The Impact Of Trump's Tariffs On Fintech IPOs: Affirm Holdings (AFRM) And The Future Of The Market

Table of Contents

The Direct Impact of Tariffs on Fintech Supply Chains

Trump's tariffs, implemented as part of his "America First" trade agenda, significantly impacted global supply chains. For Fintech companies, this meant increased costs and potential disruptions. The "trade war" impacted the cost of manufacturing and sourcing crucial components and services.

- Increased costs of hardware components: Servers, networking equipment, and other hardware essential for Fintech operations often originate from countries subject to tariffs. This directly increased the capital expenditure for Fintech firms.

- Higher prices for software licenses and services: Many Fintech companies rely on software and services from international vendors. Tariffs on these imports increased operational costs and reduced profit margins.

- Potential delays in product development: Supply chain disruptions caused by tariffs led to delays in receiving essential components and services, hindering product development and time-to-market for new Fintech solutions.

- Case study: Affirm Holdings (AFRM): While Affirm's specific reliance on international suppliers for hardware isn't publicly detailed, the general inflationary pressure caused by tariffs likely impacted their operational costs. The increased cost of data center infrastructure, for instance, could have affected their profitability and IPO valuation. Further research into their supply chain specifics is needed to ascertain the precise impact. Keyword Variations: Trade war impact on Fintech, Tariff impact on technology supply chains.

The Indirect Impact of Tariffs on Investor Sentiment and Market Volatility

Beyond the direct costs, Trump's tariffs created broader economic uncertainty, significantly impacting investor sentiment and market volatility. This indirect effect was arguably even more impactful on Fintech IPOs.

- Increased market volatility: The trade war created a climate of uncertainty, making IPOs a riskier investment for many. Investors became more cautious, demanding higher returns to compensate for increased risk.

- Reduced investor appetite for new, high-growth companies: In periods of economic uncertainty, investors tend to favor established, stable companies over high-growth, yet potentially volatile, startups like many Fintech firms.

- Potential downward pressure on valuations during the IPO process: The increased risk and reduced investor appetite resulted in downward pressure on valuations during the IPO process, potentially limiting the funds raised by Fintech companies.

- Case study: Affirm Holdings (AFRM): Affirm's IPO occurred during a period of heightened market volatility due to the ongoing trade war. While Affirm successfully went public, it's reasonable to speculate that the tariff-induced uncertainty might have influenced its valuation and the overall investor response to its offering. Keyword Variations: Investor confidence, Fintech market volatility, IPO valuation, Trade uncertainty.

Affirm Holdings (AFRM) as a Case Study

Affirm Holdings' IPO provides a valuable case study to analyze the impact of Trump's tariffs on Fintech IPOs.

- IPO Timing and Tariff Correlation: Analyzing Affirm's IPO timing in relation to the specific tariff announcements and market reactions can reveal potential correlations. Did Affirm attempt to time its IPO to capitalize on more favorable market conditions, or were they forced to proceed despite the uncertainties?

- Affirm's Business Model and Risk Profile: Affirm's success despite the tariff environment could be attributed to its unique business model and relatively low reliance on imported physical goods. Their focus on buy-now-pay-later services reduces their exposure to the direct impact of tariffs on hardware and manufacturing.

- Mitigation Strategies: Understanding the strategies Affirm implemented (if any) to mitigate the negative effects of tariffs can provide valuable insights for other Fintech companies. Did they diversify their supply chain, renegotiate contracts, or hedge against currency fluctuations?

