The House Passes The Trump Tax Bill: A Breakdown Of The Changes

Table of Contents

Individual Income Tax Changes

The Trump Tax Bill significantly altered the individual income tax system. Understanding these changes is key to accurate tax filing and financial planning.

Changes to Tax Brackets

The bill reduced the number of individual income tax brackets and adjusted the rates within them. This resulted in lower tax rates for many, but the impact varied depending on income level.

- Before the Trump Tax Bill: Higher tax rates applied to lower income brackets.

- After the Trump Tax Bill: Tax brackets were simplified, with lower rates in many brackets. For example, the top bracket was lowered from 39.6% to 37%. However, the income thresholds for each bracket also changed, impacting overall tax liability. Specific examples will depend on your filing status (single, married filing jointly, etc.) and income. A tax professional can provide personalized calculations.

Keywords: Tax brackets, individual income tax, tax rates, tax reform, tax liability, filing status.

Standard Deduction and Personal Exemptions

A major change was the significant increase in the standard deduction and the complete elimination of personal exemptions.

- Increased Standard Deduction: The standard deduction nearly doubled, providing a larger tax break for many taxpayers. This change benefits those who previously itemized deductions.

- Elimination of Personal Exemptions: This eliminated a deduction for each dependent claimed on a tax return. This impacted family tax planning.

Example: A married couple with two children previously might have claimed four personal exemptions. While this is offset by the increased standard deduction, the overall impact is complex and highly depends on individual circumstances.

Keywords: Standard deduction, personal exemptions, tax deductions, tax filing, itemized deductions, dependent.

Child Tax Credit Modifications

The Trump Tax Bill also modified the Child Tax Credit (CTC), expanding its reach and increasing its value.

- Increased Credit Amount: The maximum credit amount increased.

- Expanded Eligibility: The credit became partially refundable, meaning that some portion of the credit could be received as a refund, even if it exceeded the taxpayer's tax liability. This helped lower-income families.

Example: A family with two qualifying children now receives a significantly larger tax credit.

Keywords: Child tax credit, child tax, tax credits, family tax benefits, refundable tax credit, qualifying child.

Corporate Tax Rate Reductions

The Trump Tax Bill dramatically lowered the corporate tax rate, aiming to stimulate economic growth.

Impact on Businesses

The corporate tax rate was reduced from 35% to 21%. This substantial decrease was intended to boost business investment and job creation.

- Increased Investment: Lower taxes could lead to increased capital expenditures and business expansion.

- Job Creation: Companies may hire more employees with increased profitability.

- International Competitiveness: The lower rate aimed to improve the competitiveness of U.S. companies on the global stage.

Keywords: Corporate tax rate, corporate tax reform, business taxes, tax cuts, capital expenditures, job creation.

Pass-Through Businesses

The bill also affected pass-through businesses, such as S corporations and partnerships, by modifying their tax treatment. Specific changes included alterations to deductions and limitations on certain expenses. The exact impact varied considerably based on the business structure and income.

Keywords: Pass-through entities, S corporations, partnerships, small business taxes, business deductions, business expenses.

Other Significant Changes

Beyond individual and corporate taxes, the Trump Tax Bill included several other noteworthy changes.

Estate and Gift Taxes

The bill doubled the estate and gift tax exemption amount. This significantly increased the amount of wealth that could be passed down to heirs without incurring estate tax.

- Impact on High-Net-Worth Individuals: High-net-worth individuals and families benefited most from this change.

- Reduced Tax Revenue: The larger exemption reduced tax revenue from estate taxes.

Keywords: Estate tax, gift tax, inheritance tax, wealth transfer tax, exemption amount, high-net-worth individuals.

State and Local Tax Deductions (SALT)

The bill imposed a $10,000 limit on the deduction of state and local taxes (SALT). This impacted taxpayers in high-tax states disproportionately.

- Impact on High-Tax States: Taxpayers in states with high property taxes and state income taxes faced a significant reduction in their tax deductions.

- Increased Tax Burden: The limitation increased the effective tax burden for many residents of high-tax states.

Keywords: SALT deduction, state and local taxes, property tax deduction, high-tax states, effective tax rate.

Conclusion

The Trump Tax Bill, the Tax Cuts and Jobs Act of 2017, represents a monumental restructuring of the US tax code. This breakdown of its key changes – including the revised individual tax brackets, the corporate tax rate reduction, and significant adjustments to deductions and credits – highlights its profound potential impact on individuals, businesses, and the national economy. Understanding these changes is essential for effective financial planning and tax compliance. For further information and personalized tax advice tailored to your specific situation, consult a qualified tax professional. Stay informed about the ongoing implications of the Trump Tax Bill and its effects on your financial future.

Featured Posts

-

Kapitaalmarktrentes Stijgen Verder Euro Klimt Boven 1 08 Live Update

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Euro Klimt Boven 1 08 Live Update

