The Impact Of US Sanctions On Chinese-Iranian Plastics Trade

Table of Contents

H2: Disruption of Supply Chains and Trade Routes

US sanctions on Iranian plastics have significantly disrupted supply chains and traditional trade routes between China and Iran. The sanctions make it exceedingly difficult for Iranian producers to export plastics to China and vice-versa, forcing businesses to seek alternative, often more expensive and less efficient options. This has resulted in:

- Increased shipping costs and transit times: Sanctions force the rerouting of shipments, lengthening transit times and significantly increasing transportation costs. Direct routes are often impassable, leading to longer journeys through multiple countries, adding to expenses and delays.

- Reliance on less transparent and riskier shipping routes: Businesses are increasingly reliant on less transparent and more vulnerable shipping routes, increasing the risk of cargo loss or seizure. This necessitates higher insurance premiums and heightened security measures.

- Difficulty securing financing for transactions: Banks and financial institutions are hesitant to process transactions related to Iranian plastics due to the fear of violating sanctions, making it difficult for businesses to secure the necessary financing for imports and exports.

- Increased scrutiny from banks and financial institutions: Even seemingly legitimate transactions face increased scrutiny from banks and financial institutions, leading to delays and potential rejection of legitimate business activities. This heightened scrutiny creates further uncertainty and complexity for businesses operating within these sanctions.

H2: Impact on Pricing and Market Volatility

The sanctions on Chinese-Iranian plastics trade have introduced considerable volatility into the market, significantly impacting pricing. Reduced supply due to sanctions-related disruptions, coupled with increased transportation costs and risks, has driven up prices for both Iranian and Chinese plastics in global markets. This has led to:

- Increased prices for Iranian and Chinese plastics in global markets: The reduced supply and increased risk associated with trading with Iran have resulted in higher prices for Iranian plastics globally, impacting the competitiveness of Chinese companies using these materials.

- Price volatility due to supply chain uncertainties: The constant uncertainty surrounding sanctions enforcement and their impact on supply chains leads to fluctuating prices, making it difficult for businesses to plan effectively and manage their budgets.

- Potential for shortages of certain types of plastics: Disruptions to supply chains can lead to shortages of specific types of plastics, further impacting downstream industries reliant on a consistent supply of materials.

- Impact on downstream industries reliant on these plastics: Businesses using Iranian and Chinese plastics in their production processes face increased input costs, impacting their profitability and potentially leading to price increases for consumers.

H2: Adaptation Strategies and Circumvention Tactics

Faced with the challenges imposed by sanctions, businesses are employing various adaptation strategies and, in some cases, tactics to circumvent restrictions. These actions carry significant ethical and legal implications. Some common approaches include:

- Use of shell corporations and intermediaries: Businesses may use shell corporations and intermediaries in third-party countries to mask the origin and destination of goods, thereby attempting to circumvent sanctions.

- Increased reliance on informal trade networks: Informal trade networks, operating outside regulated channels, are increasingly used to facilitate transactions, bypassing formal banking systems.

- Development of new trade routes and logistics systems: Businesses are actively seeking and developing new trade routes and logistics systems to avoid sanctions-related disruptions, often at a substantially higher cost.

- Growing use of cryptocurrencies for transactions: The use of cryptocurrencies is growing as a means of making payments that are more difficult to trace and monitor, potentially aiding in sanctions evasion.

H3: The Role of Third-Party Countries

Third-party countries play a crucial role in facilitating trade between China and Iran, despite the sanctions. These countries often act as intermediaries, providing transit routes or offering alternative financial mechanisms. This creates both opportunities and challenges for these transit countries:

- Transit countries: Some countries benefit economically from the increased trade flowing through their territories, while others face diplomatic pressure from the US to curtail their involvement.

- Regional trade: The increased reliance on third-party countries has significant implications for regional trade dynamics and power balances within the area.

- Intermediary roles: The participation of third-party countries in facilitating trade creates new geopolitical complexities and potential for increased tensions.

H2: Geopolitical Implications and International Relations

The sanctions on Chinese-Iranian plastics trade have significant geopolitical implications, impacting bilateral relations between China and Iran, as well as broader international relations. These implications include:

- Strain on US relations with both China and Iran: The sanctions exacerbate existing tensions between the US and both China and Iran, further complicating diplomatic efforts.

- Strengthening of the China-Iran strategic partnership: The sanctions may inadvertently strengthen the China-Iran strategic partnership as both countries find common cause in navigating US pressure.

- Potential for increased tensions in the Middle East and Asia: The sanctions and the resulting adaptations have the potential to escalate tensions in the Middle East and Asia, impacting regional stability.

3. Conclusion

US sanctions have significantly impacted Chinese-Iranian plastics trade, creating widespread disruptions to supply chains, driving price volatility, and prompting the adoption of various adaptation strategies, some of which operate in a legal gray area. The geopolitical implications are significant, straining international relations and impacting regional stability. Understanding the complexities of these sanctions is crucial for navigating the challenging landscape of international commerce. Further research into sanctions’ evolving impact on various industries is needed for effective decision-making. Stay informed on the latest developments in US sanctions and their impact on the Chinese-Iranian plastics trade to better understand these intricate global economic trends.

