The Impact Of Oil Supply Disruptions On Air Travel And Airlines

Table of Contents

The Direct Impact of Rising Fuel Costs on Airlines

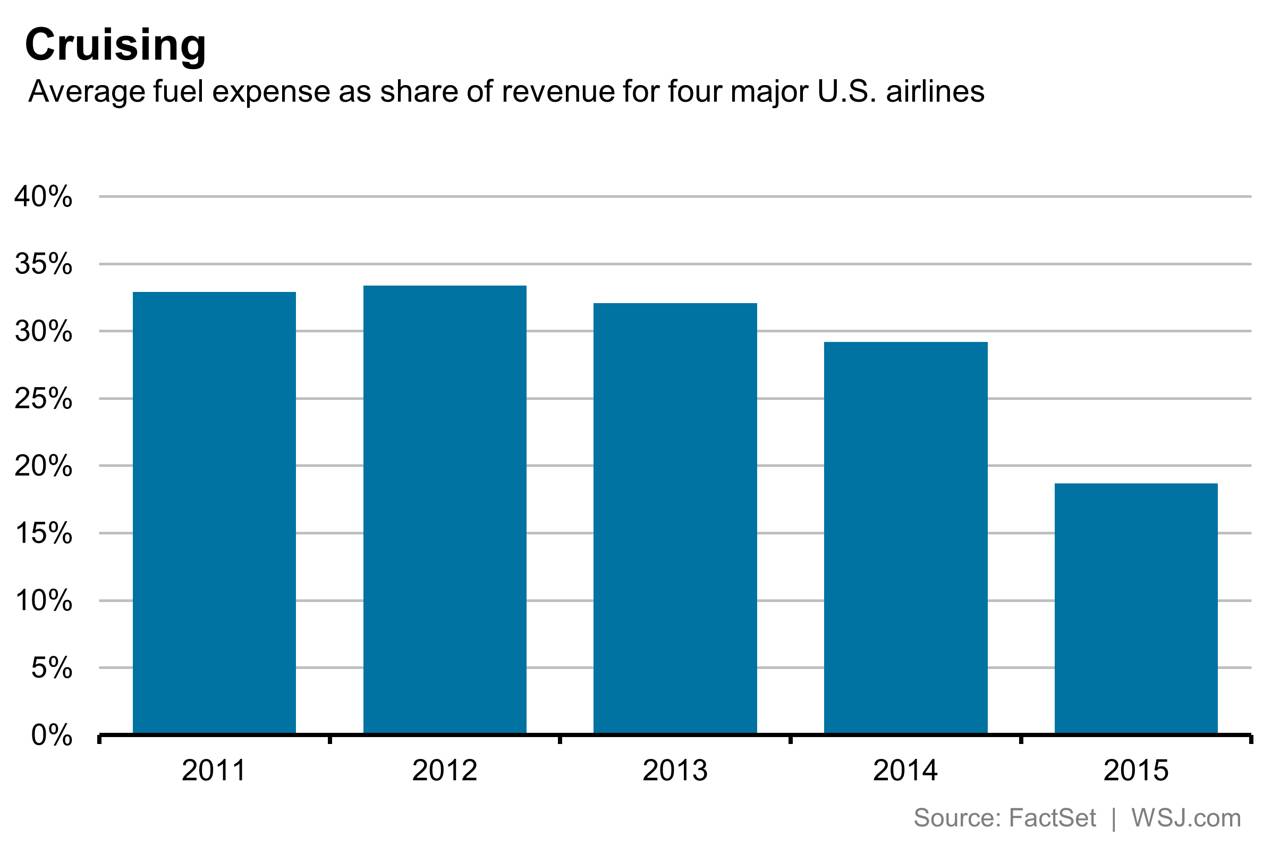

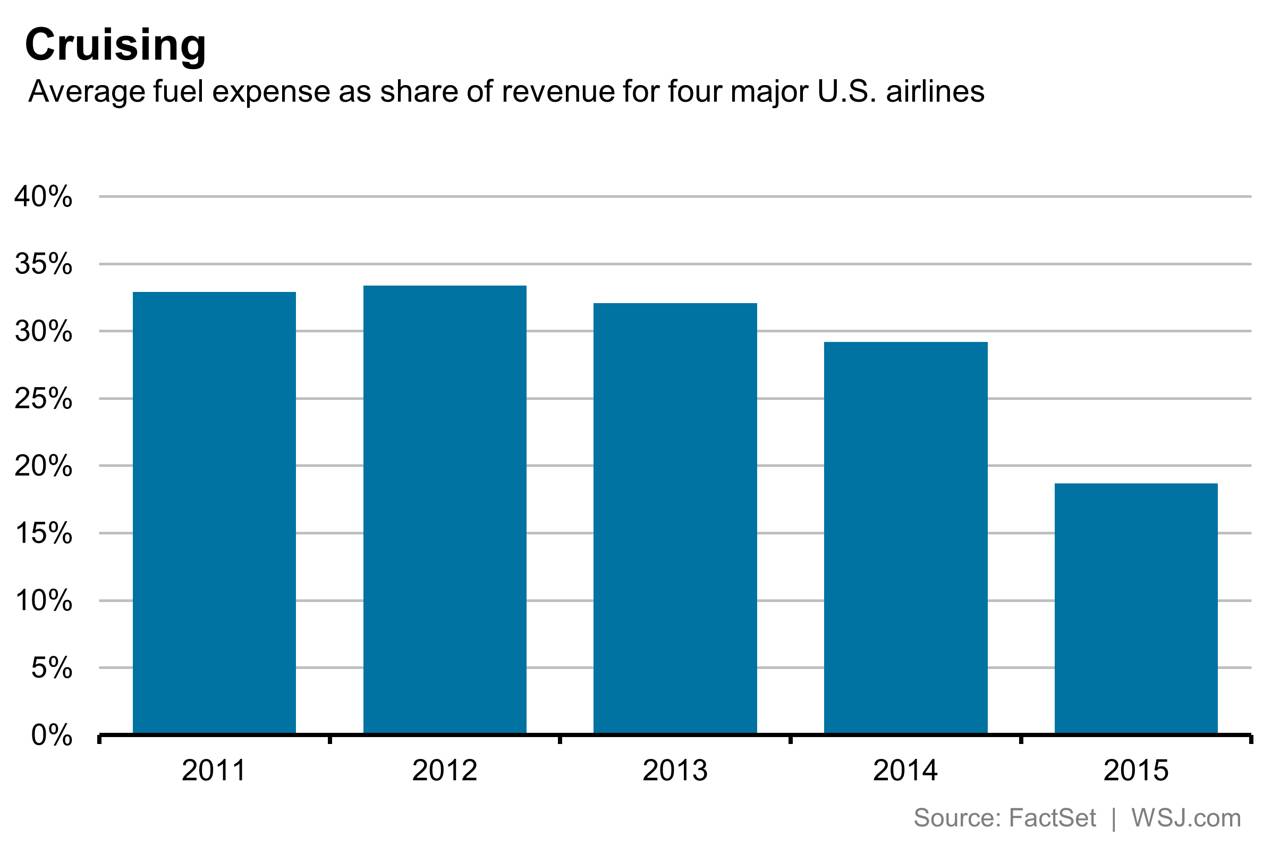

Oil price increases directly translate to higher operational costs for airlines. Aviation fuel prices represent a significant portion of an airline's operating expenses, often second only to labor costs. This makes the industry exceptionally sensitive to volatility in the oil market. Airlines, unlike many businesses, can't easily pass on all increased costs to consumers, especially in a competitive market.

- Increased fuel costs represent a significant portion of airline operating expenses. Estimates frequently place this figure between 20% and 40% of total operating costs, varying by airline size, route type, and aircraft efficiency.

- Airlines have limited ability to immediately pass on all increased costs to consumers. Competition from other airlines and the price elasticity of demand for air travel limit an airline's ability to fully recover increased fuel costs through higher airfares. A sudden spike in oil prices can severely squeeze profit margins.

- Impact on profit margins and potential for reduced investments in fleet modernization and expansion. Reduced profitability can force airlines to delay or cancel plans for upgrading their fleets with more fuel-efficient aircraft, hindering efforts to improve sustainability and reduce long-term fuel costs. Expansion plans, including opening new routes or increasing flight frequency, may also be put on hold.

- Examples of airlines impacted by previous oil price shocks. Numerous historical examples demonstrate the significant impact of oil price spikes on airline profitability. During periods of high oil prices, many airlines experienced reduced profits, necessitating cost-cutting measures and even bankruptcies in some cases.

Related Keywords: Aviation fuel prices, airline fuel hedging, operating costs, profitability, airline finance.

The Impact on Flight Schedules and Routes

High fuel prices often force airlines to make difficult decisions regarding their flight schedules and routes. To maintain profitability in the face of increased operating costs, airlines might implement several strategies.

- Reduced frequency of flights on less profitable routes. Airlines may reduce the number of flights on less-traveled routes, particularly those with lower passenger loads and higher operational costs.

- Consolidation of routes, leading to fewer choices for passengers. Similar routes might be merged, reducing the overall number of choices available to passengers. This can impact competition and potentially increase airfares on the remaining routes.

- Potential for route cancellations, especially on longer, less-populated routes. Long-haul flights are particularly susceptible to fuel price increases, as they consume significantly more fuel. Airlines may be forced to cancel less profitable long-haul routes altogether.

