The Impact Of PwC's Withdrawal From Sub-Saharan Africa

Table of Contents

Impact on the Auditing and Accounting Landscape in Sub-Saharan Africa

PwC's significant presence in Sub-Saharan Africa meant more than just providing accounting services; it represented a cornerstone of the region's auditing infrastructure. Its departure creates a ripple effect with profound consequences.

Reduced Competition and Potential for Increased Prices

PwC's exit diminishes competition, potentially leading to higher audit fees and reduced choice for businesses across the continent. This is especially problematic for:

- Smaller businesses: With limited resources, they are most vulnerable to price increases and may struggle to find affordable, high-quality audit services.

- Startups and SMEs: These burgeoning sectors rely heavily on access to affordable and reliable auditing to attract investors and secure funding. Increased costs can stifle growth.

- Non-profit organizations: These organizations, often dependent on external funding, face similar challenges to smaller businesses due to increased costs.

The potential for monopolies or oligopolies to form among the remaining audit firms is a serious concern, hindering market efficiency and potentially leading to price gouging. This lack of competitive pressure can ultimately harm the integrity and transparency of financial reporting in the region.

Loss of Expertise and Capacity Building

Beyond the immediate impact on pricing, PwC's withdrawal represents a significant loss of expertise and training opportunities for local professionals. This includes:

- Reduced mentorship opportunities: PwC's experienced professionals provided valuable mentorship and training for younger accountants. Their absence creates a skills gap.

- Decreased skills development: The firm offered specialized training programs in areas like IFRS (International Financial Reporting Standards) and auditing best practices. This crucial training is now diminished.

- Challenges for succession planning: The loss of experienced personnel within local accounting firms hinders the ability to build a strong pipeline of future accounting leaders.

This loss of expertise hampers the development of a robust and independent accounting profession in Sub-Saharan Africa, which is crucial for long-term economic growth and stability.

Economic and Investment Implications of PwC's Departure

The ramifications of PwC's withdrawal extend beyond the accounting sector, impacting the broader economic landscape and investment climate.

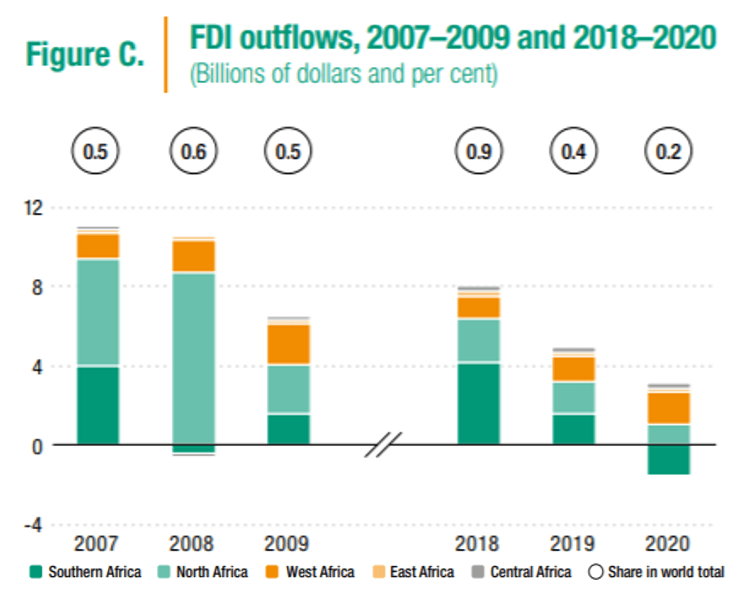

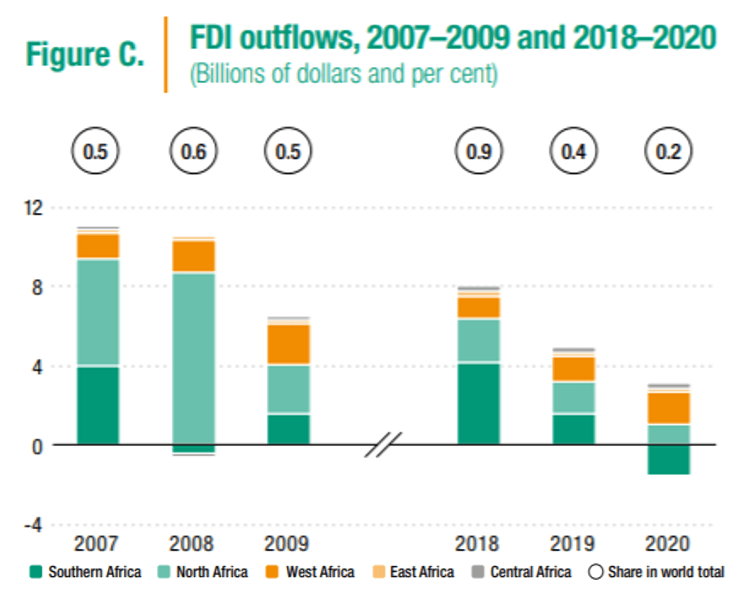

Impact on Foreign Direct Investment (FDI)

The withdrawal may negatively influence investor confidence, potentially deterring Foreign Direct Investment (FDI). This is because:

- Concerns about regulatory frameworks: Investors may perceive the withdrawal as a sign of weakness or instability in the regulatory environment of certain Sub-Saharan African countries.