Featured Posts

-

Ayesha Curry Explains Her Familys Unique Structure

May 07, 2025

Ayesha Curry Explains Her Familys Unique Structure

May 07, 2025 -

Lotto Results For Saturday April 12 2025

May 07, 2025

Lotto Results For Saturday April 12 2025

May 07, 2025 -

De Bussers Leadership Go Ahead Eagles Cup Final Comeback Story

May 07, 2025

De Bussers Leadership Go Ahead Eagles Cup Final Comeback Story

May 07, 2025 -

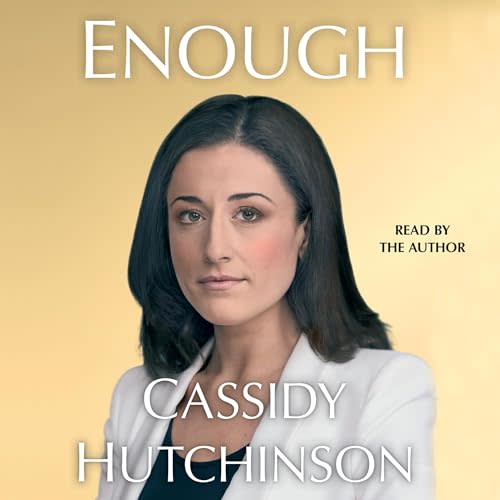

Cassidy Hutchinson Memoir A Deeper Dive Into The January 6th Hearings

May 07, 2025

Cassidy Hutchinson Memoir A Deeper Dive Into The January 6th Hearings

May 07, 2025 -

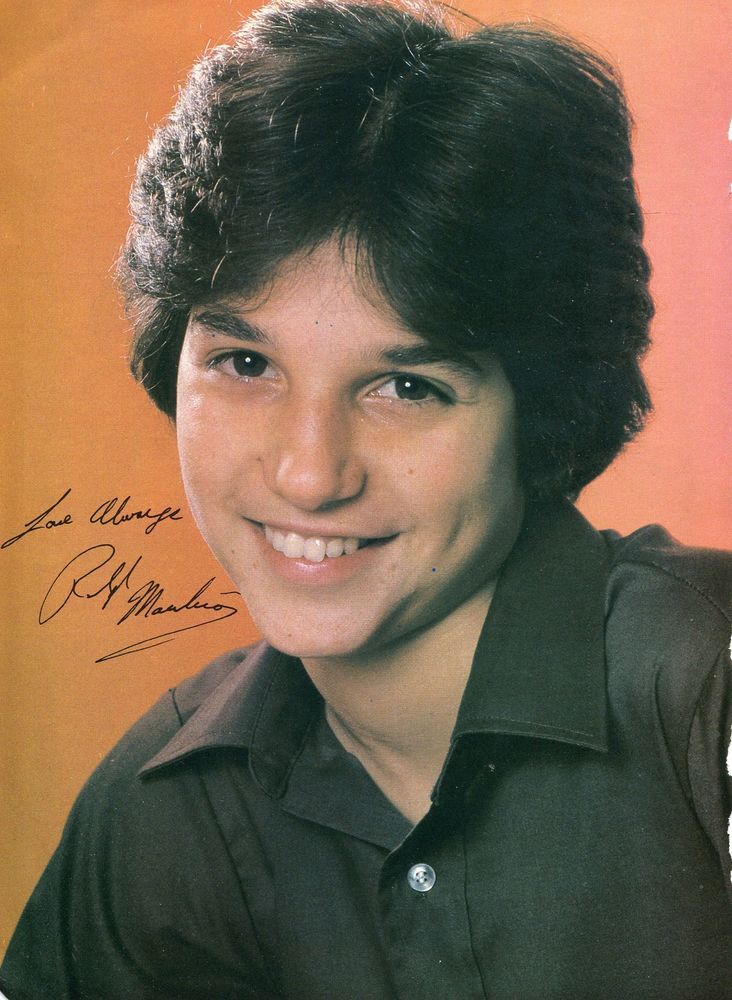

Ralph Macchios Karate Kid 6 Return Excitement And Uncertainty

May 07, 2025

Ralph Macchios Karate Kid 6 Return Excitement And Uncertainty

May 07, 2025

Latest Posts

-

What Are Rogue Exiles And Their Role In Path Of Exile 2

May 08, 2025

What Are Rogue Exiles And Their Role In Path Of Exile 2

May 08, 2025 -

Rogue One Actors Honest Opinion Of A Fan Favorite

May 08, 2025

Rogue One Actors Honest Opinion Of A Fan Favorite

May 08, 2025 -

Rogue Exiles Key Aspects Of Path Of Exile 2

May 08, 2025

Rogue Exiles Key Aspects Of Path Of Exile 2

May 08, 2025 -

Unexpected Views A Rogue One Star On Fan Favorite Characters

May 08, 2025

Unexpected Views A Rogue One Star On Fan Favorite Characters

May 08, 2025 -

The Rogue Exiles A Deep Dive Into Path Of Exile 2

May 08, 2025

The Rogue Exiles A Deep Dive Into Path Of Exile 2

May 08, 2025