The Impact Of National Debt On Mortgage Interest Rates And Availability

Table of Contents

How National Debt Influences Interest Rates

The connection between national debt and mortgage interest rates isn't always immediately apparent, but it's a powerful one. Essentially, the government's need to borrow money to finance its debt significantly impacts the broader financial landscape, directly affecting the cost of borrowing for consumers.

The Relationship Between Government Bonds and Mortgage Rates

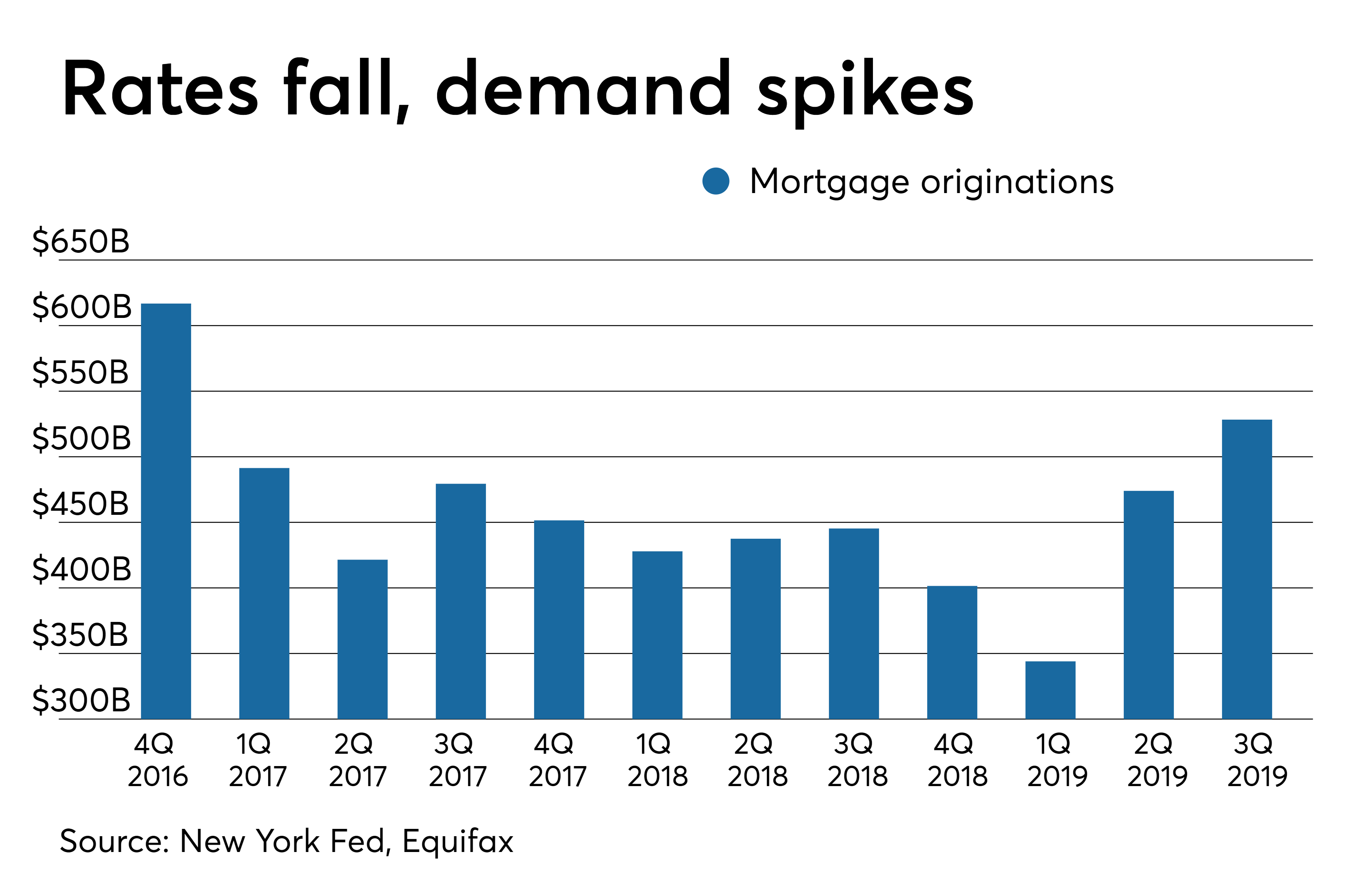

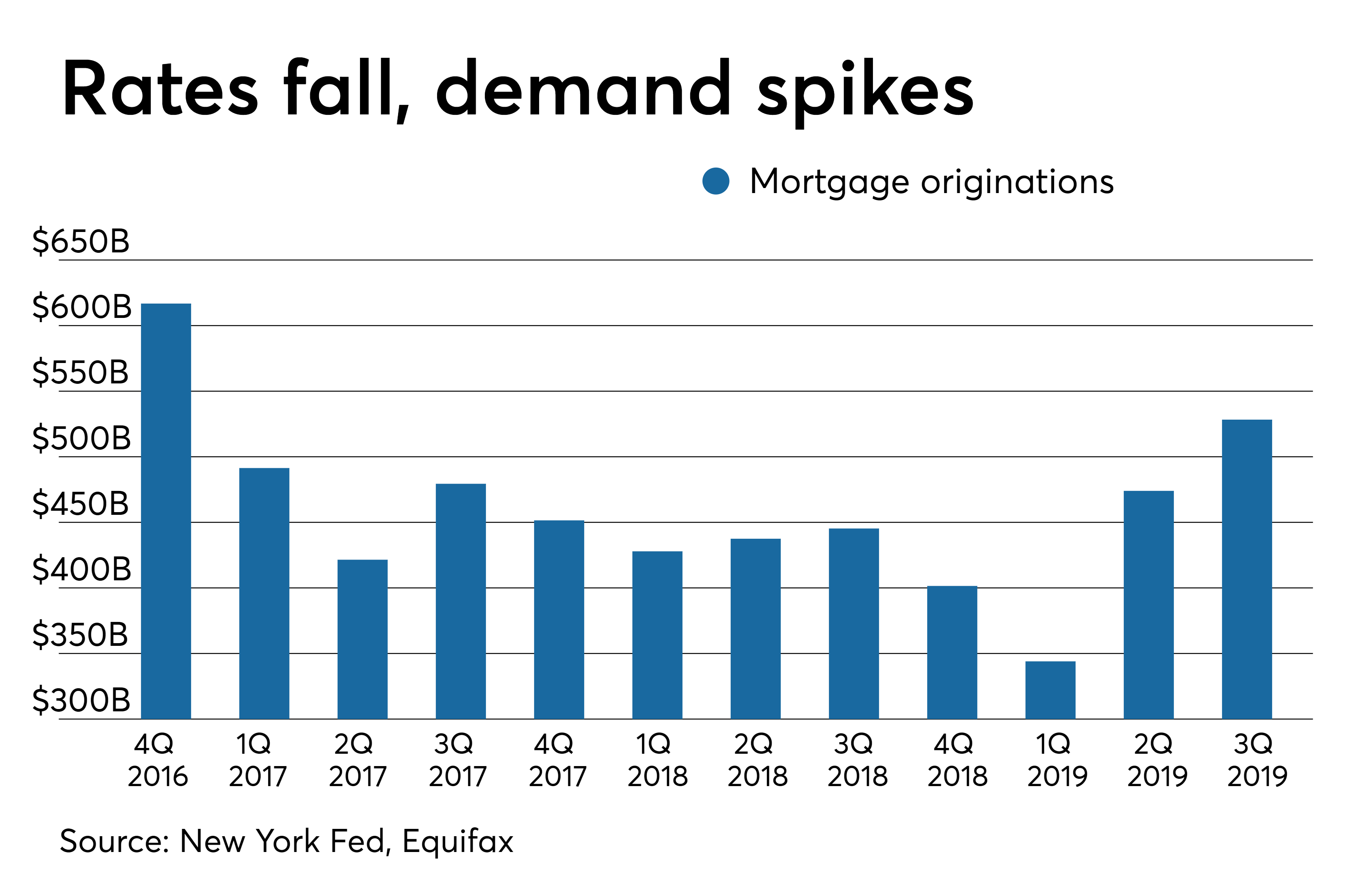

The U.S. government finances its debt primarily by issuing Treasury bonds. These bonds are considered low-risk investments, making them attractive to both domestic and international investors. However, increased government borrowing drives up the demand for these bonds. This increased demand, in turn, pushes bond prices down and yields up. There's an inverse relationship: as bond yields rise, interest rates across the board tend to follow suit.

- Increased borrowing drives up demand for bonds, pushing prices down and yields up. When the government needs to borrow more money, it issues more bonds, increasing the supply. This increased supply, coupled with consistent demand, doesn't necessarily drive prices up, rather it maintains prices while yields rise.

- Higher bond yields signal increased risk, leading lenders to charge higher mortgage interest rates. Higher bond yields are often seen as an indicator of increased risk in the overall economy. Lenders, wanting to protect their profits, then increase the interest rates they charge on mortgages to compensate for this perceived elevated risk.

