The Impact Of High Down Payments On Canadian Homeownership

Table of Contents

The Financial Implications of High Down Payments in Canada

Saving for a substantial down payment is a critical first step in the Canadian homeownership journey. Let's examine the financial aspects in detail.

Reduced Mortgage Payments and Interest Costs

A larger down payment translates directly into a smaller mortgage principal. This leads to lower monthly mortgage payments and significantly less interest paid over the life of the loan.

- Example 1: A $500,000 home with a 5% down payment ($25,000) results in a larger mortgage and higher monthly payments compared to a 20% down payment ($100,000).

- Example 2: A 25% down payment ($125,000) on the same home further reduces the mortgage amount, leading to even lower monthly payments and substantially less interest accrued over 25 years.

- Tax Implications: Interest paid on your mortgage may be tax deductible, offering further financial benefits. Consult with a tax professional to understand the specifics.

Impact on Mortgage Approval Rates

In today's competitive Canadian housing market, a larger down payment dramatically increases your chances of mortgage approval. Lenders view a substantial down payment as a lower risk.

- Credit Score and Debt-to-Income Ratio: While a good credit score and a low debt-to-income ratio are crucial, a high down payment can compensate for a slightly less-than-perfect credit history.

- Mortgage Options: A larger down payment opens doors to a wider range of mortgage options, potentially securing more favorable interest rates. You might qualify for a conventional mortgage instead of a high-ratio mortgage, which typically requires mortgage loan insurance.

Opportunity Cost of a Large Down Payment

While essential for homeownership, a significant down payment represents a considerable opportunity cost. The funds used for the down payment could have been invested elsewhere.

- Potential Investment Returns: The money tied up in a down payment could have generated returns through stocks, bonds, or other investments.

- Financial Planning: It's crucial to carefully weigh the potential returns from alternative investments against the benefits of homeownership and the security of owning a property.

The Impact of High Down Payments on Home Buying Strategies in Canada

High down payments significantly influence your home buying strategy in the Canadian context.

Access to Desirable Properties

A larger down payment expands your buying power, allowing you to compete for homes in more desirable areas and competitive markets.

- City Comparisons: The purchasing power of a 20% down payment in Toronto will differ significantly from that in a smaller Canadian city.

- Bidding Wars: In competitive markets, a higher down payment makes your offer more attractive and increases your chances of winning a bidding war.

Negotiating Power with Sellers

A substantial down payment demonstrates financial stability and seriousness, giving you stronger negotiating power with sellers.

- Strong Offer: A large down payment, coupled with a pre-approval letter and flexible closing date, makes your offer more compelling.

- Seller's Perspective: Sellers are more likely to accept an offer with a higher down payment, even if it is slightly lower than other offers with smaller down payments.

Time to Homeownership

Saving for a large down payment can extend the time it takes to buy a home.

- Accelerating Savings: Employ strategies like high-yield savings accounts, Tax-Free Savings Accounts (TFSAs), and Registered Retirement Savings Plans (RRSPs) to accelerate your savings.

- Emotional Toll: The extended timeline can be emotionally challenging, requiring patience and persistence.

Government Programs and High Down Payments in Canada

Several government programs aim to alleviate the burden of high down payments for first-time homebuyers in Canada.

First-Time Home Buyer Incentives

Various federal and provincial programs offer incentives to first-time homebuyers, potentially reducing the required down payment.

- Program Details: Research programs like the First-Time Home Buyer Incentive to understand their eligibility criteria and benefits.

- Affordability Impact: These programs can significantly increase affordability by lowering the upfront costs associated with purchasing a home.

Conclusion: Navigating the Challenges of High Down Payments for Canadian Homeownership

High down payments significantly impact Canadian homeownership, both financially and strategically. Understanding the financial implications, the effect on your buying power, and the role of government programs is crucial for making informed decisions. Careful financial planning is essential to weigh the benefits of a large down payment against the opportunity cost of tying up significant capital. Consult with a financial advisor to determine the optimal down payment strategy for your individual circumstances. Continue your research on high down payments and Canadian homeownership to make the best decisions for your future.