- Impact on regional connectivity and accessibility. The reduction or cancellation of routes, especially in less densely populated areas, can significantly impact regional connectivity and accessibility, creating difficulties for travelers in those regions.

Related Keywords: Flight cancellations, route optimization, airline scheduling, network planning.

The Effect on Airfares and Passenger Demand

The relationship between oil price increases and airfare increases is complex. While airlines attempt to pass on increased fuel costs through higher airfares, the degree to which they can do so depends on several factors.

- Airlines pass on some increased fuel costs to passengers through higher airfares. However, this rarely represents a one-to-one correlation, as airlines carefully consider the price elasticity of demand for air travel.

- The impact on passenger demand – price elasticity of demand for air travel. Higher airfares can lead to a decrease in passenger demand, particularly for leisure travel, as consumers become more price-sensitive. Business travel tends to be less affected by price increases.

- Potential for a decrease in leisure travel due to higher prices. Price-sensitive leisure travelers are likely to postpone or cancel trips when airfares rise significantly, resulting in lower passenger numbers for airlines.

- The role of ancillary revenue in offsetting fuel costs. Airlines are increasingly relying on ancillary revenue (baggage fees, seat selection, etc.) to help offset increased fuel costs and maintain profitability.

Related Keywords: Airfare prices, passenger demand, air travel costs, ancillary revenue, airline pricing strategies.

The Broader Economic Consequences

Oil supply disruptions in the aviation sector have far-reaching economic ramifications that extend beyond the airlines themselves.

- Impact on tourism and hospitality sectors. Reduced air travel due to higher prices or route cancellations can negatively affect the tourism and hospitality industries, leading to decreased revenue and potential job losses in those sectors.

- Job losses within the aviation industry and related businesses. Airlines might be forced to reduce staff or implement hiring freezes in response to financial pressures caused by rising fuel costs. This effect cascades down to related businesses, such as ground handling services, maintenance providers, and airport staff.

- Reduced economic activity due to decreased air travel. Air travel plays a crucial role in global economic activity. Disruptions caused by oil supply shocks can lead to reduced economic activity as trade, tourism, and business travel are affected.

- Geopolitical implications of oil supply disruptions. Oil supply disruptions can have significant geopolitical implications, potentially leading to international tensions and impacting global stability.

Related Keywords: Tourism economics, economic impact, supply chain disruptions, geopolitical risks.

Conclusion

Oil supply disruptions present a significant challenge to the air travel industry. Rising fuel costs directly impact airline profitability, leading to adjustments in flight schedules, airfares, and potentially broader economic consequences. Understanding the complex interplay between oil prices and air travel is crucial for both airlines and passengers. By staying informed about the dynamics of oil supply disruptions and their impact, consumers and industry stakeholders can better navigate this challenging landscape and make informed decisions regarding air travel planning and investment strategies. Managing the volatility of oil price fluctuations is key to the long-term health of the aviation industry.

Featured Posts

-

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025 -

Macron Remonte Par Sardou Un Diner Tendu

May 03, 2025

Macron Remonte Par Sardou Un Diner Tendu

May 03, 2025 -

Tuesdays Snowstorm Four Inches Plus Expected Bitter Cold Predicted

May 03, 2025

Tuesdays Snowstorm Four Inches Plus Expected Bitter Cold Predicted

May 03, 2025 -

Netherlands Largest Heat Pump Utrecht Wastewater Plant Innovation

May 03, 2025

Netherlands Largest Heat Pump Utrecht Wastewater Plant Innovation

May 03, 2025 -

Tuerkiye De 1 Mayis Ve Arbedeler Tarihsel Bir Bakis

May 03, 2025

Tuerkiye De 1 Mayis Ve Arbedeler Tarihsel Bir Bakis

May 03, 2025

Latest Posts

-

3 Arena Loyle Carner Live In Dublin

May 03, 2025

3 Arena Loyle Carner Live In Dublin

May 03, 2025 -

Loyle Carner Fatherhood Influences New Music And Glastonbury Set

May 03, 2025

Loyle Carner Fatherhood Influences New Music And Glastonbury Set

May 03, 2025 -

Loyle Carners Glastonbury Performance And New Music A Fathers Perspective

May 03, 2025

Loyle Carners Glastonbury Performance And New Music A Fathers Perspective

May 03, 2025 -

A Grieving Familys Tribute To Poppy A Beloved Manchester United Fan

May 03, 2025

A Grieving Familys Tribute To Poppy A Beloved Manchester United Fan

May 03, 2025 -

Loyle Carner Fatherhood New Album And Glastonbury

May 03, 2025

Loyle Carner Fatherhood New Album And Glastonbury

May 03, 2025