The Impact Of Japan's Steepening Bond Curve On Economic Growth

Table of Contents

Understanding Japan's Bond Market Dynamics

The Japanese bond market, dominated by JGBs, is one of the world's largest and most influential. JGBs are debt securities issued by the Japanese government to finance its spending. The Bank of Japan (BOJ), the nation's central bank, plays a crucial role in managing JGB yields through its monetary policies, historically maintaining a low interest rate environment. The yield curve itself represents the relationship between the interest rates (yields) and the time to maturity of bonds. A "steepening yield curve" indicates a growing difference between short-term and long-term interest rates.

Key characteristics of the Japanese bond market include:

- High levels of government debt: Japan carries one of the highest levels of public debt among developed nations.

- BOJ dominance: The BOJ's extensive JGB holdings significantly influence market dynamics.

- Historically low interest rates: For many years, Japan maintained an exceptionally low interest rate environment.

- Recent policy shifts: The BOJ's recent shift towards a more flexible monetary policy has directly impacted yield curves.

Factors Contributing to the Steepening Bond Curve in Japan

Several factors are contributing to the recent steepening of Japan's bond curve:

- BOJ policy shifts: The BOJ's gradual retreat from its aggressive quantitative easing (QE) program, often discussed as potential tapering, is altering market expectations and pushing yields higher. This includes adjustments to the yield curve control (YCC) policy.

- Inflationary pressures: Rising inflation, both domestically and globally, is forcing investors to demand higher yields to compensate for the erosion of purchasing power.

- Increased investor demand for higher yields: With global interest rates rising, investors are seeking better returns, increasing demand for higher-yielding Japanese bonds.

- Changes in market expectations: Shifting expectations about future interest rate hikes by the BOJ are also contributing to the upward pressure on long-term yields.

Each factor plays a significant role. The BOJ's actions directly impact short-term rates, while inflation and global market forces influence long-term rates, thus widening the spread.

Impact on Economic Growth: Positive and Negative Consequences

The steepening bond curve presents both opportunities and challenges for Japan's economic growth:

Potential Positive Impacts:

- Curbing inflation: Increased borrowing costs could potentially dampen excessive spending and inflationary pressures.

- Attracting foreign investment: Higher yields on JGBs could attract foreign investment, injecting capital into the Japanese economy.

- Increased savings and investment: Higher interest rates may incentivize saving and investment.

Potential Negative Impacts:

- Stifling business investment: Higher borrowing costs could make it more expensive for businesses to invest, potentially hindering economic expansion.

- Increased government debt servicing costs: A steeper yield curve increases the cost of servicing Japan's substantial government debt.

- Economic slowdown: The combination of higher borrowing costs and reduced investment could lead to a slowdown in economic activity.

Long-Term Implications and Policy Responses

The long-term consequences of Japan's steepening bond curve are complex and uncertain. The BOJ's policy responses will be crucial in navigating this situation.

Potential long-term effects include:

- Impact on inflation: The interplay between inflation and interest rates will determine the long-term impact on the economy.

- Sustainability of government debt: The increased cost of servicing Japan's debt could pose significant challenges to fiscal sustainability.

- Future BOJ policy adjustments: The BOJ will likely need to adapt its monetary policies to manage the yield curve and maintain price stability.

A comparison with other developed economies facing similar challenges could offer valuable insights and inform policy decisions. The BOJ must carefully balance its commitment to price stability with the need to support economic growth.

Conclusion: The Future of Japan's Economy in Light of its Steepening Bond Curve

Japan's steepening bond curve presents a multifaceted challenge, with potential benefits and drawbacks for the economy. While higher yields could attract investment and potentially curb inflation, increased borrowing costs could stifle growth and exacerbate the country's debt burden. The BOJ's response will be critical in managing this transition and ensuring a stable economic future.

Monitoring the situation closely is paramount. Further research and public discourse are needed to fully understand the implications of Japan's steepening bond curve and inform effective policy responses. Stay informed about developments in the Japanese bond market and economic policy to better grasp the future of Japan’s economic landscape. Understanding the complexities of Japan's steepening bond curve is crucial for investors and policymakers alike.

