The Impact Of Trump's Trade War: A Wall Street Perspective

Table of Contents

Impact on Stock Markets

The trade war initiated by the Trump administration created significant market volatility and uncertainty for investors on Wall Street.

Volatility and Uncertainty

- Increased uncertainty led to unpredictable stock price swings: The constant threat of new tariffs and retaliatory measures created a climate of fear and uncertainty, making it incredibly difficult for investors to predict future market performance. This unpredictability led to sharp increases and decreases in stock prices across various sectors.

- Investors struggled to assess the long-term implications of tariffs: The complexity of the trade disputes, coupled with the constantly shifting landscape of tariffs and trade agreements, made long-term forecasting exceptionally challenging. Investors were forced to constantly reassess their portfolios and strategies.

- Specific sectors (e.g., technology, agriculture) experienced disproportionate volatility: Sectors heavily reliant on international trade, such as technology (due to supply chains and global sales) and agriculture (due to export dependence), experienced particularly dramatic price swings. The impact of tariffs was felt most keenly in these industries.

Sectoral Winners and Losers

The trade war created a complex web of winners and losers within the stock market.

- Domestically produced goods saw increased demand in some cases: Protectionist measures, such as tariffs on imported goods, led to increased demand for domestically produced alternatives in certain sectors. This benefited some US companies, leading to stock price increases.

- Import-dependent businesses faced higher costs and reduced competitiveness: Businesses that relied heavily on imported goods and materials faced increased costs due to tariffs, reducing their profitability and competitiveness in the global market. This resulted in decreased stock valuations for many companies.

- Analysis of specific stock performance during the trade war period: A detailed analysis of individual company stock performance during this period reveals a clear correlation between exposure to international trade and the impact of the trade war. Companies with significant international operations often experienced greater volatility and, in many cases, lower returns.

The Role of the Federal Reserve

The Federal Reserve (Fed) played a crucial role in attempting to mitigate the economic fallout from Trump's trade war.

Monetary Policy Response

The Fed employed several monetary policy tools to counter the negative economic effects.

- Interest rate cuts aimed to stimulate economic growth: To counteract the potential for an economic slowdown, the Fed lowered interest rates, making borrowing cheaper and encouraging investment and spending.

- Quantitative easing measures were considered to boost liquidity: While not fully implemented, the Fed considered further quantitative easing (QE) to inject liquidity into the financial system and prevent a credit crunch.

- Analysis of the effectiveness of the Fed's response to the trade war: The effectiveness of the Fed's response is still debated. While the interest rate cuts likely prevented a deeper recession, the trade war's underlying structural issues were not directly addressed by monetary policy.

Balancing Act

The Fed faced a difficult balancing act in responding to the trade war.

- Inflationary pressures vs. economic slowdown: The Fed needed to balance the risk of inflation (potentially exacerbated by tariffs) with the threat of a significant economic slowdown.

- Maintaining financial stability amidst market turmoil: The Fed’s mandate included maintaining financial stability, a challenging task during periods of heightened market volatility caused by the trade war.

- The limitations of monetary policy in addressing trade-related issues: Monetary policy is primarily focused on inflation and employment. It has limited power to directly address structural economic issues caused by protectionist trade policies.

Impact on Investment Strategies

Trump's trade war forced a significant reassessment of investment strategies on Wall Street.

Diversification and Risk Management

The trade war underscored the importance of diversification and robust risk management.

- Investors sought to reduce exposure to vulnerable sectors: Investors actively sought to reduce their exposure to sectors particularly vulnerable to the trade war's impact, such as those heavily reliant on international trade.

- Increased focus on geopolitical risk assessment: Geopolitical risk assessment became a critical component of investment strategies, as the trade war highlighted the potential for significant disruptions caused by international political events.

- Adaptation of investment strategies to account for trade uncertainty: Investment strategies were adapted to incorporate increased uncertainty and volatility stemming from the ongoing trade disputes.

Shifting Investment Flows

The trade war also impacted global investment flows.