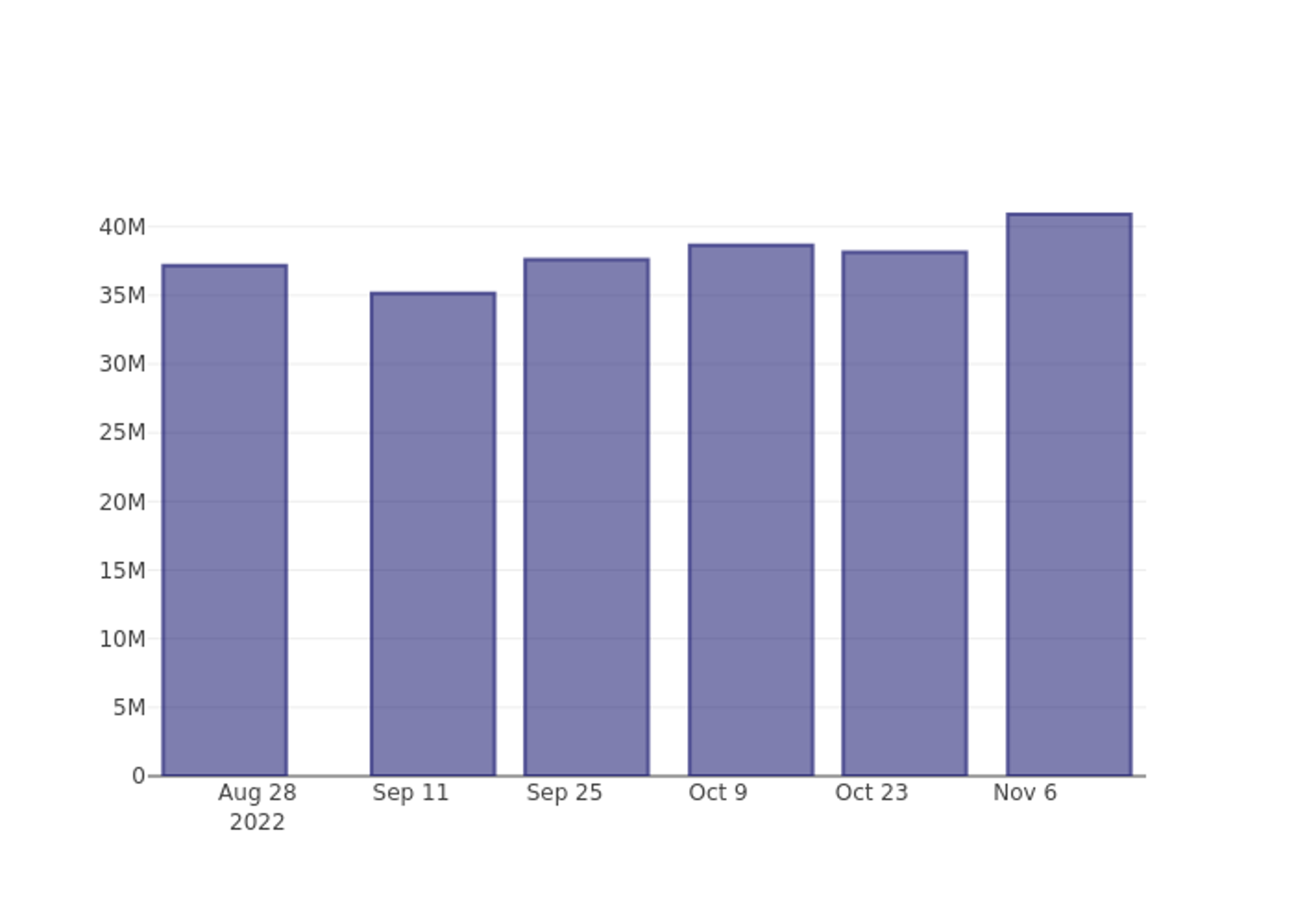

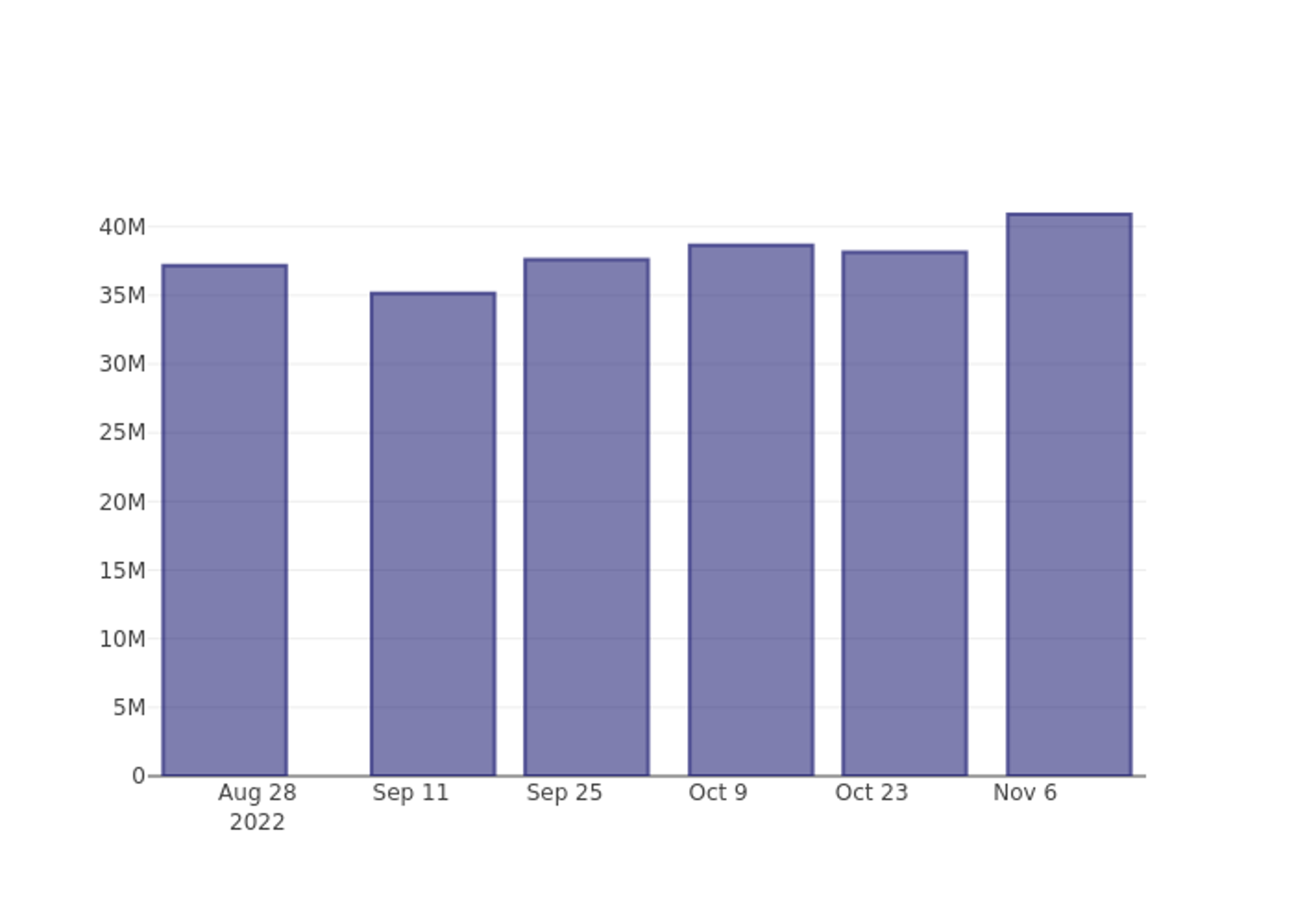

- Post-IPO Performance: Examining Affirm's post-IPO performance in light of the tariff environment provides crucial data for evaluating the long-term consequences of trade policies on Fintech companies. Keyword Variations: Affirm IPO analysis, Affirm Holdings stock performance, Fintech IPO case study.

Long-Term Implications for Fintech IPOs

The experience with Trump's tariffs has fundamentally altered how Fintech companies approach IPOs and global operations.

- Increased Focus on Supply Chain Diversification: Fintech companies are increasingly prioritizing diversification of their supply chains to reduce their vulnerability to future trade disruptions. This includes sourcing components and services from multiple regions and countries.

- Enhanced Risk Management Strategies: The uncertainty generated by the trade war highlighted the need for robust risk management strategies to navigate global economic uncertainty and potential future trade disputes.

- Changes in Investor Expectations: Investors now demand greater transparency and detail regarding supply chain resilience and risk management in their due diligence processes for Fintech IPOs.

- Potential for Increased Domestic Manufacturing and Sourcing: The tariffs provided some incentive for companies to explore "reshoring" or "nearshoring" – moving manufacturing and sourcing closer to home to reduce reliance on potentially volatile global supply chains. Keyword Variations: Fintech IPO strategy, Global supply chain diversification.

Conclusion

