring Initiatives

The trend of reshoring (bringing production back to the home country) and nearshoring (relocating production to nearby countries) is gaining momentum. Companies are motivated by several factors:

- Reduced reliance on distant suppliers: This reduces vulnerability to geopolitical risks and supply chain disruptions.

- Improved supply chain resilience: Proximity to production facilities enhances responsiveness and reduces lead times.

- Lower transportation costs: Relocating production closer to markets reduces shipping expenses.

Industries like manufacturing and pharmaceuticals are leading the charge in adopting these strategies.

The Search for Supply Chain Resilience

The COVID-19 pandemic starkly revealed the fragility of globally interconnected supply chains. The ensuing shortages of essential goods underscored the need for diversification and resilience. Companies are actively seeking ways to mitigate risks associated with over-reliance on single sources. This includes:

- Increased diversification: Spreading production across multiple locations to reduce dependence on any single region.

- Improved risk management: Implementing robust risk assessment and mitigation strategies.

- Technological advancements: Leveraging technologies like blockchain to enhance supply chain transparency and traceability.

The Implications of the Great Decoupling

The Great Decoupling has significant implications for global growth, development, and the future of globalization itself.

Impact on Global Growth and Development

The decoupling process may lead to both positive and negative consequences for economic growth. While it can enhance resilience and national security, it also carries the risk of fragmenting global markets and hindering economic efficiency. Developing countries heavily reliant on global trade may face challenges adapting to the changing landscape. Multinational corporations also face the need to adjust strategies and operations.

- Shift in global economic power: Regional economic blocs may emerge, potentially altering the balance of global economic influence.

- Changes in trade patterns: Trade flows may become more regionalized, leading to shifts in comparative advantage.

- Potential for regional economic blocs: The rise of regional trade agreements may reshape global economic relations.

The Future of Globalization

The Great Decoupling does not necessarily signal the end of globalization, but rather a significant transformation. While regionalization is increasing, the need for international cooperation remains. Technology will continue to play a pivotal role in shaping the future of global trade, facilitating new forms of collaboration and enabling greater efficiency in regionalized supply chains.

- Regionalization: Trade relationships will likely become more geographically concentrated.

- New trade partnerships: New trade agreements may emerge to facilitate regional cooperation.

- Technological advancements: Digital technologies will continue to reshape global trade patterns.

Conclusion: Navigating the Great Decoupling

The Great Decoupling is driven by a complex interplay of geopolitical tensions and economic factors, resulting in a fundamental reshaping of global trade and investment patterns. Understanding the Great Decoupling is crucial for businesses and governments alike. Successfully navigating the Great Decoupling requires adapting strategies to embrace regionalization, enhance supply chain resilience, and manage geopolitical risks effectively. Prepare your business for the Great Decoupling by diversifying your supply chains, investing in risk management, and staying informed about the evolving geopolitical landscape. The future of global trade hinges on our ability to adapt and thrive in this new era of economic and geopolitical uncertainty.

Featured Posts

-

The Likelihood Of Xrp Reaching 5 By 2025

May 08, 2025

The Likelihood Of Xrp Reaching 5 By 2025

May 08, 2025 -

Lahwr Ky Panch Ahtsab Edaltyn Khtm Bra Fyslh Awr As Ke Athrat

May 08, 2025

Lahwr Ky Panch Ahtsab Edaltyn Khtm Bra Fyslh Awr As Ke Athrat

May 08, 2025 -

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

Court Rules On E Bays Liability For Listings Of Banned Chemicals Under Section 230

May 08, 2025

Court Rules On E Bays Liability For Listings Of Banned Chemicals Under Section 230

May 08, 2025 -

Is Rogue The Right Leader For The X Men

May 08, 2025

Is Rogue The Right Leader For The X Men

May 08, 2025

Latest Posts

-

Jayson Tatum Injury Update Bone Bruise Could Keep Him Out Of Game 2

May 09, 2025

Jayson Tatum Injury Update Bone Bruise Could Keep Him Out Of Game 2

May 09, 2025 -

Jayson Tatums Bone Bruise Game 2 Status Update And Injury Report

May 09, 2025

Jayson Tatums Bone Bruise Game 2 Status Update And Injury Report

May 09, 2025 -

Gear Up For The Finals Find Authentic Boston Celtics Apparel At Fanatics

May 09, 2025

Gear Up For The Finals Find Authentic Boston Celtics Apparel At Fanatics

May 09, 2025 -

Boston Celtics Gear Shop The Latest Styles At Fanatics

May 09, 2025

Boston Celtics Gear Shop The Latest Styles At Fanatics

May 09, 2025 -

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Nba Finals Run

May 09, 2025

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Nba Finals Run

May 09, 2025