The Impact Of Tariffs On Brookfield's US Manufacturing Strategy

Table of Contents

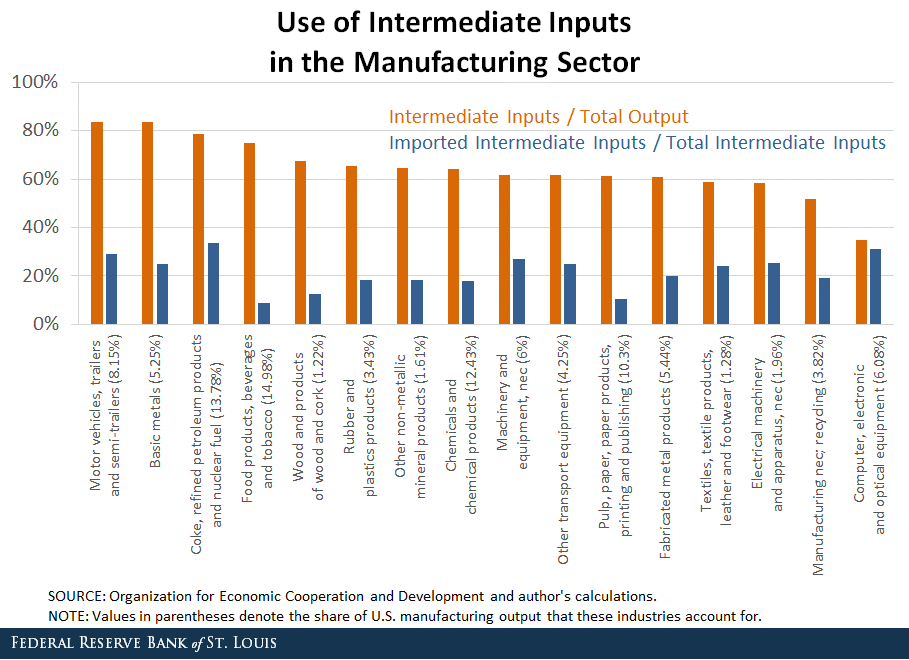

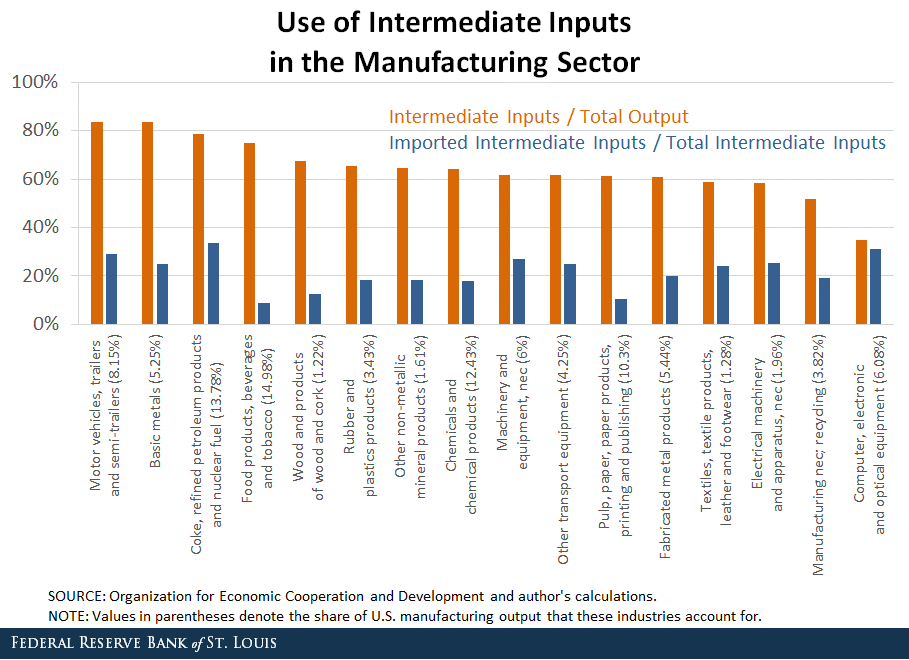

Increased Input Costs and Price Competitiveness

Tariffs on imported materials, including steel, essential components, and raw materials, directly increase production costs for Brookfield's US manufacturing facilities. This has several significant consequences:

-

Higher raw material prices reduce profit margins. The added tariff expense translates to a direct reduction in profitability, impacting the bottom line of Brookfield's manufacturing operations. This necessitates careful cost analysis and potentially price adjustments to maintain profitability.

-

Increased prices may reduce competitiveness against foreign manufacturers. Passing increased costs onto consumers through higher prices can make Brookfield's products less competitive in the global marketplace, particularly against manufacturers in countries without similar tariffs. This potential loss of market share requires a strategic response.

-

Potential for decreased market share in the face of global competition. If Brookfield cannot effectively manage increased costs, it risks losing market share to competitors who may have access to cheaper imported materials or operate in regions with more favorable trade policies.

To mitigate these cost increases, Brookfield may adopt several strategies:

- Domestic sourcing: Shifting to domestically produced materials whenever feasible reduces reliance on imported goods subject to tariffs.

- Negotiating with suppliers: Stronger relationships with suppliers can lead to better pricing and potentially shared burden of tariff costs.

- Investing in automation and technology: Automation can improve efficiency and reduce labor costs, offsetting some of the tariff-induced price increases.

Reshoring and Nearshoring Initiatives

Tariffs incentivize companies to reconsider their global manufacturing footprint. For Brookfield, this translates to increased consideration of reshoring (bringing manufacturing back to the US) and nearshoring (moving manufacturing to countries closer to the US).