- Increased investment in less trade-exposed sectors: Investors shifted capital towards sectors less exposed to international trade, seeking relative stability during this period of uncertainty.

- Potential capital flight to other countries: Some investors considered moving their investments to countries perceived as less vulnerable to trade wars or offering more stable political environments.

- Impact on foreign direct investment in the US: The trade war likely discouraged some foreign direct investment in the US, creating further uncertainty for the economy.

Long-Term Consequences and Lessons Learned

The long-term effects of Trump's trade war continue to be felt globally.

Structural Changes in the Global Economy

The trade war may have accelerated significant changes to the global economic landscape.

- Reshoring and nearshoring trends: Companies started exploring reshoring (bringing manufacturing back to the US) and nearshoring (moving production to nearby countries) to reduce their dependence on distant supply chains, a direct response to the trade war’s disruptions.

- Increased focus on regional trade agreements: The trade war highlighted the benefits of regional trade agreements as a means to reduce reliance on global supply chains and mitigate risks associated with major trade disputes.

- Long-term implications for global trade patterns: The trade war’s lasting impact on global trade patterns remains to be fully understood, but it's clear that the pre-trade war status quo has been irrevocably altered.

Geopolitical Implications

The geopolitical consequences of Trump's trade war were substantial.

- Strained relations with key trading partners: The trade war significantly strained relations with major trading partners, leading to increased tensions and mistrust.

- Impact on international cooperation: The trade war cast doubt on the commitment to international cooperation and multilateral trade agreements.

- Increased protectionism globally: The trade war may have emboldened other countries to adopt protectionist policies, potentially leading to a more fragmented and less efficient global economy.

Conclusion

Trump's trade war profoundly impacted Wall Street, causing significant market volatility and forcing adjustments to investment strategies. While some sectors benefited from protectionist measures, others suffered considerably. The Federal Reserve played a critical role in mitigating the economic fallout, but the long-term consequences, including structural changes in the global economy and strained geopolitical relations, continue to unfold. Understanding the impact of Trump's trade war remains crucial for navigating the complexities of global finance. Further research into the lasting effects of these policies is needed to inform future investment decisions and economic policy. To stay informed about the ongoing implications of Trump's trade war and its impact on Wall Street, continue reading our in-depth analyses and market insights.

Featured Posts

-

Twenty Years Later Bryan Cranstons How I Met Your Mother Prediction About Pete Rose

May 29, 2025

Twenty Years Later Bryan Cranstons How I Met Your Mother Prediction About Pete Rose

