The Impact Of The Bond Crisis On Global Markets

Table of Contents

Rising Interest Rates and their Effect on Bond Yields

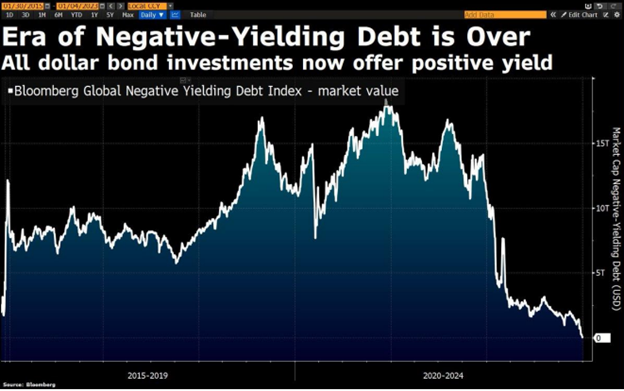

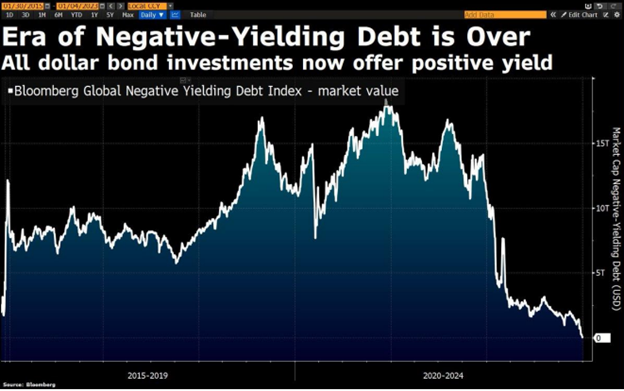

The core of the current bond crisis lies in the inverse relationship between bond prices and interest rates. As central banks globally combat inflation through aggressive interest rate hikes, bond yields rise. This means that existing bonds, offering a fixed interest rate, become less attractive compared to newer bonds offering higher yields. This dynamic is impacting various bond types differently. Government bonds, traditionally considered safe haven assets, are seeing reduced demand, leading to price declines. Corporate bonds, already facing increased scrutiny due to economic uncertainty, are experiencing even higher yields as investors demand greater compensation for the increased risk.

- Increased borrowing costs for governments and corporations: Higher interest rates translate to significantly higher borrowing costs for governments, potentially impacting public spending and economic growth. Corporations face similar challenges, hindering investment and potentially leading to job losses.

- Reduced investor demand for bonds: The appeal of bonds diminishes as interest rates climb, prompting investors to seek higher returns elsewhere, further driving down bond prices.

- Potential for defaults and credit downgrades: For highly indebted corporations and governments, increased borrowing costs can strain budgets and increase the risk of default, leading to credit rating downgrades and further market instability. This risk is particularly acute in emerging markets with high levels of dollar-denominated debt.

Impact on Equity Markets

The bond market and the equity market are intricately linked. Rising interest rates and the uncertainty surrounding the bond crisis have a direct impact on stock valuations. Higher interest rates increase the cost of capital for companies, reducing their profitability and potentially impacting future earnings forecasts. This negative sentiment often leads to a sell-off in equity markets.

- Decreased investor confidence leading to stock market sell-offs: Uncertainty surrounding the bond crisis erodes investor confidence, prompting them to move away from riskier assets like stocks.

- Reduced corporate investment due to higher borrowing costs: As borrowing becomes more expensive, companies reduce investment in expansion, research and development, and hiring, leading to slower economic growth.

- Potential for a recession triggered by a weakening equity market: A prolonged and severe downturn in the equity market can trigger a recession, as consumer spending decreases and businesses cut back on operations.

Consequences for the Currency Markets

Bond yields play a significant role in influencing currency exchange rates. Higher bond yields in a particular country attract foreign investment, increasing demand for that country's currency and strengthening it. This effect is intensified during periods of uncertainty, leading to a "flight to safety" phenomenon. Investors move their capital towards perceived safe-haven currencies like the US dollar, Japanese yen, or Swiss franc, pushing these currencies higher while weakening others.

- Strengthening of safe-haven currencies: Currencies of countries with perceived political and economic stability, like the US dollar, benefit from capital inflows during the bond crisis, leading to appreciation.

- Weakening of currencies in countries facing bond market stress: Countries grappling with high debt levels and bond market instability often see their currencies depreciate as investors withdraw capital.

- Increased exchange rate volatility impacting global trade and investment: Fluctuations in currency values create uncertainty for businesses involved in international trade and investment, hindering economic growth.

Impact on Emerging Markets

Emerging markets are particularly vulnerable to global bond market shocks. These economies often rely heavily on foreign investment and are susceptible to capital flight during periods of uncertainty. Rising global interest rates increase borrowing costs for emerging market governments, making it more challenging to service their debt.

- Increased borrowing costs for emerging market governments: Higher global interest rates translate to higher borrowing costs for emerging markets, potentially leading to debt distress.

- Potential for sovereign debt crises: Countries with high levels of external debt face a higher risk of sovereign debt crises, potentially triggering economic and political instability.

- Reduced foreign investment flows: Uncertainty in the global bond market discourages foreign investment in emerging markets, hindering their economic growth and development.

Conclusion: Navigating the Uncertainties of the Global Bond Crisis

The current bond crisis has far-reaching consequences for global markets. The interconnectedness of equity, currency, and emerging markets means that the effects of this crisis are amplified and spread rapidly. The uncertainty surrounding the future trajectory of interest rates and the potential for further economic slowdown presents significant risks for investors and businesses.

To navigate these complexities, it’s crucial to stay informed about the evolving bond market situation. Understanding the nuances of interest rate risk and portfolio diversification is paramount. We strongly recommend seeking professional financial advice to assess your personal risk tolerance and make informed investment decisions in the face of this global bond crisis. Further reading on the global economic outlook, interest rate risk management, and effective portfolio diversification strategies will enhance your understanding and help you mitigate potential losses.

Featured Posts

-

Broadway Showdown Clooney And Jackman To Clash

May 28, 2025

Broadway Showdown Clooney And Jackman To Clash

May 28, 2025 -

Marlins Defeat Cubs Stowers Two Home Runs And Weathers Strong Pitching

May 28, 2025

Marlins Defeat Cubs Stowers Two Home Runs And Weathers Strong Pitching

May 28, 2025 -

Dodgers Vs Diamondbacks Prediction A Look At Las Chances

May 28, 2025

Dodgers Vs Diamondbacks Prediction A Look At Las Chances

May 28, 2025 -

Arsenal Set For Record Breaking Signing World Class Striker Targeted

May 28, 2025

Arsenal Set For Record Breaking Signing World Class Striker Targeted

May 28, 2025 -

Espana Confirma Su Equipo Para El Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025

Espana Confirma Su Equipo Para El Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025