Trump's tariffs had a significant, multifaceted impact on Fintech IPOs. The direct impact included increased costs and supply chain disruptions, while indirectly, the tariffs created market volatility and reduced investor confidence. Affirm Holdings' IPO experience offers a compelling case study, revealing the challenges and potential adaptation strategies for navigating this uncertain landscape. The long-term implications for the Fintech industry include a greater emphasis on supply chain diversification, enhanced risk management, and evolving investor expectations. Understanding the impact of factors like Trump's tariffs on Fintech IPOs is crucial for investors and entrepreneurs alike. Continue your research on the influence of global trade on the Fintech market and the future of Fintech IPOs.

Featured Posts

-

The Intentional Walk Strategy Should You Walk Aaron Judge

May 14, 2025

The Intentional Walk Strategy Should You Walk Aaron Judge

May 14, 2025 -

Dubai Tennis Sabalenka Defeats Paolini Ending Title Run

May 14, 2025

Dubai Tennis Sabalenka Defeats Paolini Ending Title Run

May 14, 2025 -

Moose Jaw Hopes Tariffs Will Attract Canadian And American Businesses

May 14, 2025

Moose Jaw Hopes Tariffs Will Attract Canadian And American Businesses

May 14, 2025 -

Captain America Brave New World Disney Release Date Announced

May 14, 2025

Captain America Brave New World Disney Release Date Announced

May 14, 2025 -

Madrid Open Potapova Defeats Zheng Qinwen In Surprise Result

May 14, 2025

Madrid Open Potapova Defeats Zheng Qinwen In Surprise Result

May 14, 2025

Latest Posts

-

Exploring Vince Vaughns Ethnicity Italian Or Not

May 14, 2025

Exploring Vince Vaughns Ethnicity Italian Or Not

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025 -

Is Vince Vaughn Of Italian Descent A Look At His Family Roots

May 14, 2025

Is Vince Vaughn Of Italian Descent A Look At His Family Roots

May 14, 2025 -

Vince Vaughns Heritage Unpacking His Ancestry

May 14, 2025

Vince Vaughns Heritage Unpacking His Ancestry

May 14, 2025 -

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025