The Impact Of Trump's Tariffs On Norway's Sovereign Wealth Fund: A Look At Nicolai Tangen's Strategies

Table of Contents

Trump's Tariffs: A Global Economic Disruption

Donald Trump's administration initiated a series of tariffs, ostensibly aimed at protecting American industries, but with far-reaching consequences for global trade. These tariffs, targeting various sectors, significantly impacted the international economic landscape, creating a "Trump trade war" that caused considerable uncertainty. For Norway, sectors like aluminum and seafood, key components of its export economy, were particularly vulnerable. The ripple effects were immediate and profound.

The increased tariffs led to:

- Global trade disruption: Supply chains were disrupted, leading to increased costs for businesses worldwide. For example, the tariffs on aluminum affected Norwegian producers reliant on importing raw materials.

- Tariff impact on Norwegian industries: Norwegian exporters faced reduced competitiveness in international markets due to the tariffs imposed by the US and retaliatory tariffs imposed by other countries.

- Increased economic uncertainty: Businesses struggled to plan for the future due to the unpredictable nature of the trade policies, leading to reduced investment and slower economic growth.

Bullet Points:

- Specific examples: The tariffs on aluminum significantly impacted Norwegian aluminum producers, while tariffs on seafood affected export volumes to the US market.

- Statistical data: Studies show a significant increase in market volatility in various sectors during the period of tariff implementation. Specific figures need to be researched and added here.

- Expert quotes: Statements from economists and industry experts on the negative economic consequences of Trump's trade policies should be included (cite sources appropriately).

The Norwegian Sovereign Wealth Fund's Exposure

Norway's Sovereign Wealth Fund, with its incredibly diverse portfolio, still held significant exposure to sectors affected by Trump's tariffs. While the fund's diversification strategy aimed to mitigate risk, the scale and unpredictability of the tariff imposition presented unique challenges.

- Portfolio Diversification: The SWF's strategy focuses on broad diversification across various asset classes and geographies. This reduced its dependence on any single sector and helped mitigate losses.

- Direct and Indirect Impacts: The direct impact came from lower returns on investments in the affected sectors. Indirectly, the global economic slowdown stemming from the trade war influenced overall market performance and decreased overall fund returns.

Bullet Points:

- Percentage breakdown: Specific data on the percentage of the SWF's portfolio invested in sectors affected by the tariffs needs to be added (this requires research).

- Performance analysis: A comparison of the fund's performance before, during, and after the tariff implementation would reveal the impact. (requires research and data).

- Successful diversification examples: Examples of the SWF's strategic diversification across various geographies and asset classes should be cited here.

Nicolai Tangen's Strategic Responses

Nicolai Tangen's leadership during this period was crucial. His responses to the challenges posed by the tariffs highlight the importance of adaptive investment strategies and clear communication.

- Investment Strategy Adaptation: Tangen likely adjusted the SWF's investment strategy, potentially reducing exposure to highly vulnerable sectors while increasing investment in more resilient ones.

- Risk Mitigation: Strengthened risk management protocols are vital in such uncertain times. A more robust approach to risk assessment and forecasting was likely implemented.

- NBIM Communication: Transparent communication with stakeholders was essential to maintain confidence in the fund's management during such a volatile period.

Bullet Points:

- Specific strategic shifts: Details about any significant changes in investment allocation (requires research) are needed here.

- Quotes from Tangen: Inclusion of quotes from Tangen regarding his decision-making process and strategy would add credibility (requires research).

- Analysis of NBIM communication: An examination of the fund's communication efforts during this time would complete this section (requires research).

Long-Term Implications for the Norwegian Economy

The long-term effects of Trump's tariffs on Norway's economy and its Sovereign Wealth Fund are still unfolding. However, valuable lessons can be learned from this period.

- Long-term economic impact: The impact of the tariffs on Norway's long-term economic growth requires a detailed analysis, looking beyond the immediate effects to assess the lasting consequences.

- Investment lessons learned: The experience underscores the importance of comprehensive risk assessment and diversification in managing large-scale investment portfolios.

- Future investment strategies: The event should drive improvements in the SWF's risk management framework, including the development of more robust models to predict and respond to future economic disruptions.

Bullet Points:

- Predictions for future growth: Expert opinions on the future economic trajectory of Norway, accounting for the effects of the tariffs, are needed (requires research).

- Potential changes in SWF strategy: Likely changes in the SWF's long-term investment strategy, informed by the experience of the Trump tariffs, should be discussed (requires research).

- Recommendations for risk management: Recommendations for improvements to the SWF's risk management practices, based on lessons learned, should be included.

Conclusion

The impact of Trump's tariffs on Norway's Sovereign Wealth Fund highlighted the interconnectedness of global markets and the challenges of managing vast investment portfolios during times of significant economic uncertainty. Nicolai Tangen's leadership, his strategic responses, and the fund's diversification strategy played crucial roles in mitigating the negative consequences. Understanding the complexities of navigating such events is essential for responsible management of sovereign wealth funds. Learn more about the intricacies of managing Norway's Sovereign Wealth Fund during periods of global economic turbulence and the lasting effects of Trump's tariffs by conducting further research. The impact of Trump's tariffs on Norway's Sovereign Wealth Fund serves as a compelling case study for future risk management strategies.

Featured Posts

-

Ufc Des Moines Predictions Betting Tips And Fight Breakdown

May 04, 2025

Ufc Des Moines Predictions Betting Tips And Fight Breakdown

May 04, 2025 -

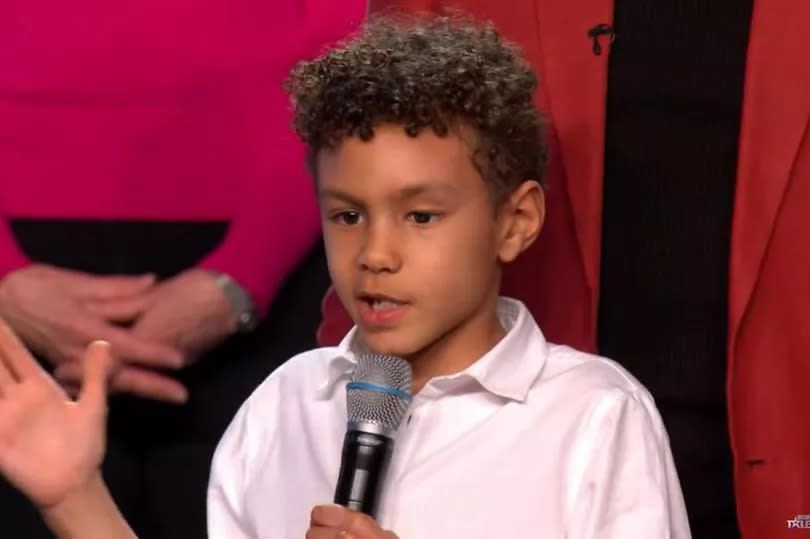

Nervous Child Leaves Britains Got Talent Stage During Live Show

May 04, 2025

Nervous Child Leaves Britains Got Talent Stage During Live Show

May 04, 2025 -

The Great Leslie Next Stage Of Eurovision

May 04, 2025

The Great Leslie Next Stage Of Eurovision

May 04, 2025 -

Long Prison Sentence For Hate Crime Targeting Palestinian American Family

May 04, 2025

Long Prison Sentence For Hate Crime Targeting Palestinian American Family

May 04, 2025 -

Icon

May 04, 2025

Icon

May 04, 2025