May 24, 2025 -

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup Details

May 24, 2025

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup Details

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

Whats Open On Memorial Day 2025 In Michigan Your Guide To The Holiday

May 24, 2025

Whats Open On Memorial Day 2025 In Michigan Your Guide To The Holiday

May 24, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Prehlad O Situacii

May 24, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Prehlad O Situacii

May 24, 2025

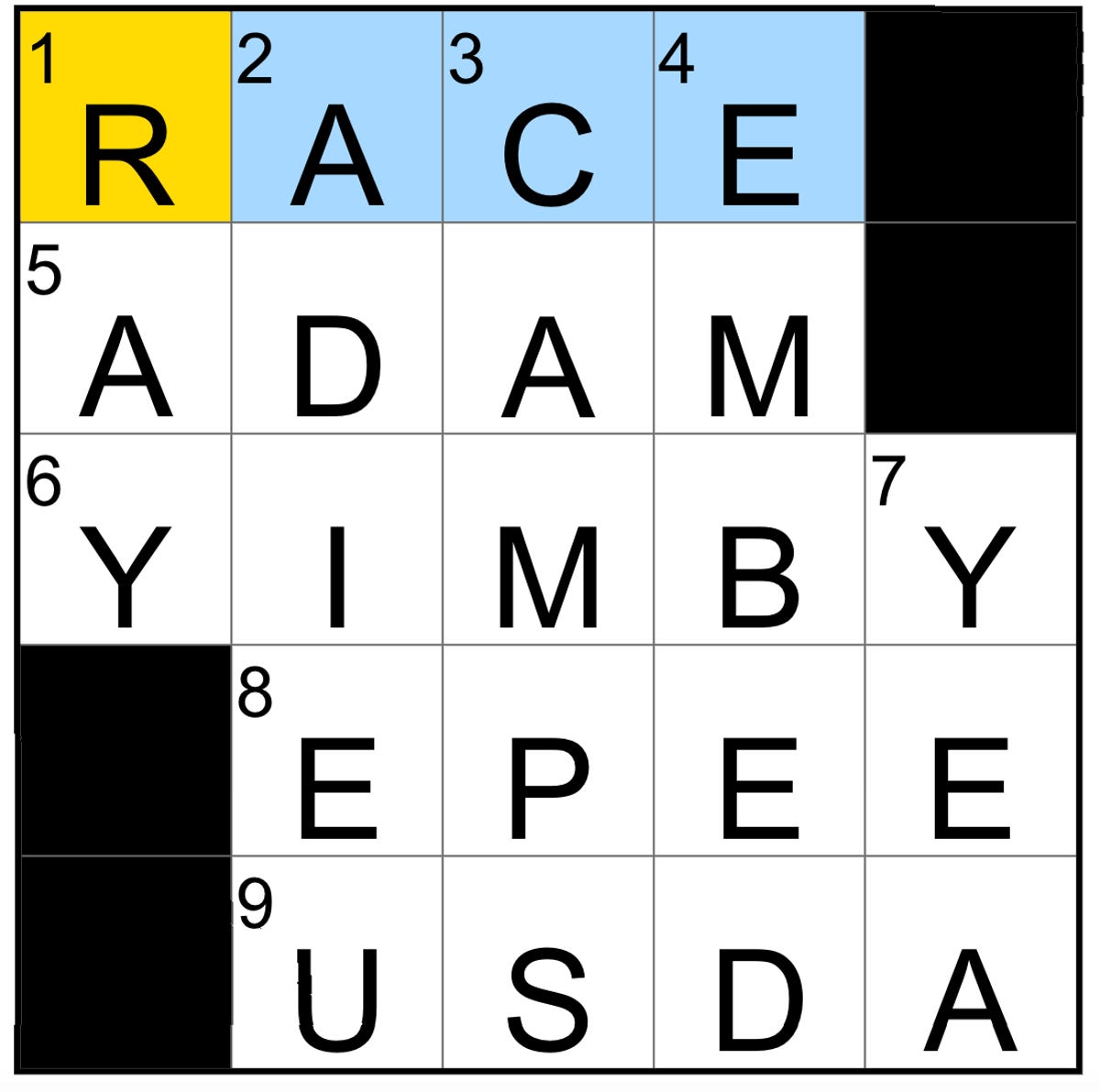

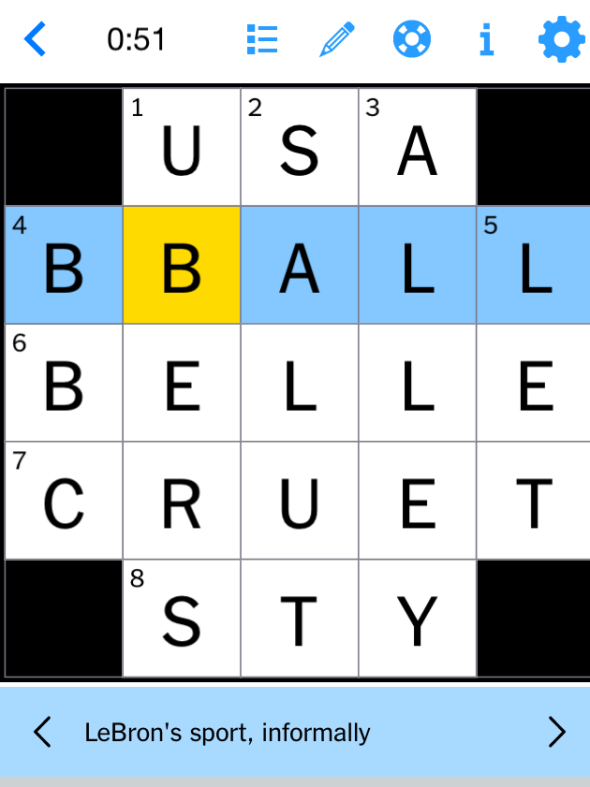

Finding The Answers To The Nyt Mini Crossword April 18 2025

Finding The Answers To The Nyt Mini Crossword April 18 2025

Nyt Mini Crossword April 18 2025 Answers And Solutions

Nyt Mini Crossword April 18 2025 Answers And Solutions

Complete Guide Nyt Mini Crossword April 18 2025 Solutions

Complete Guide Nyt Mini Crossword April 18 2025 Solutions

Finding The Answers Nyt Mini Crossword March 24 2025

Finding The Answers Nyt Mini Crossword March 24 2025