The House Republican Plan: A Deep Dive Into Trump's Proposed Tax Cuts

Table of Contents

Key Features of the House Republican Tax Plan

The House Republican tax plan, a key element of Trump's proposed tax reform, aimed for significant reductions across the board. Its core tenets revolved around substantial cuts to both individual and corporate tax rates, simplification of the tax code, and incentivizing business investment.

-

Individual Income Tax Rate Reductions: The plan proposed reducing the number of individual income tax brackets and lowering the rates within those brackets. Specific proposals included a reduction from seven brackets to three or four, with rates significantly lower than under previous legislation. This aimed to stimulate individual spending and economic growth.

-

Changes to the Standard Deduction and Personal Exemptions: The plan increased the standard deduction substantially while eliminating personal exemptions. This simplification aimed to reduce complexity but potentially altered the tax burden for families.

-

Corporate Tax Rate Cuts: A dramatic reduction in the corporate tax rate was a central feature. The proposed cut from 35% to 21% aimed to boost corporate profits, investment, and job creation.

-

Pass-Through Business Tax Changes: The plan included provisions to alter the taxation of pass-through businesses (like partnerships and S corporations). The goal was to provide tax relief for these businesses, stimulating small business growth and entrepreneurship.

-

Impact on Estate and Gift Taxes: The plan proposed significant changes to estate and gift taxes, including increasing the exemption amount, potentially benefiting wealthy families and reducing the tax burden on inherited wealth.