Featured Posts

-

Finding The Real Safe Bet A Practical Guide To Risk Management

May 09, 2025

Finding The Real Safe Bet A Practical Guide To Risk Management

May 09, 2025 -

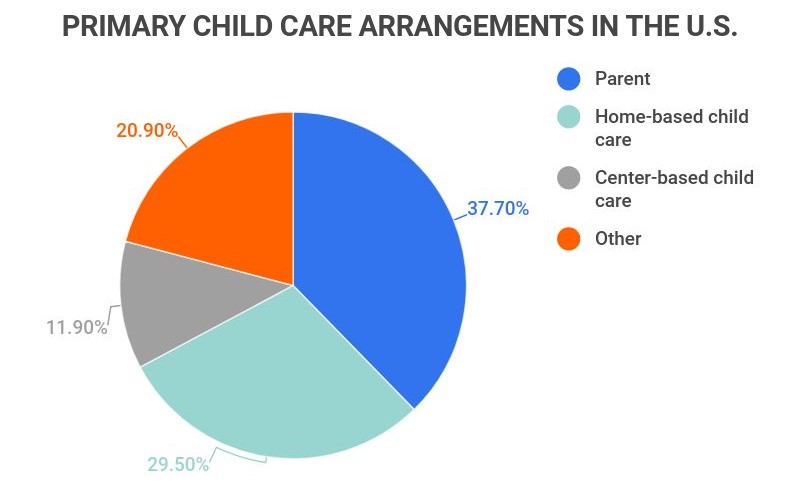

The High Cost Of Childcare A Mans Experience With Babysitting And Daycare

May 09, 2025

The High Cost Of Childcare A Mans Experience With Babysitting And Daycare

May 09, 2025 -

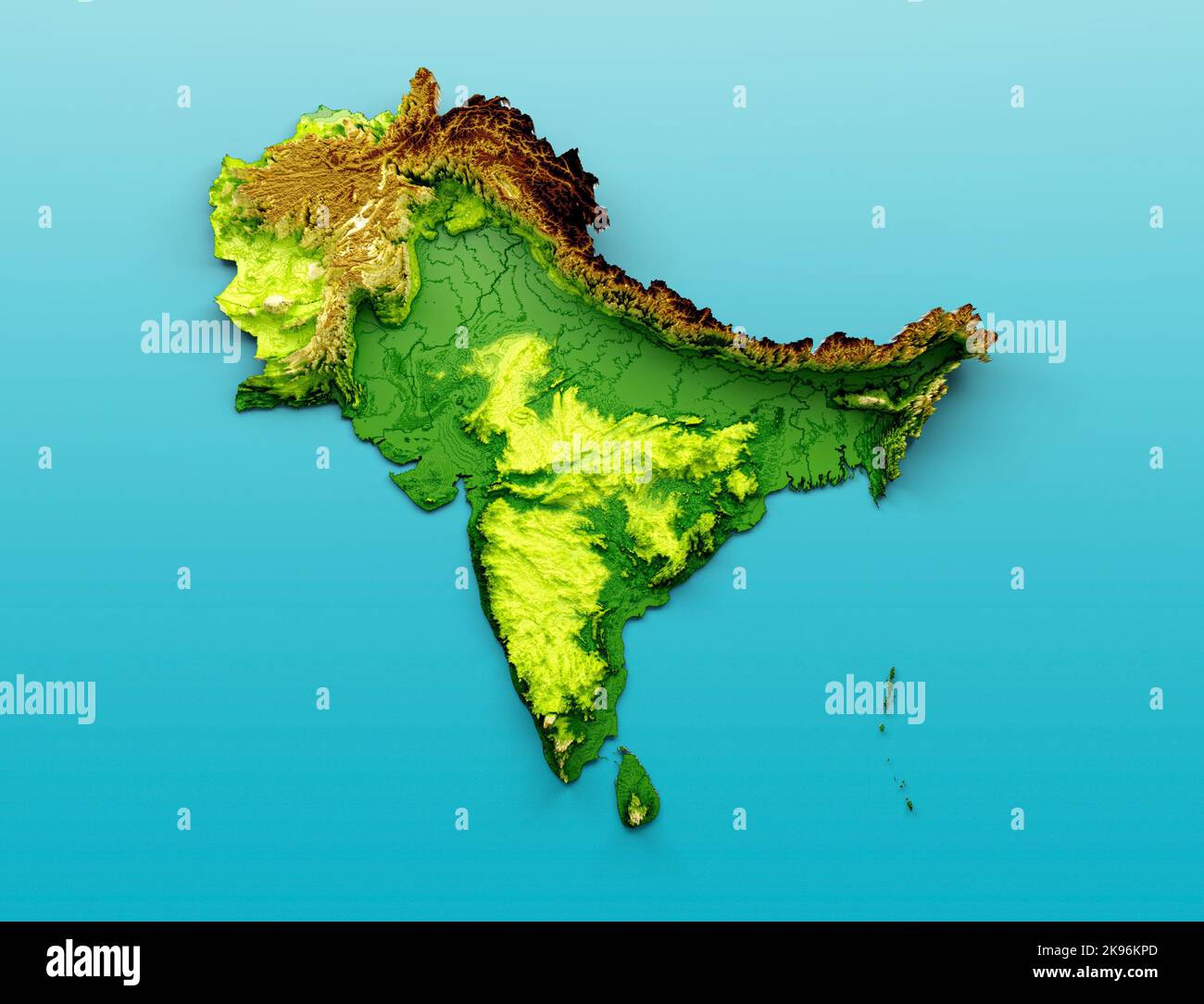

Brekelmans Inzet Voor Een Sterke Band Met India

May 09, 2025

Brekelmans Inzet Voor Een Sterke Band Met India

May 09, 2025 -

Proposed Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 09, 2025

Proposed Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 09, 2025 -

Cowherd On Tatum A Post Game 1 Celtics Loss Critique

May 09, 2025

Cowherd On Tatum A Post Game 1 Celtics Loss Critique

May 09, 2025