The Impact Of Tariffs On IPO Activity: Current State And Future Outlook

Table of Contents

The imposition of tariffs, often a byproduct of trade disputes or protectionist policies, significantly impacts global economic conditions. This ripple effect profoundly influences the Initial Public Offering (IPO) market, creating uncertainty and affecting investor sentiment, company valuations, and overall market activity. This article examines the current state and future outlook of IPOs in light of fluctuating tariff regimes, delving into the complexities of this relationship and analyzing potential scenarios for the future.

Current State of IPO Activity Amidst Tariff Uncertainty

Reduced IPO Volume

The increased economic uncertainty caused by tariffs has led to a noticeable decline in IPO filings and successful offerings. Several factors contribute to this reduction:

- Examples: We've seen reduced IPO activity in sectors heavily reliant on international trade, such as manufacturing and technology. The automotive industry, for example, has experienced significant delays in IPO plans due to tariff-related anxieties.

- Statistical Data: A comparison of IPO volume in 2022 with pre-tariff periods (e.g., 2017) reveals a substantial drop, with a percentage decrease highlighting the impact of trade wars on investor confidence. (Note: Specific data would need to be inserted here based on current market conditions and reputable sources.)

- Expert Opinions: Financial analysts and market experts widely agree that tariff uncertainty is a major deterrent for companies considering an IPO. The difficulty in predicting future earnings in a volatile tariff environment contributes to this hesitancy. Many companies are choosing to delay their IPOs until the trade landscape becomes clearer.

Impact on Company Valuations

Tariffs directly affect company profitability and, consequently, their IPO valuations. Increased input costs due to tariffs force companies to:

- Increased Input Costs: Companies face higher costs for imported raw materials or components, squeezing profit margins.

- Pricing Strategies: Companies must decide whether to absorb these increased costs, reducing profitability, or pass them onto consumers, potentially impacting sales volume.

- Consistent Revenue Growth: Demonstrating consistent revenue growth to investors becomes significantly more challenging in a tariff-volatile environment, making accurate valuation difficult.

Companies with high import/export reliance are particularly vulnerable. For example, a manufacturer heavily dependent on imported steel will see its valuation impacted directly by steel tariffs. Analysts are adapting their valuation methodologies to account for these tariff-related risks, but the process remains complex and often results in lower valuations.

Investor Sentiment and Risk Aversion

Trade war uncertainties have significantly shifted investor behavior, leading to increased risk aversion:

- Investor Hesitancy: Investors are less willing to invest in volatile markets, preferring safer alternatives.

- Decreased Market Liquidity: Reduced IPO activity contributes to decreased market liquidity, making it harder to buy or sell shares quickly and easily.

- Investment Strategies: Many investors are adopting a wait-and-see approach, delaying investment decisions until the tariff situation becomes clearer.

The inherent difficulty in predicting the long-term growth of IPOs under conditions of high uncertainty contributes to this wait-and-see attitude. Investors are understandably hesitant to commit capital to companies facing significant, unpredictable trade-related challenges.