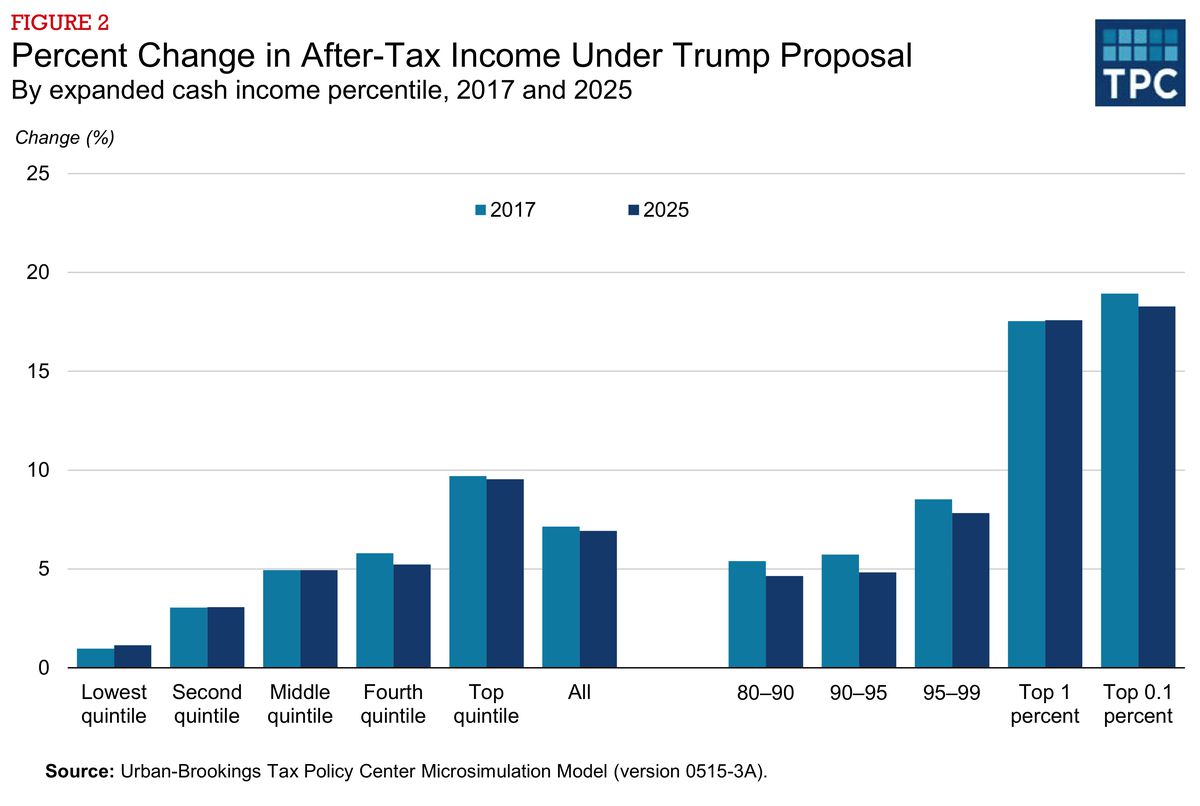

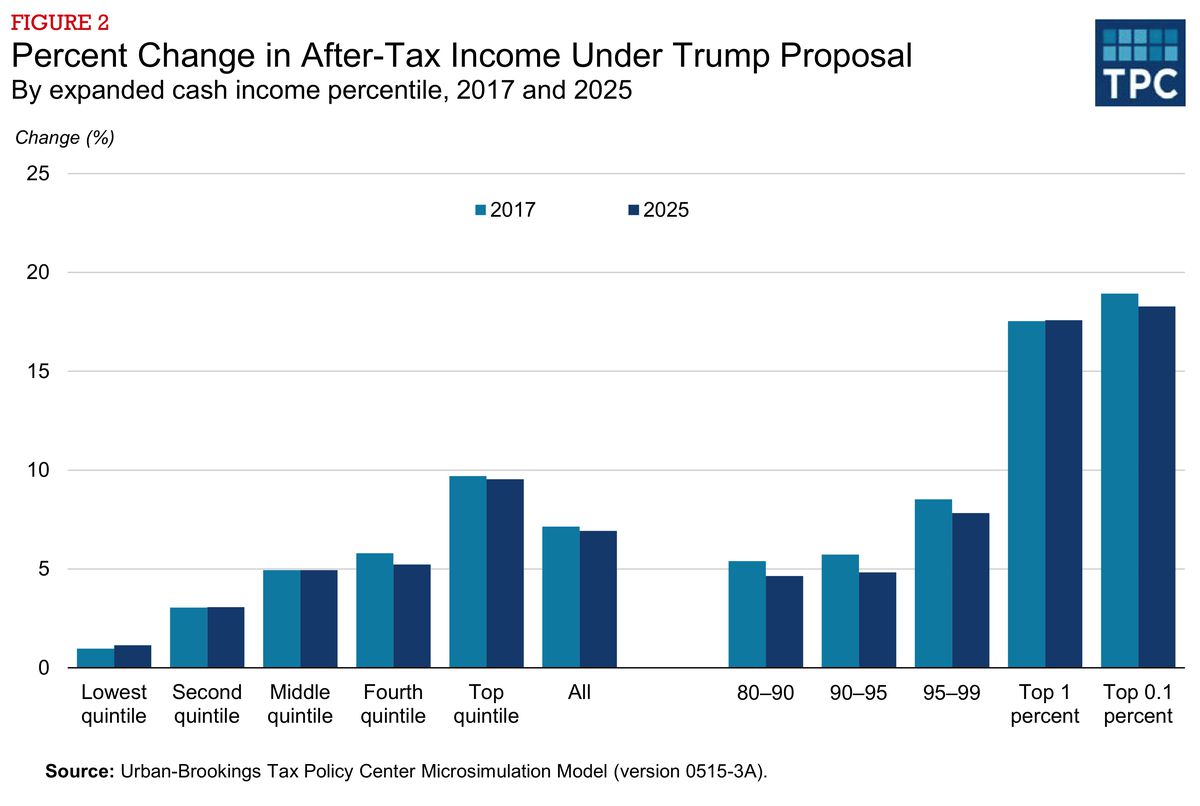

Winners and Losers Under Trump's Tax Cuts

The distributional effects of Trump's proposed tax cuts, as outlined in the House Republican Plan, were highly debated.

-

Which income groups would benefit most? Generally, higher-income individuals and corporations were projected to benefit the most from the proposed cuts due to the lower tax rates and other provisions.

-

Which income groups would benefit least or face potential tax increases? Lower-income individuals might see smaller benefits or potentially face tax increases due to the elimination of personal exemptions, even with the increased standard deduction.

-

Impact on different demographics: The impact varied significantly across demographics. Families with high incomes would likely see considerable tax savings, while families with lower incomes might see less significant changes or even a small tax increase. The plan's effect on corporations was clearly beneficial, driving potential increases in stock prices and executive compensation. Small businesses, depending on their structure, could benefit from pass-through business tax changes.