-

Cost-benefit analysis of reshoring/nearshoring: Brookfield must carefully weigh the costs of establishing or upgrading US-based facilities against the potential savings from avoiding tariffs. Labor costs, infrastructure investment, and transportation expenses are key factors in this decision-making process.

-

Investment in new facilities or upgrades to existing ones: Reshoring and nearshoring require significant capital investment in new factories, equipment upgrades, and potentially workforce training.

-

Potential challenges associated with reshoring: Reshoring can present challenges, including higher labor costs in the US compared to some other countries, and potential infrastructure limitations.

The impact on employment and the US economy is substantial. Reshoring efforts can create jobs and boost domestic manufacturing, contributing positively to the national economy.

Impact on Supply Chain Management and Diversification

Tariffs significantly impact Brookfield's supply chain management. The increased complexity necessitates several strategic adjustments:

-

Increased complexity in sourcing and logistics: Navigating tariff regulations and managing multiple sourcing options adds significant complexity to supply chain operations.

-

Need for greater supply chain diversification to mitigate risks: To avoid over-reliance on any single supplier or source country, Brookfield needs to diversify its supply chain, reducing vulnerability to disruptions caused by tariff changes or other geopolitical events.

-

Exploration of alternative sourcing strategies and partnerships: Developing strategic partnerships with suppliers and exploring alternative sourcing regions are crucial to ensuring a resilient and cost-effective supply chain.

Technology plays a crucial role in enhancing supply chain visibility and resilience. Real-time tracking, data analytics, and predictive modeling can help Brookfield anticipate and mitigate disruptions.

Government Policies and Regulatory Compliance

Navigating the ever-changing landscape of government policies and regulations related to tariffs is crucial for Brookfield.

-

Navigating the complexities of tariff regulations and compliance requirements: Understanding and complying with complex tariff regulations requires dedicated resources and expertise.

-

Lobbying efforts and engagement with policymakers: Brookfield may engage in lobbying efforts to advocate for policies that support its interests and the broader manufacturing sector.

-

Assessment of the long-term stability of the regulatory environment: Predicting future tariff policies is challenging, demanding careful risk assessment and proactive planning to adapt to potential shifts.

Effective risk management strategies are vital for mitigating the impact of unpredictable regulatory changes.

Long-Term Strategic Implications for Brookfield's US Manufacturing Portfolio

The long-term effects of tariffs on Brookfield's US manufacturing investments and future strategy are significant.

-

Adaptation of business models to account for tariff volatility: Brookfield needs to develop flexible business models that can adapt to fluctuations in tariff rates and other geopolitical factors.

-

Potential for mergers and acquisitions to consolidate market share: Strategic acquisitions could help Brookfield gain market share and enhance its competitive position in the face of tariff-related challenges.

-

Focus on innovation and technological advancements to enhance competitiveness: Investing in innovation and technological advancements will allow Brookfield to improve efficiency, reduce costs, and develop new products to maintain its competitive edge.

Ultimately, the impact of tariffs on Brookfield's US manufacturing portfolio significantly affects shareholder value and investment returns. Careful planning and adaptation are crucial for navigating this evolving landscape.

Conclusion

This article has examined the profound impact of tariffs on Brookfield's US manufacturing strategy, covering increased input costs, reshoring initiatives, supply chain complexities, and regulatory considerations. The long-term implications for Brookfield's investments and its future strategic direction are substantial and demand continuous adaptation and proactive management. Understanding the impact of tariffs on Brookfield's US manufacturing strategy is crucial for investors and stakeholders. Staying informed about evolving tariff policies and their influence on global manufacturing is essential for making informed decisions and mitigating potential risks. Further research into Brookfield's specific responses to tariffs and their broader impact on the US manufacturing sector is strongly recommended.

Featured Posts

-

Priscilla Pointer Dies At 100 Amy Irvings Mother And Carrie Star Passes Away

May 02, 2025

Priscilla Pointer Dies At 100 Amy Irvings Mother And Carrie Star Passes Away

May 02, 2025 -

Priscilla Pointer Carrie Actress And Daughters Co Star Dies At 100

May 02, 2025

Priscilla Pointer Carrie Actress And Daughters Co Star Dies At 100

May 02, 2025 -

Officieel Bram Endedijk Is De Nieuwe Presentator Van Nrc Vandaag

May 02, 2025

Officieel Bram Endedijk Is De Nieuwe Presentator Van Nrc Vandaag

May 02, 2025 -

Facelift Fears Fan Backlash Over Stars Unrecognizable Photoshoot

May 02, 2025

Facelift Fears Fan Backlash Over Stars Unrecognizable Photoshoot

May 02, 2025 -

Addressing The Urgent Mental Health Needs Of Young Canadians Global Lessons

May 02, 2025

Addressing The Urgent Mental Health Needs Of Young Canadians Global Lessons

May 02, 2025

Latest Posts

-

High Public Trust In South Carolina Elections 93 Approval

May 02, 2025

High Public Trust In South Carolina Elections 93 Approval

May 02, 2025 -

Sc Election Results 93 Of Respondents Express Confidence

May 02, 2025

Sc Election Results 93 Of Respondents Express Confidence

May 02, 2025 -

South Carolina Election Integrity A 93 Confidence Rate

May 02, 2025

South Carolina Election Integrity A 93 Confidence Rate

May 02, 2025 -

Examining Maines Inaugural Post Election Audit

May 02, 2025

Examining Maines Inaugural Post Election Audit

May 02, 2025 -

Post Election Audit Pilot Program Begins In Maine

May 02, 2025

Post Election Audit Pilot Program Begins In Maine

May 02, 2025