Sector-Specific Impacts of Tariffs on IPOs

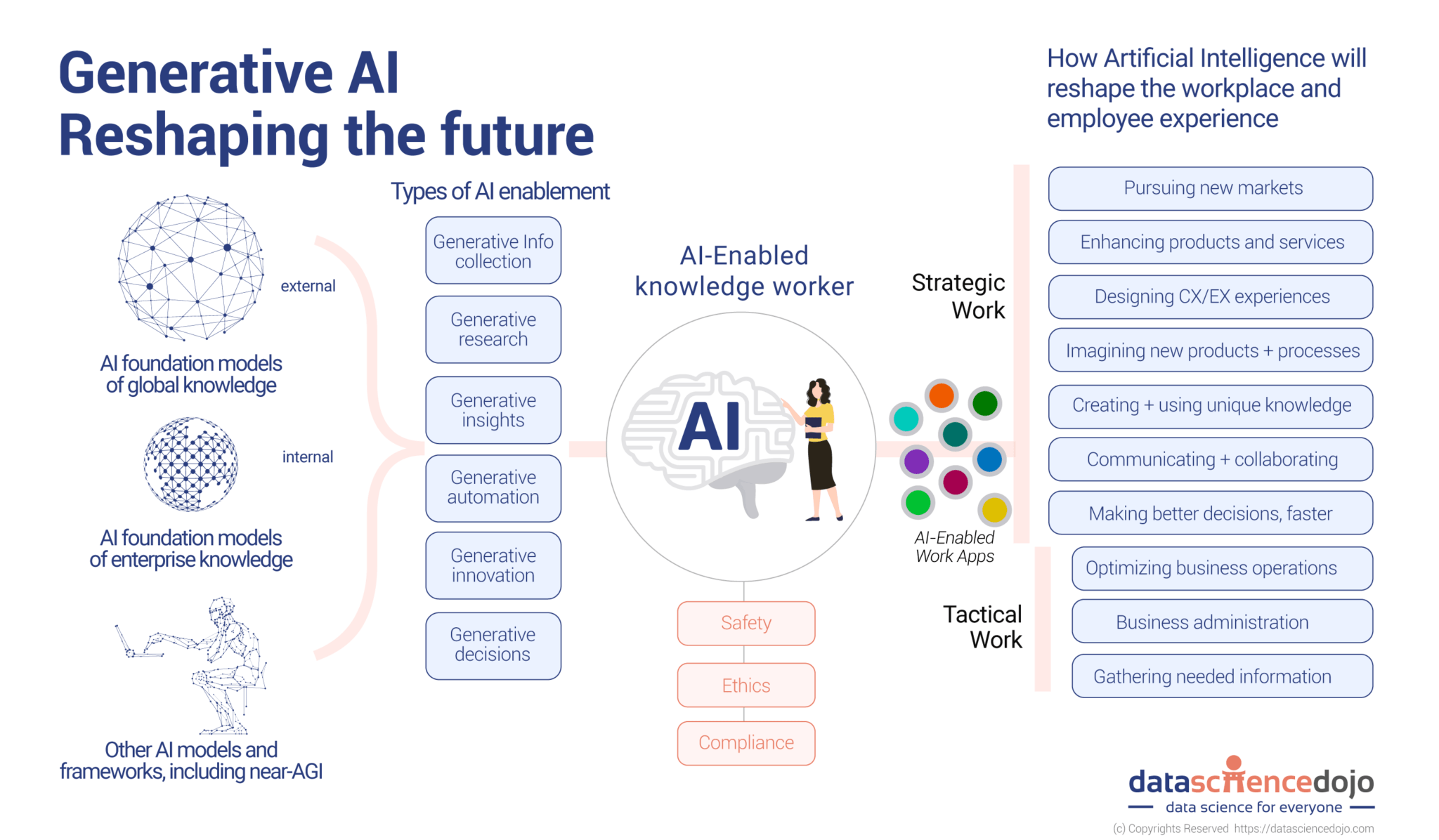

Manufacturing and Technology

The manufacturing and technology sectors, highly dependent on international trade, experience a disproportionate impact from tariffs:

- Specific Examples: Companies involved in global supply chains, such as electronics manufacturers reliant on imported components, have been directly impacted.

- Supply Chain Disruptions: Tariffs often disrupt supply chains, leading to delays, increased costs, and decreased efficiency.

- Impact on Innovation and Investment: Uncertainty about future tariff policies discourages investment in research and development, hindering innovation.

The interconnectedness of global supply chains means that even a seemingly small tariff increase can have far-reaching consequences, affecting numerous companies across different sectors.

Consumer Goods and Retail

Changes in tariff policies significantly influence consumer spending and the IPO market for consumer goods and retail companies:

- Increased Prices: Tariffs increase the prices of imported goods, reducing consumer purchasing power.

