The Impact Of The US Trade War: China's Efforts To Mask Economic Weakness

Table of Contents

Manipulating Economic Data

Keywords: GDP manipulation, inflation statistics, unemployment figures, data reliability, statistical discrepancies

The reliability of China's economic data has long been a subject of debate. While the government reports consistent GDP growth, inconsistencies emerge when comparing these figures with other key economic indicators. This raises concerns about potential data manipulation aimed at presenting a rosier picture than reality.

- Evidence of inconsistencies: Official growth figures often contrast sharply with indicators like industrial production and consumption data, suggesting a potential gap between reported and actual economic performance. Independent economists frequently cite these discrepancies.

- Biased data collection methods: The lack of transparency in data collection methods fuels suspicion. Critics argue that the methodology may be inherently biased towards reporting higher growth numbers, potentially overlooking or underreporting negative trends.

- Divergence from independent forecasts: Numerous independent economic forecasts consistently project lower growth rates than those officially reported by the Chinese government, further highlighting the potential for manipulation.

- Historical precedent: Past instances of data manipulation in China, albeit on a smaller scale, lend credence to concerns about the current data's accuracy. These past events serve as cautionary tales.

- Implications for investors and policymakers: The unreliability of economic data poses significant challenges for investors making crucial decisions based on these figures. Similarly, international policymakers rely on accurate data for formulating effective economic policies and trade agreements.

The Rise of Hidden Debt and Shadow Banking

Keywords: Shadow banking, non-performing loans (NPLs), hidden debt, financial risk, local government debt, debt-to-GDP ratio

The rapid expansion of China's shadow banking system has created a significant accumulation of hidden debt, adding to the complexity of assessing the country's true economic health. This hidden debt represents a significant systemic risk.

- Shadow banking's role: The shadow banking system, encompassing a range of unregulated financial activities, has facilitated the growth of hidden debt, making it difficult to track and assess.

- Non-performing loans (NPLs): The increasing level of NPLs within the banking system indicates a growing problem of bad debt. This, combined with hidden debt, increases the risk of a financial crisis.

- Local government debt: The extent of local government debt remains largely opaque, posing a challenge to accurately assessing the overall debt-to-GDP ratio and the country's financial stability.

- Implications for economic stability: High levels of hidden debt pose a significant threat to future economic stability, potentially leading to financial instability and slower growth.

- SOEs and debt accumulation: State-owned enterprises (SOEs) play a crucial role in accumulating and masking debt, further obscuring the true state of the economy.

State-Owned Enterprises (SOEs) and Economic Distortions

Keywords: State-Owned Enterprises (SOEs), inefficient allocation of resources, market competition, economic reform, SOE debt, zombie companies

The dominance of SOEs in the Chinese economy has contributed to economic distortions and inefficient resource allocation. While SOEs might artificially boost GDP growth numbers, this comes at a cost.

- Inefficient operations: Many SOEs operate inefficiently due to lack of competition and market pressures, hindering overall economic productivity.

- Propping up growth figures: SOEs can be used to artificially prop up economic growth figures, masking underlying weaknesses in other sectors of the economy.

- Growing debt burden: A significant number of SOEs are burdened with substantial debt, increasing the risk of defaults and further destabilizing the financial system. Many have become “zombie companies,” surviving only on government support.

- Challenges of reform: Reforming SOEs and fostering greater market competition are essential for improving efficiency and promoting sustainable economic growth. However, this process faces significant political and economic challenges.

- Impact on innovation and private sector: The dominance of SOEs can stifle innovation and hinder the growth of the private sector, which is often more dynamic and efficient.

Impact on Foreign Investment

Keywords: Foreign Direct Investment (FDI), trade disputes, investment uncertainty, economic outlook, China's economic future