- The role of the Federal Reserve and its monetary policy in managing interest rates. The Federal Reserve (the Fed) plays a pivotal role in influencing interest rates through its monetary policy. While the Fed doesn't directly control mortgage rates, its actions concerning the federal funds rate (the target rate for overnight lending between banks) significantly influence broader interest rates, including those for mortgages. Changes in monetary policy in response to high national debt can impact mortgage rates.

Inflation's Role in Mortgage Rates

High national debt can contribute to inflation through increased government spending. When the government spends more money than it takes in through taxes, it can lead to an increase in the money supply. This increased money supply, without a corresponding increase in goods and services, can lead to inflation.

- Government spending and inflation: Excessive government spending, often financed by borrowing, can fuel inflation. This is especially true if the spending isn't productive and doesn't increase the supply of goods and services.

- Lenders adjust rates to protect their returns against inflation: Lenders are keenly aware of inflation. To maintain the real value of their returns, they often adjust mortgage interest rates upward to account for expected inflation, ensuring they don't lose purchasing power.

- Historical examples: Examining historical periods with high national debt often reveals a correlation between high national debt, increased inflation, and subsequently higher mortgage rates. The stagflation of the 1970s is a prime example.

National Debt and Mortgage Availability

Beyond impacting interest rates, high national debt can also affect the availability of mortgages. This is because increased national debt frequently leads to greater economic uncertainty and risk for lenders.

Lender Risk Assessment and National Debt

High national debt often translates to increased economic uncertainty. This uncertainty makes lenders more cautious and wary of extending credit. They become more risk-averse, leading to stricter lending criteria and reduced mortgage availability.

- Economic uncertainty linked to high national debt affects lender confidence. Lenders assess the overall economic outlook before approving mortgages. High national debt can signal economic instability, making them hesitant to extend credit.

- Impact on lending standards: Expect higher down payments, stricter credit score requirements, and a more rigorous application process when national debt is high. Lenders protect themselves by making it harder to qualify for a mortgage.

- Potential reductions in loan-to-value ratios: Loan-to-value (LTV) ratios, which represent the loan amount as a percentage of the property value, are likely to decrease during times of high national debt. This means borrowers need a larger down payment.

Government Intervention and Mortgage Programs

Government intervention can influence mortgage availability. However, the impact can be multifaceted. Government programs like FHA loans aim to make homeownership more accessible, but the government's response to high national debt might also necessitate adjustments or reductions in these programs.

- Government policies aimed at stimulating the economy can impact the mortgage market: Policies designed to boost the economy (such as lower interest rates or tax incentives) can temporarily increase mortgage availability.

- Potential negative consequences of government intervention: Government interventions can sometimes have unintended negative consequences. For instance, artificially low interest rates may create unsustainable bubbles in the housing market.

- Examples of past government responses: Analyzing historical government responses to economic challenges (like the Great Recession) and their subsequent impact on mortgage availability provides valuable insight into the complex interplay between national debt, government policy, and the housing market.

Conclusion

High national debt exerts considerable influence on both mortgage interest rates and availability. Increased bond yields resulting from government borrowing and inflationary pressures stemming from increased spending contribute to higher mortgage interest rates. Simultaneously, the economic uncertainty associated with high national debt leads lenders to tighten lending standards, reducing mortgage availability. Understanding the impact of national debt on mortgage interest rates and availability is crucial for making informed financial decisions. Monitor national debt levels and their influence on the housing market to make informed decisions regarding your homeownership goals. Learn more about how changes in national debt affect your mortgage options and plan accordingly.

Featured Posts

-

Ufc 313 Preview A Deep Dive Into The Rookie Fighters

May 19, 2025

Ufc 313 Preview A Deep Dive Into The Rookie Fighters

May 19, 2025 -

Eurovision 2025 Protest Resilience And Austrias Jj

May 19, 2025

Eurovision 2025 Protest Resilience And Austrias Jj

May 19, 2025 -

Hollywoods Transformation Kristen Stewart At The Forefront

May 19, 2025

Hollywoods Transformation Kristen Stewart At The Forefront

May 19, 2025 -

Den Pagaende Debatten Mellan Pedro Pascal Och J K Rowling

May 19, 2025

Den Pagaende Debatten Mellan Pedro Pascal Och J K Rowling

May 19, 2025 -

Is This The Loneliest Generation An Interview With Dr John Delony

May 19, 2025

Is This The Loneliest Generation An Interview With Dr John Delony

May 19, 2025