-

Geographical disparities in the impact of the plan: The effects were not uniform across states and regions. States with a higher concentration of high-income earners or corporate headquarters stood to see a greater economic boost from the proposed tax cuts.

Economic Projections and Analysis

Numerous economic analyses were conducted on the projected consequences of the House Republican Plan. These forecasts varied depending on the assumptions made, but some common themes emerged.

-

GDP growth projections: Supporters of the plan projected increased GDP growth due to greater investment and consumer spending stimulated by lower tax rates.

-

Job creation estimates: Proponents predicted significant job creation as a result of increased business investment and economic activity.

-

Potential impact on the national debt: Critics expressed concerns that the tax cuts would lead to a substantial increase in the national debt due to reduced government revenue.

-

Analysis of potential inflationary pressures: Some analyses warned of potential inflationary pressures as a result of increased consumer spending and business activity.

Political Ramifications and Public Opinion

The House Republican Plan and Trump's proposed tax cuts generated significant political debate and diverse public reactions.

-

Congressional responses and voting patterns: The plan faced considerable opposition from Democrats and some Republicans, leading to lengthy legislative debates and close votes.

-

Public opinion polls and surveys regarding the plan's popularity: Public opinion polls showed divided reactions to the plan, with varying levels of support across different demographics and political affiliations.

-

Arguments for and against the plan from different political perspectives: Supporters argued that the cuts would stimulate economic growth and job creation. Opponents criticized them for exacerbating income inequality and increasing the national debt.

-

Impact on future elections and political strategies: The tax cuts became a central issue in subsequent elections, influencing voter behavior and shaping political strategies for both parties.

Long-Term Implications of the House Republican Plan

The long-term effects of the House Republican Plan remain a subject of ongoing discussion.

-

Long-term fiscal impact on the budget deficit and national debt: The long-term fiscal impact was a major concern, with potential for increased deficits and debt unless offset by spending cuts or economic growth exceeding expectations.

-

Potential effects on income inequality: Critics worried that the tax cuts could exacerbate income inequality, further concentrating wealth among high-income individuals and corporations.

-

Influence on future tax policies and economic strategies: The plan's success or failure has influenced subsequent tax policy debates and economic strategies in the US.

-

International comparisons and best practices in tax policy: Comparisons to tax policies in other developed nations, examining their effectiveness and impact on income inequality and economic growth, provide valuable insights.

Conclusion: Understanding the House Republican Plan and Trump's Proposed Tax Cuts

The House Republican Plan, a significant component of Trump’s proposed tax cuts, involved substantial changes to both individual and corporate tax rates, aiming to stimulate economic growth. While it led to projected benefits for higher-income individuals and corporations, concerns remained about its impact on lower-income groups and the national debt. The plan’s political ramifications were significant, shaping the national conversation on tax reform and influencing future legislative priorities. Understanding the long-term implications requires a continued examination of its effects on income inequality, economic growth, and fiscal stability. To stay informed on the ongoing debate surrounding the House Republican Plan and its impact on American taxpayers, continue your research using credible news sources and economic analysis reports. Share your thoughts on the long-term effects of Trump’s proposed tax cuts in the comments section.

Featured Posts

-

2025 Nba Draft Lottery Predicting The Odds And Cooper Flaggs Destination

May 13, 2025

2025 Nba Draft Lottery Predicting The Odds And Cooper Flaggs Destination

May 13, 2025 -

Fords Brazilian Decline Byds Opportunity To Dominate The Ev Market

May 13, 2025

Fords Brazilian Decline Byds Opportunity To Dominate The Ev Market

May 13, 2025 -

Delhi Heatwave Government Issues Advisory Warns Of Heatstroke

May 13, 2025

Delhi Heatwave Government Issues Advisory Warns Of Heatstroke

May 13, 2025 -

Gaza Hostage Crisis Ends Edan Alexanders Freedom And The Road Ahead

May 13, 2025

Gaza Hostage Crisis Ends Edan Alexanders Freedom And The Road Ahead

May 13, 2025 -

Slobodna Dalmacija Di Capriojeva Promjena Tko Je Ovaj Covjek

May 13, 2025

Slobodna Dalmacija Di Capriojeva Promjena Tko Je Ovaj Covjek

May 13, 2025