The High Cost Of Public Sector Pensions: Are Taxpayers Paying Too Much?

Table of Contents

The Mounting Financial Burden of Public Sector Pension Schemes

The financial burden associated with public sector pensions is immense and continues to grow. Understanding the complexities of these schemes is crucial to addressing the challenges they present.

Understanding the Liabilities

Public sector pension schemes often grapple with significant unfunded liabilities – the difference between the present value of promised future benefits and the value of the assets currently set aside to pay those benefits. These unfunded liabilities represent a considerable long-term financial risk for taxpayers. The sheer scale of these liabilities is alarming and necessitates immediate attention.

- Example 1: The Teacher Retirement System of Texas, for instance, has reported substantial unfunded liabilities, impacting the state's budget.

- Example 2: Comparison studies consistently show that public sector pension benefits are often significantly more generous than those offered in the private sector, contributing to the higher costs.

- Future Cost Projections: Experts predict a dramatic increase in pension payouts in the coming decades due to an aging population and longer life expectancies, further exacerbating the financial strain.

The Impact on Tax Rates and Public Services

The escalating costs of public sector pensions directly impact taxpayers through higher taxes and reduced funding for other essential public services. This creates a difficult balancing act for governments.

- Tax Increases: In many jurisdictions, increased tax rates are directly attributed to the need to fund public sector pension obligations, impacting household budgets.

- Service Cuts: Rising pension costs often lead to cuts in vital public services like healthcare, education, and infrastructure, potentially harming citizens' well-being.

- International Comparisons: A comparative analysis of different countries reveals varying degrees of success in managing public sector pension costs, offering valuable lessons for reform strategies.

Factors Contributing to the High Cost of Public Sector Pensions

Several key factors contribute to the high cost of public sector pensions, creating a complex challenge for policymakers.

Generous Benefit Packages

Public sector pension plans frequently offer generous benefit packages compared to private sector schemes, significantly impacting the overall cost.

- Early Retirement: Many public sector employees can retire earlier than their private sector counterparts, increasing the total payout period.

- High Final Salary Calculations: Pension calculations often based on a high final salary inflate the benefit amount.

- Cost-of-Living Adjustments: Annual cost-of-living adjustments, often exceeding inflation, further escalate the long-term cost. Private sector pensions usually do not have this level of automatic adjustment.

Demographic Shifts and Increased Life Expectancy

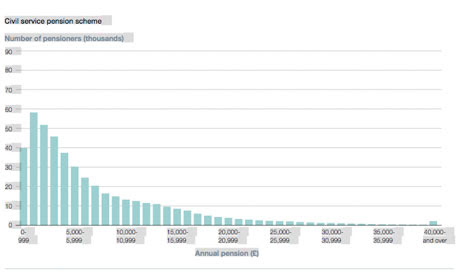

Demographic shifts, particularly an aging population and increased life expectancies, place enormous pressure on the long-term financial sustainability of public sector pension schemes.

- Life Expectancy Trends: Data shows a steady rise in life expectancy, meaning pensioners are drawing benefits for longer periods.

- Increased Payouts: A longer life expectancy directly translates into higher total pension payouts over the retiree’s lifetime.

- Mitigation Strategies: Strategies to mitigate this impact include adjusting retirement ages, increasing contribution rates, or exploring alternative pension models.

Lack of Transparency and Accountability

Concerns regarding a lack of transparency and accountability in the management and administration of public sector pension funds often hinder effective oversight and cost control.

- Mismanagement Examples: Instances of mismanagement or lack of transparency in pension fund administration erode public trust and highlight the need for reform.

- Government Oversight: Improved government oversight and independent audits are crucial for ensuring the responsible management of pension funds.

- Improved Transparency: Greater transparency in reporting pension fund performance, liabilities, and investment strategies is essential.

Potential Solutions and Reforms for Public Sector Pensions

Addressing the high cost of public sector pensions requires a multi-pronged approach involving various reform strategies.

Reforming Pension Benefit Structures

Reforming the structure of pension benefits is crucial to achieving long-term financial sustainability.

- Raising Retirement Age: Gradually increasing the retirement age aligns with increased life expectancy and reduces the overall payout period.

- Defined Contribution Plans: Shifting towards defined contribution plans, where benefits are based on contributions rather than final salary, can help mitigate risk.

- Adjusting Cost-of-Living Adjustments: Modifying cost-of-living adjustments to better reflect actual inflation can significantly reduce long-term costs.

Improving Investment Strategies

Optimizing investment strategies and risk management can improve the financial health of public sector pension funds.

- Diversification: Diversifying investments across different asset classes can reduce risk and potentially improve returns.

- Active Management: Employing active investment management strategies can potentially enhance returns and improve fund performance.

- Independent Oversight: Independent oversight of investment decisions ensures transparency and accountability.

Enhanced Transparency and Accountability

Promoting greater transparency and accountability is crucial for building public trust and ensuring responsible management of public sector pension funds.

- Regular Reporting: Implementing regular, transparent reporting of pension fund performance, assets, and liabilities.

- Independent Audits: Mandating independent audits to ensure financial accuracy and identify potential issues.

- Public Access to Information: Providing the public with easy access to information about pension fund management.

Conclusion

The high cost of public sector pensions presents a significant challenge for taxpayers and governments. Understanding the contributing factors – generous benefit packages, demographic shifts, and a lack of transparency – is crucial to developing effective solutions. Reforming benefit structures, optimizing investment strategies, and enhancing transparency are essential steps toward ensuring the long-term financial sustainability of these important retirement schemes. The high cost of public sector pensions demands careful consideration and decisive action. Let's work together to find sustainable solutions that ensure fair retirement benefits while safeguarding taxpayer interests. Learn more about the ongoing debate on public sector pension reform and contribute your voice to the conversation.

Featured Posts

-

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

Apr 29, 2025

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

Apr 29, 2025 -

Capital Summertime Ball 2025 A Guide To Ticket Acquisition

Apr 29, 2025

Capital Summertime Ball 2025 A Guide To Ticket Acquisition

Apr 29, 2025 -

Shedeur Sanders Receives Apology For Prank Call From Son Of Falcons Dc

Apr 29, 2025

Shedeur Sanders Receives Apology For Prank Call From Son Of Falcons Dc

Apr 29, 2025 -

Rekordiniai Porsche Pardavimai Lietuvoje 2024 Metais

Apr 29, 2025

Rekordiniai Porsche Pardavimai Lietuvoje 2024 Metais

Apr 29, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 29, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 29, 2025

Latest Posts

-

New Controversy Our Yorkshire Farm And The Latest Complaints Against Amanda Owen

Apr 30, 2025

New Controversy Our Yorkshire Farm And The Latest Complaints Against Amanda Owen

Apr 30, 2025 -

Where To Watch Ru Pauls Drag Race Season 17 Episode 9 Without Cable

Apr 30, 2025

Where To Watch Ru Pauls Drag Race Season 17 Episode 9 Without Cable

Apr 30, 2025 -

9 Children And Country Life Amanda Owens Family Photos

Apr 30, 2025

9 Children And Country Life Amanda Owens Family Photos

Apr 30, 2025 -

Our Yorkshire Farm Amanda Owen Hit With Repeat Complaints Post Channel 4 Update

Apr 30, 2025

Our Yorkshire Farm Amanda Owen Hit With Repeat Complaints Post Channel 4 Update

Apr 30, 2025 -

Free Streaming Of Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025

Free Streaming Of Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025