Featured Posts

-

Thibodeau On Knicks 37 Point Loss A Plea For More Determination

May 17, 2025

Thibodeau On Knicks 37 Point Loss A Plea For More Determination

May 17, 2025 -

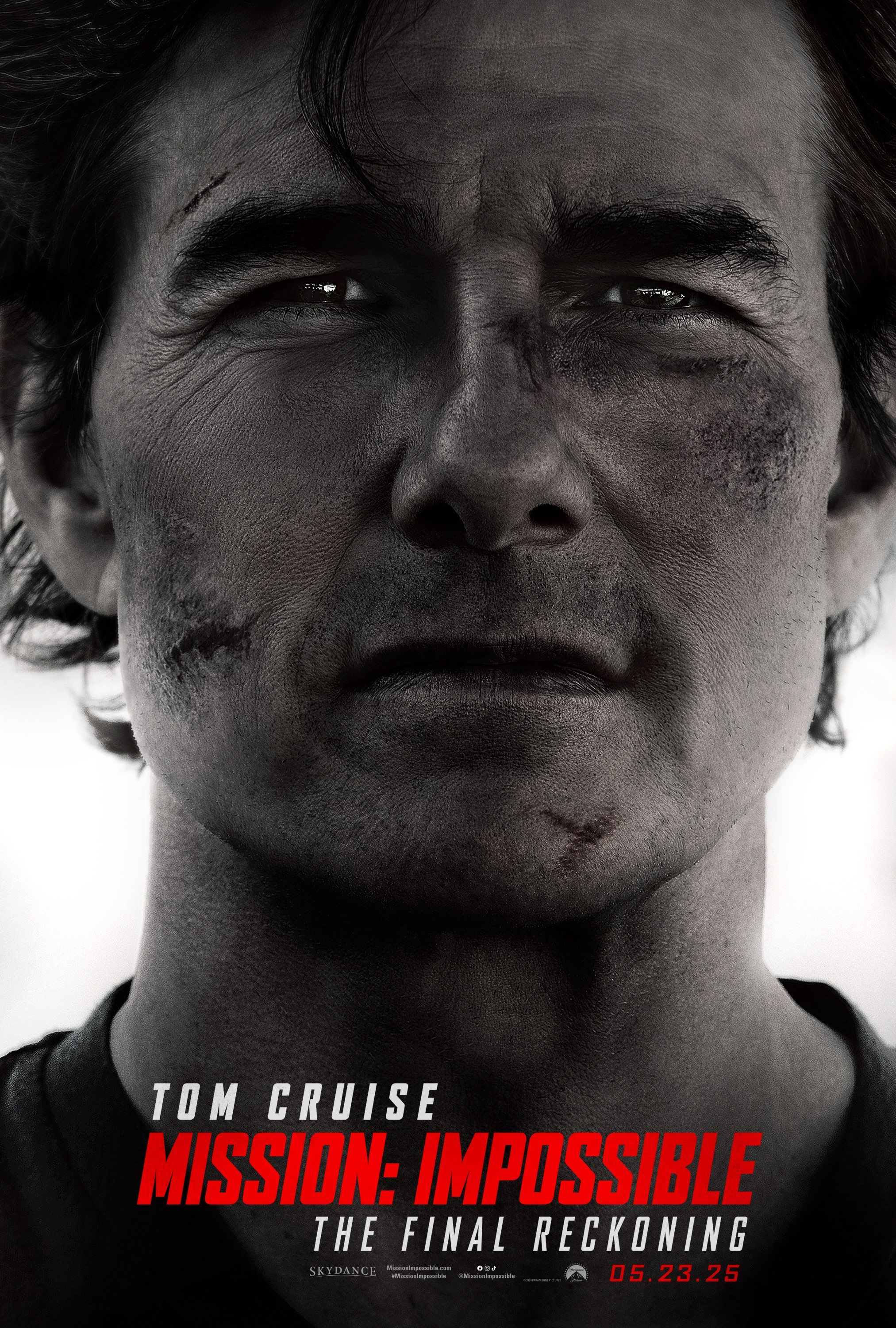

Paramount Announces China Release For Mission Impossible Franchise

May 17, 2025

Paramount Announces China Release For Mission Impossible Franchise

May 17, 2025 -

51m Price Tag Liverpools Pursuit Of German Midfielder

May 17, 2025

51m Price Tag Liverpools Pursuit Of German Midfielder

May 17, 2025 -

Week In Review Flashbacks To Failure Learning From Mistakes

May 17, 2025

Week In Review Flashbacks To Failure Learning From Mistakes

May 17, 2025 -

Should You Take Creatine A Comprehensive Overview

May 17, 2025

Should You Take Creatine A Comprehensive Overview

May 17, 2025