- Decreased trust in local accounting practices: The perception of reduced audit quality, due to decreased competition and expertise, can lead to a decreased trust in financial reporting.

- Impact on multinational corporations’ decisions to invest: Multinational corporations (MNCs) often rely on the presence of major international audit firms to mitigate risks associated with international investments.

This perception of increased risk associated with investing in the region can significantly impact capital flows and economic growth.

Effects on Economic Growth and Development

Reduced audit quality and increased costs can hinder economic growth and development efforts in several ways:

- Impacts on access to capital for businesses: Higher audit fees and reduced investor confidence can limit access to credit and financing for businesses, hindering expansion and job creation.

- Reduced transparency and accountability: A weakened audit function can lead to reduced transparency and accountability in financial reporting, potentially fueling corruption and hindering good governance.

- Challenges for sustainable development goals: Economic stability and robust financial reporting are fundamental for achieving sustainable development goals (SDGs), particularly those related to economic growth, infrastructure, and good governance.

The potential ripple effect on related industries and overall economic stability is a significant concern.

Responses and Adaptations to PwC's Withdrawal

While PwC's withdrawal presents challenges, it also creates opportunities for other firms and necessitates adjustments in policy and regulation.

Increased Role for Regional and Local Accounting Firms

The withdrawal creates opportunities for regional and local accounting firms to expand their services and market share. However, this presents both:

- Increased demand for services: Existing local firms are now faced with a significant increase in demand.

- Need for capacity building within local firms: Meeting this increased demand requires investment in training, technology, and personnel to maintain quality.

- Potential for mergers and acquisitions: Local firms may seek to consolidate to gain scale and compete effectively.

These firms must successfully navigate these challenges and demonstrate their capability to fill the gap left by PwC.

Regulatory Response and Policy Implications

Governments in Sub-Saharan Africa must actively respond to the changes in the auditing landscape. This includes:

- Strengthening regulatory oversight: Governments need to enhance the regulatory framework governing the accounting profession, ensuring standards are maintained and competition is fostered.

- Enhancing professional standards: Increased focus on training and professional development programs will help maintain and improve accounting standards.

- Promoting competition among remaining firms: Proactive measures can ensure a healthy competitive landscape to avoid the formation of monopolies.

These proactive government initiatives are crucial to mitigate the negative impacts of PwC's withdrawal.

Conclusion

PwC's withdrawal from Sub-Saharan Africa presents significant challenges and opportunities. The reduction in competition within the auditing sector, the loss of expertise, and the potential impact on FDI are considerable concerns. However, the void created also provides a chance for regional and local firms to grow and strengthen their capabilities. Governments and industry stakeholders must actively work to mitigate the negative consequences and ensure a stable and robust accounting environment. Understanding the impact of PwC's withdrawal from Sub-Saharan Africa is crucial for navigating this changing landscape and fostering sustainable economic development in the region. Moving forward, proactive strategies addressing the challenges and seizing the opportunities will be key to the future of accounting and business in Sub-Saharan Africa.

Featured Posts

-

Assessing Pitchers Name S Case For A Mets Rotation Position

Apr 29, 2025

Assessing Pitchers Name S Case For A Mets Rotation Position

Apr 29, 2025 -

Fhi Adhd Medisinens Begrensede Effekt Pa Skoleprestasjoner

Apr 29, 2025

Fhi Adhd Medisinens Begrensede Effekt Pa Skoleprestasjoner

Apr 29, 2025 -

Bombshell Report On Black Hawk Jet Crash Key Findings And Analysis Of The 67 Fatalities

Apr 29, 2025

Bombshell Report On Black Hawk Jet Crash Key Findings And Analysis Of The 67 Fatalities

Apr 29, 2025 -

Donald Trump Promises Pete Rose A Posthumous Pardon After Mlb Decision

Apr 29, 2025

Donald Trump Promises Pete Rose A Posthumous Pardon After Mlb Decision

Apr 29, 2025 -

Delays In Kentucky Storm Damage Assessments Understanding The Challenges

Apr 29, 2025

Delays In Kentucky Storm Damage Assessments Understanding The Challenges

Apr 29, 2025

Latest Posts

-

Unexpected Family Nba Legend And Ru Pauls Drag Race Star

Apr 30, 2025

Unexpected Family Nba Legend And Ru Pauls Drag Race Star

Apr 30, 2025 -

Zaschita Na Kulturnoto Nasledstvo Kmett Na Khisarya Trsi Sredstva Za Trakiyskite Khramove

Apr 30, 2025

Zaschita Na Kulturnoto Nasledstvo Kmett Na Khisarya Trsi Sredstva Za Trakiyskite Khramove

Apr 30, 2025 -

Charles Barkleys Unforeseen Relationship With A Ru Pauls Drag Race Star

Apr 30, 2025

Charles Barkleys Unforeseen Relationship With A Ru Pauls Drag Race Star

Apr 30, 2025 -

Ru Pauls Drag Race Uncovering An Nba Legends Hidden Connection

Apr 30, 2025

Ru Pauls Drag Race Uncovering An Nba Legends Hidden Connection

Apr 30, 2025 -

Where To Stream Untucked Ru Pauls Drag Race Season 16 Episode 11 For Free Legally

Apr 30, 2025

Where To Stream Untucked Ru Pauls Drag Race Season 16 Episode 11 For Free Legally

Apr 30, 2025