May 29, 2025 -

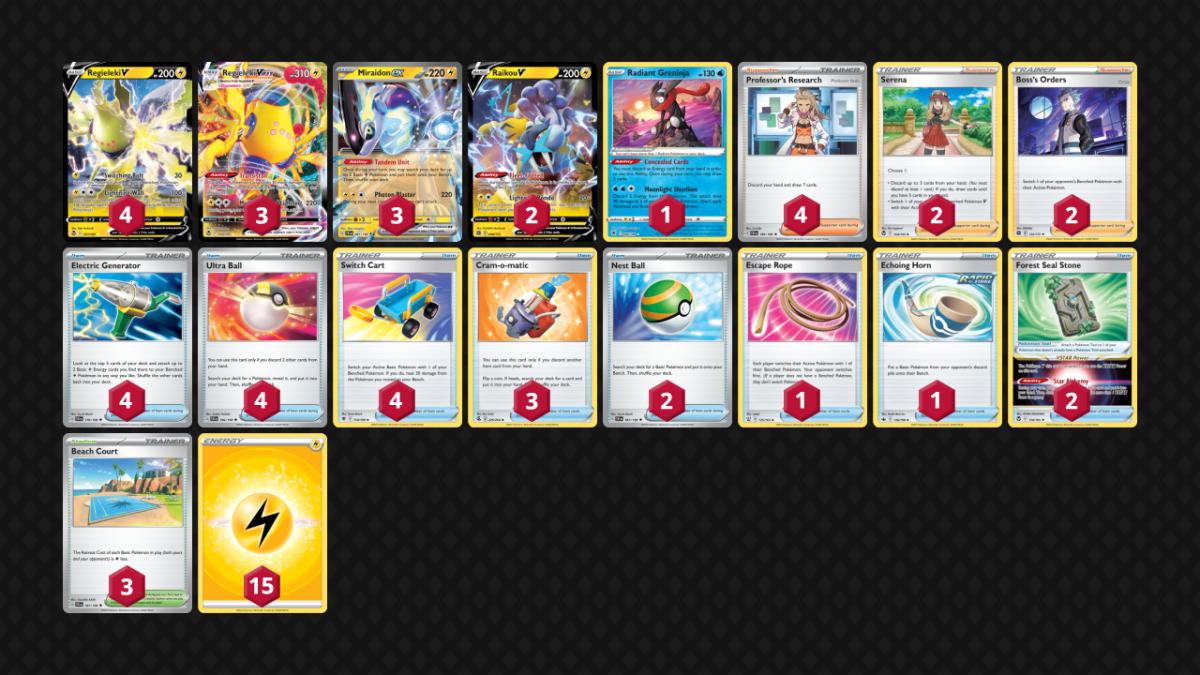

Mastering Probopass Top Decks For Pokemon Tcg Pocket

May 29, 2025

Mastering Probopass Top Decks For Pokemon Tcg Pocket

May 29, 2025 -

Mstqbl Almyah Fy Alardn Wswrya Dwr Alatfaqyat Aljdydt Fy Tezyz Alteawn

May 29, 2025

Mstqbl Almyah Fy Alardn Wswrya Dwr Alatfaqyat Aljdydt Fy Tezyz Alteawn

May 29, 2025 -

Freestyle Swimmer Komashko Announces Uc Davis Commitment

May 29, 2025

Freestyle Swimmer Komashko Announces Uc Davis Commitment

May 29, 2025 -

Cherry Hill Resident Shot After Confrontation

May 29, 2025

Cherry Hill Resident Shot After Confrontation

May 29, 2025

Latest Posts

-

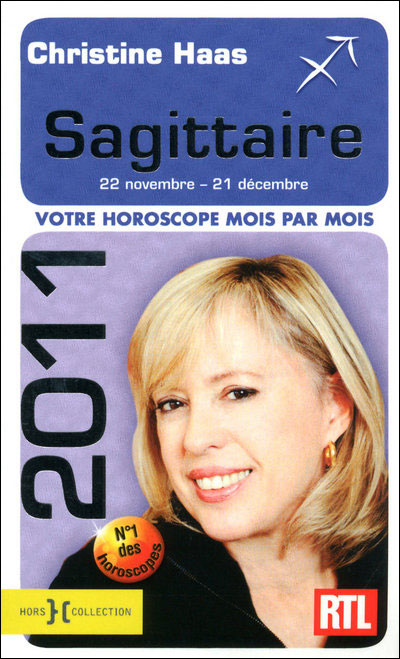

Horoscope For May 27 2025 Christine Haas Predictions