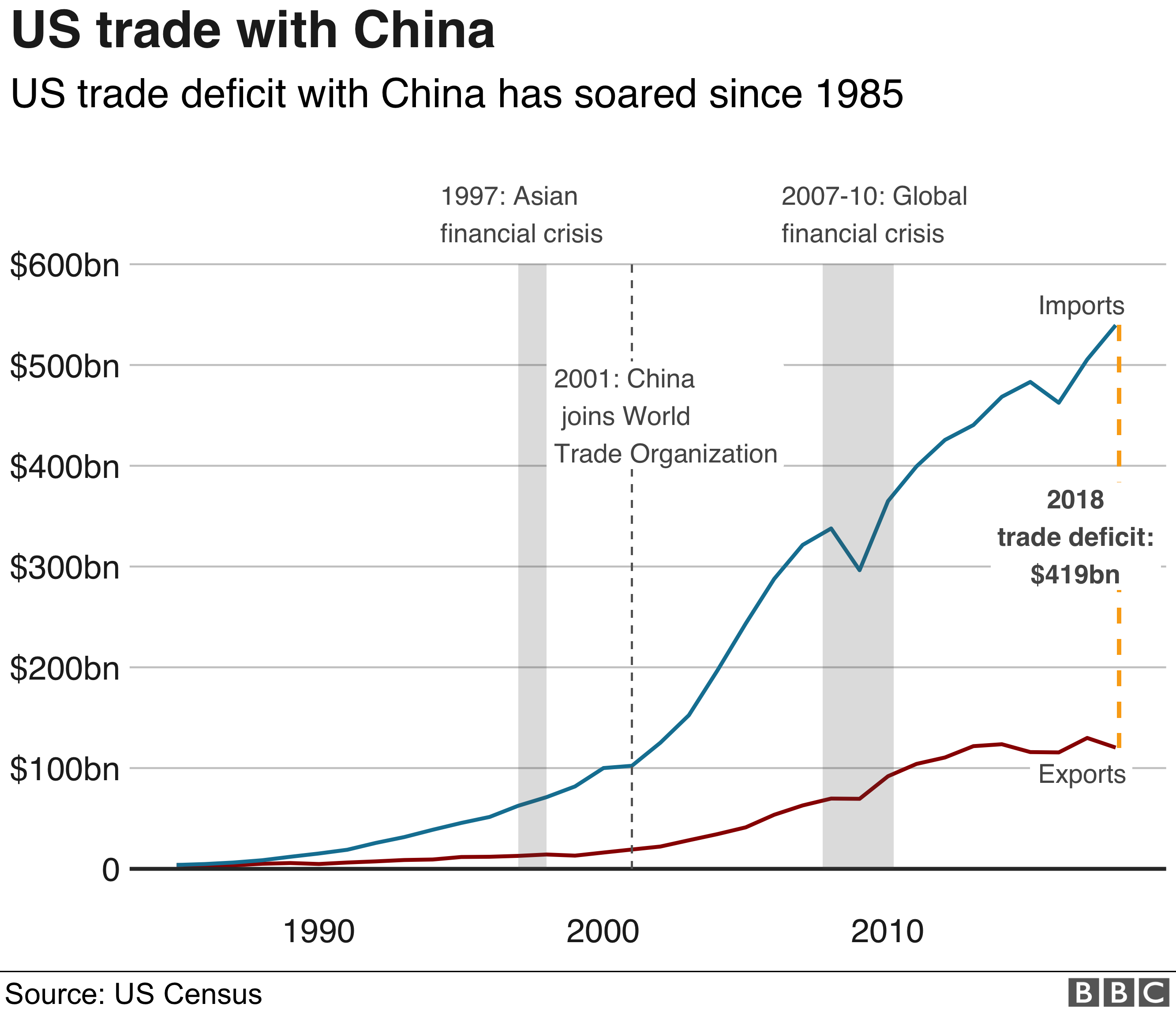

The US trade war and the efforts to mask economic weakness have created uncertainty, impacting foreign direct investment (FDI) into China.

- Impact of trade war and uncertainty: The trade war and the resulting economic uncertainty have discouraged foreign investment, leading to decreased FDI flows into China.

- Investor confidence: Attempts to mask economic weakness erode investor confidence, making China a less attractive destination for foreign investment.

- Potential for capital flight: The perception of economic instability may lead to capital flight, further weakening the Chinese economy.

Conclusion

The US trade war has undoubtedly exposed vulnerabilities in the Chinese economy. While official figures might present a picture of resilience, the evidence suggests that China has been actively masking underlying economic weaknesses through data manipulation, reliance on hidden debt, and the continued dominance of inefficient SOEs. Understanding these strategies is crucial for navigating the complexities of the Chinese economy and assessing its long-term prospects.

Call to Action: To stay informed about the evolving dynamics of the US-China trade relationship and the true state of the China economy, continue to research reliable economic analyses and stay updated on the latest developments related to the US Trade War and its impact on China's efforts to mask economic weakness. Understanding this complex situation is key to making informed decisions in this critical geopolitical and economic landscape.

Featured Posts

-

Blue Origin Cancels Rocket Launch Vehicle Subsystem Problem

May 03, 2025

Blue Origin Cancels Rocket Launch Vehicle Subsystem Problem

May 03, 2025 -

Smart Rings And Fidelity Would You Wear One

May 03, 2025

Smart Rings And Fidelity Would You Wear One

May 03, 2025 -

A Place In The Sun Your Guide To Finding The Perfect Property

May 03, 2025

A Place In The Sun Your Guide To Finding The Perfect Property

May 03, 2025 -

The Photoshopping Debate Analyzing Christina Aguileras Recent Images

May 03, 2025

The Photoshopping Debate Analyzing Christina Aguileras Recent Images

May 03, 2025 -

A Robust Poll Data System Preventing Errors And Ensuring Fair Elections According To The Chief Election Commissioner

May 03, 2025

A Robust Poll Data System Preventing Errors And Ensuring Fair Elections According To The Chief Election Commissioner

May 03, 2025

Latest Posts

-

Mo Salah Contract Liverpools Plan And The Risks Involved

May 03, 2025

Mo Salah Contract Liverpools Plan And The Risks Involved

May 03, 2025 -

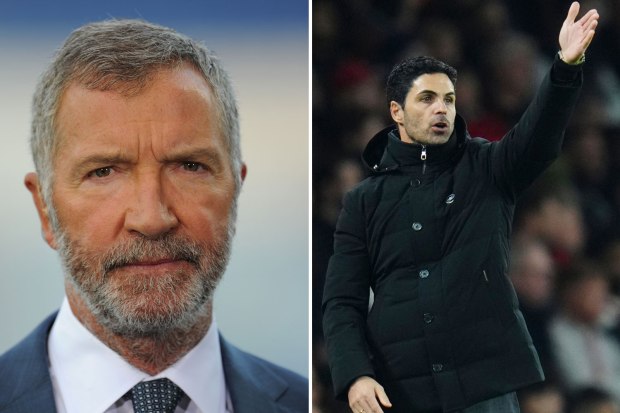

Is Havertz The Right Fit Sounesss Epl Verdict On Arsenal Signing

May 03, 2025

Is Havertz The Right Fit Sounesss Epl Verdict On Arsenal Signing

May 03, 2025 -

Epl Analysis Souness Slams Havertzs Arsenal Transfer

May 03, 2025

Epl Analysis Souness Slams Havertzs Arsenal Transfer

May 03, 2025 -

Havertzs Arsenal Performance Souness Questions Epl Impact

May 03, 2025

Havertzs Arsenal Performance Souness Questions Epl Impact

May 03, 2025 -

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025