- Impact on Profitability: Retail companies face pressure to maintain sales volume while managing higher input costs.

- Effect on IPO Valuations: Reduced consumer demand and profit margins directly impact the valuations of companies considering an IPO.

The retail sector is highly sensitive to macroeconomic conditions, and tariff-induced price increases can cause a ripple effect throughout the entire industry.

Future Outlook and Potential Scenarios

Resolution of Trade Disputes

Resolving trade disputes would have a profoundly positive impact on future IPO activity:

- Increased IPO Volume: A more stable trade environment would likely lead to a significant increase in the number of IPOs.

- Increased Valuations: Greater certainty would result in higher company valuations, as investors would be more willing to take on risk.

- Improved Investor Sentiment: Confidence in the market would improve, attracting more investment.

- Positive Economic Indicators: Resolution of trade conflicts would likely lead to other positive economic indicators, further bolstering investor sentiment.

A predictable trade environment is crucial for fostering confidence and encouraging companies to pursue IPOs.

Continued Tariff Uncertainty

Prolonged tariff uncertainty, conversely, would lead to further stagnation in the IPO market:

- Persistence of Low IPO Activity: Companies would remain hesitant to go public due to unpredictable costs and uncertain market conditions.

- Stagnation in Valuations: Continued uncertainty would likely keep valuations low, deterring companies from pursuing IPOs.

- Continued Investor Hesitancy: Investor risk aversion would persist, reducing investment in IPOs.

- Potential for Market Corrections: Prolonged economic uncertainty could trigger market corrections, further dampening IPO activity.

The longer the uncertainty persists, the greater the risk of a prolonged downturn in IPO activity.

Conclusion

The impact of tariffs on IPO activity is multifaceted and significant. The current state reveals a clear correlation between increased trade protectionism and reduced IPO activity, impacted company valuations, and heightened investor uncertainty. While resolving trade disputes promises a more optimistic future for IPOs, continued tariff uncertainty could lead to further stagnation. Understanding the intricate relationship between tariffs and the IPO market is crucial for investors, companies considering an IPO, and policymakers alike. Staying informed about evolving tariff policies and their potential impact is vital for navigating this complex landscape and making informed decisions concerning tariff-related risks and opportunities in the IPO market.

Featured Posts

-

Captain America Brave New World Where To Watch On Pvod Online

May 14, 2025

Captain America Brave New World Where To Watch On Pvod Online

May 14, 2025 -

Daria Kasatkinas Australian Debut Wta Rankings Reveal New Chapter

May 14, 2025

Daria Kasatkinas Australian Debut Wta Rankings Reveal New Chapter

May 14, 2025 -

Povernennya Damiano Davida Na Yevrobachennya Fakti Ta Chutki

May 14, 2025

Povernennya Damiano Davida Na Yevrobachennya Fakti Ta Chutki

May 14, 2025 -

Cross National Collaboration Reshaping The Eurovision Landscape

May 14, 2025

Cross National Collaboration Reshaping The Eurovision Landscape

May 14, 2025 -

9 Massive Hollyoaks Spoilers For Next Weeks Episodes

May 14, 2025

9 Massive Hollyoaks Spoilers For Next Weeks Episodes

May 14, 2025

Latest Posts

-

Analiza Dokovicevih Rekorda Prevazilazenje Federerove Ere

May 14, 2025

Analiza Dokovicevih Rekorda Prevazilazenje Federerove Ere

May 14, 2025 -

Cosas Que Hacer En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Cosas Que Hacer En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025 -

Dokovic Rusenje Federerove Kule Od Karata U Svetu Tenisa

May 14, 2025

Dokovic Rusenje Federerove Kule Od Karata U Svetu Tenisa

May 14, 2025 -

Ocio En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025

Ocio En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025 -

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025