May 31, 2025

Horoscope For May 27 2025 Christine Haas Predictions

May 31, 2025 -

Jaime Munguias Tactical Adjustments Lead To Surace Rematch Win

May 31, 2025

Jaime Munguias Tactical Adjustments Lead To Surace Rematch Win

May 31, 2025 -

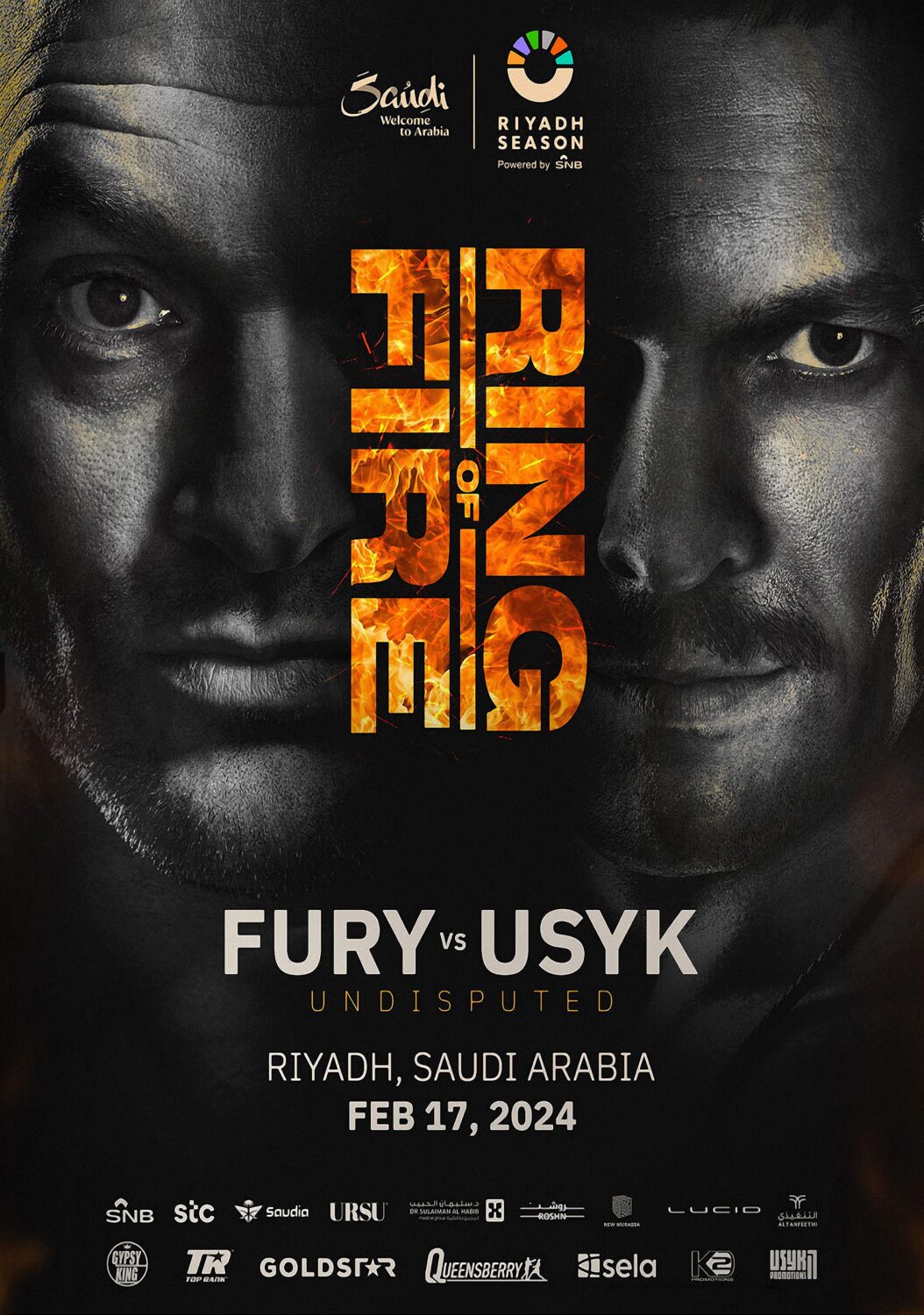

Fatal Fury Boxing May Showdown In Riyadh

May 31, 2025

Fatal Fury Boxing May Showdown In Riyadh

May 31, 2025 -

Canelo Vs Golovkin When Does The Fight Start Full Ppv Card Revealed

May 31, 2025

Canelo Vs Golovkin When Does The Fight Start Full Ppv Card Revealed

May 31, 2025 -

Munguia Vs Surace Ii How Adjustments Secured The Win

May 31, 2025

Munguia Vs Surace Ii How Adjustments Secured The Win

May 31, 2025